Oftentimes we find ourselves questioning about where we’ve spent all our money, but thanks to technology, we can now track our spending and savings with the best budget app that will suit each of our needs. Whether it’s about tracking your daily expenses or an app that actually pay your bills for you or simply lets you know if your bank account is dry, there is surely one for you.

But why use budgeting apps? First, it will help you track your expenses. And tracking expenses creates financial awareness. If you don’t know where your money goes, you won’t change those habits that blows your budget. Second, it helps you stick to your budget. Once you consistently track your expenses, it will be easier to make necessary changes for your finances. And of course, budgeting apps are the most convenient way of tracking your finances.

To help you start tracking and budgeting your finances, we have rounded up the best budget app in no particular order.

The Best Budget App

1. Mint

Mint is one of the most popular budgeting apps available. It has a wide array of features that will help you track and manage your money from a giant list of banks, credit card issuers and other financial institutions.

This budget app can automatically categorize your transactions from your linked debit and credit card and track them against the budget you have setup and customize to your needs. You will also be alerted if you go over budget. With Mint, you can easily see your overall cash flow.

Price: Free on Android and iOS

2. Fudget

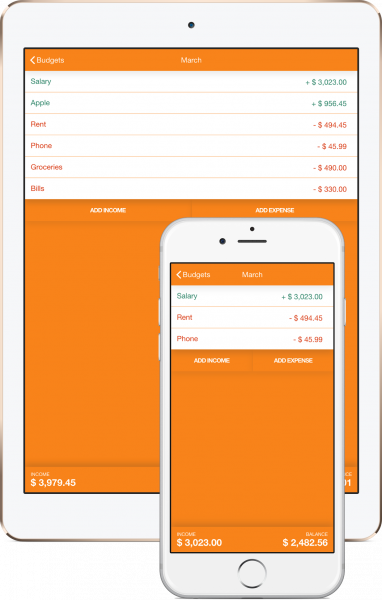

Fudget is one of the best budget apps available because it is less complicated compared to most apps. It comes in the form of quick, straight-to-the-point and color-coded daily, weekly, monthly lists detailing your income and expenses.

Fudget has no categories or charts unlike other apps but it has an option to highlight a recurring expenses. It is great for day-to-day budgeting for its quick and easy input method. Although, its lack of categories may be frustrating if you are looking for more organization and classification.

Price: Free on Android and iOS

3. You Need A Budget (YNAB)

YNAB lets you build your budget based on your income. It has a unique approach compared to other budgeting apps. You can easily link connect all you bank accounts and has a debt paydown feature that helps you get out of debt.

It also has a detailed, visual spending and trend reports that measures your progress when it comes to savings or spending. Plus a goal tracking that will help you set and track goals to reach them faster. And it has an around the clock support team that will assist you.

Price: Free for 30 days on Android and iOS

4. Simple Expense Note

An interface the captures the style of classic organizers and planners, Simple Expense Note lives up to its foolproof feature that can be accessed anytime and anywhere, even offline. It’s simple, uncomplicated and lightweight.

This budget app lets you record and list down your daily expenses and calculates your total income and expenses on a daily, monthly or even yearly basis. It can even create graphs out your given data. Although, it might not appeal to others as the color is not customizable.

Price: Free on Android

5. Goodbudget: Budget And Finance

Based from the familiar envelope budget philosophy, Goodbudget allows you stay on top of your bills and finances in this virtual envelope system. You share and sync your budget across Android, iOS and even the web, making it great for people with shared finances.

Upon adding a new transaction, you have the option to add details and divide your expenses in different envelopes. Budget by categories (or envelopes in this app) with free 10 categories each user. An upgrade on your good old envelope system.

Price: Free on Android and iOS

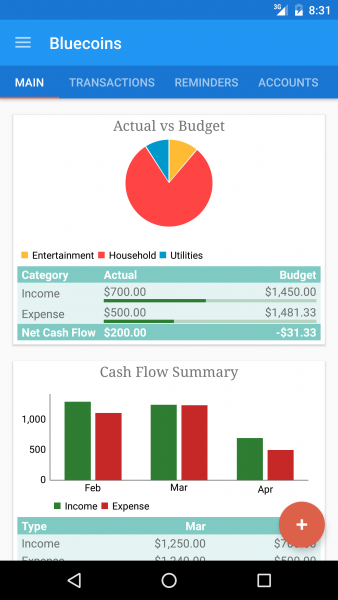

6. Bluecoins Finance

Minimalist and efficient, Bluecoins Finance helps users keep track of their credit cards, bank accounts, loans and debts through graph reports. It also has customizable categories that can be viewed per week, month, quarter and year.

It is available for free but if you upgrade to premium you will have unlimited accounts and budgeting categories, extra themes to customize the look of your app and access to your complete financial history. Surely one of the best budget app available.

Price: Free on Android, one-time permanent upgrade of $8.

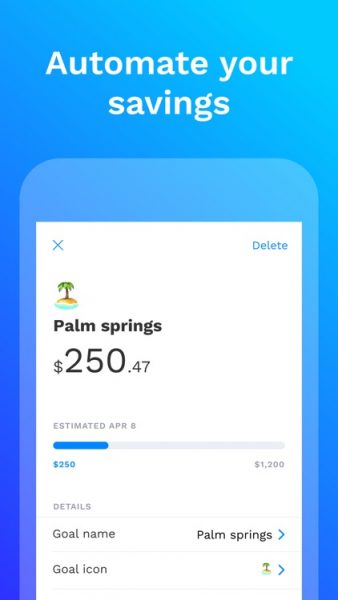

7. Albert: Save And Spend Smarter

Looking for a personal assistant for your money? Then this budgeting app is for you! Albert offers a revolutionary feature offering guidance from their team of experts or what the call “geniuses”. These geniuses are real people that will help improve your financial health.

The app also automatically creates a budget based on your income, bills and spending habits and also sets aside a portion of your money for your savings fund. It keeps track of your account just like majority of budgeting apps.

Price: Free on iOS

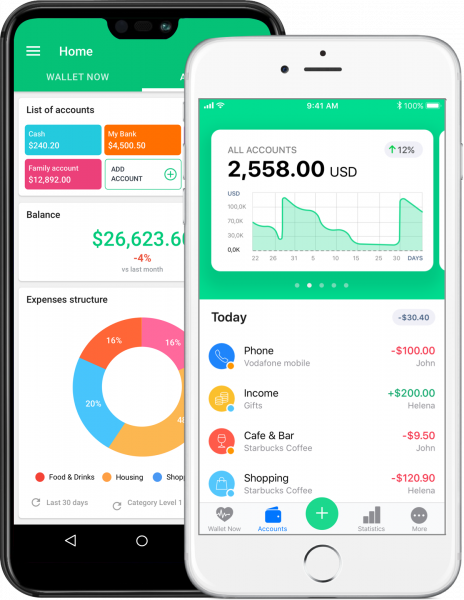

8. Wallet by BudgetBakers

This budget app has user-friendly interface that will help you plan and manage your savings and expenses better. You can set up your monthly income, track your expenses, including your debts and get an overview with automated graph reports.

Wallet allows you to sync your account with over 4,000 banks worldwide. Data also counts your feelings toward your expenses that will help you for your future decision making. You can also manually import your bank transaction data.

Price: Free on Android and iOS

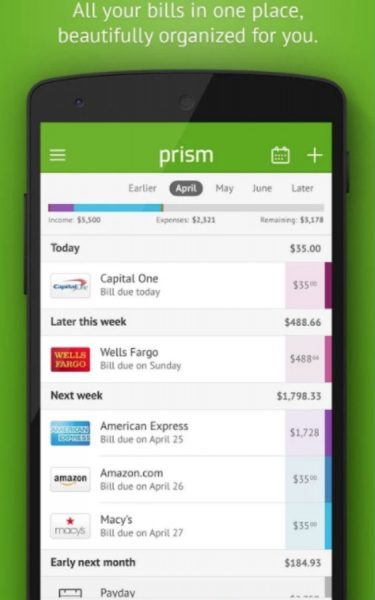

9. Prism

Prism knows how hard it is to stay on top of your money. That’s why this budgeting app helps bring together all your money, bills and your income to give you a complete picture of all your funds. Plus, you can your bills directly on the app.

All you have to do is choose all your billers and sync all your accounts. No need for different applications, track and pay your bills all in one app. It will also notify you about your impending due date and payment confirmations.

Price: Free on Android and iOS

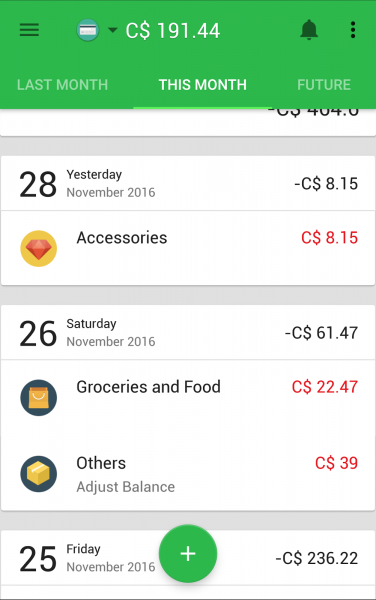

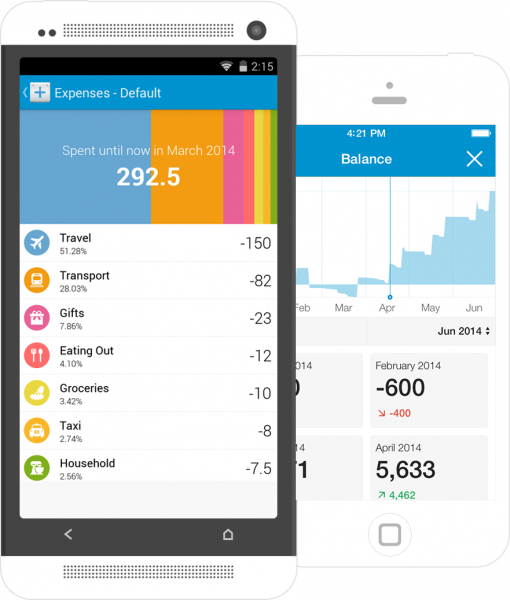

10. Money Lover

Money Lover is a budget app that has ton of functionality but is easy to use. Like most apps, you can log your daily expenses and income according to categories and compiling data into a detailed graph. You can also link your bank accounts.

You can also set budgets and savings plans based on your spending habits and create a budget forecast that you can adjust according to your needs. It has a built-in calculator and gives reminders for scheduled bills and payments.

Price: Free on Android and iOS

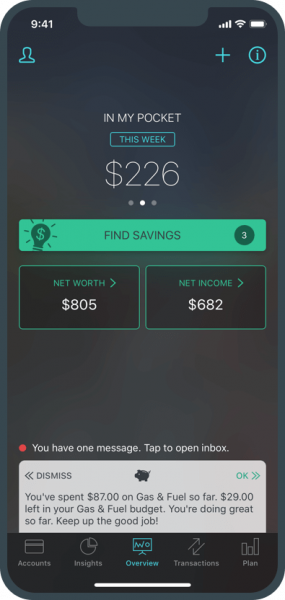

11. PocketGuard

The number one reason why most people use budgeting apps is to check how much money they have left for spending. That’s where PocketGuard comes in. This app crunches numbers to show how much money is available after accounting for bills, spending and savings goal.

All users can view how much money is left in their pocket whether by the day, week or month. You can further track down your spending through different categories. Plus, you can sync all your accounts on the application.

Price: Free on Android and iOS

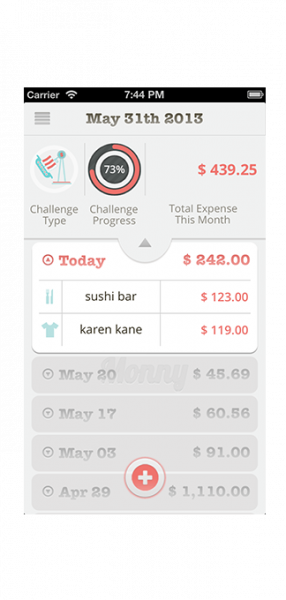

12. Monny

Looking for a cute approach for a serious task? Well, Monny boasts a cute animal-themed graphics that will surely keep your mind off the serious task of budgeting your expenses. You can fully customize the features to match your personality.

But don’t be fooled, it may look cute and colorful but it’s a serious budgeting app that allows for multiple account books and entries for expense logs and collects data and trends and rankings presented in comprehensive charts and reports.

Price: Free on Android and iOS

13. Fortune City

A game and budgeting app in one? Is that even impossible? Yes it is! Thanks to Fortune City. It gamifies bookkeeping with a fun simulation game. Record your expenses and watch as your city flourishes into a beautiful metropolis.

The graphics are fantastically rendered and you can play with your friends as well. Although it looks like all fun games, this app lets you understand your own spending habits through its readily available charts and expense records.

Price: Free on Android and iOS

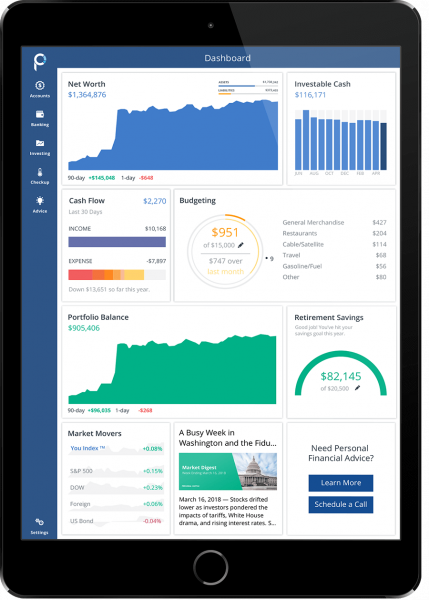

14. Personal Capital

Personal Capital is not just your regular budgeting app. It offers a complete investment advising solution, a hybrid robo-advisor and human advisor service in one. You can track your money for free and it also includes some handy budgeting features.

Although this app put the majority of its emphasis on the investment side, with free, automated analysis of your investment fees and other important details. The cash flow and budgeting tools aren’t quite as extensive as the other apps, but it’s still useful.

Price: Free on Android and iOS

15. Dollarbird

Dollarbird lets you track and forecast your money as easy as adding events to you calendar. It’s easy to use budgeting app without those complicated features. With is simple calendar-based interface, anyone can understand this app.

It has an auto-categorization feature that has a hint of an AI that will help you classify your entries instantly. Automatic balance calculation for each day or month plus a transparent breakdown of your past and planned transaction.

Price: Free on Android and iOS

For other top mobile apps, we’ve got everything you need on Cellular News.