Transferring money has never been easier with the advent of the internet and the evolution of technology. Nowadays, you can easily send money from one account to another with just a single tap. However, exchange fees are something that more people are concerned with when it comes to money transfer apps. Reliability is also another thing that people tend to consider when choosing which money transfer app to use.

Worry no more, as we have compiled the 10 best money transfer apps with low exchange fees you should try this year, in alphabetical order.

1. Azimo

While not a lot of people know about Azimo, this money transfer app still deserves a place on this list. Sending money internationally can be a pain, especially with all the hoops you have to jump through just to receive payment. With Azimo, you get location-specific instructions that make the experience much easier and faster.

Additionally, this international money transfer app keeps you updated on the status of your transaction. All you need to do is check the app. In terms of fees, they vary depending on the destination of the transfer, and this app has more than 200,000 pick-up points around the globe. The best part is, if you invite someone to join Azimo, it gives them $13 on a transfer. And, when they transfer $133 or more, you receive an incentive of $13 for yourself.

If you ever run into an issue, you can always contact their customer service, which has been praised for their quality and timely support. They do not have a hotline, though, so you will need to send them an email to get help.

You can download Azimo from the Google Play Store or the App Store.

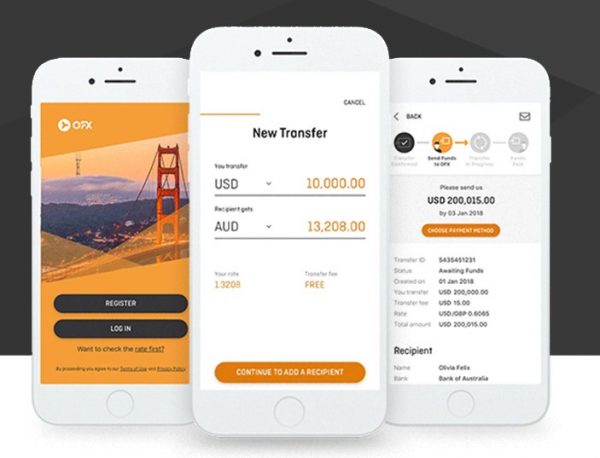

2. OFX International Money Transfers

For large mobile payments that work well for overseas transfers, consider using OFX (previously known as OzForex). This money transfer app offers its services to an extensive list of countries, which means you can virtually transfer money anywhere. You can even use a variety of different currencies to do it. In addition, OFX has some added tools that make its service topnotch.

The exchange rates differ depending on the time, which is understandable considering the volatile nature of money. Thankfully, OFX makes it easy for you to track and pinpoint the best time to transfer money based on the exchange rate. They have a live exchange rate currency converter to help you out with that. In terms of transaction limits, you can send as many times throughout the day as you like. However, they do have a minimum transfer amount of $1,000. As such, this money transfer app is best suited for transferring large sums of money internationally.

When it comes to their fees, there is no fixed rate. However, usually, OFX does not take a margin of more than 2% in fees. This is a relatively low exchange fee for the type of services OFX offers.

3. PayPal

PayPal is perhaps one of the most famous money transfer services in the world. In the beginning, PayPal was exclusively available by accessing their website. But, since the world is transitioning and relying more and more on apps, the service has followed suit.

PayPal boasts tight security measures in the form of passwords, which means you can rest easy knowing your money is in safe hands. However, if you dislike entering your password every time you open the app, then this may not be the money transfer app for you. Regardless, this type of security measures is necessary, especially given that PayPal is geared more towards businesses.

International money transfers are fast, similar to other money transfer apps on this list. However, when it comes to debit card transactions, PayPal does charge a small fee. This is unusual for domestic transfers, but PayPal makes up for it with its high transaction limits. With PayPal, you can make single transfers as high as $10,000. The exchange fees differ, though, depending on location and a few other factors.

While understanding their exchange rates takes some time, PayPal splits the difference with their ease of use. To send money, all you need to do is enter the receiver’s email address or phone number connected to their PayPal account.

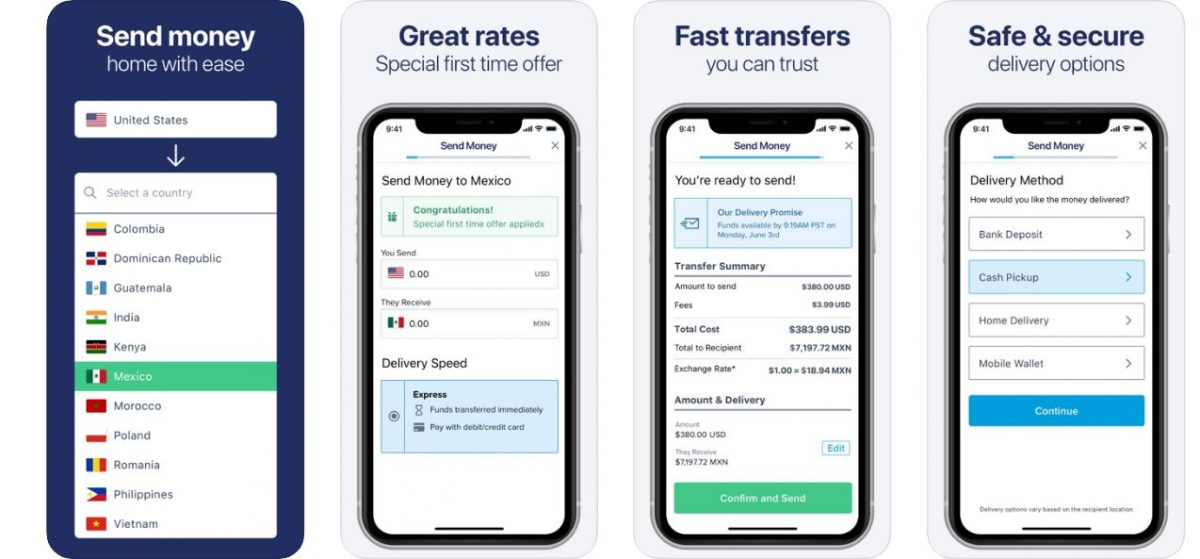

4. Remitly

Remitly makes money transfer efficient and convenient and it’s crowned one of the best Paypal alternatives recently. Using this money transfer app, you can send money directly to your friend’s overseas bank account in the currency they use. Payment options include credit card, debit card, and bank account.

When it comes to the money transfer fees, an electronic funds transfer will depend on the amount of money you intend to send and the locations of both the sender and receiver. Exchange rates are relatively low, but the service does pad them so they can make a profit. There is also a 3% fee if you choose the credit card payment option. If you want to use their express service, which transfers money within minutes, there is an added $3.99 fee, too.

Speaking of how fast money travels, with Remitly, the speed varies depending on the service you choose. As stated above, the express service is the fastest route. However, if you are not in a hurry, an average economy transfer to a person’s bank account takes 3 to 5 business days. You can also mail money directly to the receiver’s home address, but with this option, the timing is a bit more inconsistent. Generally, though, it will take 1 to 2 business days.

As for transaction limits, Remitly has three tiers. With the lowest tier, you can send $2,999 per day. On the other hand, the highest tier lets you send $10,000 a day. To level up your tier, you will need added verification of your account.

5. Square’s Cash App

What is the Cash app? Simply put, Square’s Cash app is a money transfer app that allows for fast and convenient electronic funds transfers. If you want a simple way to send money to your peers, this is the money transfer app for you. The best part is, there are no Cash app fees when you perform peer-to-peer transfers. The receiver does not even need their own Cash app account to get paid.

One question many people ask is, “Is Cash app safe?” In a word, yes. This money transfer app is very secure, as all transactions are encrypted. In fact, the encryption Square’s Cash app uses is the same as that used by banks. So, you can rest assured knowing your money is in safe hands.

The cash app is one of the easiest and simplest methods of transferring money. It works best for splitting restaurant bills or paying for apartment utilities. However, that is not to say that the Cash app will not cover other types of transactions. Due to the immense convenience associated with the Cash app, many find it one of the best money transfer apps out there. You can even create your own web page using this app so that others can make free payments to your account.

6. TransferWise – Send Money Abroad

With their motto of “borderless banking,” TransferWise makes it easy for you to manage multiple currencies in one account. A TransferWise account comes at no cost, but you do need an initial deposit of $25 to launch your borderless bank account. Setting up a borderless bank account offers plenty of benefits. For instance, the bank account you set up on TransferWise works just like a real bank account. So, if you add a euro balance, you will get a SWIFT number with the account.

There are several payment options, from credit or debit card, wire transfer, direct debit to even Apple Pay. There are no monthly fees to keep up with, though you will have to pay a fee ranging between 0.45% to 3% for card converted currencies. You can withdraw as much as $250 through ATMs every 30 days at no extra cost. However, if you surpass that limit, then your withdrawals are subject to a 2% fee.

As for transaction limits, you can send or receive $250,000 per day (and $1,000,000 per year). However, the limit only applies to US dollars. Other currencies have no limit. And while having a borderless bank account works great, it is not a requirement to transfer money using this money transfer app.

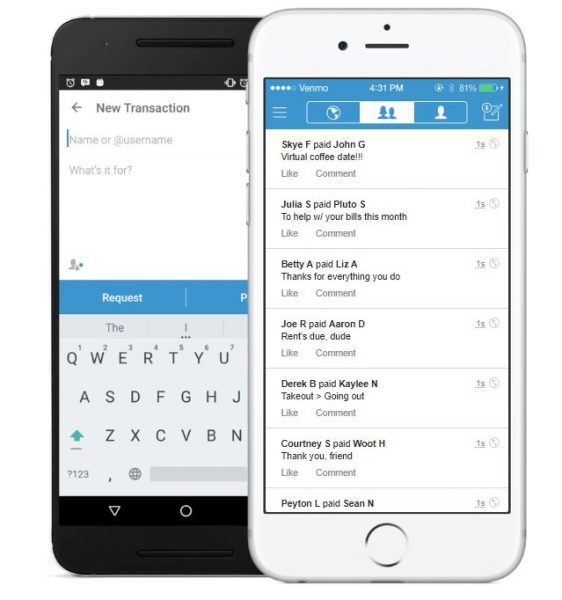

7. Venmo

Another popular money transfer app, Venmo makes peer-to-peer transfers a breeze. Although PayPal has since acquired Venmo, it remains fixated on the younger demographic, with its purchaser focusing predominantly on corporations and businesses.

If you remain unaware of what Venmo is, it is simply a digital wallet mixed with social media features. You can easily transfer money to your peers and then share your purchases on your Venmo feed. Others can add comments to your posts, too.

With Venmo, your bank accounts or debit cards are linked directly to the app. You can also store money within your Venmo account without linking to any of these options. The best part is, if you do have a bank account, you can cash out your balance and send it directly to your account. When it comes to fees, credit card transfers have a 3% rate. However, all other transfers remain free of charge.

As for Venmo limits, if you are new to the service and have yet to confirm your account, you get a sending limit of $299.99. After confirming your account, though, your Venmo transfer limit increases to a rolling $4,999.99 per week.

Due to the easy, one-two tap nature of this money transfer app, many wonders, “Is Venmo safe?” The answer is yes. Venmo has security protocols and encryption procedures in place to keep transactions safe. It has just about the same risks as any other money transfer app.

8. Western Union

Western Union started out with physical locations for their services. And while that continues to be a staple among many countries, the company has since diversified and adapted into the ever-changing global market. Now, Western Union has a money transfer app, too.

If you have ever used a physical Western Union service, you will know that it asks you to fill in a lot of details before you can proceed with your transaction. The benefit of their app is that they do not ask you to fill in the same lengthy details. Western Union makes it easier to transfer money online, especially with its Touch ID feature and card-scanning capabilities.

You can link your bank account to send payment directly from that source. Alternatively, you can also use cash or cards to transfer money. You can even incorporate Apple Pay into your Western Union account. Additionally, the app makes it a breeze to track transfers, with their MTCN tracking number.

There are a number of factors that can affect your transaction limits, including location and past transactions. Generally, though, you can transfer up to $500, which comes with a $5 fee. However, you can download the app on your smartphone for free.

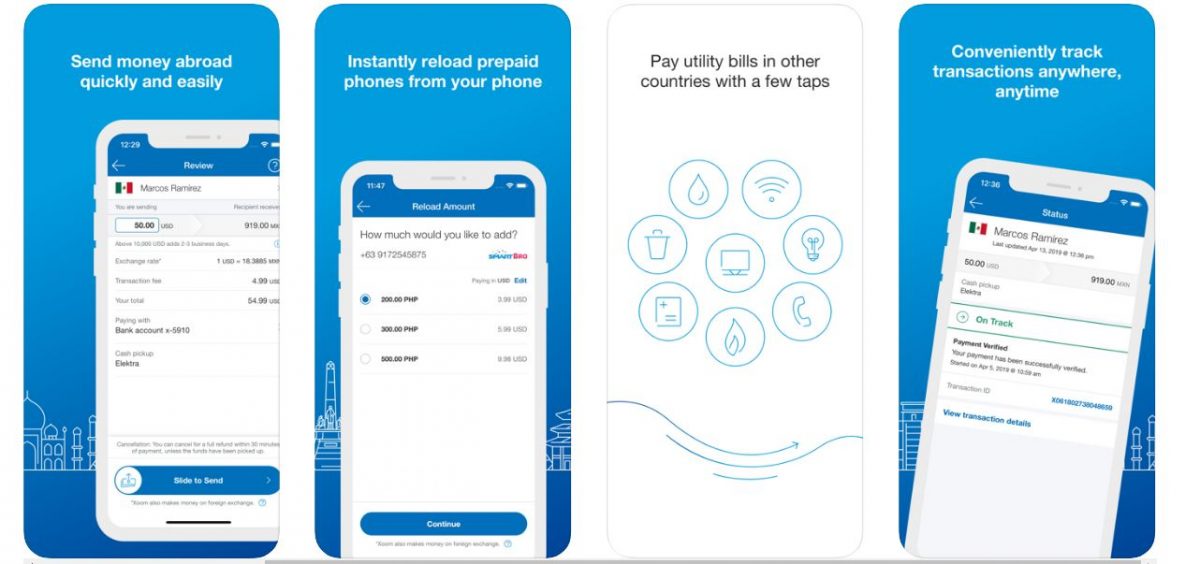

9. Xoom

If you are looking for an alternative to Western Union, Xoom money transfer is a great option. Xoom is a reputable international money transfer app that makes sending funds across the world a breeze. Signing up for an account is free, so you do not need to worry about extra or hidden fees. As for exchange or service fees, though, the amounts vary depending on your country. It also depends on the destination of your money transfer and the amount you intend to send. You can calculate your Xoom fees here.

When it comes to transaction limits, you can send up to $10,000 per transaction. In terms of speed, transfers from bank to bank can take up to 4 business days, though these types of transfers generally have lower fees. If you want a faster transaction, you can choose to transfer using a credit or debit card. However, although this route is quicker, it does have significantly higher fees.

10. Zelle

If you are looking for a simple peer-to-peer money transfer app for bank accounts, Zelle is worth a shot. Zelle makes it easy to wire- transfer money from bank to bank — a process that typically takes days to accomplish. With Zelle, though, you can perform the same process and arrive at the same outcome in a matter of minutes.

Zelle boasts more than 5,400 financial institutions as partners, which means you will probably not have any trouble looking for one in its network. Moreover, this money transfer app does not charge a fee for sending or receiving money. However, you will need to check with your bank to confirm that there are no additional fees for using the service.

Zelle does not specialize in international transfers, though. Both the sender and receiver should have a participating US bank account in order to use the service. Also, you have no way of connecting your credit or debit card to the service. It really only relies on bank accounts. Other than that, if you only need to transact using bank accounts, Zelle works great.

What to Consider When Choosing a Money Transfer App?

Not all money transfer apps are made equal. Some have functionalities that are not available in others. When you are looking for the right money transfer app for you, it is important to lay down what features you want. Here are the things you should consider when choosing a money transfer app:

- User-friendly interface. When selecting a money transfer app, take a look at the design. How intuitive is it? Can you easily learn how to use the app without much of a hassle?

- Payment options. Do you want to transfer money from your bank account? Or are you looking for a debit or credit card option? The money transfer app you choose should have the payment option you want.

- Fees. It is a given that low exchange and service fees are something everyone needs to take into account. After all, the app is taking a percentage of your money to provide you with the service.

- Speed. How fast will the other party receive your money? Do you have to wait for 2 to 3 business days? Or will they get it in an instant

- Transaction limits. If you intend to send large sums of money, then it is important to check the app’s transaction limits. This includes the amount of limits per transaction and amount limits for the day.

- Support. Does the money transfer app have a dedicated customer support team?

- Reputation. While not a lot of people think about this, reputation is a critical item to consider. Surely, you do not want to work with a service that has a bad track record.

5 Reasons You Should Start Using a Money Transfer App

Money transfer apps may seem like uncharted territory to some people. However, they provide a world of benefits when you start using them. You will soon find that using money transfer apps have perks well beyond your expectations. Here are five reasons why you should begin using money transfer apps:

- Convenient. Apps make transferring money easy. You no longer need to withdraw hard cash, drive to a physical money transfer service location, line up, and manually fill out forms. With apps, you can transfer money with the tap of a button.

- Fast. Apart from being convenient, using money transfer apps offer the benefit of speed. You can transfer cash across continents in an instant, thanks to the internet.

- Reliable. Money transfer apps offer the added benefit of reliability. Whenever you need to, you can always take out your smartphone, open the app, and transfer money in a second.

- Low Fees. Most money transfer apps charge an exchange or service fee for their services, which is no different from going to a physical money transfer service. And, more often than not, the fees that come with using apps are lower than those of physical services.

- Easy to use. A lot of money transfer apps offer intuitive and smart design layouts, making it easy for people to get the hang of using them. Even those on the elderly side can easily pick up how to use these apps.

Transfer Your Money Safely and Easily

Money transfers, whether done internationally or domestically, can be hard to do without the right tools. Thankfully, with the right money transfer app, you can send and receive money without sacrificing time and convenience. You may need to pay an exchange or service fee in the process. However, with these best money transfer apps, that is certainly a small price to pay. Weigh out your options carefully and choose from this list of money transfer apps to send or receive cash safely and easily.