Are you ready to take control of your financial future? Look no further than the Apple Savings Account! In 2023, Apple is launching its very own savings account, designed to help you grow your savings while enjoying the perks and benefits that only Apple can offer. As a leading tech company, Apple is known for its innovation and seamless user experience, and they have brought that same level of excellence to their savings account. With competitive interest rates, easy-to-use mobile banking, and exclusive Apple rewards, this account is perfect for Apple enthusiasts and anyone looking for a modern banking solution. So, let’s dive into everything you need to know about the Apple Savings Account and how it can revolutionize your financial journey.

Inside This Article

- Section 1: The Benefits of an Apple Savings Account

- Section 2: How to Open an Apple Savings Account

- Section 3: Managing Your Apple Savings Account

- Section 4: Maximizing Your Savings with Apple’s Features

- Conclusion

- FAQs

Section 1: The Benefits of an Apple Savings Account

When it comes to saving money, having a dedicated savings account is a smart move. And what better way to save than with an Apple Savings Account? Apple not only revolutionized the technology industry with its innovative products, but now they’re taking the financial world by storm with their cutting-edge savings account.

So, what makes an Apple Savings Account so beneficial? Let’s dive in and explore the advantages:

- Competitive Interest Rates: One of the major benefits of an Apple Savings Account is the competitive interest rates. Apple understands the importance of growing your savings, which is why they offer rates that are often higher than those of traditional banks. This means that while your money sits in the account, it has the potential to earn more over time.

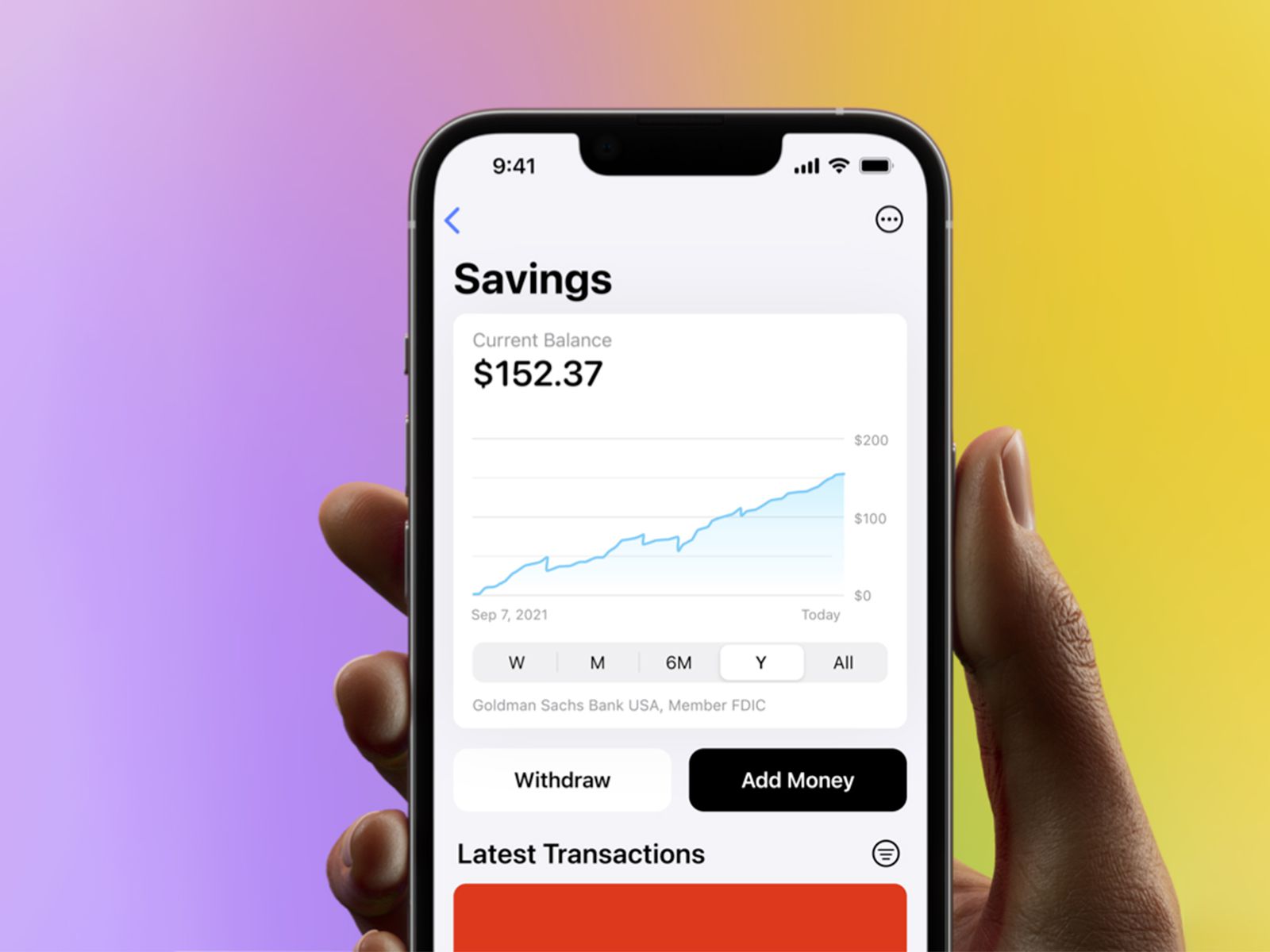

- Convenience and Accessibility: With an Apple Savings Account, you have the convenience of managing your account right from your mobile phone. Gone are the days of visiting a brick-and-mortar bank or standing in long queues. You can easily access your account, make deposits, withdrawals, and track your savings goals with just a few taps on your device.

- Financial Security: When you choose an Apple Savings Account, you can have peace of mind knowing that your funds are backed by a reputable and financially secure company. Apple has a strong track record of delivering trustworthy products and services, and their savings account is no exception.

- Seamless Integration with Apple Wallet: If you’re an avid Apple user, you’ll appreciate the seamless integration between the Apple Savings Account and Apple Wallet. You can effortlessly transfer funds between your savings account and Apple Pay, making it even easier to manage your finances and make purchases with just a few clicks.

With all these benefits, it’s clear that an Apple Savings Account offers a unique and advantageous way to save money. Whether you’re saving for a dream vacation, a down payment on a home, or simply building an emergency fund, an Apple Savings Account can help you reach your financial goals faster and more efficiently.

Section 2: How to Open an Apple Savings Account

Opening an Apple Savings Account is a straightforward process that can be completed in just a few simple steps. Here’s a step-by-step guide to help you get started:

- Visit the Apple Savings Account webpage: The first step is to go to the Apple website and navigate to the page dedicated to their savings account. You can find it within the “Personal Banking” section.

- Review the account details: Take some time to familiarize yourself with the features and benefits of the Apple Savings Account. Look for information about the interest rate, minimum balance requirements, and any fees associated with the account.

- Click on the “Open an Account” button: Once you’re ready to proceed, click on the “Open an Account” button, which will take you to the account application page.

- Provide your personal information: Fill out the application form with your personal details, including your name, address, contact information, and social security number. This information is necessary for account verification purposes.

- Select the type of account: Choose the type of Apple Savings Account you want to open. This could be a regular savings account, a high-yield savings account, or a specialized savings account for specific goals, such as retirement or education.

- Agree to the terms and conditions: Before finalizing your application, carefully read and agree to the terms and conditions set by Apple. This will include details about account access, transactions, and privacy policies.

- Submit your application: Once you’ve completed all the necessary steps, review your application for accuracy and submit it. You may receive an instant decision on whether your application is approved, or you may need to wait for further verification.

- Fund your account: Once your application is approved, you’ll need to fund your Apple Savings Account. You can do this by transferring funds from an existing bank account, setting up direct deposit, or depositing a check.

- Start saving: Congratulations! You’ve successfully opened an Apple Savings Account. Now, you can start saving and taking advantage of the various features and tools provided by Apple to help you achieve your financial goals.

Remember, it’s important to regularly monitor your Apple Savings Account and make sure you’re meeting any minimum balance requirements or taking advantage of any promotional offers. Additionally, consider exploring features such as automatic savings plans, online banking, and mobile app access to make managing your savings even more convenient.

Section 3: Managing Your Apple Savings Account

Managing your Apple Savings Account is a straightforward process that offers you flexibility and control over your finances. Here are some key aspects to consider when managing your account:

1. Online Access: With an Apple Savings Account, you can conveniently access and manage your account online. This means you can view your balance, track transactions, and set up automatic transfers or bill payments from the comfort of your own home or on the go.

2. Account Alerts: Apple offers account alerts to help you stay on top of your savings goals. You can set up alerts to notify you about account balances, deposits, withdrawals, or any other important activity. These alerts can be sent via email or text message, ensuring that you are always aware of what’s happening with your account.

3. Fund Transfers: Transferring funds to and from your Apple Savings Account is simple and convenient. You can link your account to your checking account or other financial institutions to transfer funds electronically. This allows you to easily move money in and out of your savings account as needed.

4. Automatic Deposits: Setting up automatic deposits into your Apple Savings Account is a great way to build your savings effortlessly. You can schedule regular transfers from your paycheck or checking account, ensuring that a portion of your income goes directly into your savings account every month.

5. Interest Calculation: Apple Savings Account calculates interest on a daily basis, which means your money can grow even faster. The interest is then added to your account on a monthly basis, helping your savings grow steadily over time.

6. Mobile Banking: With Apple’s mobile banking app, you can manage your savings account right from your smartphone or tablet. This allows you to check your balance, make transfers, and review transactions anytime, anywhere, making it even more convenient to stay on top of your savings.

7. Customer Support: Apple offers excellent customer support to assist you with any questions or concerns regarding your savings account. Whether you prefer to reach out via phone, email, or through their online chat, their knowledgeable team is ready to provide the assistance you need.

By effectively managing your Apple Savings Account, you can take full advantage of its features and achieve your financial goals. Whether you want to save for a dream vacation, a down payment on a house, or simply build an emergency fund, your Apple Savings Account gives you the tools to make it happen.

Section 4: Maximizing Your Savings with Apple’s Features

When it comes to maximizing your savings, Apple offers a range of innovative features and tools to help you make the most out of your Apple Savings Account. These features are designed to make saving effortless and convenient, allowing you to reach your financial goals faster. Let’s explore some of the key ways you can enhance your savings with Apple’s features.

1. Automatic Savings: One of the standout features of an Apple Savings Account is the ability to set up automatic savings. This means that a predetermined amount of money will be transferred from your linked bank account to your Apple Savings Account on a regular basis. By automating your savings, you eliminate the need to manually transfer money and ensure that you are consistently building your savings.

2. High-Interest Rates: Apple understands the importance of maximizing your savings through competitive interest rates. With an Apple Savings Account, you can enjoy high-interest rates that help your money grow over time. This allows you to earn more on your savings and achieve your financial goals sooner.

3. Goal-Based Savings: Apple’s goal-based savings feature enables you to set specific savings goals and track your progress towards achieving them. Whether you’re saving for a vacation, a down payment on a house, or a rainy day fund, you can easily allocate funds towards your desired goals. This feature provides a clear roadmap for your savings journey, keeping you motivated and accountable along the way.

4. Budgeting Tools: Managing your expenses is essential for maximizing your savings. Apple offers intuitive budgeting tools that help you track your spending, analyze your patterns, and identify areas where you can cut back or save more. By gaining insights into your financial habits, you can make informed decisions about your spending and channel more funds towards your savings.

5. Smart Recommendations: Apple’s intelligent algorithms analyze your saving and spending patterns to provide personalized recommendations. This means that you’ll receive tailored suggestions on optimizing your savings based on your unique financial situation. Whether it’s adjusting your savings amount, exploring investment opportunities, or taking advantage of exclusive offers, these recommendations can help you make smarter financial choices.

6. Seamless Mobile Experience: As a tech giant, Apple ensures that its savings account integrates seamlessly with its mobile ecosystem. Whether you’re using your iPhone, iPad, or Apple Watch, you can easily access and manage your savings account on the go. This convenience allows you to stay connected to your savings and make necessary adjustments wherever you are.

With these features and tools, Apple empowers you to take control of your financial future and maximize your savings potential. By leveraging the power of technology and intelligent algorithms, you can enjoy a seamless and efficient savings experience.

In conclusion, an Apple Savings Account is a great way to prepare for the future. By taking advantage of the innovative features and benefits offered by Apple, such as high interest rates, seamless integration, and convenient mobile banking, individuals can not only save money but also enjoy a personalized and intuitive banking experience. Whether it’s setting financial goals, tracking expenses, or managing investments, an Apple Savings Account provides the tools and resources necessary to stay on top of your finances. With the constant advancements in technology and the increasing popularity of mobile banking, it’s clear that an Apple Savings Account is not only a smart choice but also a step towards embracing the future of banking. So why wait? Start saving with an Apple Savings Account today and secure a brighter financial future tomorrow.

FAQs

1. What is an Apple Savings Account?

An Apple Savings Account is a unique financial solution offered by Apple that allows you to save money for future purchases on Apple products and services. It functions as a dedicated savings account, providing you with a convenient way to set aside funds specifically for your Apple-related expenses.

2. How does an Apple Savings Account work?

When you open an Apple Savings Account, you deposit funds into the account on a regular basis. The money saved in this account can be used towards the purchase of Apple products, including iPhones, iPads, MacBooks, and accessories. You can track your savings progress through the Apple Savings Account app, where you can also set savings goals and monitor your spending habits.

3. What are the benefits of an Apple Savings Account?

One of the main benefits of having an Apple Savings Account is the ability to save specifically for Apple purchases, making it easier to budget and control your expenses related to Apple products. This account also offers a competitive interest rate, helping your savings grow over time. Additionally, users of the Apple Savings Account gain access to exclusive offers, discounts, and rewards, making it a valuable tool for Apple enthusiasts.

4. Can I withdraw money from my Apple Savings Account?

Yes, you can withdraw money from your Apple Savings Account at any time. However, it is important to note that there may be withdrawal limits and fees associated with certain transaction types. It is recommended to review the terms and conditions of your Apple Savings Account to understand the specific withdrawal policies and any potential fees that may apply.

5. How do I open an Apple Savings Account?

To open an Apple Savings Account, you can visit the official Apple website or the Apple Store app. Look for the “Apple Savings Account” section and follow the instructions to create an account. You will typically need to provide personal information, such as your name, contact details, and identification documents. Once your account is created, you can start depositing funds and saving for your future Apple purchases.