Are you wondering how to pay off your Verizon phone and be free from the burden of monthly installments? Look no further, as we have all the information you need to break free from your phone payment plan. Whether you’re looking to upgrade to a new device or simply want to own your current phone outright, paying off your Verizon phone can offer you financial freedom and flexibility. In this article, we will guide you through the step-by-step process of paying off your phone, provide tips on managing your payments, and offer solutions to common questions and concerns. So, let’s dive in and discover how to bid farewell to those monthly phone payments once and for all!

Inside This Article

- Benefits of Paying Off Your Verizon Phone

- Different Payment Methods for Verizon Phones

- Strategies for Paying Off Your Verizon Phone Faster

- Tips for Managing Your Verizon Phone Payments

- Conclusion

- FAQs

Benefits of Paying Off Your Verizon Phone

There are several benefits to paying off your Verizon phone. Whether you are using a contract or financing your device, here are some advantages to consider:

1. Financial Freedom: Paying off your Verizon phone allows you to break free from monthly installment payments. Once you’ve paid off the device in full, you won’t have to worry about making those monthly payments anymore.

2. Lower Monthly Expenses: When you no longer have monthly payments for your Verizon phone, your monthly expenses decrease. This extra money can be used for other important things like savings, bills, or even treating yourself to something special.

3. Ownership: Paying off your Verizon phone means that you now own the device. You can do whatever you want with it, whether it’s keeping it as a backup phone, selling it, or passing it on to a family member or friend.

4. Flexibility: Paying off your Verizon phone gives you the freedom to switch carriers whenever you want. Being tied to a phone on installments or under contract can limit your options, but once it’s paid off, you have the flexibility to choose the best carrier for your needs.

5. No More Interest Charges: If you’re financing your Verizon phone, you may be paying interest charges on top of the cost of the device. By paying off your phone, you can eliminate those interest charges and save money in the long run.

6. Improved Credit Score: Paying off your Verizon phone can have a positive impact on your credit score. When you make consistent payments and pay off your device, it shows financial responsibility, which can improve your creditworthiness.

7. Upgrade Opportunities: Once your Verizon phone is paid off, you have the option to upgrade to a new device. This allows you to stay up-to-date with the latest technology without being burdened by monthly installments.

Paying off your Verizon phone has numerous benefits, from financial freedom to improved credit scores. It’s a wise financial decision that can provide you with flexibility, ownership, and potential savings in the long run.

Different Payment Methods for Verizon Phones

When it comes to paying off your Verizon phone, you have a variety of payment methods to choose from. Whether you prefer the convenience of online transactions or the flexibility of in-person payments, Verizon offers several options that cater to your needs. Let’s explore the different payment methods available:

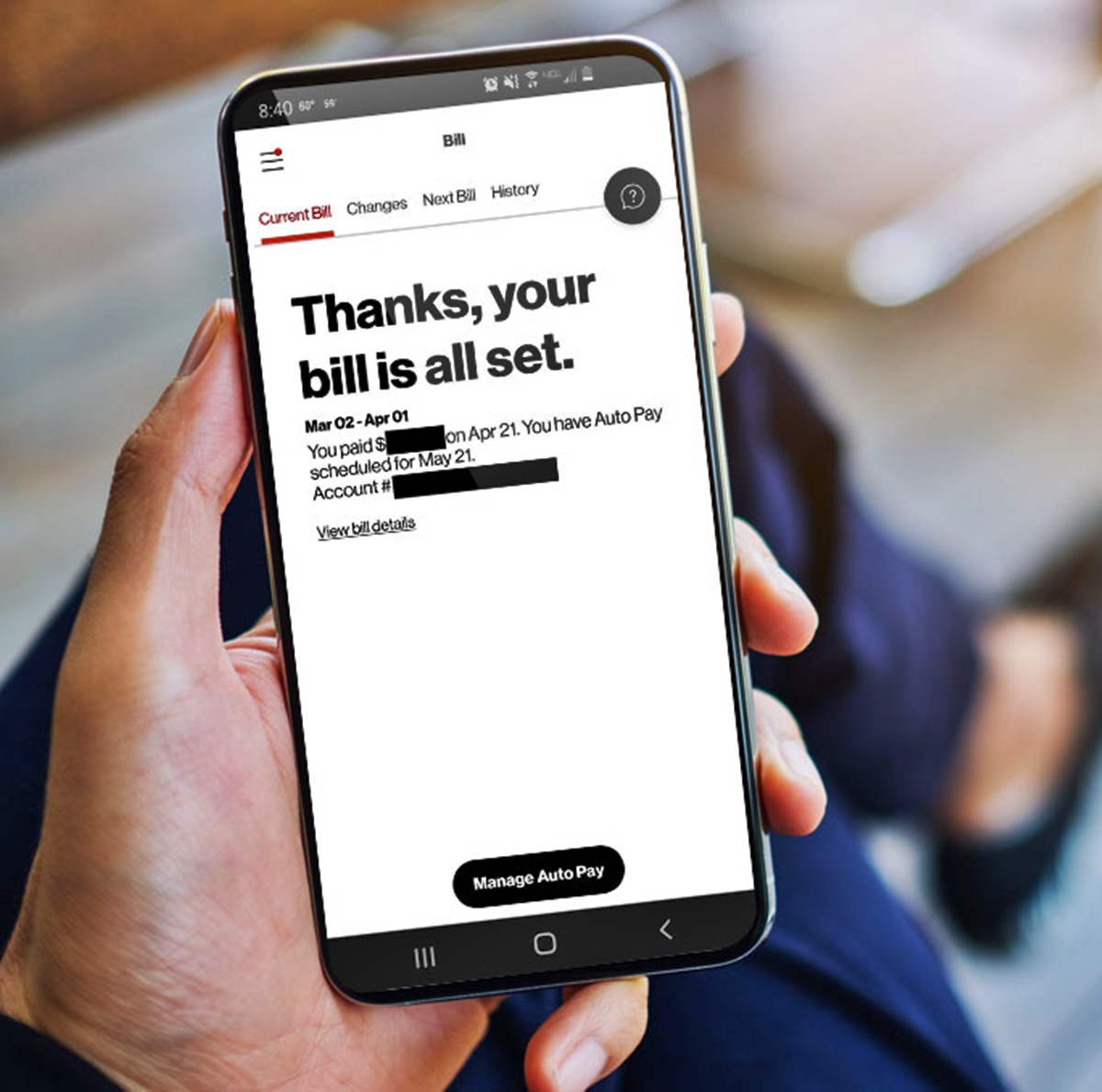

1. Online Payments: One of the most popular methods is paying your Verizon phone bill online. You can easily do this by logging into your Verizon account and making a payment through their website or mobile app. Online payments are quick, convenient, and allow you to view and manage your billing details effortlessly.

2. Automatic Bill Pay: Setting up automatic bill payments is a hassle-free way to ensure your Verizon phone bill is paid on time every month. With this method, your payment is deducted automatically from your chosen bank account or credit card. It saves you the effort of manually making payments and helps you avoid late fees.

3. In-person Payments: If you prefer face-to-face transactions, you can visit a Verizon store or an authorized payment location to pay your phone bill in person. Simply bring your bill or account number, and a representative will assist you in completing the payment. This method allows for personalized customer service and gives you the opportunity to ask any questions you may have.

4. Phone Payments: Verizon also provides the option to pay your phone bill over the phone. All you need to do is call Verizon’s customer service line and follow the prompts to make your payment. This method is convenient for those who prefer a more hands-on approach and want to ensure their payment is completed securely.

5. Mail-in Payments: For those who prefer traditional methods, you can opt to pay your Verizon phone bill by mail. Simply detach the payment slip from your paper bill, write a check or money order for the amount due, and mail it to the address provided. Keep in mind that mail-in payments may take longer to process, so ensure you send it well in advance of the due date.

Regardless of the payment method you choose, it is essential to make timely payments to avoid any disruptions to your Verizon phone service. Consider setting reminders or enabling notifications to stay on top of your payment obligations. By taking advantage of the various payment methods offered by Verizon, you can find a convenient and efficient way to pay off your phone bill.

Strategies for Paying Off Your Verizon Phone Faster

Paying off your Verizon phone faster not only gives you the satisfaction of owning your device outright, but it can also help you save money in the long run. Here are some strategies to consider:

1. Make Extra Payments: One of the most effective ways to pay off your Verizon phone faster is to make extra payments whenever possible. Consider allocating some of your monthly budget towards paying more than the minimum payment. This will help you reduce the overall balance and shorten the payment term.

2. Prioritize Your Payments: If you have multiple bills to pay each month, it’s important to prioritize your Verizon phone payment. Make it a top priority to ensure that you allocate enough funds to cover the minimum payment. By doing this, you can avoid any potential late fees and penalties that could hinder your progress in paying off the device.

3. Cut Back on Expenses: Take a closer look at your monthly expenses and see if there are any areas where you can cut back. By reducing discretionary spending, such as dining out or entertainment expenses, you can free up extra money that can be directed towards paying off your Verizon phone.

4. Consider a Balance Transfer: If you have other outstanding debts, such as credit card bills, you may want to explore the option of a balance transfer. By consolidating your debts onto a single credit card with a low-interest rate, you can potentially save money on interest charges and allocate more funds towards paying off your Verizon phone.

5. Take Advantage of Promotional Offers: Keep an eye out for any promotional offers or discounts that Verizon may offer for paying off your device early. These offers can provide incentives, such as reduced interest rates or waived fees, that can help you pay off your phone faster and save money in the process.

6. Set a Budget and Stick to It: Creating a budget and sticking to it is essential for managing your finances effectively. Set a realistic budget that includes your Verizon phone payment as a priority expense. By staying disciplined and following your budget, you can ensure that you have enough funds allocated towards paying off your phone.

7. Consider Refinancing: If you’re struggling to meet your Verizon phone payment obligations, you may want to consider refinancing your device. This option allows you to extend the payment term and potentially reduce your monthly payments. However, keep in mind that refinancing may result in paying more interest over time.

By implementing these strategies, you can accelerate the process of paying off your Verizon phone. Remember, the key is to stay focused and committed to your goal of owning the device free and clear. With determination and smart financial choices, you’ll be one step closer to being debt-free.

Tips for Managing Your Verizon Phone Payments

Managing your Verizon phone payments efficiently can help you stay on top of your bills and ensure a smooth financial experience. Here are some tips to help you manage your Verizon phone payments effectively:

1. Set up Auto Pay: One of the easiest ways to manage your Verizon phone payments is to enroll in Auto Pay. This feature allows Verizon to automatically deduct your monthly bill from your chosen payment method. By setting up Auto Pay, you can avoid late fees and ensure timely payments.

2. Create a Budget: Take the time to review your income and expenses and create a budget that includes your Verizon phone payment. This will help you allocate the necessary funds and avoid any surprises.

3. Opt for Paperless Billing: By choosing paperless billing, you can receive your Verizon phone bill electronically via email. This not only reduces paper waste but also makes it easier to track and manage your bills online.

4. Monitor Usage Regularly: Keep an eye on your Verizon phone usage to avoid unexpected charges or overage fees. You can check your usage online or through the Verizon app to stay informed and make adjustments if needed.

5. Consider Device Insurance: Accidents happen, and having device insurance can give you peace of mind. Verizon offers device protection plans that can help cover the cost of repairs or replacements if your phone gets damaged or lost.

6. Use Usage Alerts: Take advantage of Verizon’s usage alerts feature to receive notifications when you’re approaching your monthly limits. This can help you stay within your plan’s limits and avoid any additional charges.

7. Check for Promotions and Discounts: Keep an eye out for any promotions or discounts offered by Verizon. They often have special deals on plans or devices that can help you save money on your monthly bill.

8. Contact Customer Service: If you’re facing difficulties with your Verizon phone payments, don’t hesitate to reach out to customer service. They can provide guidance, offer solutions, or even help adjust your payment schedule if necessary.

9. Plan Ahead for Upgrades: If you’re considering upgrading your phone or changing your plan, make sure to factor in the potential increase in your monthly payments. Planning ahead can help you avoid any financial strain.

10. Review Your Bill Regularly: Take the time to review your Verizon phone bill every month. Check for any discrepancies or unauthorized charges and contact Verizon immediately if you notice anything unusual.

By implementing these tips, you can effectively manage your Verizon phone payments and ensure a hassle-free experience. Remember, staying organized and proactive is key to maintaining control over your finances and enjoying the benefits of your Verizon phone service.

Conclusion

In conclusion, paying off your Verizon phone is a smart move that can give you greater flexibility and financial freedom. By following the steps outlined in this article, you can take control of your phone payments and eliminate any outstanding balance. Remember to review your contract, check your payment options, and utilize any available promotions or discounts to save money. Whether you choose to make lump sum payments or divide the cost into manageable installments, paying off your Verizon phone will free you from monthly obligations and potentially unlock additional benefits, such as the ability to upgrade or switch to a new device. So take the necessary steps today and enjoy the satisfaction of fully owning your Verizon phone!

FAQs

1. How can I pay off my Verizon phone?

2. Can I pay off my Verizon phone early?

3. Will paying off my Verizon phone early save me money?

4. Is there a penalty for paying off my Verizon phone early?

5. Can I pay off my Verizon phone online?