Subscription services have become increasingly popular in recent years, with consumers signing up for everything from streaming platforms to meal delivery kits. However, keeping track of multiple subscriptions and managing finances can be a daunting task. This is where Truebill comes in. Truebill is a mobile app that helps users monitor their subscriptions and even refund bank fees. With its user-friendly interface and powerful features, Truebill takes the stress out of managing subscriptions and helps users save money by identifying unnecessary charges and negotiating lower bills. In this article, we will explore the various benefits and features of Truebill, and how it can revolutionize the way you manage your subscriptions and financial transactions.

Inside This Article

What is Truebill?

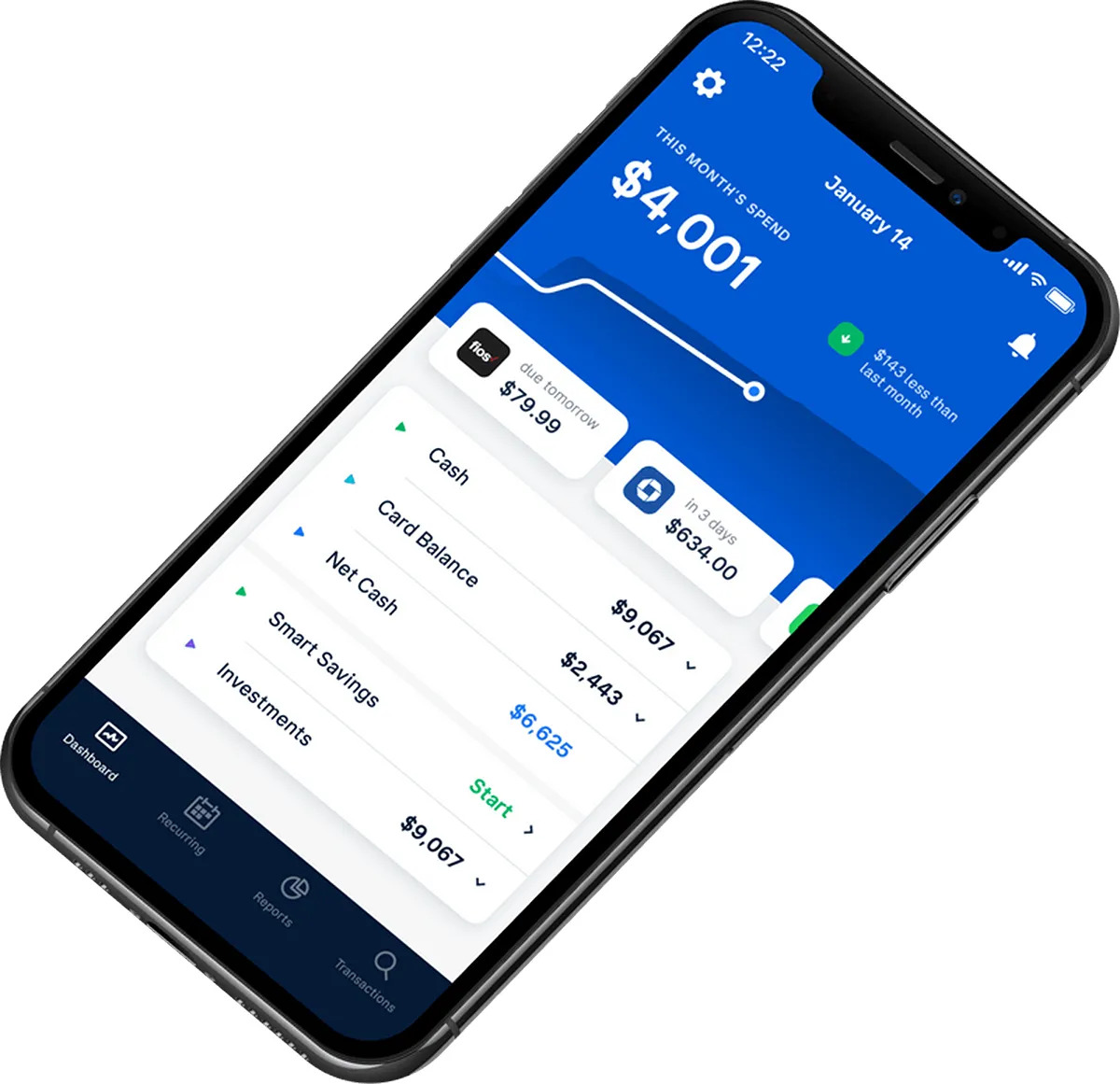

Truebill is a mobile app that helps consumers take control of their finances by monitoring their subscriptions and refunding bank fees. It is designed to simplify the often confusing and time-consuming process of managing recurring payments and expenses.

With Truebill, users can easily track and manage their subscriptions in one place. The app analyzes users’ bank statements and identifies recurring charges, making it easier to see where money is being spent. It provides a comprehensive overview of all subscriptions, including their costs, renewal dates, and payment methods.

In addition to subscription monitoring, Truebill also offers a bank fee refund feature. This allows users to get refunds for various types of bank fees, such as overdraft fees, ATM fees, and monthly maintenance fees. By submitting refund requests directly through the app, users can potentially save hundreds of dollars annually.

Truebill is compatible with numerous banks and financial institutions, making it accessible to a wide range of users. It is available for both iOS and Android devices, ensuring that users can easily access and manage their finances from anywhere.

As an added bonus, Truebill also provides personalized budgeting tools and helps users identify potential savings opportunities. By analyzing spending habits and patterns, the app offers insights and suggestions for ways to save money without compromising on essentials or lifestyle choices.

Overall, Truebill is a comprehensive financial app that empowers users to take control of their finances and make more informed decisions. Whether it’s monitoring subscriptions, refunding bank fees, or optimizing budgets, Truebill offers a convenient and user-friendly solution that can have a significant impact on one’s financial well-being.

Subscription Monitoring

Do you ever find yourself overwhelmed by various subscriptions draining your bank account? With Truebill’s subscription monitoring service, you can regain control over your finances and ensure you are only paying for what you actually need.

Truebill’s advanced technology and intuitive interface make it easy to track and manage all your subscriptions in one place. Gone are the days of sifting through countless emails and statements to keep tabs on your recurring payments.

This powerful app connects directly to your bank accounts and credit cards, automatically detecting any subscriptions you may have. It provides a comprehensive overview of your streaming services, gym memberships, magazine subscriptions, and more.

Once detected, Truebill categorizes your subscriptions, presenting you with a clear and concise breakdown of your monthly expenses. This enables you to identify any redundant or forgotten subscriptions that you may no longer use or need.

But subscription monitoring doesn’t stop at just giving you visibility. Truebill takes it a step further by offering convenient cancellation and negotiation services.

If you decide to part ways with a subscription, Truebill can assist you in canceling it right from the app. No need to search for contact information or go through a lengthy cancellation process. Truebill streamlines it for you, saving you time and hassle.

Additionally, Truebill gives you the option to negotiate better rates for your existing subscriptions. Their team of experts will reach out to service providers on your behalf and try to secure discounts or promotional offers. This feature alone has the potential to save you significant money each month.

Truebill’s subscription monitoring service also helps you stay on top of upcoming due dates and payment notifications. You can set reminders to avoid any surprise charges or late fees, ensuring you have full control over your subscription expenses.

With Truebill’s subscription monitoring service, you can regain financial transparency, cut unnecessary expenses, and save money, all with just a few taps on your phone. Take control of your subscriptions today and start maximizing your savings.

Bank Fee Refunds

One of the features that sets Truebill apart from other personal finance apps is its ability to help users get refunds on bank fees. We have all experienced the frustration of unexpected bank fees eating into our hard-earned money. Whether it’s an overdraft fee, an ATM fee, or a foreign transaction fee, these charges can add up quickly. Truebill steps in to advocate for its users and help them get those fees refunded.

Truebill’s bank fee refund process is straightforward and user-friendly. Once you connect your bank account to the app, Truebill’s technology analyzes your transaction history, identifies any potential refundable fees, and initiates the refund process on your behalf. They will contact your bank, negotiate with them, and work towards getting your fees refunded.

The best part is that this service is completely automated, saving you the time and effort of calling or emailing your bank to dispute the fees. Truebill takes care of the entire process, allowing you to focus on other important aspects of your financial life.

The success rate of Truebill’s bank fee refund process is impressive. The app’s advanced algorithms and expert negotiators have helped countless users recover significant amounts of money that may have otherwise been lost to bank fees. Users have reported getting back hundreds and even thousands of dollars in refunded fees, which can make a real difference in your financial well-being.

Another great advantage of using Truebill for bank fee refunds is the peace of mind it provides. You no longer have to constantly worry about being charged excessive fees or struggle with the hassle of getting them reversed. Truebill acts as your financial advocate, working diligently to ensure that you are being treated fairly by your bank.

It’s important to note that while Truebill strives to help users obtain refunds on bank fees, success is not guaranteed in every case. Each bank has its own policies and procedures regarding fee refunds, and some may be more willing to negotiate than others. However, Truebill’s dedicated team will do their best to maximize your chances of getting a refund.

Conclusion

In conclusion, Truebill is a powerful tool that offers a range of features to help users effectively monitor their subscriptions and save money on bank fees. With its automated tracking and cancellation assistance, users can effortlessly stay on top of their recurring expenses and avoid unnecessary charges. Truebill’s refund service is also a standout feature, providing users with the opportunity to effortlessly reclaim any unjustified fees.

Additionally, Truebill’s user-friendly interface and intuitive design make it accessible to users of all levels of tech-savviness. Whether you’re a student, a busy professional, or simply looking to optimize your finances, Truebill can be a valuable asset in your financial management toolkit.

With its commitment to transparency, security, and customer satisfaction, Truebill has gained a strong reputation in the market. By saving users time, money, and stress, Truebill stands out as a top choice for those looking to take control of their subscriptions and bank fees.

FAQs

1. What is Truebill?

Truebill is a financial management app that helps users monitor and manage their subscriptions, as well as negotiate and refund bank fees. It provides a centralized platform to keep track of all your subscriptions, detect and cancel unused services, and even take actions to lower bills and save money.

2. How does Truebill monitor subscriptions?

Truebill uses advanced algorithms and artificial intelligence to analyze your bank statements and identify recurring payments. By linking your bank accounts and credit cards to the app, Truebill can automatically detect subscriptions and categorize them for easier tracking and management. This eliminates the hassle of manually reviewing and canceling subscriptions.

3. Can Truebill help me save money on subscriptions?

Absolutely! Truebill not only helps you stay organized by consolidating all your subscriptions in one place but also provides insights and recommendations to optimize your expenses. The app highlights unused or underutilized subscriptions, allowing you to decide which ones to cancel, saving you money every month.

4. How does Truebill negotiate and refund bank fees?

Truebill has a feature called Bill Negotiation, which can reach out to service providers and negotiate better rates or even secure refunds on your behalf. This includes bank fees, credit card interest rates, and other monthly bills. Simply provide the necessary information, and Truebill’s negotiating team will handle the rest.

5. Is Truebill safe and secure?

Yes, Truebill takes the security and privacy of its users seriously. The app uses bank-level encryption to ensure that your financial data remains protected. It also employs multi-factor authentication and does not store any sensitive information, such as your full bank account numbers.