The Internal Revenue Service (IRS) plays a vital role in collecting taxes and ensuring compliance with tax laws in the United States. As a taxpayer, you may have questions or need assistance with filing your taxes, understanding tax regulations, or resolving issues related to your tax returns. In such situations, contacting the IRS by phone can be a convenient and effective way to receive the help you need.

However, finding the right phone number and knowing how to navigate through the IRS’s phone system can be a daunting task. That’s why in this article, we will guide you on how to contact the IRS by phone. Whether you have general inquiries, need assistance with a specific tax matter, or want to get updates on the status of your refund, we have got you covered. Let’s explore the different options and procedures to connect with the IRS easily and efficiently.

Inside This Article

- IRS Phone Contact: A Step-by-Step Guide

- How to Locate the Correct IRS Phone Number

- Preparing Before Calling the IRS

- Tips for a Successful Call with the IRS

- Alternatives to Phone Contact with the IRS

- Conclusion

- FAQs

IRS Phone Contact: A Step-by-Step Guide

When you need to contact the Internal Revenue Service (IRS), it’s important to have the correct phone number and be prepared for your call. The IRS offers a range of phone contacts for different types of inquiries, and navigating through the options can seem overwhelming. To help you out, we’ve put together this step-by-step guide on how to contact the IRS by phone.

Step 1: Locate the Correct IRS Phone Number

The first step is to find the correct phone number for your specific inquiry. The IRS has different phone numbers for various types of issues, such as tax refunds, payment assistance, and general inquiries. To ensure you reach the right department, visit the official IRS website and look for the “Contact Us” or “Telephone Assistance” section.

Remember that scammers often target taxpayers using phone calls, so it’s crucial to verify the phone number you are calling. The official IRS website is the best source to find accurate phone numbers, as well as any updates or changes to their contact information.

Step 2: Prepare Before Calling the IRS

Before you make the call, gather all the necessary information and documents related to your inquiry. This may include your Social Security number, tax return information, and any relevant correspondence or notices from the IRS. Having this information on hand will help streamline the conversation with the IRS representative.

In addition, it’s advisable to jot down any specific questions or concerns you have before the call. This will ensure that you don’t forget to address any important issues during the conversation.

Step 3: Tips for a Successful Call with the IRS

When you’re ready to call, keep the following tips in mind to make your conversation with the IRS as successful as possible:

- Choose the right time: Calling during non-peak hours, such as early mornings or late afternoons, can help reduce wait times and improve your chances of reaching an IRS representative more quickly.

- Stay patient: Be prepared for potential wait times, as the IRS can be busy during certain periods. Stay on the line and try not to get frustrated; your call will be answered eventually.

- Be polite and professional: It’s important to maintain a respectful tone during your conversation with the IRS representative. Stay calm, be clear in your communication, and avoid any confrontational or argumentative behavior.

- Take notes: During the call, make sure to take notes of the date, time, and the name of the representative you are speaking to. These details may come in handy if you need to refer back to the conversation later.

- Follow up if needed: If your issue is not resolved during the initial call, don’t hesitate to follow up with the IRS. They may provide further guidance or request additional information to address your inquiry.

Step 4: Alternatives to Phone Contact with the IRS

If you prefer not to contact the IRS by phone or find it difficult to get through, there are alternative options available:

- Online portals: The IRS has various online portals where you can find information, request assistance, and communicate with them through secure messaging.

- Mail: Some inquiries can be addressed by sending a letter to the IRS. However, keep in mind that the response time may be longer compared to phone or online contact.

- Local IRS office: If your issue requires face-to-face interaction, you can visit a local IRS office. Check the IRS website for locations and appointment requirements.

Remember, contacting the IRS by phone can be an effective way to address your tax-related questions or concerns. By following this step-by-step guide and being prepared, you can have a productive conversation with the IRS and obtain the information or assistance you need.

How to Locate the Correct IRS Phone Number

When you need to contact the IRS by phone, it’s essential to have the correct phone number to reach the appropriate department or service. Here are some steps to help you locate the correct IRS phone number:

1. Visit the Official IRS Website: Start by visiting the official website of the Internal Revenue Service at www.irs.gov. This website is a valuable resource for various tax-related information, including contact details for different IRS services.

2. Navigate to the “Contact Us” Page: Once on the IRS website, look for the “Contact Us” page. This page typically provides a list of phone numbers related to different IRS services. Click on the “Contact Us” link to access this information.

3. Determine Your Purpose: Before you start searching for a phone number, determine the purpose of your call. Are you looking for general information about your tax account? Do you have questions about a specific form or tax topic? Knowing the purpose will help you locate the most appropriate phone number.

4. Use the Interactive Tax Assistant: The IRS website offers an Interactive Tax Assistant feature that can help you find answers to common tax questions. By using this tool, you may be able to find the relevant phone number for your query.

5. Check IRS Letters or Forms: If you have received a letter from the IRS or are filling out a tax form, there may be a specific phone number provided for inquiries related to that specific matter. Look for any contact information mentioned on the letter or form.

6. Consult the IRS Directory: The IRS directory is a comprehensive list of contact numbers for specific departments, offices, and services within the IRS. You can access this directory on the IRS website and search for the relevant phone number based on your geographical location or specific query.

7. Utilize Online Resources: There are several reliable online resources that provide comprehensive lists of IRS phone numbers. These resources often categorize the phone numbers, making it easier for you to identify the right one for your needs. However, always double-check the information from reliable sources like the official IRS website.

8. Call the IRS Taxpayer Assistance Center: If you are unable to find the appropriate phone number using the above methods, you can contact the IRS Taxpayer Assistance Center. They can assist you in locating the correct phone number or connect you with the right department.

Remember, it’s important to have patience when searching for the correct IRS phone number. Take your time to ensure you find the right contact information to address your specific needs. Using the official IRS website as your primary source of information will help ensure you have accurate and up-to-date phone numbers for efficient communication with the IRS.

Preparing Before Calling the IRS

Calling the IRS can be an intimidating process, but with proper preparation, you can make your call more productive and efficient. Here are some essential steps to take before contacting the IRS:

Gather Your Information

Prior to calling the IRS, gather all the necessary information related to your tax issue. This may include your Social Security number, tax ID number, previous tax returns, and any relevant correspondence you have received from the IRS. Having this information readily available will help streamline the conversation and ensure that you can provide accurate details to the IRS representative.

Clarify the Reason for Calling

Clearly identify the reason for your call and the specific questions or issues you need assistance with. This will help you stay focused during the conversation and ensure that you address all your concerns. If you have multiple inquiries, it may be helpful to prioritize them in order of importance, so you can address the most pressing matters first.

Review Relevant Documentation

Prior to making the call, review any relevant documentation or notices you have received from the IRS. This will enable you to have a better understanding of the specific issue and help you articulate your questions or concerns more effectively. Familiarize yourself with the specific tax laws or regulations related to your situation, as this will help you navigate the conversation more confidently.

Prepare a List of Questions

Compile a list of questions you have for the IRS representative. Organize them in a logical order to streamline the conversation. Be as specific as possible when framing your questions, and provide any context that may be necessary for the representative to understand and address your concerns. Having a list of questions prepared will help you stay focused and ensure that you cover all the necessary topics during your call.

Set Aside Ample Time

Before making the call, set aside enough time to have a thorough conversation with the IRS representative. It is important to be patient and allocate sufficient time to address all your questions and concerns. Avoid making the call when you are in a rush or have other pressing commitments, as this may lead to a rushed or incomplete conversation.

Consider Seeking Professional Assistance

If you are facing complex tax issues or are unsure about how to handle a particular situation, it may be beneficial to seek professional assistance. Tax professionals such as enrolled agents, certified public accountants (CPAs), or tax attorneys can provide expert guidance and help you navigate the IRS process more effectively. Their knowledge and experience can ensure that you receive accurate advice and assistance tailored to your specific situation.

By taking these preparatory steps, you will be better equipped to have a productive and successful call with the IRS. Being organized and well-informed will help you address your tax concerns more effectively and increase the likelihood of a satisfactory resolution. Remember to stay calm and polite during the call, as having a respectful demeanor can go a long way in building a positive rapport with the IRS representative.

Tips for a Successful Call with the IRS

Calling the IRS can often feel intimidating, but with the right preparation and approach, you can have a successful interaction. Here are some useful tips to help you navigate your call with the IRS:

- Be Prepared: Before making the call, gather all the necessary documents and information that you may need to reference during the conversation. This may include your tax return, social security number, and any correspondence you have received from the IRS.

- Choose the Right Time: Avoid calling during peak hours when the lines are usually busy. Early mornings and late afternoons are generally less busy, increasing your chances of getting through to a representative more quickly.

- Stay Calm and Patient: Dealing with the IRS can be stressful, but it’s important to remain calm and patient throughout the call. Take deep breaths and focus on speaking clearly and politely.

- Listen Carefully: While speaking with the IRS representative, pay close attention to what they are saying. Take notes if necessary, as this will help you remember important details and instructions for any follow-up actions.

- Be Honest and Accurate: When providing information to the IRS, it’s crucial to be honest and accurate. Providing incorrect or misleading information can result in further issues down the line. If you are unsure about something, it’s best to clarify with the representative.

- Ask for Clarification: If the representative uses jargon or terminology that you don’t understand, don’t hesitate to ask for clarification. It’s important that you fully understand what they are saying to ensure effective communication.

- Take Notes: Throughout the call, make a note of the date of the call, the representative’s name, and any reference or case numbers given to you. Having this information handy can be useful for future reference.

- Follow Up, if Necessary: If the issue discussed on the call requires further action or follow-up, make sure to note down the necessary steps and deadlines provided by the IRS representative. Take the necessary actions promptly to resolve any outstanding matters.

- Keep Records: After the call ends, keep a record of any notes, documents, or correspondence related to the call. This will help you maintain a clear record of your interactions with the IRS.

By following these tips, you can increase the chances of having a productive and successful call with the IRS. Remember to remain calm, be prepared, and communicate clearly to achieve the best outcome.

Alternatives to Phone Contact with the IRS

While calling the IRS by phone is a common method of contacting them, there are alternative ways to get in touch with them. These alternatives can save you time and provide additional options for resolving your tax-related issues. Here are a few alternatives to consider:

- Online Chat: The IRS offers an online chat service on their website, which allows you to communicate with an IRS representative in real-time. This can be a convenient option if you prefer typing your questions or concerns rather than speaking on the phone.

- Mail: If your issue is not urgent, you can communicate with the IRS by sending them a letter through traditional mail. Make sure to include all necessary documentation and provide a clear explanation of your situation. Keep in mind that responses through mail may take longer compared to other contact methods.

- IRS Website Resources: The IRS website offers a vast array of resources and information that can help answer many common tax-related questions. From tax forms to frequently asked questions, the website is a valuable tool for obtaining information and understanding various tax topics.

- Taxpayer Assistance Centers: The IRS operates Taxpayer Assistance Centers (TACs) in various locations across the country. These centers provide in-person assistance to taxpayers with tax-related inquiries, including help with filing taxes, resolving issues, and answering questions.

- Authorized Tax Professionals: If you prefer to work with a tax professional to help you navigate your tax matters, you can consider hiring an authorized tax professional. These professionals, such as enrolled agents, certified public accountants (CPAs), or tax attorneys, can assist you with understanding your tax obligations and representing you in front of the IRS if needed.

It’s important to note that while these alternatives can be helpful, some complex or specific tax matters may still require direct communication with the IRS via phone. If you are unsure which method is best for your situation, it is advisable to consult with a tax professional who can guide you in determining the most appropriate course of action.

Remember, regardless of the contact method you choose, it’s crucial to provide accurate and complete information to the IRS to ensure that your concerns are addressed appropriately. By selecting the method that suits your needs and being prepared with the necessary documentation and information, you can effectively communicate with the IRS and find resolution to your tax-related matters.

Conclusion

In conclusion, contacting the IRS by phone can be a valuable resource when you need to resolve tax-related issues or seek assistance. By following the steps outlined in this article, you can ensure a smooth and efficient experience when contacting the IRS by phone. Remember to gather all necessary information beforehand, be patient during peak times, and have any relevant documents or forms ready for reference. Additionally, utilizing other channels such as the IRS website and online tools can provide you with additional resources and information. By combining these methods, you can successfully navigate the process and get the answers you need. So, don’t hesitate to pick up the phone and reach out to the IRS for assistance, knowing that help is just a phone call away.

FAQs

1. How can I contact the IRS by phone?

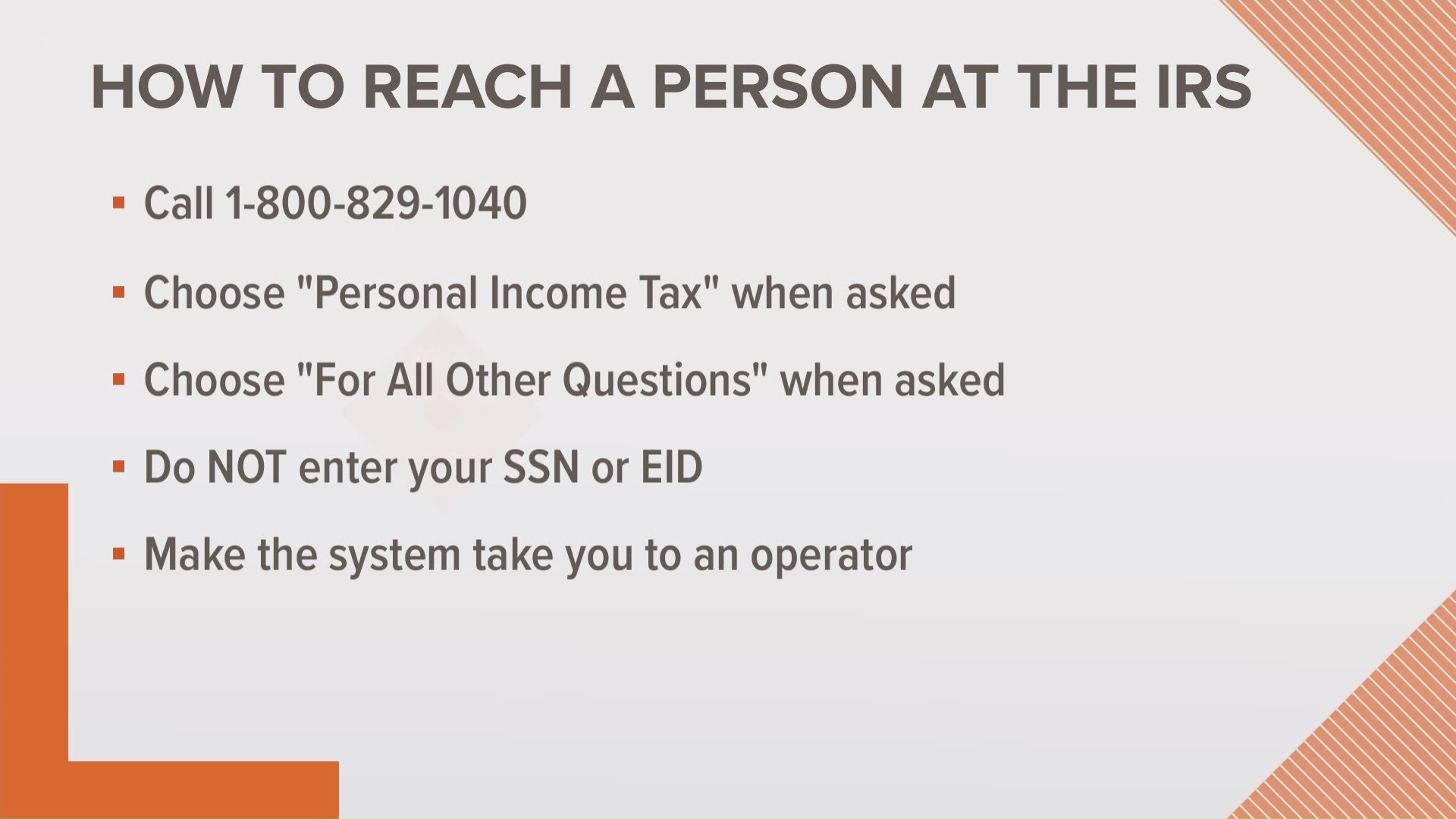

To contact the IRS by phone, you can call their toll-free hotline at 1-800-829-1040. This number is available Monday through Friday, from 7 a.m. to 7 p.m. local time. Be prepared to provide your personal information and have any relevant documents or tax forms ready when you call.

2. What should I do if I need help with my taxes?

If you need help with your taxes, the IRS offers various resources. Start by visiting their website at www.irs.gov, which provides valuable information and resources for taxpayers. You can also call the IRS hotline mentioned above to speak to a representative who can provide guidance and assistance with your tax-related questions.

3. How can I check the status of my tax refund?

To check the status of your tax refund, you can use the “Where’s My Refund?” tool available on the IRS website. This tool allows you to track the progress of your refund by entering your Social Security number, filing status, and the exact amount of your expected refund. Alternatively, you can call the IRS hotline mentioned above and follow the automated prompts to check your refund status.

4. What if I have a specific question about my tax return?

If you have a specific question about your tax return, it is best to call the IRS hotline mentioned earlier. They have trained representatives who can provide personalized assistance with your tax-related inquiries. Be prepared to provide relevant details about your tax return, such as your filing status, income sources, and deductions, to help them better understand your situation.

5. Can I make a payment to the IRS over the phone?

Yes, you can make a payment to the IRS over the phone. The IRS provides various payment options, including electronic funds transfer, credit card, or debit card payments. To make a payment over the phone, you can call the IRS hotline and follow the prompts to make a payment. Make sure to have your bank account or card details ready when making the payment.