According to the latest report, MediaTek has managed to gain an impressive 2% market share, while Qualcomm has witnessed a decline of 4% in the highly competitive cell phone market during the second quarter of 2023. This development highlights a significant shift in the dynamics of the industry as MediaTek, a Taiwanese semiconductor company, continues to make strides in the market dominated by Qualcomm. The report suggests that MediaTek’s success can be attributed to its focus on offering budget-friendly yet high-performance chipsets, which have gained popularity among smartphone manufacturers and consumers alike. On the other hand, Qualcomm’s drop in market share can be attributed to various factors such as increased competition and supply chain disruptions. As we delve deeper into the implications of these market changes, let’s explore the driving forces behind MediaTek’s success and the challenges faced by Qualcomm.

Inside This Article

- Overview of the Market Share in Q2 2023 – MediaTek’s 2% Market Share Gain – Qualcomm’s 4% Market Share Drop

- Factors Influencing MediaTek’s Gain

- Factors Contributing to Qualcomm’s Decline

- Conclusion

- FAQs

Overview of the Market Share in Q2 2023 – MediaTek’s 2% Market Share Gain – Qualcomm’s 4% Market Share Drop

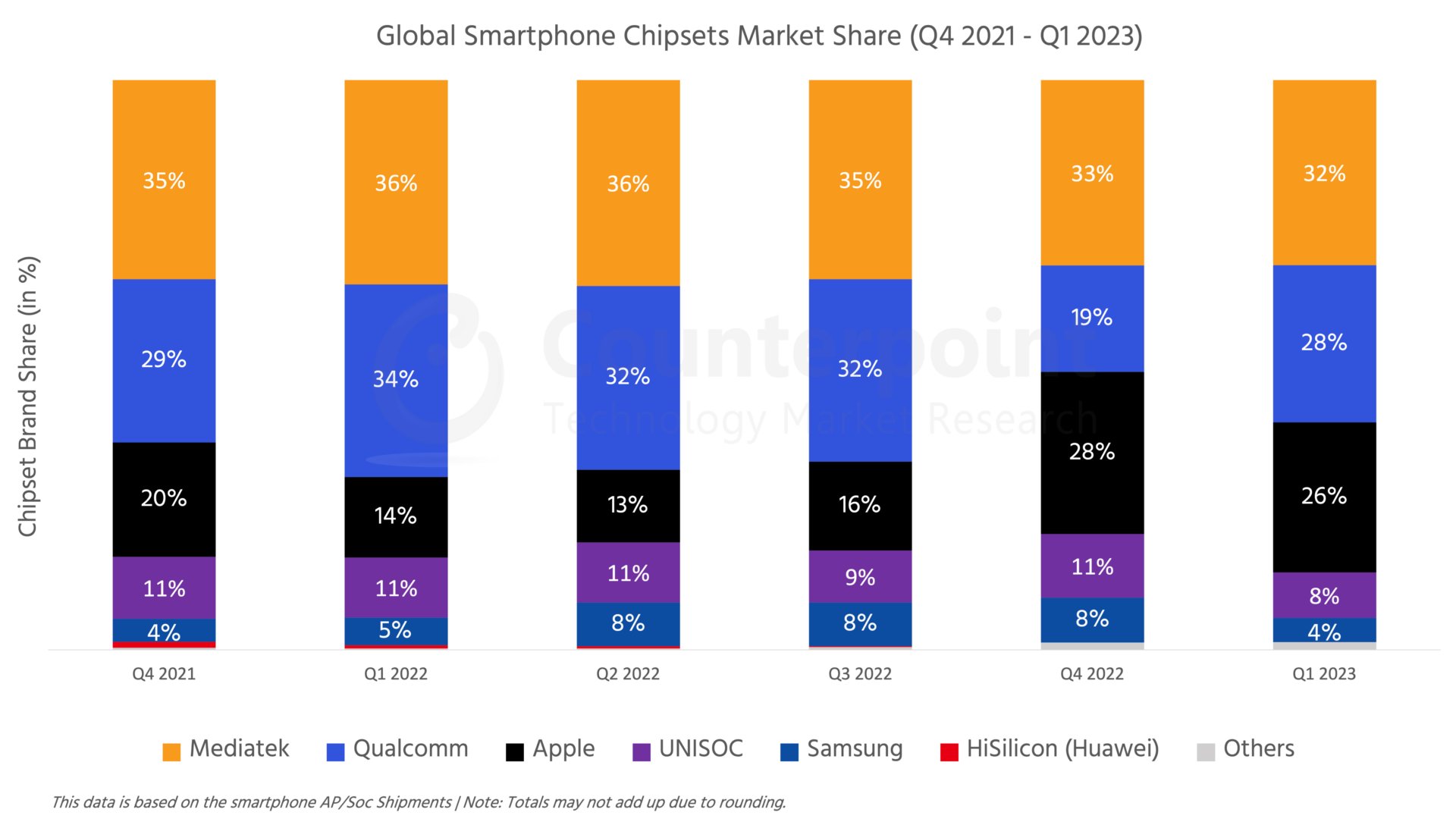

In the dynamic and ever-evolving world of mobile technology, market share trends can significantly impact the standing of industry leaders. The second quarter of 2023 witnessed interesting developments, with MediaTek experiencing a 2% increase in market share, while Qualcomm faced a 4% decline.

MediaTek, a Taiwanese semiconductor company, made impressive strides in Q2 2023 by gaining an additional 2% of the market share. This growth can be attributed to several factors, including their diverse and innovative product portfolio.

The performance of MediaTek’s chipsets has been well-received by consumers, offering competitive performance in terms of processing power, graphics capabilities, and energy efficiency. This has led to increased adoption by smartphone manufacturers, boosting MediaTek’s market share.

Furthermore, MediaTek has implemented a strategic pricing strategy that has allowed them to offer their chipsets at more affordable prices compared to competitors like Qualcomm. This competitive pricing has resonated with budget-conscious consumers, further contributing to MediaTek’s market share gain.

Additionally, MediaTek has focused on expanding its presence in emerging markets, where price sensitivity is higher. By forging partnerships with local smartphone manufacturers and capturing market demand in these regions, MediaTek has successfully increased its market share.

Conversely, Qualcomm, a renowned mobile chipset manufacturer, experienced a 4% drop in market share during Q2 2023. Several factors contributed to this decline, including intensifying competition in the industry.

Competitors such as MediaTek, Samsung, and Huawei have been vying for a larger piece of the market, challenging Qualcomm’s dominance. These companies have been improving their chipsets’ performance and features, narrowing the gap with Qualcomm’s offerings.

In addition to increased competition, Qualcomm faced challenges due to supply chain disruptions caused by global events such as the pandemic. These disruptions affected production and availability of their chipsets, impacting their market share.

Furthermore, Qualcomm faced difficulties in the adoption of 5G technology. As 5G became more prevalent, Qualcomm’s 5G chipsets faced tough competition from rivals, leading to a decline in their market share.

Looking ahead, these market share developments in Q2 2023 have significant implications for the industry. MediaTek’s gain highlights the company’s successful product strategies, competitive pricing, and expansion efforts, positioning them as a strong contender in the market.

On the other hand, Qualcomm will need to address the challenges they faced in order to regain lost market share. They will need to continue innovating their chipsets, strengthening their supply chain resilience, and improving their position in the emerging 5G market.

Overall, the market share changes in Q2 2023 suggest a dynamic and competitive landscape, with MediaTek gaining ground and Qualcomm facing temporary setbacks. It will be interesting to see how these trends continue to evolve in the coming quarters and how the industry leaders adapt to maintain or improve their market share.

Factors Influencing MediaTek’s Gain

MediaTek’s gain in market share in Q2 2023 can be attributed to several key factors:

Product portfolio and performance: MediaTek has been successful in developing a strong product portfolio that caters to a wide range of consumer needs. Their processors offer competitive performance, innovative features, and power efficiency, making them a popular choice among smartphone manufacturers.

Competitive pricing strategy: MediaTek has adopted a competitive pricing strategy, making their processors more affordable compared to their rivals. This has allowed them to capture market share in price-sensitive markets and gain traction with budget and mid-range smartphone brands.

Market expansion efforts: MediaTek has been proactive in expanding their presence and partnerships in emerging markets. By establishing strong relationships with local manufacturers, they have been able to penetrate markets where Qualcomm traditionally had a strong foothold. MediaTek’s focus on these regions has proven to be fruitful in driving their market share growth.

Overall, MediaTek’s gain in market share can be attributed to their strong product offerings, competitive pricing, and strategic market expansion efforts. By consistently delivering value to their partners and customers, MediaTek has positioned themselves as a formidable competitor in the smartphone processor market.

Factors Contributing to Qualcomm’s Decline

Qualcomm, a renowned name in the semiconductor industry, experienced a decline in market share during the second quarter of 2023. Several key factors contributed to this downturn, including intensifying competition, supply chain disruptions, and challenges in 5G technology adoption.

Firstly, the semiconductor market has become increasingly competitive, with numerous players vying for market share. Competitors such as MediaTek and Samsung have been introducing innovative and cost-effective chipsets, posing a significant challenge to Qualcomm’s dominance. This intensified competition has put pressure on Qualcomm to differentiate its products and deliver superior performance to attract consumers.

Secondly, the impact of supply chain disruptions has taken a toll on Qualcomm’s operations. The global shortage of semiconductor components, coupled with logistical challenges, has hindered Qualcomm’s ability to meet the demand for its products. This has led to delays in production and delivery, causing potential customers to seek alternative solutions from competitors who can fulfill their requirements more effectively.

Lastly, the adoption of 5G technology has presented challenges for Qualcomm. While Qualcomm has been a leader in developing 5G technologies, the rapid pace of implementation and the need for interoperability across different devices have posed hurdles. As other players in the market have caught up and released their own 5G-enabled chipsets, Qualcomm has faced increased competition and the need to continuously innovate to maintain its market presence.

Overall, the combination of intensifying competition, supply chain disruptions, and challenges in 5G technology adoption has contributed to Qualcomm’s decline in market share. To regain its position, Qualcomm will need to navigate these challenges effectively, invest in research and development to stay ahead in the technology race, and forge strategic partnerships to enhance its supply chain resilience.

Based on the latest report, MediaTek has experienced a significant increase in market share, gaining 2% in Q2 2023. On the other hand, Qualcomm has seen a noticeable decline, with a 4% drop during the same period. This shift in market share reflects the evolving landscape of the cell phone industry and the competition between these two major players.

The rise of MediaTek highlights the strength of their products and their ability to cater to the growing demand for affordable and mid-range smartphones. With their innovative chipsets and competitive pricing, MediaTek has captured the attention of consumers who are looking for quality devices without breaking the bank.

Meanwhile, Qualcomm’s drop in market share could be attributed to various factors, such as increased competition, supply chain challenges, or shifts in consumer preferences. It will be interesting to see how Qualcomm responds to this setback and whether they can regain their market share in the coming quarters.

Overall, the changing dynamics in the market highlight the importance of continuous innovation and adaptability for cell phone manufacturers. As technology advances and consumer demands evolve, companies must stay ahead of the curve to maintain their competitiveness and meet the ever-changing needs of smartphone users.

FAQs

1. What is the significance of MediaTek gaining market share?

MediaTek gaining market share indicates that their products are gaining popularity among consumers. It could be a result of their focus on providing affordable and feature-rich options in the cell phone market.

2. Why did Qualcomm experience a drop in market share?

The drop in Qualcomm’s market share could be due to various factors. It could be a result of increased competition from other chipset manufacturers like MediaTek and Exynos. It could also be related to any product or performance issues faced by Qualcomm during the specified quarter.

3. How does market share impact the cell phone industry?

Market share is an important metric in the cell phone industry as it provides insights into the popularity and success of different manufacturers and chipset providers. Higher market share usually signifies a larger consumer base and indicates the trust and demand for a particular brand or product.

4. Can market share fluctuations impact the pricing of cell phones?

Market share fluctuations can indirectly impact the pricing of cell phones. When a manufacturer gains significant market share, it can have the advantage of economies of scale, leading to more competitive pricing. On the other hand, if a manufacturer experiences a drop in market share, they may need to adjust their pricing to attract more consumers.

5. How does the market share of chipset providers affect cell phone performance?

The market share of chipset providers can have an impact on cell phone performance. Different chipset providers have varying levels of expertise, technologies, and optimizations. A higher market share indicates that more cell phones are using a particular chipset, which might have a positive impact on compatibility, software optimization, and overall performance of the devices.