**

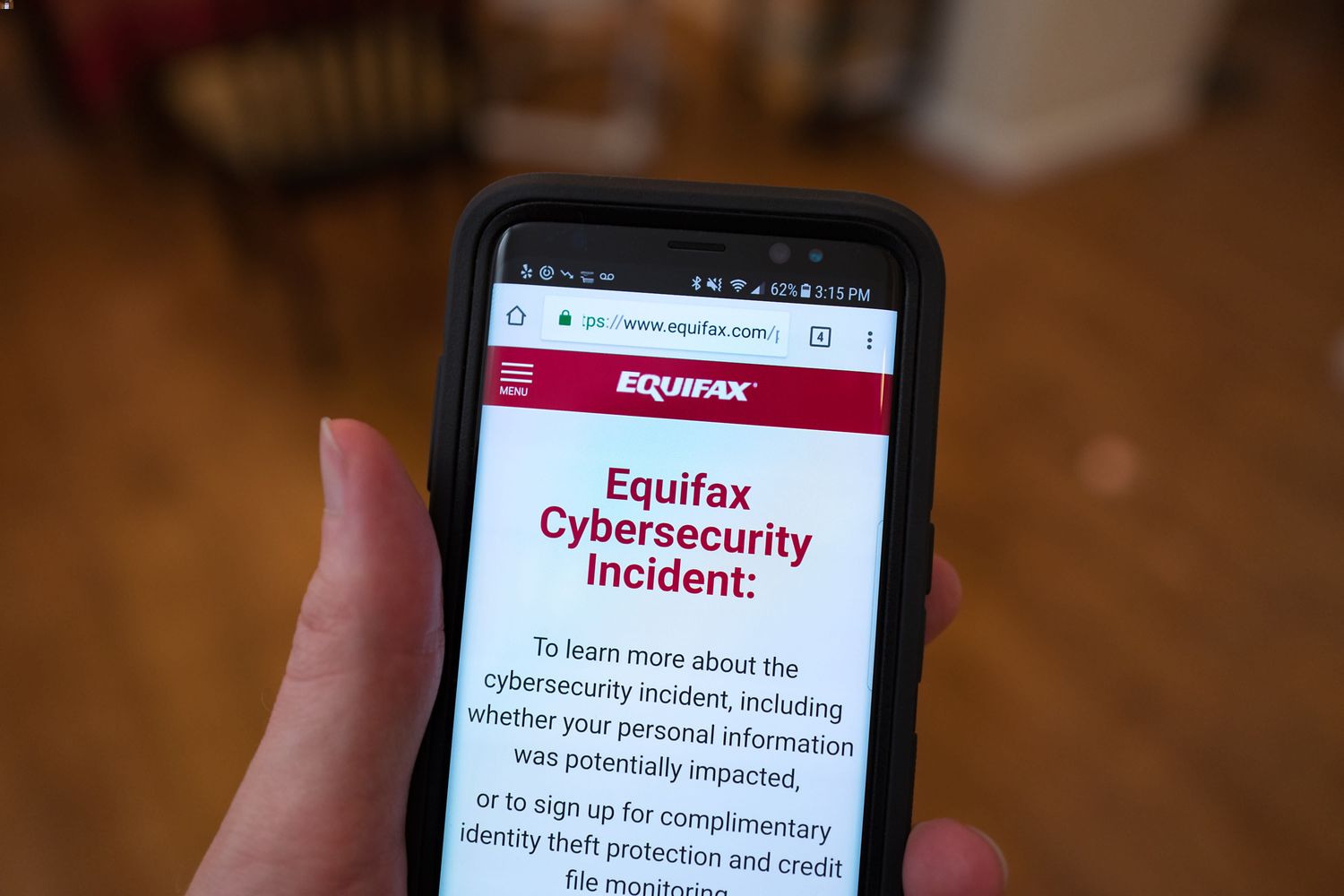

**In today's digital age, safeguarding personal information is paramount, and one effective way to do so is by freezing your credit. Equifax, one of the major credit reporting agencies, allows individuals to freeze their credit to prevent unauthorized access to their credit reports. To initiate this process, you might need to contact Equifax to freeze your credit. Understanding the telephone number to call Equifax to freeze credit is crucial for taking proactive steps in protecting your financial well-being. In this article, we will delve into the importance of freezing credit, the process of contacting Equifax to freeze credit, and frequently asked questions to provide you with comprehensive insights. By the end, you'll have a clear understanding of how to take control of your credit security.

Inside This Article

- Equifax Credit Freeze Phone Number

- Why Should You Freeze Your Credit?

- How to Freeze Your Credit with Equifax

- Additional Tips for Freezing Your Credit

- Conclusion

- FAQs

Equifax Credit Freeze Phone Number

If you are looking to freeze your credit with Equifax, it’s essential to have the right phone number at your fingertips. Freezing your credit can be a crucial step in protecting your financial information from unauthorized access and potential fraud. By initiating a credit freeze, you can restrict access to your credit report, making it more challenging for identity thieves to open new accounts in your name.

One of the most effective ways to freeze your credit with Equifax is by contacting them directly. You can reach Equifax to freeze your credit by calling their dedicated phone number. This allows you to speak with a representative who can guide you through the process and address any questions or concerns you may have.

Equifax’s credit freeze phone number is 1-800-349-9960. By dialing this number, you can connect with Equifax’s customer service team and take the necessary steps to freeze your credit quickly and efficiently.

Why Should You Freeze Your Credit?

Freezing your credit is a proactive measure to protect yourself from identity theft and financial fraud. By placing a freeze on your credit reports, you can prevent unauthorized individuals from opening new accounts or obtaining credit in your name. This safeguard is especially crucial in today’s digital age, where data breaches and identity theft incidents are increasingly common. Additionally, freezing your credit provides peace of mind, knowing that your financial information is secure and inaccessible to potential fraudsters.

Furthermore, freezing your credit does not impact your existing accounts or credit score. It simply restricts access to your credit reports, ensuring that only authorized parties can view your credit information. This added layer of security can prevent unauthorized inquiries and applications, safeguarding your financial reputation and minimizing the risk of fraudulent activity.

Ultimately, freezing your credit empowers you to take control of your financial well-being and protect yourself from the potentially devastating consequences of identity theft. It is a proactive step that can provide long-term security and peace of mind in an increasingly interconnected and data-driven world.

How to Freeze Your Credit with Equifax

Freezing your credit with Equifax is a proactive step to protect your personal information from unauthorized access. Here’s a simple guide on how to freeze your credit with Equifax:

1. Gather Your Information: Before initiating the credit freeze process, ensure you have your personal details readily available, including your social security number, date of birth, and other relevant identification information.

2. Visit the Equifax Website: Access the Equifax website and navigate to the section dedicated to credit freezes. Look for the specific page or portal that allows you to initiate a credit freeze.

3. Initiate the Freeze: Follow the prompts provided on the Equifax website to initiate the credit freeze process. You may need to create an account or log in to your existing Equifax account to proceed.

4. Verify Your Identity: Equifax will likely require you to verify your identity before proceeding with the credit freeze. This may involve answering security questions or providing additional documentation.

5. Confirm the Freeze: After completing the necessary steps, you should receive confirmation that your credit freeze with Equifax has been successfully initiated. Make a note of any reference numbers or confirmation details provided.

6. Monitor Your Credit: Once the credit freeze is in place, it’s advisable to monitor your credit reports regularly. You can also set up alerts to notify you of any suspicious activity related to your credit.

By following these steps, you can effectively freeze your credit with Equifax, adding an extra layer of security to safeguard your financial information.

Additional Tips for Freezing Your Credit

Aside from the essential steps of freezing your credit with Equifax, there are additional tips to consider to further safeguard your financial information. These tips can provide extra layers of protection and help you navigate the process with ease.

1. Consider Freezing Your Credit with Other Bureaus: While freezing your credit with Equifax is crucial, it’s equally important to freeze your credit with the other major credit bureaus, such as Experian and TransUnion. This comprehensive approach ensures that your credit is protected across the board, minimizing the risk of unauthorized access.

2. Monitor Your Credit Regularly: Even after freezing your credit, it’s advisable to monitor your credit reports regularly. You can request free credit reports from each of the three major credit bureaus annually. Keeping a close eye on your credit activity allows you to detect any suspicious or unauthorized transactions promptly.

3. Stay Informed About Security Breaches: Stay informed about any security breaches or data leaks that may affect your personal information. In the event of a breach, consider taking additional precautions, such as updating your passwords and monitoring your accounts more closely.

4. Understand the Thawing Process: Familiarize yourself with the process of thawing your credit. In some situations, you may need to temporarily lift the freeze to apply for a loan or credit card. Understanding the steps involved in thawing your credit can help you navigate such situations efficiently.

5. Keep Your PIN Secure: When you freeze your credit, you’ll receive a unique PIN for future use. It’s crucial to keep this PIN secure and confidential. Avoid sharing it with unauthorized individuals and store it in a safe, easily accessible location in case you need to thaw your credit in the future.

By implementing these additional tips, you can fortify the security of your credit information and minimize the risk of unauthorized access or fraudulent activity.

Freezing your credit with Equifax is a crucial step in safeguarding your financial security. By placing a freeze on your credit report, you can prevent unauthorized access to your personal information, mitigating the risk of identity theft and fraud. Remember, while the process of freezing and unfreezing your credit may seem cumbersome, the protection it offers is invaluable. Stay vigilant by regularly monitoring your credit reports, and consider placing freezes with the other major credit bureaus, Experian and TransUnion, for comprehensive protection. By taking proactive measures to secure your credit, you can enjoy greater peace of mind and financial stability.

FAQs

1. What is a credit freeze?

A credit freeze, also known as a security freeze, restricts access to your credit report, making it more difficult for identity thieves to open new accounts in your name.

2. Why should I freeze my credit?

Freezing your credit adds an extra layer of security, reducing the risk of unauthorized access to your credit report and potential identity theft.

3. How can I freeze my credit with Equifax?

To freeze your credit with Equifax, you can do so online, by phone, or by mail. The telephone number to call Equifax to freeze your credit is 1-800-349-9960.

4. Is there a fee to freeze my credit with Equifax?

Equifax offers free credit freezes until further notice, in compliance with federal law. However, there may be fees to lift or remove the freeze temporarily.

5. How long does a credit freeze last?

A credit freeze remains in place until you choose to lift or remove it. It’s a proactive measure to safeguard your credit and personal information.