In today’s fast-paced digital world, managing personal finances has never been easier thanks to the availability of mobile apps. With the power of technology at our fingertips, we can now track expenses, set budgets, and even invest with just a few taps on our smartphones. Whether you’re an iPhone user or an Android enthusiast, there is an abundance of personal finance apps available to assist you in achieving your financial goals.

In this article, we will explore the top 10 personal finance apps for both iPhone and Android platforms in 2023. From budgeting and expense tracking to investment management and bill reminders, these apps offer a wide range of features to help you take control of your finances and make informed decisions. So, let’s dive into the world of financial technology and discover the best apps that can revolutionize how you manage your money.

Inside This Article

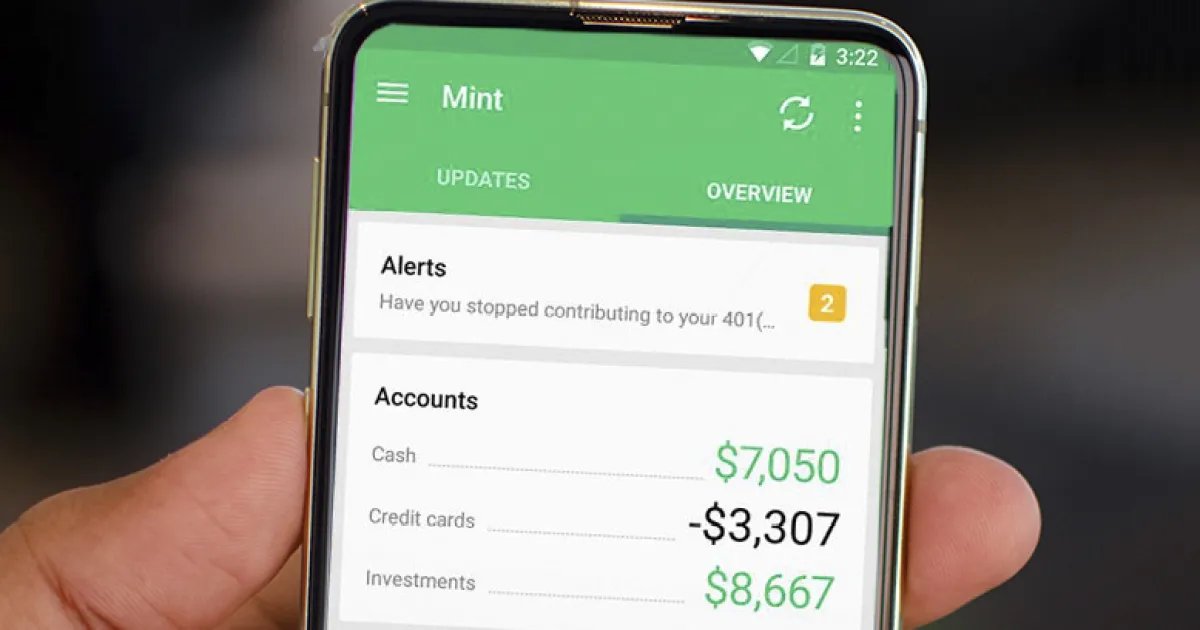

Mint

Mint is one of the most popular personal finance apps available for both iPhone and Android users. With its user-friendly interface and comprehensive features, it helps users manage their money, track expenses, and keep an eye on their financial goals.

With Mint, you can link your bank accounts, credit cards, and other financial accounts to get a holistic view of your financial situation. It automatically categorizes your transactions and provides insights into your spending habits, allowing you to understand where your money is going.

One of the standout features of Mint is its budgeting tool. You can create personalized budgets based on your income and expenses, set financial goals, and track your progress. The app sends you alerts and notifications to help you stay on track and avoid overspending.

Mint also offers a free credit score monitoring feature, which allows you to keep an eye on your credit health. You can get personalized tips on improving your credit score and receive alerts if any suspicious activity is detected.

Furthermore, Mint provides bill tracking and payment reminders. You can link your bills to the app and receive notifications when they are due. This helps you avoid late payments and potential fees.

The app also offers a variety of personalized saving recommendations and investment options. Whether you want to save for a vacation, pay off debt, or plan for retirement, Mint provides guidance and suggestions to help you make informed financial decisions.

Overall, Mint is a powerful personal finance app that offers a comprehensive set of tools to help you manage your money. Its user-friendly interface, extensive features, and proactive notifications make it a top choice for individuals looking to take control of their finances.

YNAB (You Need a Budget)

When it comes to personal finance apps, one name that consistently stands out is YNAB, short for “You Need a Budget.” YNAB is a powerful budgeting tool that helps users gain control of their finances and make smarter financial decisions.

With its user-friendly interface and comprehensive features, YNAB has emerged as a top choice for individuals and families looking to track their income, expenses, and savings. The app’s core philosophy revolves around the concept of giving every dollar a job, ensuring that every penny is allocated towards a specific purpose.

One of YNAB’s key strengths is its ability to sync seamlessly across multiple devices, making it convenient for users to access their budget on the go. Whether you’re using an iPhone or an Android device, you can easily stay connected to your budget and update your financial information in real-time.

YNAB offers robust budgeting features that allow users to create customizable categories, set spending goals, and track their progress over time. The app also offers transaction importing, which automatically categorizes your expenses and income based on predefined rules. This feature eliminates the hassle of manual data entry and ensures accurate budgeting.

One of the standout features of YNAB is its emphasis on financial education and goal setting. The app provides comprehensive support and resources, including online workshops and tutorials, to help users develop healthy money management habits. Additionally, YNAB encourages users to prioritize their financial goals and provides tools to track their progress towards achieving them.

Another noteworthy aspect of YNAB is its ability to handle complex financial situations. Whether you have irregular income, debt to pay off, or expenses spread across different categories, YNAB’s flexible interface can adapt to your unique financial circumstances.

Overall, YNAB is an excellent choice for individuals and families looking to take control of their finances. With its intuitive interface, powerful features, and emphasis on financial education, YNAB helps users create budgets that align with their goals and lead to long-term financial success.

Personal Capital

Personal Capital is a highly-rated personal finance app for both iPhone and Android devices. It offers a comprehensive suite of tools and features to help you manage your money, track your expenses, and plan for your financial goals.

One of the standout features of Personal Capital is its ability to sync with all of your financial accounts, allowing you to get a holistic view of your finances in one place. This includes bank accounts, credit cards, investments, loans, and more. By having all your financial information at your fingertips, you can better understand your net worth, analyze your spending habits, and make informed decisions about your money.

With Personal Capital, you can set realistic budgets and track your spending to ensure you stay on top of your financial goals. The app provides detailed insights into your spending patterns, categorizing your expenses and showing you where your money is going. This helps you identify areas where you can cut back and save more.

Furthermore, Personal Capital offers robust investment tracking and analysis tools. It allows you to link your investment accounts and provides detailed information on your portfolio performance, asset allocation, and investment fees. You can also access personalized investment advice and recommendations to help you optimize your investment strategy.

Personal Capital also prioritizes security, implementing industry-standard encryption protocols to protect your data. This ensures that your financial information is kept safe and secure while using the app.

In addition to its powerful features, Personal Capital has a user-friendly interface with intuitive navigation. The app provides clear visuals and charts to help you understand your financial situation at a glance. It also offers educational resources and financial calculators to further enhance your financial knowledge.

Whether you are looking to track your expenses, plan for retirement, or optimize your investments, Personal Capital is a top-notch personal finance app that can help you achieve your financial goals. It combines convenience, security, and comprehensive features to provide you with a complete financial management solution.

Acorns

Acorns is a popular mobile app that aims to simplify your investments and help you grow your wealth. With its user-friendly interface and innovative features, Acorns has become one of the best personal finance apps available for both iPhone and Android users.

One of the standout features of Acorns is its automatic round-up feature. This feature allows you to link your credit or debit card to the app, and every time you make a purchase, Acorns will round up the amount to the nearest dollar and invest the spare change. This “round-up” method is a great way to start investing without even realizing it. It takes the small amounts that often go unnoticed and allows them to accumulate over time.

Another impressive feature of Acorns is its “Found Money” program. This program allows you to earn cashback when you shop with Acorns’ partner brands. Instead of receiving traditional reward points, you get a percentage of your purchase deposited into your Acorns investment account. It’s a fantastic way to earn extra money while making everyday purchases.

When it comes to investing your money, Acorns offers a range of portfolios to choose from based on your risk tolerance and financial goals. Whether you’re a conservative investor or willing to take on more risk, Acorns has a portfolio that suits your needs. The app also provides useful tools and educational content to help you make informed investment decisions.

Acorns also recognizes the importance of saving for retirement and offers an easy-to-use retirement planning tool. The app allows you to set retirement goals and estimates how much you need to save to reach those goals. It provides a clear picture of your retirement savings progress and helps you stay on track for a comfortable future.

With its sophisticated technology and intuitive design, Acorns makes investing and growing your wealth accessible to everyone. It’s a fantastic personal finance app for individuals who want to start investing with small amounts and watch their money grow over time.

Conclusion

In conclusion, the ever-growing market of personal finance apps offers a multitude of options for iPhone and Android users to manage their finances with ease. These apps empower individuals to take control of their financial well-being by providing features such as budget tracking, expense management, bill reminders, investment tracking, and more.

With their intuitive interfaces, advanced security measures, and real-time syncing capabilities, personal finance apps have revolutionized the way we manage our money. They have made it simpler and more convenient for users to track their expenses, set savings goals, and make informed financial decisions.

Whether you are a budget-conscious individual, a small business owner, or someone looking to streamline their finances, the best personal finance apps for iPhone and Android can be valuable tools to achieve your financial goals. So, don’t wait any longer—explore the apps mentioned in this article and start taking control of your finances today!

FAQs

Q: Are personal finance apps safe to use?

A: Most personal finance apps take user security and privacy seriously. They implement encryption protocols and follow industry-standard security practices to protect your financial information. However, it’s always recommended to read app reviews and check the app’s privacy policy before sharing any sensitive data.

Q: Can I trust the budgeting features in personal finance apps?

A: Yes, personal finance apps often come with robust budgeting features that can help you track your expenses, set financial goals, and manage your money effectively. However, the accuracy of these features depends on how diligently you update your spending and income details within the app.

Q: Can personal finance apps integrate with my bank accounts?

A: Many personal finance apps offer the ability to link your bank accounts, credit cards, and other financial institutions. This allows you to automatically sync your transactions and balances, making it easier to keep track of your finances in one place. However, it’s important to check if your app supports integration with your specific bank.

Q: Are personal finance apps suitable for small business owners?

A: Yes, personal finance apps can be beneficial for small business owners as well. They can help you track income and expenses, generate reports, and manage your cash flow effectively. However, if you have complex business accounting needs, you may find that using dedicated small business accounting software is more suitable.

Q: Can I access personal finance apps on multiple devices?

A: Most personal finance apps offer cross-platform support, allowing you to access your financial data from multiple devices like smartphones, tablets, and even desktop computers. This ensures that you can stay updated with your finances no matter where you are. Just make sure to sign in with the same account across all devices.