Saving money can prove to be difficult in modern times. That’s why people jump at the opportunity to save up whenever they can. In the past, coupons were a big part of saving money on important purchases. People used to collect and clip coupons to have big savings.

In later years, rewards cards popped up as shops and companies provided people more opportunities to save via different methods. More recently, as technology continues to flourish, cashback has become a new method for many people. You can save money even as you shop. Even with low percentages, as the amount snowballs over time, you might even find yourself saving up to $1,000. How do cashback apps work, though? Moreover, which ones are more worth your time? Here, you’ll find the best answer for the best cashback apps that are worth the download.

How Do Cashback Apps Work?

Unlike the investment apps, the way cashback apps work is that for every purchase you make within the app, you’ll get a percentage off the price. It’s kind of like a discount but much more. Cashback works like a small refund for every purchase. It might sound sketchy, but cashback apps are legitimate businesses that give you real money back.

Cashback apps’ business model operates on the premise of loyalty—both from the customers and the partner stores. They gather up partner stores and shops with the promise of digital foot traffic. These stores pay a sort of “virtual rent” to the apps that promise to bring people to buy their products.

Customers, in turn, are enticed by cashback apps because they, well, give you some cashback from purchases. However, cashback apps usually only allow withdrawals after you spend a minimum amount. This will encourage a degree of loyalty from customers so that partner shops will get that promised foot traffic.

What Are the Things to Look For?

There are certain factors to look for when you’re evaluating if a cashback app is good. It’s important to understand these first before you choose between different apps. That way, you’ll be able to sift through cashback apps and find the best one for your needs.

1. The Qualifying Amount

We’ve already mentioned this before, but cashback apps will have a qualifying amount before you can withdraw money. This amount will vary from app to app. Only avail of a cashback app if you’re somewhat sure you can meet the minimum.\

2. The List of Stores

Sure, cashback apps are great to save on purchases. However, there’s no real benefit if the stores available aren’t ones you like to shop in.

3. The Payment Method

Many apps will want you to redeem your cashback through gift cards, PayPal, or check. You have to take this into account when choosing an app.

4. The Frequency of Payout

You might think cash will come immediately after a few purchases. However, that’s not always the case. Take a look at how often payouts occur per-app before you make a decision.

10 Best Cashback Apps You Need Now

Now that you know how cashback apps work, let’s look at some of the best apps out there. In this list, we’ll run through the pros and cons of these apps and why you should—or shouldn’t—consider them.

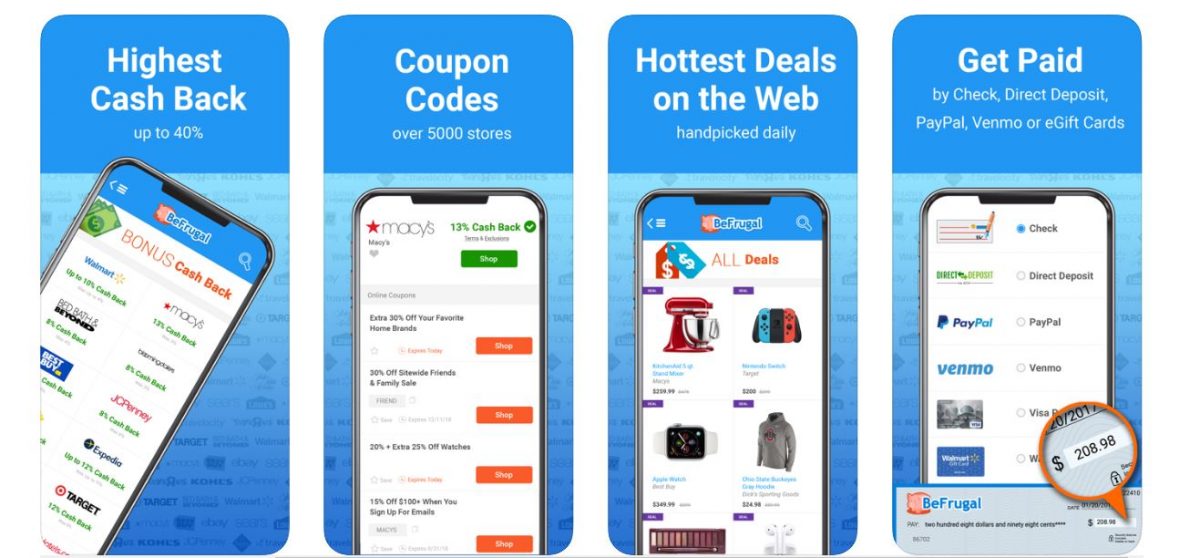

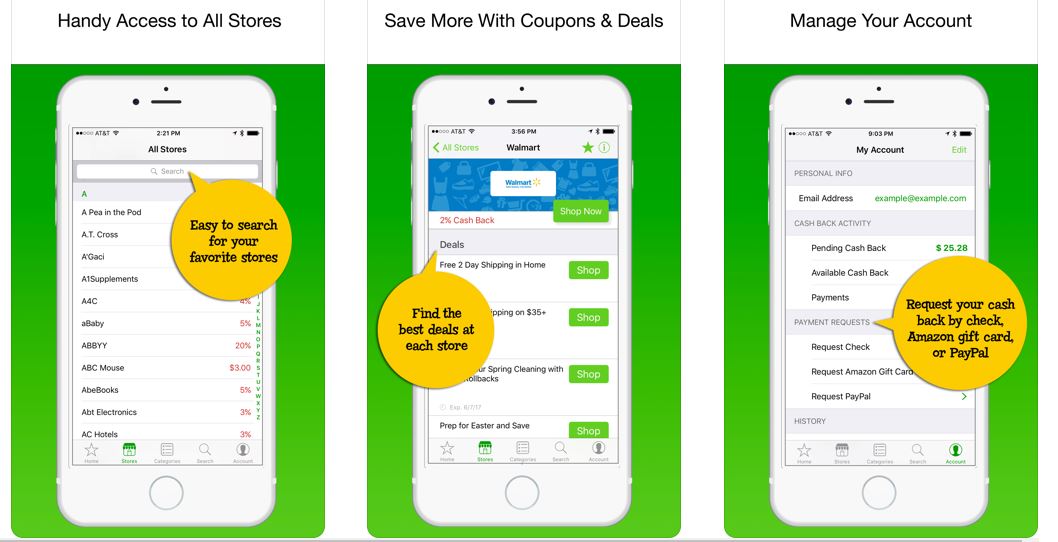

1. BeFrugal

BeFrugal is one of the best cashback apps with over 5,000 partner online stores. That’s a huge list of partner stores—more than a lot of the others on this list. This includes getting Best Buy, Amazon, Groupon, eBay, and Target cashback on your purchases. All your favorites are present.

BeFrugal is easy to sign up for because membership is free and even gives you $10 as a welcome gift. With BeFrugal, you can earn up to 40% cashback with access to thousands of Befrugal exclusive promo and coupon codes. BeFrugal prides itself on this and even guarantees a $5 payment if the promo codes aren’t up-to-date.

They’re also quite diligent when it comes to matching competitors’ rates. Additionally, they even put 25% on top of the cashback, making their rates incredibly competitive.

When it comes to withdrawals, BeFrugal offers checks, direct deposits, and PayPal. These withdrawal options come with no minimum except for check withdrawals that require at least $25. Additionally, you can opt to convert your rebates into gift cards with an added 1% – 6% as a bonus.

Pros

- Over 5,000 partner stores

- Free membership

- Up to 40% cashback

- Exclusive coupons and promo codes

- $10 for sign up and referral

- Multiple platform availability

Cons

- In-store transactions have no cashback

- Spam emails

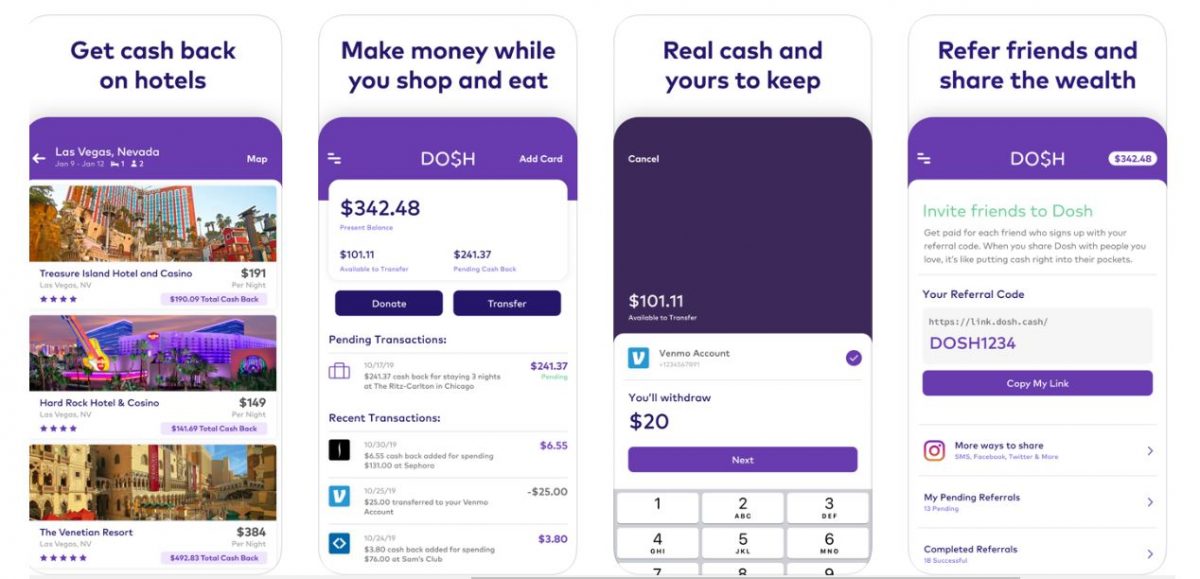

2. Dosh

Dosh is one of the mobile cashback apps recommended by many users. It’s a great app that keeps track of your purchases at physical shops and restaurants.

Dosh is easy to recommend because you don’t even have to think when you’re using it. As long as your cards are linked, you automatically get cashback if you purchase from participating stores. It’s also convenient to withdraw cash since they can wire the money directly to your bank account. Alternatively, you can also opt for withdrawing through Venmo or PayPal. Of course, you still have to meet the qualifying amount before you can make a withdrawal.

Dosh is great to pair with other discounts like credit card rewards. If you shop at their partner stores often, you can easily save lots of money. Moreover, aside from stores, Dosh also has hotel and accommodation partners. Booking vacations with these hotels can earn you up to 40% cashback.

Pros

- Physical store cashback

- Credit card linking for passive cashback

- Partner hotels and accommodations

- Bonus money for referrals

- Encrypted and secure data

- Easy to use

Cons

- It is limited to mobile.

- Cashback depends on you frequenting their physical partner stores, which might be inconvenient depending on where you live.

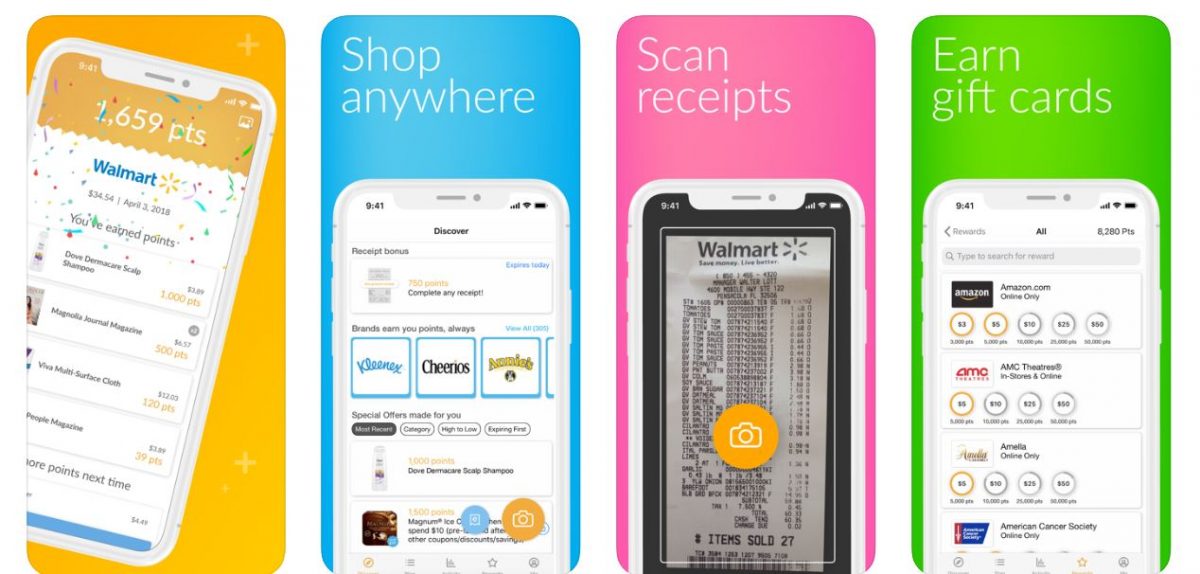

3. Fetch Rewards

Fetch Rewards is unique in that it’s a brand-based cashback app. Instead of partnering with stores, the brands you buy will give you cashback. That means you can shop almost anywhere and get redeemable cashback.

How does it work? Well, Fetch Rewards requires you to upload your receipts from places you’ve shopped at. You can get a Costco rebate, a Walmart rebate, and more. Honestly, it could be any kind of store. As long as it finds that you’ve purchased from one of their partner brands, you’ll get rewards.

Once you’ve scanned in your receipts, you can redeem your rewards as gift cards. They can be claimed at tech stores, charities, clothing stores, and more. However, Fetch Rewards does offer little earnings. Oftentimes it’s $0.25 to $2 per offer. Plus, you have to be very diligent in keeping your receipts.

Pros

- Being brand-based means if you frequently buy a certain brand, cashback is guaranteed.

- It’s available on the web and mobile app.

Cons

- Cashback earnings are relatively small

- Only redeemable via gift cards

- Requires you to keep receipts

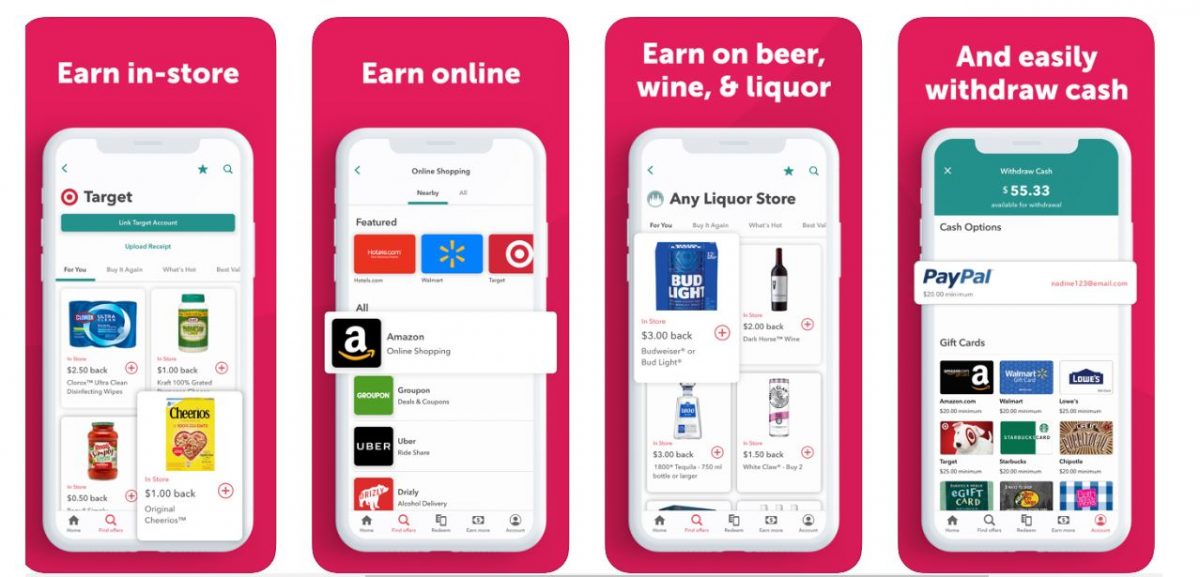

4. Ibotta

Ibotta is one of the top cashback apps available with both in-store and online shopping cashback. If you shop from physical stores, just scan the barcode and upload receipt photos to earn rebates. Alternatively, you can also shop online to earn cashback.

There is a catch to iBotta, though. Their products need to be unlocked for them to be eligible for cashback. To unlock them, you need to accomplish a few tasks. The tasks are minor like watching videos or answering polls. However, it’s an added way to earn additional points since each product isn’t restricted to one task.

If you don’t mind the task-based eligibility, Ibotta can prove to be quite useful. They claim that on average, users earn about $30 per month. Ibotta transactions also process quickly, being finished in 48 hours or less. You can choose to withdraw points via gift card or cash transfer.

Pros

- User-friendly

- Has both physical and digital cashback

- Handy as a digital wallet

Cons

- Requires receipts and barcodes, which may be tedious to keep

- Task-based eligibility of products

5. Mr. Rebates

Mr. Rebates is a cashback website that’s easy to use. All you have to do is sign up, shop, and cash will be deposited into your account. Simple and easy.

There are a few differences Mr. Rebates possesses in contrast to other cashback apps. Firstly, there’s a one-to-three-day waiting period before your account will be credited with the cashback. There’s also a 90-day pending period upon credit. You can withdraw your balance only after this period.

Additionally, Mr. Rebates requires a $10 qualifying amount for withdrawals, and withdrawals can only happen once a month. When it comes to withdrawals, they can come in various forms. You have the option to withdraw them as a check, via PayPal deposit, or convert them to gift cards.

Pros

- $5 sign-up bonus after your first transaction

- Frequent payout frequency (once per month)

- Mobile app availability

- Over 2,000 partner stores

- Relatively low qualifying amount ($10)

Cons

- 90-day pending period before withdrawal

- 1 to 3-day waiting period to credit your account

- Unappealing website design

- No physical stores

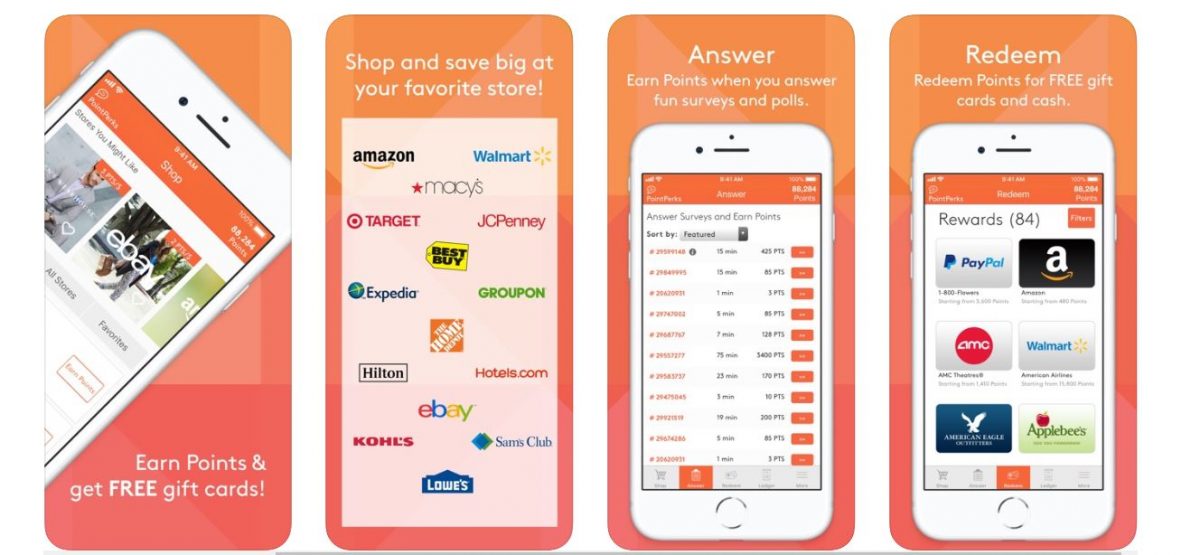

6. MyPoints

MyPoints is one of the best apps with many participating stores. They have partnerships with Amazon, Walmart, Target, eBay, Home Depot, and more. No doubt you’ll be shopping from these retailers quite regularly.

MyPoints offers big percentages—as high as 40%—for cashback. They even have added tasks to help you earn more points. These tasks include taking surveys, viewing videos, playing games, and reading emails.

The payout options are slightly more limited, though. You can only credit them through PayPal or gift cards. The upside is there’s no minimum withdrawal amount. You can redeem your points anytime.

MyPoints sometimes also offers a $10 bonus upon sign-up provided you spend $20 in the first month. They even offer 25 points per referral and an additional 750 points if they spend $20 within 30 days. The downside is MyPoints is only available in the US and Canada.

Pros

- Up to 40% cashback

- Over 2,000 of the most widely known retailers

- Redeem points anytime

- Activities as an added option to earn points

- Quick payment

- App availability

- Gift card cashback is available for 75+ retailers

- No minimum qualifying amount for withdrawals

- Added points for referrals

Cons

- Only options for a payout are PayPal and gift card

- No cash back for physical stores

- Only for US and Canada

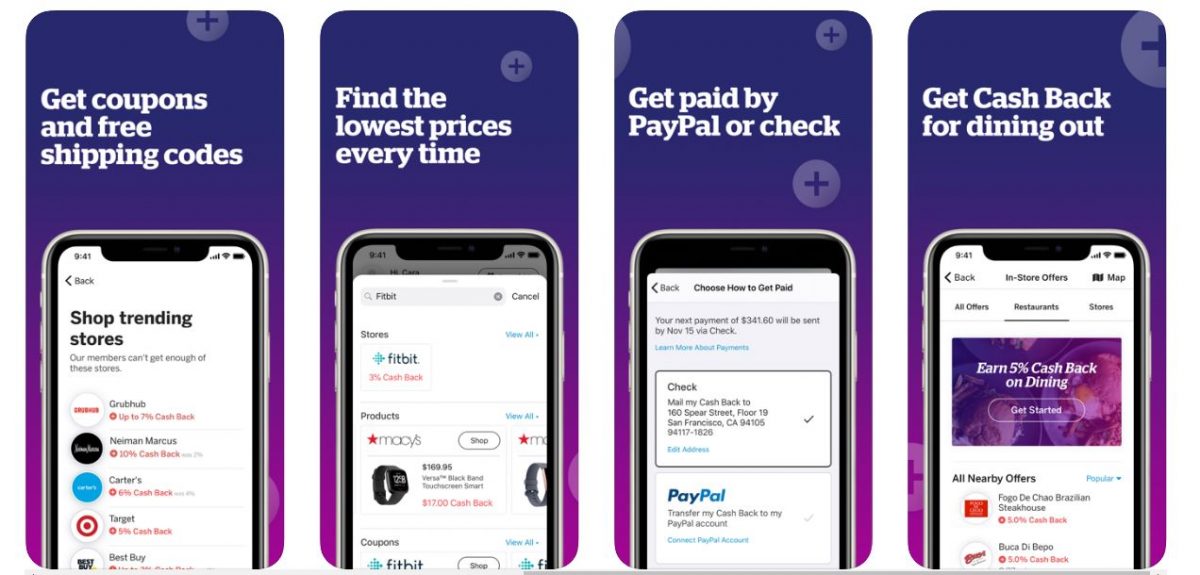

7. Rakuten (Ebates)

Rakuten, formerly the Ebates app, is one of the best cashback apps if you want real cash. Almost any online purchase can get you some cashback via the Chrome extension. If you’re at a partner store’s site, you’ll immediately get a notification. This makes cashback a breeze since you don’t even have to think about it. If you make lots of purchases online, then you should install Rakuten. Otherwise, you’re losing out on easy cashback.

Cashback payouts are available via check or PayPal. However, you’ll only get that payout quarterly. That’s a little infrequent if you want to redeem your cashback more quickly.

If you sign up for Rakuten, you’ll get a $10 bonus if you spend $25 within your first quarter. Referrals can also earn you up to $25 as a bonus.

Rakuten has great opportunities and you can even get up to 40% cashback. However, it’s more typical to earn around 5% to 10% in cashback.

Pros

- Get real cash checkout via check

- $10 sign-up bonus if you spend $25 on your first quarter

- Up to 40% cashback

- Earn up to $25 from referrals

- Convenient Google Chrome extension

Cons

- Quarterly payouts only

- No payout option for gift cards

8. Upromise

If you’re a student, Upromise should pique your interest quite a bit. It’s an app that’s designed to be used to pay off student debt. However, it isn’t limited to just that.

Through Upromise shopping, you can earn 5% cashback on your purchases from participating online stores. Additionally, you can also earn around 2.5% cashback for the app’s participating restaurants. That means you can get cashback even as you eat. Upromise also offers many other special discounts within their app.

If all that’s not enough for you, Upromise even has a Mastercard. For every purchase you make with the card, you earn 1.25% in cashback. Yes, that’s true even for non-partner retailers.

If you have a 529 savings plan, Upromise can also give you a bonus of 15%. All you have to do to gain all of its perks is to link your credit card to the app. However, do keep in mind that some have noticed it’s a little slow to credit cashback.

Pros

- Designed for student loans

- Upromise Mastercard adds 1.25% for non-partner stores

- Eating at partner restaurants also gives you cashback

- An additional perk for people with a 529 savings plan

- The passive cashback that requires only your credit cards to be linked

- Focused on student loans or 529 savings plans

- Redeemable through check deposits into your bank account

Cons

- Crediting cashback to your account is slow

- No mobile app

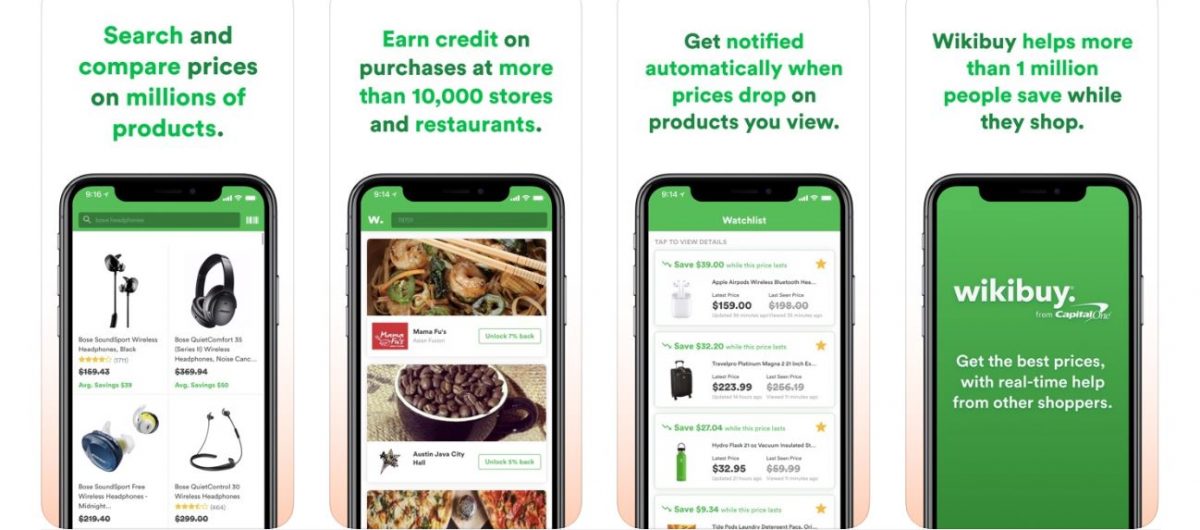

9. Wikibuy

Wikibuy is great for people who love online shopping. It not only gets you cashback but also discounts when you shop.

Wikibuy works as a browser extension on Chrome, Firefox, Edge, and Safari. When you shop online and Wikibuy finds a cheaper price for the item elsewhere, you’ll be notified. If you’ve viewed an item recently and the price drops, you’ll also be notified. All points earned will go toward gift cards.

Wikibuy also offers a barcode scanner within its mobile app. When you scan a barcode, it’ll compare that product’s price with its online price. That way you can get the best price on all your purchases.

Wikibuy also works like other cashback apps. However, the only downside is that it will use your shopping data. It’s used to log the cheapest prices and expired coupon codes so their users get the best experience. If you’re asking, “Is Wikibuy safe?” given its data usage, it still is.

Pros

- Browser extension that looks for cheaper prices

- Convenient barcode scanner for comparing in-store prices to online prices

- Wide variety of compatible browsers

Cons

- It uses users’ data to compile the best prices on products and to log coupons that are no longer effective.

- Gift cards are the only option for payout.

10. Yelp

If you like getting cash back on restaurants, try out Yelp cashback. Beyond the use of Yelp for restaurant reviews, this app actually does help you earn while you spend. It has local business partners but it’s mostly focused on restaurants.

Once you sign up for Yelp, you’ll have to link your Visa, Mastercard, or American Express credit card. After that, as long as you purchase from a participating shop/restaurant, you get cashback. Cashback rates will vary per establishment per area.

Cashback credits will come only the following month after your transactions, though. That means it can be a little slow. However, it’s still a good deal if you want to save some money on restaurants you frequent.

Pros

- Many partner restaurants

- Passive cashback earnings via credit card linking

- Website and app availability

Cons

- Cashback credits don’t come immediately.

- It’s focused mostly on restaurants, which can be difficult if you’re more interested in shopping.

Conclusion

Cashback apps are a great way to earn a bit of money back from your purchases. They’re mostly free and easy to use. It would be a waste for anyone to miss out on these apps that pay you back.