In today’s digital age, making payments has become more convenient than ever before thanks to the advent of digital wallets. One of the most convenient and secure ways to make payments is through Near Field Communication (NFC) technology. NFC payment allows users to simply tap their smartphones or other NFC-enabled devices against a payment terminal to complete a transaction, eliminating the need for physical credit cards or cash.

Whether you’re new to NFC payments or looking to deepen your understanding, this article will guide you through the process of making an NFC payment. We’ll explore the benefits of NFC technology, how to set up your digital wallet on your smartphone, and the steps involved in making a successful NFC transaction. So grab your smartphone and get ready to embrace the future of seamless and secure payments!

Inside This Article

- Overview of NFC Payments

- Setting Up NFC Payment on Your Devices

- Making an NFC Payment

- Security Measures for NFC Payments

- Conclusion

- FAQs

Overview of NFC Payments

In today’s digital era, making payments has become more convenient and secure than ever before. One of the latest technologies that has revolutionized the payment industry is Near Field Communication (NFC). NFC enables users to make contactless payments through their smartphones or other compatible devices, eliminating the need for physical cash or traditional credit cards.

NFC works by establishing a wireless connection between two devices in close proximity, usually within a few centimeters. It relies on electromagnetic fields to securely transmit information between the devices. This technology is widely used in digital wallets, which store payment information and facilitate transactions with just a tap or a wave.

One of the main advantages of NFC payments is their speed and convenience. With just a simple tap, you can make a payment at a wide range of NFC-enabled terminals, such as retail stores, restaurants, and transportation systems. There’s no need to swipe a card or enter a PIN, making the checkout process quick and hassle-free.

NFC payments also offer a high level of security. Each transaction generates a unique code, ensuring that the payment information is protected from unauthorized access. Additionally, many smartphones and digital wallets require biometric authentication, such as fingerprint or facial recognition, for added security.

To make an NFC payment, you’ll need a compatible device, such as a smartphone or smartwatch, with NFC capabilities. Additionally, you’ll need to set up a digital wallet and add your payment card information. This can typically be done through the digital wallet app, where you can securely store your card details and manage your transactions.

It’s worth noting that NFC payments are widely accepted in many countries and by various merchants. However, it’s essential to ensure that the place where you want to make a payment has an NFC-enabled terminal. Look for the contactless payment symbol, typically depicted as a wave or Wi-Fi symbol, on the payment terminal.

Setting Up NFC Payment on Your Devices

Setting up NFC payment on your devices is a simple and convenient process that allows you to make contactless transactions with just a tap. Whether you have a smartphone, smartwatch, or even a credit card with NFC capabilities, you can easily enable NFC payment to streamline your transactions.

The first step is to ensure that your device supports NFC technology. Most modern smartphones and smartwatches come equipped with NFC capabilities, but it’s always a good idea to double-check. You can find this information in your device’s settings or by referring to the user manual.

To enable NFC payment on your device, you’ll also need to download a compatible digital wallet application. Popular digital wallet apps include Apple Pay, Google Pay, Samsung Pay, and other third-party apps. These apps not only support NFC payments but also offer additional features such as loyalty card integration, in-app purchases, and more.

Once you’ve installed the digital wallet app, you’ll need to add your preferred payment methods, such as credit or debit cards. This usually involves entering your card information manually or scanning the card using your device’s camera. The app will securely store your card details and encrypt them to ensure maximum security.

After adding your payment methods, you may need to verify your cards to authenticate them. This typically involves a verification process where the card issuer may send you a one-time password or ask you to confirm some personal information. Follow the instructions provided in the app to complete the verification process successfully.

Next, you’ll need to set your default payment method within the digital wallet application. This determines which card will be used for NFC transactions when you tap your device on a compatible payment terminal. You can usually modify this setting within the app’s settings or payment preferences section.

Before you start making NFC payments, it’s a good idea to familiarize yourself with the payment terminal’s compatibility. Look for the contactless payments symbol or the NFC logo on the terminal. Most modern payment terminals support NFC payments, but it’s always best to confirm to avoid any confusion or inconvenience during your transactions.

Finally, ensure that NFC is enabled on your device. Go to your device’s settings and locate the NFC option. Toggle it on to enable NFC functionality. You may also need to configure additional settings, such as allowing your device to remain unlocked when making payments or enabling biometric authentication for added security.

Once you’ve completed the setup process, you’re all set to start making NFC payments. Just tap your device on the payment terminal, and the transaction will be processed securely and swiftly. Enjoy the convenience of contactless payments and leave your wallet at home!

Making an NFC Payment

If you’ve set up NFC payment on your device, making a payment is a quick and hassle-free process. Here’s a step-by-step guide to making an NFC payment:

- Ensure that NFC is enabled on your device. Most smartphones have an option to enable or disable NFC in the settings menu. Make sure that it is turned on before attempting to make a payment.

- Open the digital wallet app on your phone. The digital wallet app serves as a virtual container for your payment information and allows you to make contactless payments using NFC technology.

- Select the payment method you want to use. Depending on your digital wallet app, you may have multiple payment methods linked, such as credit cards, debit cards, or even loyalty cards.

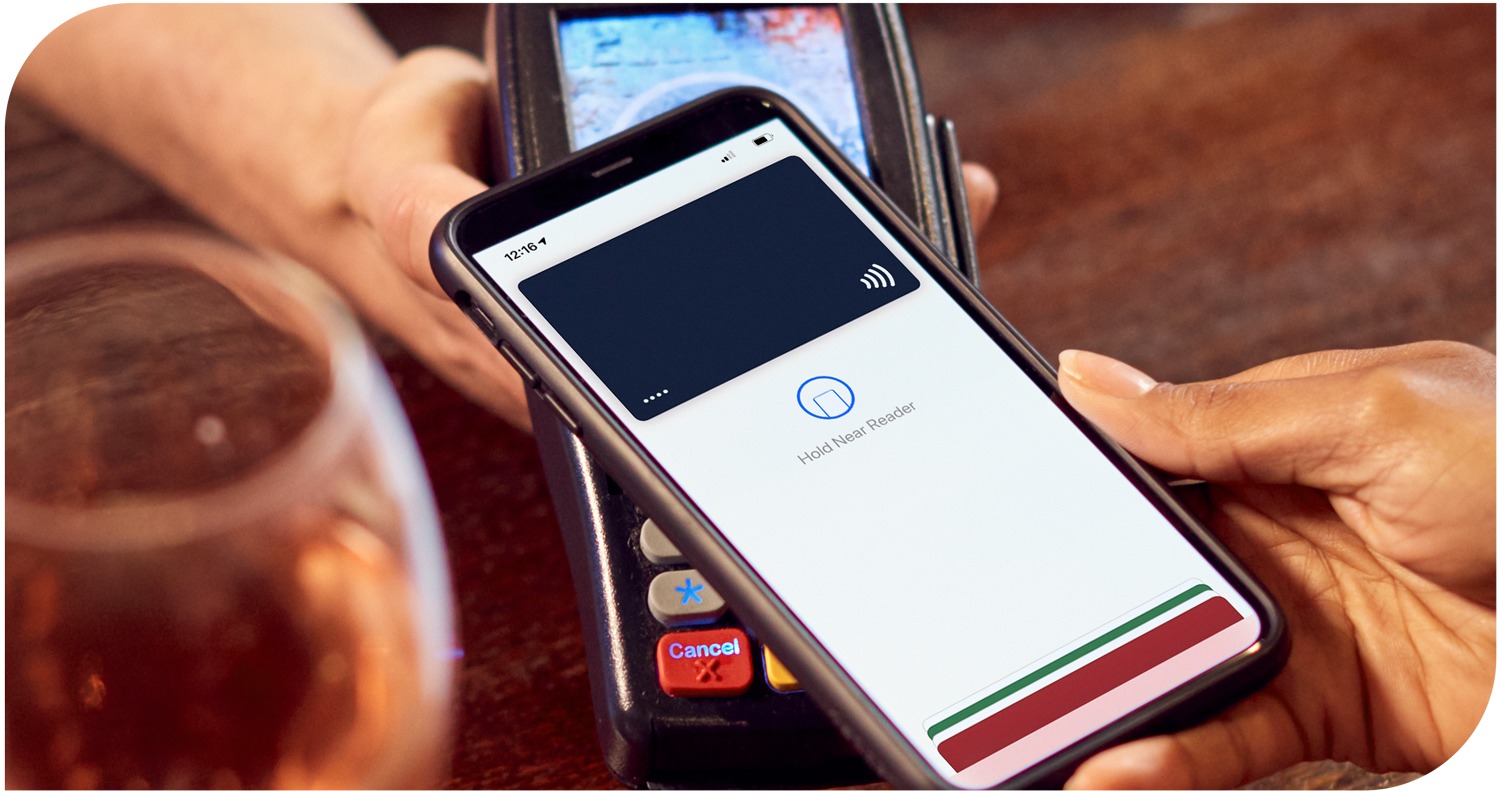

- Bring your phone close to the contactless payment terminal. In most cases, you’ll find the NFC symbol or logo displayed on the terminal. Simply hold your phone near the terminal, and the NFC technology will establish a connection with it.

- Authenticate the payment. Depending on your device and digital wallet app, you may need to use biometric authentication methods like fingerprint scanning or facial recognition, or enter a PIN to confirm the transaction.

- Wait for the payment to be processed. Once you’ve authenticated the payment, the NFC technology in your phone will communicate with the terminal, and the payment will be processed within seconds.

- Receive a confirmation. After a successful NFC payment, you’ll receive a confirmation message on your device, indicating that the transaction was completed.

- Retrieve your receipt if necessary. If you require a receipt for your transaction, you can either request a printed copy from the merchant or check the digital receipt in your digital wallet app.

Making an NFC payment is not only convenient but also secure. The technology uses encryption to protect your payment information, making it difficult for unauthorized individuals to intercept or clone your card details. With the increasing popularity of NFC payments, more merchants are adopting contactless terminals, making it easier than ever to make quick and secure transactions with just a tap of your phone.

Security Measures for NFC Payments

As digital wallet technology continues to gain popularity, it’s crucial to ensure that the security of NFC (Near Field Communication) payments remains a top priority. With the convenience of tap and pay transactions, it’s essential for users to understand the security measures in place to protect their financial information. Here, we dive into some of the key security measures that make NFC payments secure.

Encryption: One of the fundamental security measures for NFC payments is encryption. When making an NFC payment, the data transmitted between the device and the payment terminal is encrypted, making it extremely difficult for hackers to intercept and decode the information. This ensures that your financial details remain safe and secure.

Tokenization: Another important security measure is tokenization. Instead of transmitting the actual card details during an NFC payment, a unique token is generated and used as a representation of the card information. This tokenization process adds an extra layer of security, as even if the token is intercepted, it cannot be used to access the original card data.

Biometric Authentication: Many devices now incorporate biometric authentication, such as fingerprint or facial recognition, for NFC payments. This provides an additional level of security, as it ensures that only authorized users can make payments. Biometric data is unique to each individual, making it difficult for unauthorized individuals to access the device or initiate a payment.

Device Authentication: NFC payments also rely on device authentication to ensure secure transactions. This involves verifying the authenticity of the device used for the payment. The device and the payment terminal communicate with each other to establish a secure connection, ensuring that only trusted devices can initiate transactions.

Transaction Limits: Another security measure implemented in NFC payments is transaction limits. These limits set a maximum amount that can be spent using NFC payments without additional verification or authentication. By setting transaction limits, even if a malicious individual gains unauthorized access to the device, they will be restricted in the amount they can spend.

Two-Factor Authentication: Some digital wallet providers offer the option of enabling two-factor authentication for NFC payments. This means that in addition to the device authentication, an additional verification step is required, such as entering a PIN or receiving a one-time password via SMS. Two-factor authentication provides an extra layer of security, ensuring that only the rightful owner of the device can complete the payment.

Continuous Monitoring and Updates: To stay ahead of evolving security threats, digital wallet providers constantly monitor and update their security protocols. This includes addressing any vulnerabilities and enhancing security features to protect against potential risks. It’s important for users to keep their devices updated with the latest software versions to ensure they benefit from the most current security measures.

By implementing these security measures, digital wallet providers and NFC technology strive to make payments secure and give users peace of mind when using NFC payments. However, it’s always recommended to practice good security habits, such as protecting your device with a strong password, regularly monitoring your transactions, and reporting any suspicious activities to your digital wallet provider.

Conclusion

The ease and convenience of making NFC payments through digital wallets have revolutionized the way we handle transactions. With just a tap of your smartphone or smartwatch, you can securely and swiftly make purchases at a wide range of retail establishments.

Not only do NFC payments offer a contactless and hygienic alternative to traditional payment methods, but they also provide added layers of security through encryption and tokenization. This ensures that your financial information remains protected, giving you peace of mind.

Whether you’re using popular digital wallet services like Apple Pay, Google Pay, or Samsung Pay, or exploring options offered by your bank or credit card provider, embracing the world of NFC payments opens up a world of convenience and efficiency.

So, say goodbye to fumbling for cash or swiping your card, and say hello to the future of payments. Embrace the power of NFC technology and enjoy the simplicity and security of making payments with your digital wallet.

FAQs

1. What is NFC?

NFC stands for Near Field Communication. It is a technology that allows two devices to communicate wirelessly when they are in close proximity to each other, typically within a few centimeters. NFC is commonly used for contactless payments, data exchange, and device pairing.

2. What is a digital wallet?

A digital wallet, also known as an e-wallet or mobile wallet, is a virtual wallet that enables users to store their payment card information and make secure transactions using their smartphones or other mobile devices. It eliminates the need to carry physical cards and provides a convenient and secure way to make payments.

3. How does NFC payment work?

NFC payment works by utilizing the NFC technology in your smartphone and a compatible payment terminal. When making a payment, you simply need to unlock your device, hold it near the payment terminal, and authenticate the transaction using your device’s security method, such as a fingerprint or PIN. The NFC technology establishes a secure connection to transfer payment information, and the transaction is completed in seconds.

4. Which smartphones support NFC payments?

Most modern smartphones support NFC payments. Popular smartphone brands like Apple, Samsung, Google, and others have integrated NFC technology into their devices. However, it’s always a good idea to check the specifications of your smartphone to confirm if it supports NFC payments.

5. Are NFC payments safe?

Yes, NFC payments are considered safe and secure. NFC technology utilizes encryption and authentication protocols to protect your payment information. Additionally, most mobile wallet platforms implement additional security features like tokenization, where a unique token is generated for each transaction, providing an extra layer of security. However, it is always important to ensure that your device has the latest security updates and avoid connecting to untrusted Wi-Fi networks to further safeguard your transactions.