Contactless payments are slowly becoming the way to go when it comes to everyday transactions. They’re much more convenient and fast, and they let you send and receive money with just a few taps. Cash App and Venmo are two of the best money transfer apps that are paving the way for the wider use of contactless payment. They may seem similar at first, but each app has its own set of pros and cons. If you’re thinking of switching to either of these apps, you’ve come to the right place. Find out which of the two is the better mobile payment app in this Cash App vs Venmo breakdown.

Cash App vs Venmo: A Quick Comparison

| Features | Cash App | Venmo |

| Compatibility | Android, iOS, and web browser | Android, iOS, and web browser |

| Payment Methods | Bank account, debit card, credit card, Google Pay, and Apple Pay | Bank account, debit card, and credit card |

| Ways of Receiving | Bank account, mobile wallet, ATM, debit card | Bank account, mobile wallet, ATM, debit card |

| Transfer Fee | Free for standard transfers, 1.5% for instant transfers, 3% for transfers via credit card | Free for standard transfers, 1.5% for instant transfers, 3% for transfers via credit card |

| Withdrawal/Transfer Speed | 1-3 business days for standard transfers, at most 30 minutes for instant transfers | 1-3 business days for standard transfers, at most 30 minutes for instant transfers |

| International Payment | Yes, but only between the US and the UK | No |

| Next Step | Go to site | Go to site |

Cash App vs Venmo: Payment Methods

Cash App has an advantage over Venmo when it comes to payment methods. Besides being able to pay through your bank account, credit card, and debit card, you can also make payments using Google Pay and Apple Pay. With Venmo, on the other hand, you can only choose between three payment methods: your bank account, debit card, or credit card. However, Venmo makes up for this by letting you link two bank accounts and two cards to your account. By contrast, Cash App only lets you link one bank account and one card to your Cash App account.

Both apps also let you pay via Bluetooth low energy (or Bluetooth LE), a feature they both call Nearby Payments. With this feature, you’ll be able to see other nearby Cash App or Venmo users on your app when you have your phone’s Bluetooth on. Simply tap on someone’s name or icon, and send them the amount they need. That way, you don’t need to have someone’s contact information before you can pay them, which makes paying friends or colleagues much quicker and easier.

Ways of Receiving

In terms of ways of receiving money, Cash App and Venmo are on the same playing field. Cash App lets you receive funds via bank account, mobile wallet, ATM, and debit card. Venmo offers the same options. Both apps also make it easy for you to request a payment.

Cash App’s payment request system is more straightforward. All you have to do is go to the Cash tab (the money icon at the bottom), type in the amount, contact information, and reason for the request, then confirm. Once the person you’re requesting from accepts the request, you’ll see the amount on your balance. Sometimes, though, you’ll have to accept the payment before it shows up on your account.

Venmo’s payment request system is pretty much the same, but with a couple of added features. When you request money on Venmo, you can send stickers and emojis when you type in what the request is for. You also have the option of making the transaction public, private, or visible to friends. If you choose to make the transaction public or visible to friends, it shows up on your feed once the person has approved the request. Unlike Cash App, though, you don’t have to approve a payment — it will be added to your balance right away.

Cash App vs Venmo: Bank Transfer Fees and Hidden Costs

Both Cash App and Venmo don’t charge for basic transactions. These include paying with your Cash App or Venmo debit card, sending money from your bank account or debit card, and transferring funds to your bank account using the standard process, which takes around one to three business days for both mobile payment apps.

The fees come in when you make an instant transfer, which takes at most 30 minutes to process. For Cash App, there’s a 1.5% fee for instant transfers, with a minimum fee of $0.25. Venmo’s fee for instant transfers is supposedly lower at 1%, with a minimum of $0.25 and a maximum of $10. However, as of August 2021, they started charging the same as Cash App for instant transfers. The minimum fee is still the same, but the maximum fee is now $15.

Both Cash App and Venmo also charge you a 3% fee when you send money using a credit card that’s linked to these apps. That’s pretty much the standard across all mobile payment apps. In addition, you’ll need to pay extra when you withdraw money from an ATM using your Cash App Cash Card or Venmo Mastercard. Cash App charges an additional $2 for every ATM withdrawal. On the other hand, Venmo charges $2.50 when you withdraw from a non-MoneyPass ATM. If you make a withdrawal at a MoneyPass ATM, though, you can avoid the fees altogether.

Cash App vs Venmo: Transfer Limit

With both Cash App and Venmo, there are two tiers for transfer limits: one for unverified users and the other for verified users. Below, we take an in-depth look at how much you can send and receive using each app.

Cash App

The great thing about Cash App is that you don’t need to set up an account to be able to use it. However, the catch is that there’s a limit to how much you can send and receive. If you’re an unverified user, you can only send up to $250 within any seven-day period and receive a maximum of $1,000 every 30 days.

If you want to send a higher amount per week and receive a higher amount per month, you’ll have to verify your identity with Cash App. The verification process can take up to 48 hours, but the requirements are pretty basic. You only need to provide your full name, birth date, and the last four numbers of your National ID number (or SSN). Of course, you have to be at least 18 years old. Once verified, you can then send a maximum of $7,500 every seven days, and your receiving limit is automatically lifted.

Venmo

Venmo has the advantage of having higher transfer limits. That said, unlike Cash App, you won’t be able to pay with your Venmo balance using an unverified account; you can only receive money, transfer funds to a bank account, and make payments using a linked bank account, debit card, or credit card.

Verifying your account increases your sending and receiving limits and allows you to pay using your Venmo balance. To do so, you’ll need to provide your name, business or personal address, birth date, and SSN or ITIN. Unlike with Cash App, verifying your identity with Venmo only takes a few minutes. Plus, its sending limit is significantly much higher. With a verified account, you can send a maximum of $19,999.99 every seven days. Take note, though, that the largest amount you can send per transfer is $2,999.99. Similar to Cash App, there’s no receiving limit for verified Venmo users.

Cash App vs Venmo: International Payment

Neither Cash App nor Venmo is the best option when it comes to making international payments. However, if you really have to choose between the two, Cash App is your option just because Venmo doesn’t have the international payment option in the first place. With Cash App, you can transfer money from the US to the UK and vice versa, but that’s as international as the service gets.

Sending and requesting international payments through Cash App is completely free. However, the amount you end up sending will depend on the current mid-market exchange rate. Don’t worry, though, since Cash App will show you the USD to GBP exchange rate before you confirm your payment.

Cash App vs Venmo: Safety and Security Features

Safety and security are of utmost importance when it comes to mobile payment apps. After all, who would want to be the victim of a phishing attack or any other money scam? Luckily, both Cash App and Venmo have safety features in place to protect you and your money from fraudulent schemes. We examine just how effective they are in the next section of our Cash App vs Venmo comparison.

Cash App

Cash App uses several tools to ensure that your payments are processed safely. For starters, the app is PCI (Payment Card Industry) compliant and has a PCI-DSS Level 1 certification, the highest and strictest of all PCI-DSS levels. Cash App also makes use of encryption to keep all of your data safe. Plus, it gives you the option to turn on the Security Lock setting, which requires your passcode, Touch ID, or Face ID before proceeding with every transaction.

On top of those, Cash App also sends you text, email, and push notifications any time there is a transaction using your account. In case you lose or misplace your Cash Card, you can easily pause card spending from within the app. The app is also equipped with fraud detection technology, so you’re protected from unauthorized charges.

But as with anything that exists online, Cash App isn’t immune to vulnerabilities, as evidenced by the rise of security incidents on the app this past year. Thus, you still have to take the necessary precautions when you make transactions through the app. For instance, make sure that the bank account and the credit and debit cards you link to your Cash App account are in your name. Also, only transact with legitimate businesses and people you know.

Venmo

Venmo also offers several safety features. Just like Cash App, it’s PCI-compliant and makes use of fraud detection algorithms to protect you from unauthorized charges. It also encrypts all of your sensitive financial data so that no one — not even you — can access your bank and card details through the app. In addition, Venmo gives you the option to enable other security features, like push notifications and text and email alerts, passcode lock and/or Touch ID, and the ability to remotely log out of any web session and disable any device.

Regardless, Venmo also had a fair share of security breaches numerous times in the past and even in the present. In 2015, a Venmo user lost $2,850 and was locked out of his account. The following year, the Federal Trade Commission (FTC) conducted an investigation on the company for alleged deceptive practices. And, just this year, Buzzfeed News easily found President Joe Biden’s private Venmo account using only the app’s search and friend list features. By finding his account, they also found the accounts of his entire network, including his family, several White House officials, and everyone else on their friend lists.

The President’s contacts being exposed on the app isn’t really good news, especially since spies (or worse) can easily exploit this information. To this, Venmo responded by taking down the accounts of the President and his network. They also assured their users that they’re constantly improving their privacy measures.

Cash App vs Venmo: Customer Service

Cash App and Venmo both offer multiple ways to contact their customer support teams. With Cash App, you can ask for assistance through the app (simply go to the Cash Support tab), their website, or by calling them at 1 (800) 969-1940. If you want, you can also contact them via mail. Venmo offers more or less similar channels for customer support. You can reach them via email, the live chat feature on the app, or by calling them at (855) 812-4430. However, if your concern is about your Venmo credit card, you’ll have to contact Symphony Bank for that. That’s because they’re the ones who issue credit cards.

The quality of Cash App’s and Venmo’s customer service is another story. To put it quite plainly, the customer support of each app isn’t the best. Cash App’s customer service team is always short on staff, so you’ll have to wait long before someone can accommodate you. And when someone does accommodate you, they aren’t always the most helpful. The same goes for Venmo. Some users have complained that they’ve had to wait days for an agent to assist them. But often, they don’t receive the help they need.

That isn’t to say that the customer service teams of Cash App and Venmo are completely useless; it’s just that getting reliable help when you encounter an issue really is a hit or miss. Thus, be extra careful not to make avoidable mistakes (like entering the wrong contact information) when you’re using Cash App or Venmo. Also, if you can, avoid keeping a large sum of money on either of these apps.

Cash App vs Venmo: Special Features

Cash App and Venmo both offer features beyond sending and receiving money. Let’s take a look at some of their special features below.

Cash App

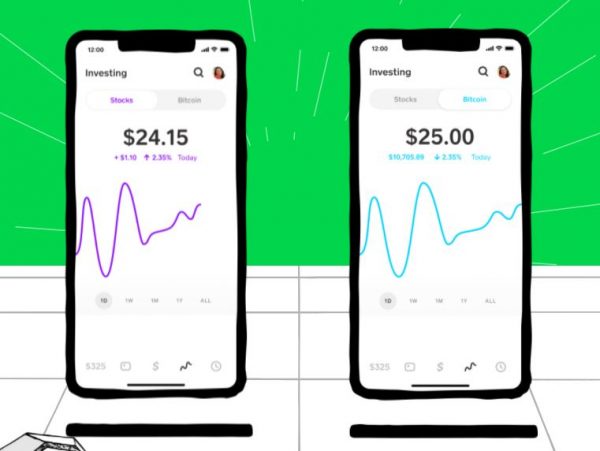

One of Cash App’s special features is that it lets you buy and sell stocks and Bitcoin right from the app. What’s great about this feature is that it’s beginner-friendly and guides you through each step of the process. Plus, you can start with as little as $1, and you can spend your Cash App investment income using your debit card.

Cash App won’t charge you a commission fee when you buy and sell stocks. But that doesn’t mean it’s completely free; the SEC or other government agencies can still impose fees, which Cash App will disclose before you confirm each stock trade. Bitcoin transactions, on the other hand, are subject to service fees and other additional fees by Cash App.

You can also order a Cash Card, which is a Visa debit card from Cash App, for free when you set up your account. Unlike other mobile payment apps that offer debit cards, Cash App offers instant discounts, called Boosts, when you use your Cash Card at select stores. You can also link it to your Google Pay and/or Apple Pay accounts. For $5, Cash App also gives you the option to redesign your card by changing the color, adding emojis, and adding your signature.

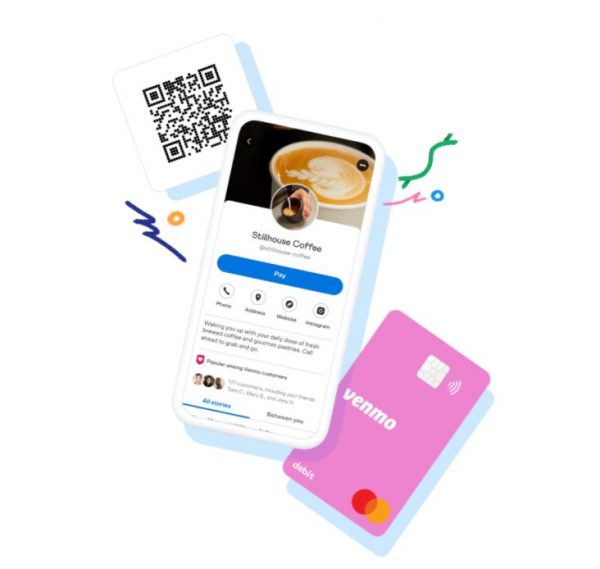

Venmo

Venmo’s definitive feature is its social component, which users either love or hate. The app lets you add friends by syncing your phone and Facebook contacts. By default, every transaction you make on Venmo is public, which means it’s visible to everyone, not just your friends. However, the app only shows who you’re transacting with and the purpose of your transaction but not the amount. If you’re not a fan of that, you can always set your account to private.

On the one hand, Venmo’s social component makes the app more engaging, and more people seem to be using it for that. Scrolling through your Venmo news feed is almost like scrolling through Twitter, as most users try to be as amusing or funny as possible when writing the “for” part of their transactions. Plus, the small businesses that you and your friends buy from gain exposure through the Venmo news feed.

However, not everyone appreciates the social side of Venmo, which is understandable. Most people would want to keep their financial transactions private. Plus, being social creates a slew of security challenges, like hackers impersonating your friends to request payment.

Other than being social, Venmo also lets you invest in four types of crypto: Bitcoin, Bitcoin Cash, Ethereum, and Litecoin. Like Cash App, you can invest as little as $1 to get started, but you’ll have to pay a fee per transaction, which ranges from 1.5% to 2.3%. Venmo also offers articles and videos to guide you in your investment journey.

On top of that, Venmo also offers its very own Visa credit card. By using their credit card, you earn at least 2% cashback on all eligible purchases. Plus, you can earn all sorts of Visa Credit Card perks.

Why You’d Want to Go for Cash App

Cash App is the perfect mobile payment app for you if:

- You don’t want to have to verify your account to keep using your balance. However, as we mentioned, your sending and receiving limits are very low with an unverified Cash App account.

- You want a straightforward and easy way to split bills and pay your friends and family.

- Investing in stocks and Bitcoin is something you’re interested in.

- You want to keep your transactions private.

- You have a Google Pay or Apple Pay account to link to your mobile payment app.

Why You’d Want to Go for Venmo

Venmo is a viable option for you if:

- Social engagement is something you’re looking for in a finance app.

- You want higher sending and receiving limits.

- You want a fast identity verification process.

- Investing in different types of cryptocurrencies, not just Bitcoin, is of interest to you.

- You want a credit card with your mobile payment app.

Cash App vs Venmo: The Verdict

Cash App and Venmo are among the most used mobile payment apps in the US because they’re accessible, simple to use, and mostly free. Both apps make sending and receiving money much easier than they used to be. And since they both have millions of users and are accepted by many businesses, switching to either app is almost a no-brainer.

They may not be perfect. Cash App has its fair share of security issues, and Venmo even more so. However, both mobile payment apps have said that they’re constantly improving their safety and security features.

Now, the answer to which of the two you should use is completely up to you. If you want, you can download both to get a better feel of which app you find more useful. Doing so also makes sending or receiving money much easier in case the person you’re transacting with only has one app or the other. However, remember to be extra careful when you’re using either of these apps. That way, you can avoid scams and keep your money intact.

A bit short ahead of payday? Pick the best app like Dave here to get a cash advance.