Are you struggling to locate your 1095-A form on the Health Connector? Don’t worry, we’ve got you covered! Finding important documents like the 1095-A can sometimes be a daunting task, especially when you’re not familiar with the platform or the process. But fret not, because in this article, we will guide you through the steps to easily find your 1095-A form on the Health Connector. Whether you need it for tax purposes or for reviewing your health insurance coverage, we’ll provide you with all the information you need. So, let’s dive in and make the search for your 1095-A on Health Connector a breeze!

Inside This Article

- Overview of Form 1095-A

- Accessing Your Form 1095-A on the Health Connector Website

- Contacting the Health Connector Support for Assistance

- Understanding the Information on Form 1095-A

- Conclusion

- FAQs

Overview of Form 1095-A

Form 1095-A is an important document that individuals who purchased health insurance through the Health Connector marketplace need to be aware of. It is a tax form that provides information about the health insurance coverage obtained through the marketplace. This form is issued by the Health Connector and is used when filing your federal income tax return.

Form 1095-A includes details about the coverage period, the amount of premium tax credits received, and the monthly premiums for the health insurance plan. It is crucial to have this form on hand to accurately report your health coverage and any premium tax credits you received during the tax year.

Understanding Form 1095-A is essential because it helps determine if you are eligible for the Premium Tax Credit (PTC) and if any adjustments need to be made in your tax return. The PTC is a refundable tax credit that helps individuals and families with low to moderate incomes afford health insurance coverage through the marketplace.

By receiving Form 1095-A, you can reconcile the premium tax credits you received in advance with the actual amount you were eligible for based on your income. This process ensures that you receive the correct amount of subsidies and avoid any potential under or overpayments.

To accurately complete your tax return, you need to carefully review the information on Form 1095-A, including the premium amounts, coverage dates, and any changes in coverage throughout the year. It is important to ensure that the information on the form matches your records and that any discrepancies are resolved.

Accessing Your Form 1095-A on the Health Connector Website

Finding and accessing your Form 1095-A on the Health Connector website is a straightforward process. The Form 1095-A is an important document that provides information about the coverage you had in the previous year through the Health Connector marketplace. It is necessary for filing your federal income taxes and determining your eligibility for the Premium Tax Credit.

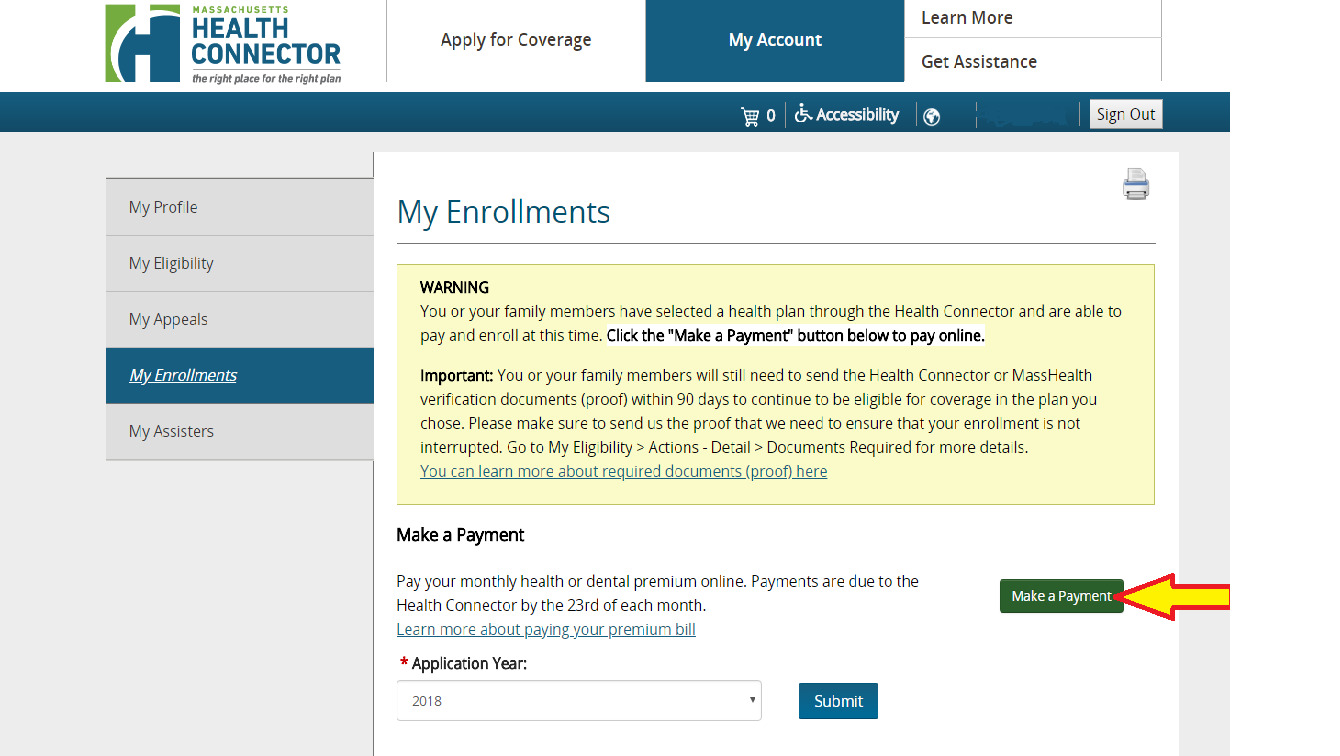

To begin the process, log in to your account on the Health Connector website. Once logged in, navigate to the section where your tax forms are located. Look for the option that says “Tax Forms” or “1095-A” and click on it. This will take you to the page where you can access your Form 1095-A.

On the Form 1095-A page, you will see a list of tax years for which you have a Form 1095-A available. Select the appropriate tax year that you need, and click on it. This will open the Form 1095-A in a new window or tab, depending on your browser settings.

Once you have accessed your Form 1095-A, you can view, download, or print it for your records. It is important to review the form carefully and ensure that all the information, including your personal details and coverage details, is accurate. If you notice any errors or discrepancies, it is recommended to contact the Health Connector support for assistance (more on that later).

It is also worth mentioning that if you had coverage through the Health Connector for multiple members of your household, each individual will receive a separate Form 1095-A. Make sure to access the correct form for each individual when filing your taxes.

Keep in mind that the Form 1095-A will typically be available on the Health Connector website by the end of January for the previous tax year. If you cannot find your Form 1095-A or if you have any difficulties accessing it on the website, don’t worry. The Health Connector support team is available to assist you.

Contacting the Health Connector Support for Assistance

If you are unable to find your Form 1095-A on the Health Connector website or need further assistance, you can reach out to their support team. The Health Connector provides various means of contacting their support staff to help you with any issues you may encounter.

The first avenue to explore is contacting the Health Connector support by phone. They have a dedicated customer service helpline that you can call to speak with a representative directly. The phone number for customer service can usually be found on the Health Connector website or any correspondence you have received from them regarding your enrollment. Be prepared to provide your personal information and details about your Health Connector account to facilitate a smoother support experience.

If you prefer a more online-centric approach, you can also reach out to the Health Connector support via their website’s live chat feature. This allows you to chat with a support agent in real-time and get immediate assistance for any queries or concerns you may have. The live chat feature is usually available during their business hours, so make sure to check the Health Connector website for the specific hours of operation.

For those who prefer written communication, you can send an email to the Health Connector support team. Their email address can typically be found on their website’s contact page or in the FAQ section. When composing your email, be sure to provide clear and concise details about your issue and include any relevant information, such as your Health Connector account number or enrollment details. Keep in mind that response times may vary, so it’s best to be patient while waiting for a reply.

In some cases, the Health Connector may also have a presence on social media platforms. You can check if they have official accounts on platforms like Facebook or Twitter and reach out to them through direct messaging or public comments. While social media may not be the most traditional support channel, it can be a convenient option for quick questions or inquiries.

If you have tried all these channels and still haven’t received the assistance you need, you can also consider reaching out to local resources or advocacy organizations that specialize in helping individuals with health insurance-related concerns. They may be able to provide additional guidance or escalate your issue to the appropriate channels.

Remember, when contacting the Health Connector support for assistance, it’s important to remain patient and provide the necessary information to help them understand and address your issue effectively. By utilizing the available support avenues, you can ensure a smoother experience and find the assistance you need to locate your Form 1095-A successfully.

Understanding the Information on Form 1095-A

Form 1095-A is an important document that you receive from the Health Connector if you had health insurance coverage through the marketplace during the previous year. It provides detailed information about your coverage and any premium tax credit you may have received.

Here are the key components of Form 1095-A and what they mean:

- Recipient Information: This section includes your name, address, and social security number. It is important to review this information for accuracy to ensure the form corresponds to your coverage.

- Policy Information: This section provides details about your health plan, such as the policy number and the coverage start and end dates. It also includes information about anyone else covered under the plan, such as your spouse or dependents.

- Monthly Enrollment and Premium Amounts: In this section, each month of the year is listed along with the premium amount paid for that month. If you received advance payments of the premium tax credit, it will also be reflected here.

- Second Lowest Cost Silver Plan (SLCSP): This is an important figure used to determine the amount of premium tax credit you are eligible for. It represents the cost of the second lowest cost silver plan available in your area.

- Premium Tax Credit (PTC) Reconciliation: This section summarizes the total premium tax credit you received during the year and contrasts it with the amount you were eligible for based on your income and the cost of the SLCSP. It calculates whether you are entitled to additional premium tax credit or if you have to repay any excess credit.

It’s crucial to review your Form 1095-A carefully to ensure its accuracy. If you notice any discrepancies or errors, it’s recommended to contact the Health Connector support for assistance and guidance. They will be able to address your concerns and help you resolve any issues with your form.

Understanding the information on Form 1095-A is essential for accurately reporting your healthcare coverage and premium tax credit on your tax return. It ensures that you comply with tax regulations and maximize your benefits. If you have any questions or need further clarification, it’s always a good idea to consult with a tax professional or seek guidance from the IRS.

Conclusion

Finding your 1095-A form on the Health Connector can seem like a daunting task, but with the right steps, it can be a straightforward process. By logging into your Health Connector account and navigating to the documents section, you can easily locate and download your 1095-A form.

Remember to check your email as well, as the Health Connector may send you a notification when your form is available. If you are unable to find your 1095-A form online, don’t hesitate to reach out to the Health Connector customer support for assistance.

Having your 1095-A form is crucial for accurately filing your taxes and determining your eligibility for premium tax credits and financial help. By taking the time to locate and review this form, you can ensure that your tax information is correct and up-to-date.

So, don’t fret if you can’t find your 1095-A on the Health Connector right away. Follow the steps outlined in this guide, and you’ll be on your way to accessing the necessary information for your tax filing needs.

FAQs

1. What is a 1095-A form?

The 1095-A form, also known as the Health Insurance Marketplace Statement, is a document issued by the Health Insurance Marketplace, also called the Health Connector. It provides important information about your health insurance coverage, including details about your plan, premiums, and any financial assistance you received.

2. How do I find my 1095-A on the Health Connector?

To find your 1095-A form on the Health Connector, you will need to log in to your online account. Once logged in, navigate to the “Documents” or “Tax Forms” section. Look for the “1095-A” form and click on it to view or download a copy.

3. What if I can’t find my 1095-A on the Health Connector?

If you are unable to find your 1095-A form on the Health Connector website, you may need to contact their customer service department for assistance. They will be able to provide guidance on how to access your form or issue a duplicate copy if necessary.

4. What information is included in the 1095-A form?

The 1095-A form includes important information such as your name, address, and Social Security number. It also provides details about your health insurance coverage, including the start and end dates of your coverage, the amount of your monthly premiums, and any advance premium tax credits you received.

5. Why do I need my 1095-A form?

You will need your 1095-A form to accurately complete your federal tax return, particularly if you and your household members received premium tax credits or if you need to reconcile any advance credits you received. The information on the form will help determine if you qualify for certain tax credits and deductions related to your health insurance coverage.