The world of investment can be difficult to navigate, especially for first-timers. All of the ins and outs of the stock market can be overwhelming given its volatility. Even seasoned traders will find it hard to keep up without some sort of information, organization, or management tool. In recent years, money-making apps geared at investors have proven to be useful when it comes to navigating the stock market. However, with increasing investment app popularity comes the rise of the number of options, too. With all of the choices available, how can you know which one to trust? Moreover, how can you sift through the apps that are best for your investment goals? For these reasons, we’ve listed the best investment apps here.

Inside This Article

Best Investment Apps to Get

In this list, we run through the 15 best investment apps for all your financial needs. Each app may cater to the different needs of different people. Whether you’re a beginner or a seasoned investor, there will be an app that’s best for you.

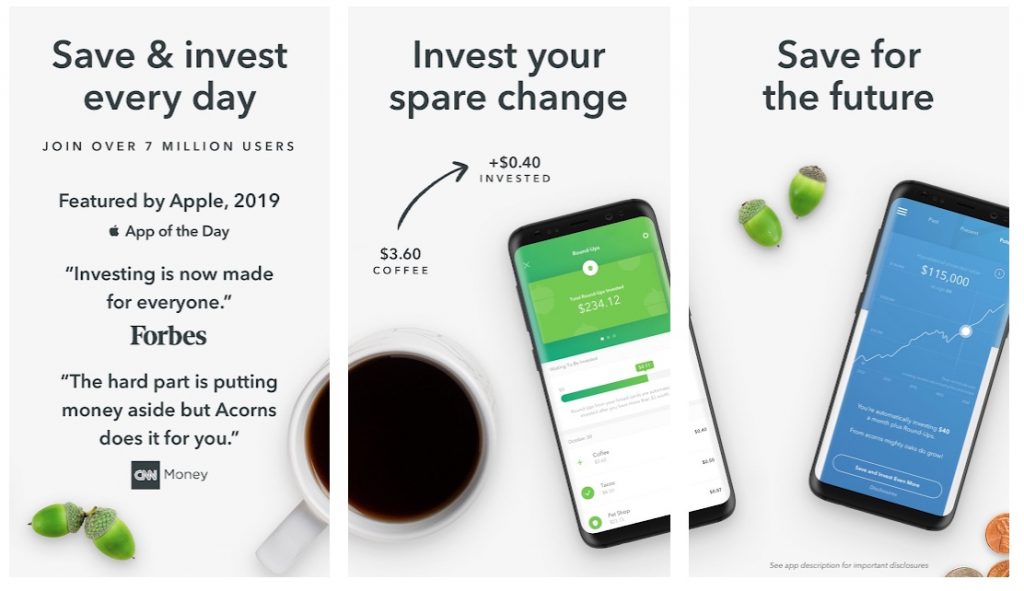

1. Acorns

Besides requiring in-depth knowledge and research, investment entails proper money management and diligence. The problem is that many people find it difficult to be diligent in saving and investing money. So, what’s the solution?

Enter the Acorns app — one of the best investment apps that assist you in automated investment and savings. Once you link your debit or credit card, you can start saving. How? Each purchase your card makes will round up to the next dollar with the spare change invested in a portfolio. Those portfolios are exchange-traded funds or ETFs of BlackRock and Vanguard.

You might be wondering how this helps. Well, if you use your card a lot, your purchases on your card will build up over time. Those tiny savings can snowball gradually to build up your portfolio without you realizing it. The app is great for beginners. Plus, it’s customizable since you have a variety of portfolio choices. You can choose to invest in either conservative portfolios or take a bit of risk and invest in aggressive ones.

Additionally, Acorns also helps you with recurring investment deposits through your account. You can engage in Acorns by opening a personal or family account worth $3 or $5 per month, respectively.

Is Acorns safe to use? Yes, it is. However, the downside is you run the risk of losing your investment over monthly fees.

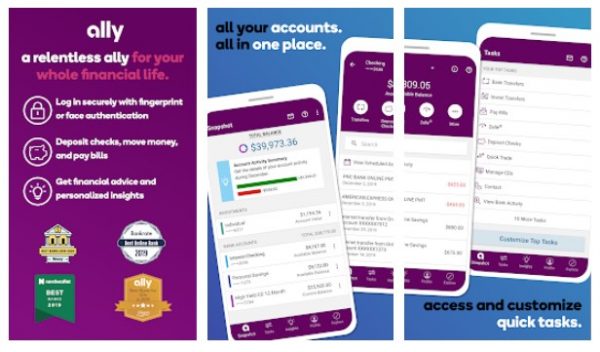

2. Ally Mobile

The best investment apps for beginners are the ones that are efficient and uncomplicated. With all the core functions included, Ally Mobile is a great investment app with low fees.

Ally is more known for its bank accounts that have low fees and high yields. However, it does offer an investment platform. It’s great for investing for beginners since it doesn’t have a required minimum deposit.

With its app, all the basics of investing and trading should be covered with an efficient and user-friendly interface. However, you can also check out their website for a more comprehensive experience.

Ally offers very low brokerage fees and $0 fees for options trades, ETFs, and online stock. However, do note that with every option contract, it will incur a flat fee of 50 cents. If you want to trade with the assistance of brokers, there’s an additional $20 commission fee. When it comes to mutual funds with no load, it’s $9.95 with additional fees depending on your situation.

If you’re going to invest with Ally, take note that it only has an online bank and brokerage. There are no physical locations you can visit for face-to-face assistance.

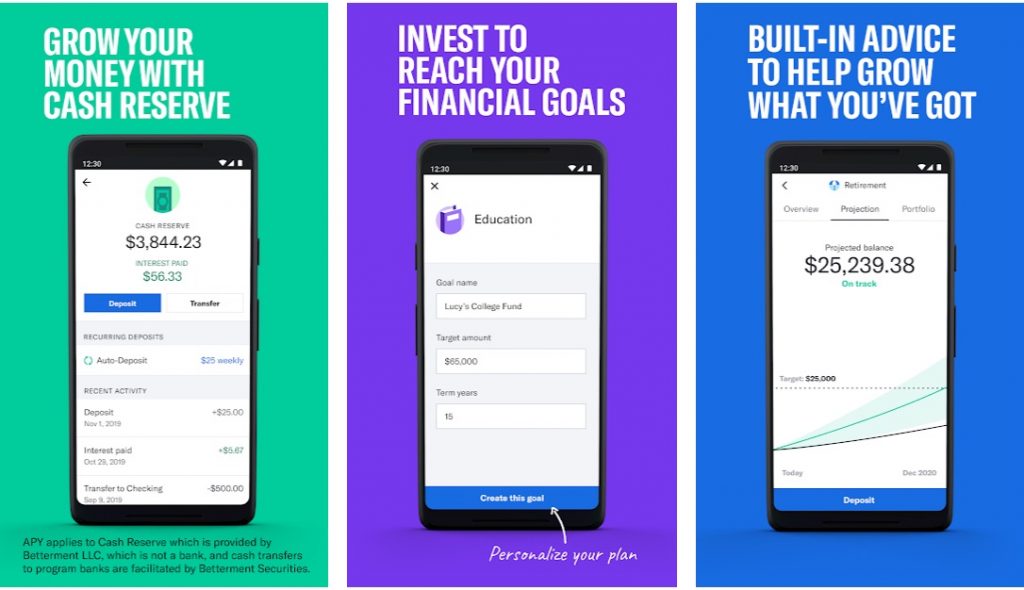

3. Betterment

Taxes can sometimes sneak up on you when you least expect it. This is also true for investment returns. If you’re looking for the best investment apps that save up on taxes, check out Betterment.

More than anything else, Betterment wants to help you save on your taxes. Thus, the app handles tax-loss harvesting on all your accounts with an added asset location strategy. This means that Betterment makes sure to efficiently distribute different investments into both taxable and retirement accounts.

Apart from its tax-efficient system, Betterment has an attractive zero account minimum, which is good for smaller investors. You can invest in a small amount and start slowly. Once you do, you can then choose to invest in either a digital or premium portfolio. Betterment only charges a 0.25% management fee for a digital portfolio. If you opt for a premium portfolio, the fee goes up to 0.40%. However, it does come with many added perks such as advice for external investment accounts from certified financial planners (CFPs). This is done with a professional over the phone and it will be available to you 24/7. The premium portfolio will require your account a minimum of $100,000.

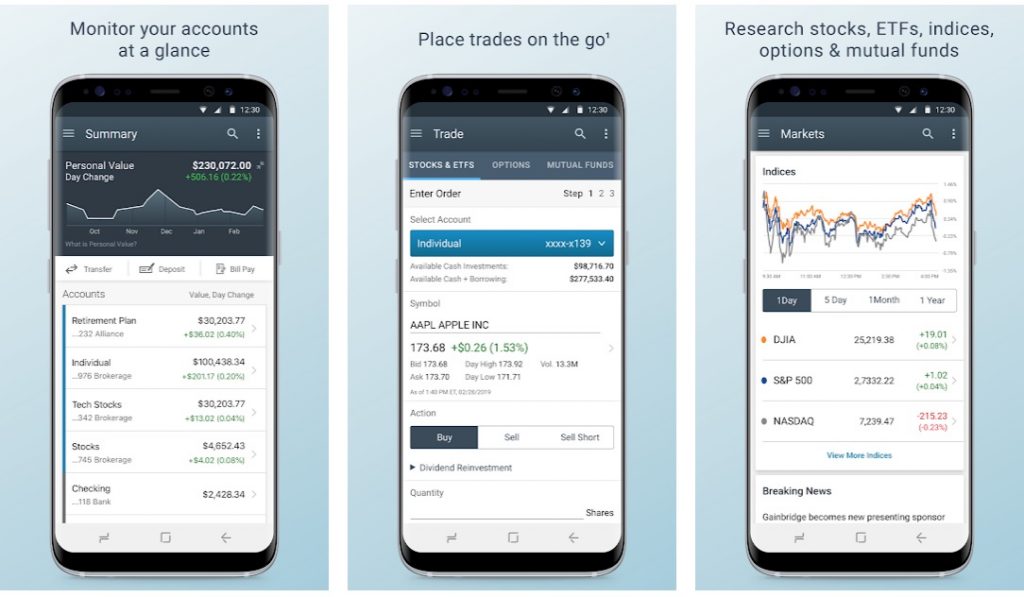

4. Charles Schwab

One of the best investment apps by far is Charles Schwab. It’s a comprehensive app providing low commissions, a wide selection of investments, and extensive research.

Firstly, Schwab shines in its low commissions with options, stocks, and ETFs all offered without commission. Many mutual funds also come with zero-transaction fees. Even contracts and proprietary index funds and ETFs come with competitive pricing and ratios. It’s easy to start since they require no account minimum. Moreover, over 4,000 investment funds require only $100 or less for investment.

Secondly, apart from low rates, Schwab also shines in the area of organization. It sorts the best funds under various categories so you can easily navigate the vast ETF selection. What’s more, you can build a custom portfolio around your financial goals, time horizon, and risk tolerance.

Thirdly, Schwab has extensive research offerings. Research is your best friend if you’re looking for the best stocks to invest in. With Schwab, you can view news and earnings reports from different sources, and Schwab’s equity ratings. They even have in-house investment experts who offer market reports and commentary.

Lastly, Schwab might even be the best stock trading app with a free-for-all, extensive trading platform. With StreetSmart Edge and StreetSmart Central, you can have customizable platforms and options trading programs. There’s also mobile trading available within the app itself.

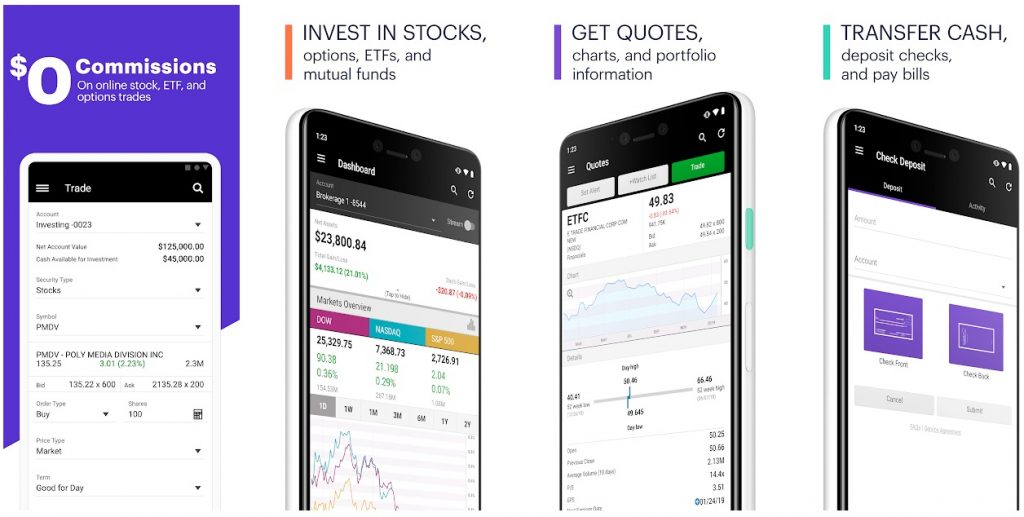

5. E*Trade

Some people don’t like putting all of their eggs in one basket. If you’re one of them, the best investment apps for you might be ones with lots of investment options. E*Trade is the best trading platform with thousands to choose from. You’ll have an option for everything whether it’s stock, mutual funds, bonds, ETFs, futures — you name it. It also comes with the perk of online trading with no commissions in ETFs, mutual funds, or stocks.

Lots of investments mean lots of market reports to keep up with and E*Trade also has that front covered. Within the app, you’ll be able to browse news and market analyses from MarketWatch, Morningstar, and CNBC. If that’s not enough for you, you can even set up customized notifications and alerts. You can collate and organize your watchlists to alert you of anything you need to be updated on. If you want to automate the process, you can do that as well with an E*Trade Core Portfolio. For a minimum balance of $500 with a 0.30% fee, you can have an automated robot-advisor.

6. Fidelity

The Fidelity app is one of the best investment apps if you’re specifically focused on long-term or retirement investments.

It’s often hard to understand investments since not everyone can be educated in that area. However, if you sign up for a Fidelity account, you can access some of the best materials on the subject. More specifically, Fidelity has a firm concentration on retirement education. It even includes calculators for retirement funds and other similar tools.

Fidelity is rare in its other offerings such as fractional share investments and integration with Apple Watch and Google Assistant. It also offers some of its proprietary mutual funds without transaction or recurring fees.

Fidelity is quite competitive in terms of fees. It offers no commission fees on options trades, stock, and ETFs with a 65-cent fee per options contract. For trades with a broker’s help, there’s a $32.95 fee and a $49.95 transaction fee for mutual funds. Most of the accounts won’t require recurring fees. Plus, there’s no minimum deposit needed.

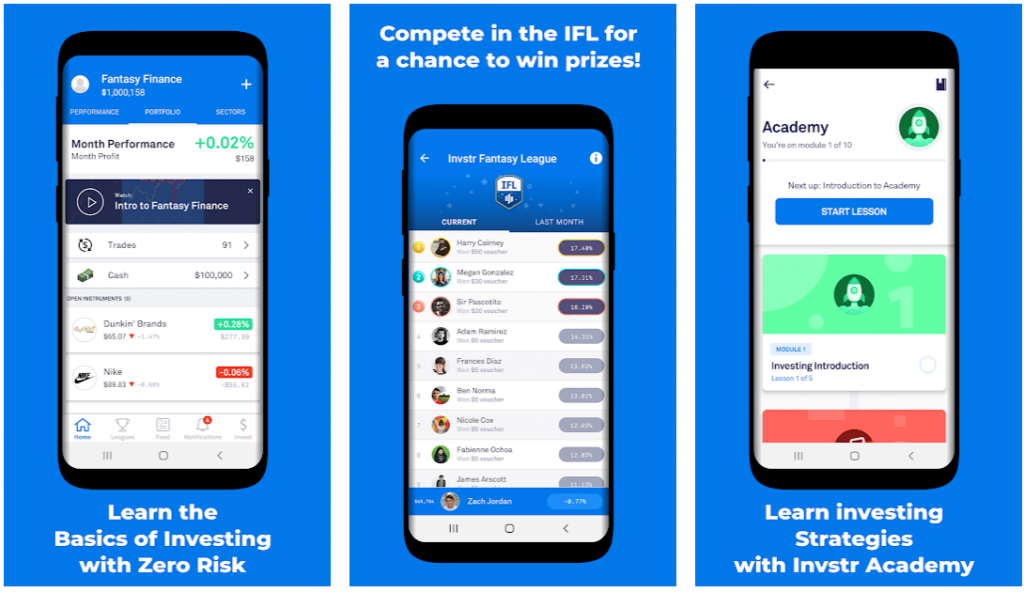

7. Invstr

If you think learning about stocks is boring, think again. With Invstr, you can play a fantasy stock game to help you learn about investment. In the game, you can help manage a fake portfolio of $200 billion. You’ll be able to access the thoughts of the investor regarding investments and stocks.

With $1 million virtual cash, you can find ideas from the game’s social network and feed. The game’s even more riveting as it offers real cash prizes for top performers. Once you’ve learned a lot, turn your fantasies into reality by buying fractional shares. They come at $0.99 per trade. If you want whole shares, you can buy them for $2.99 per trade.

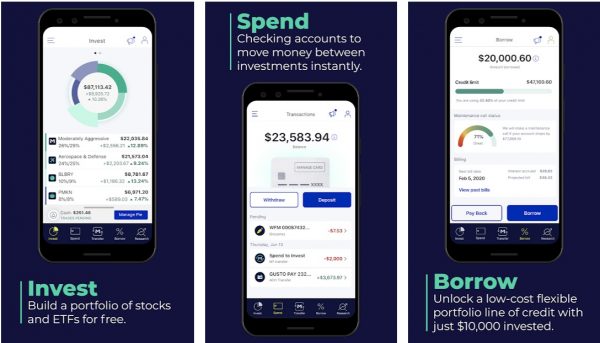

8. M1 Finance

If you want a good balance between choosing your investments and automating the process, check out M1 Finance. It’s one of the best investment apps with flexibility for manual and automated selection. Use a robot-advisor to pick a portfolio or manually choose your stocks, ETFs, or fractional shares. You can even employ both methods for added flexibility.

Two accounts are offered by M1 Finance: an IRA account and a taxable account. Both will come without fees provided that you invest at least $500 or $100, respectively. You can also upgrade your account to M1 Plus for $125 per year. This account gives a lower rate on your line of credit plus more stock options and other perks.

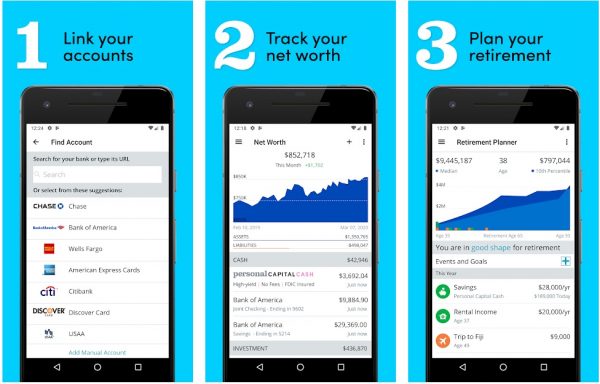

9. Personal Capital

Some people might want a robust and comprehensive investment experience. That means the best investment apps have to give the best advice in both robotic and human forms.

If you can meet Personal Capital’s enormous minimum balance, you’ll get extensive financial planning tools. Those tools will help you keep track of spending, retirement, portfolio reports, net worth, and so much more. They even include Personal Capital Cash, which is like a savings account with a 2.3% rate. Additionally, you even get to have a retirement planner to plan your retirement withdrawals.

The only difficulty is that Personal Capital requires a lot of money for its minimum balance, $100,000 to be specific. If you go over $200,000, you can even have a dedicated financial advisor. The fees are high, though, coming in at 0.89%. The higher balance investors can pay as little as 0.40% depending on their balance.

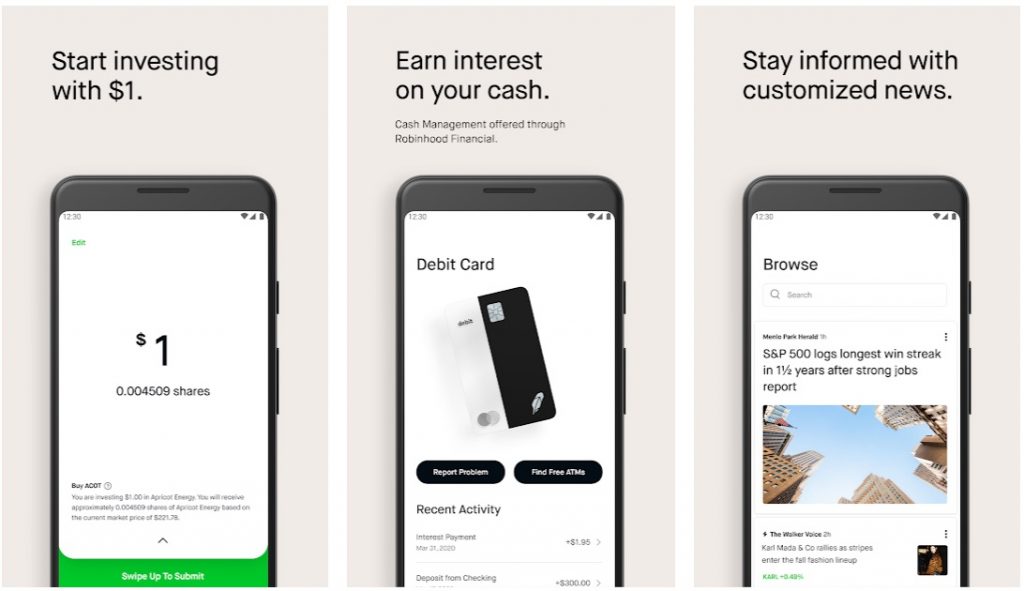

10. Robinhood

Some people value the ease of use above all else; something simple and intuitive without a lot of hassle. For an intuitive, trade commission-free experience, you should check out the Robinhood investment app. It offers stock, ETF, options, and cryptocurrency trades all without a fee.

The app is also very easy to use with an intuitive user interface. You can search for a stock page on the top of the screen, view statistics, and charts all very easily. Like social media, it has a feed with collated news, stories, and more from various sources. You can also start trading right away with instant delivery. This comes when you deposit your first $1,000 of any funds to your account.

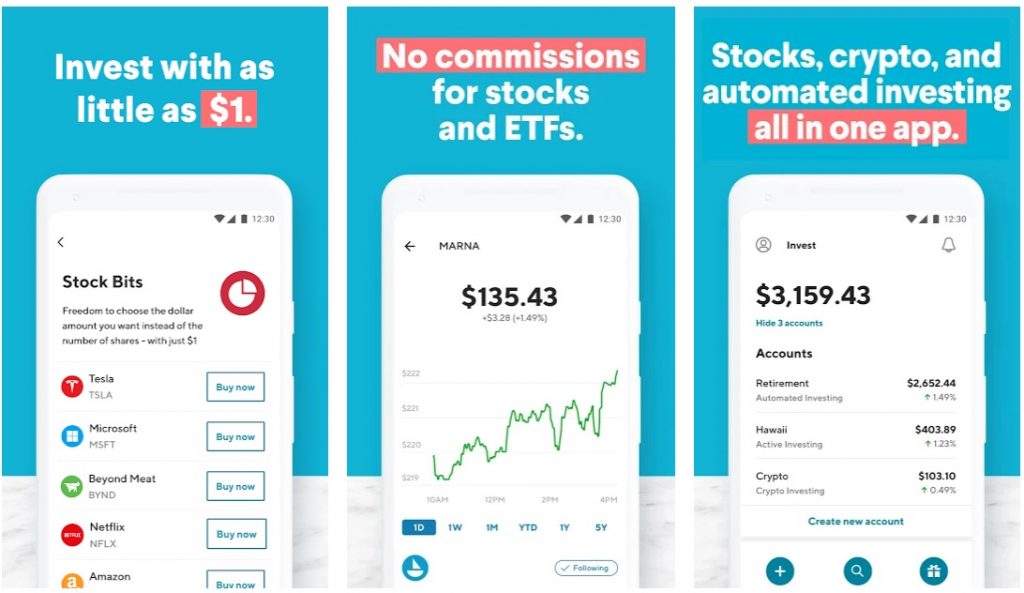

11. SoFi

What started as a lender for student loans grew into a full-blown finance company. SoFi now has lending, banking, and investing all in one app.

SoFi is one of the best investment apps for students or people who want to learn about investment. It’s great for beginners, not only for its educational benefits but also for its small fractional shares. You can start small with small investments with SoFi’s Stock Bits.

SoFi offers a curated list of stocks, ETFs, and cryptocurrencies with stocks and ETFs offered for free. It also has self-directed portfolios without management fees for investment. Additionally, SoFi offers loans and accounts for cash management.

SoFi requires a $1 minimum deposit with no fees for ETF or online stocks. However, there is a 1.25% markup for transactions on cryptocurrencies. Branded ETFs also have varied expense ratios.

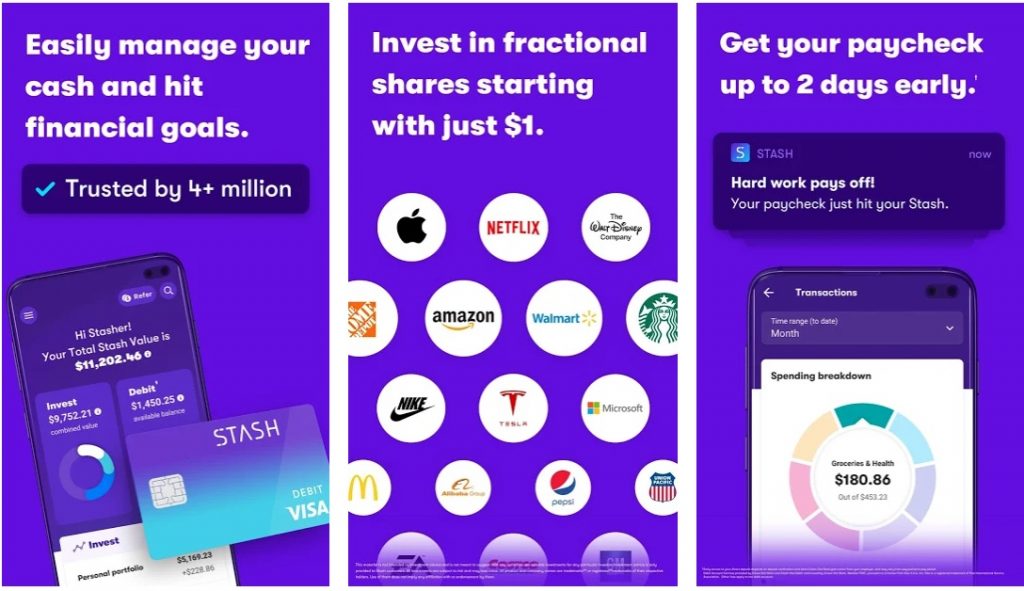

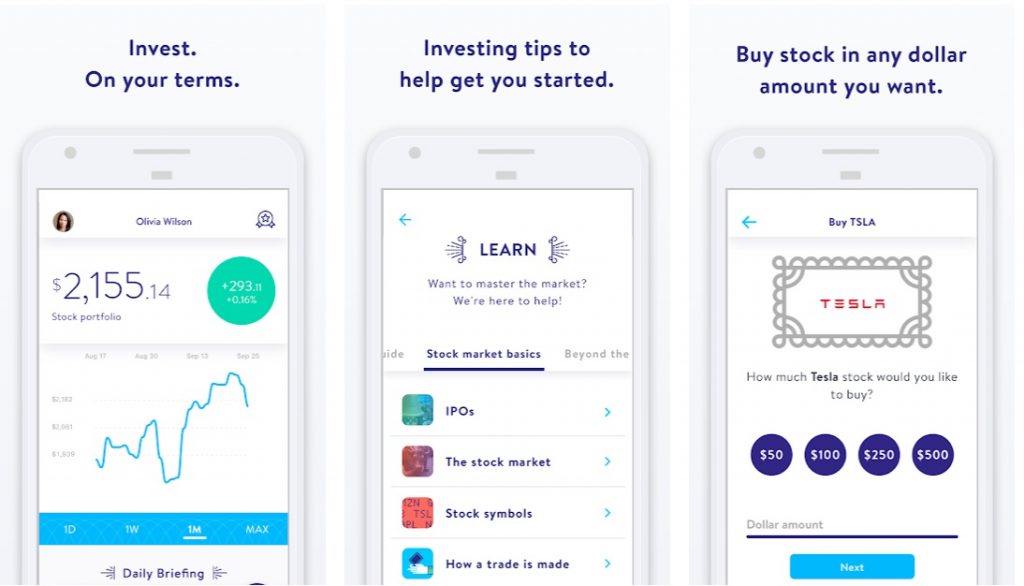

12. Stash

Beginners who want to start their investment journey should look into the Stash app. It’s one of the best investment apps that are easy to use.

Once you download the app, Stash will conduct a profile and ask you some questions. Your goals and risk-aversion will be gauged based on this. Moving forward, you’ll get suggestions for ETFs and stocks that might pique your interest. These, plus other content customized for you, will then go into the education tab. However, these are mere suggestions. Building your actual portfolio will be your task.

Investing with Stash requires only $5. There are hundreds of different stocks the app offers that you can purchase with fractional shares. Stash also offers different account types. These include a taxable account ($1 per month), a taxable + retirement account ($3 per month), or a taxable + retirement + 2 kid account ($9 per month).

13. Stockpile

Stockpile is one of the best investment apps because it offers fractional shares with no monthly fee. It only charges 99 cents per trade.

Stockpile is also unique in that it offers a handy feature in which you can gift stocks. How it works is that you can send a gift card to a friend. This gift card will then be redeemable in the form of stocks. With this, you can teach younger kids how to invest in a cool way. On top of this, sending gift cards doesn’t require a Stockpile account.

Stockpile is great if you want your kids to start young and learn about investing. With a list of stocks that you’ve approved, kids can choose to decide to invest in these stocks. There’s also a feature where kids can share a stocks wishlist with loved ones.

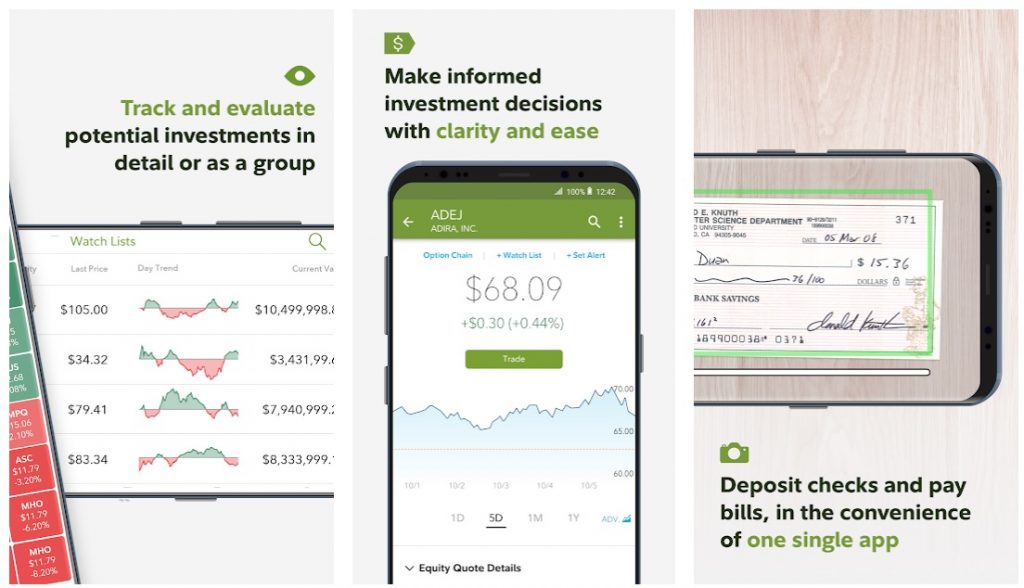

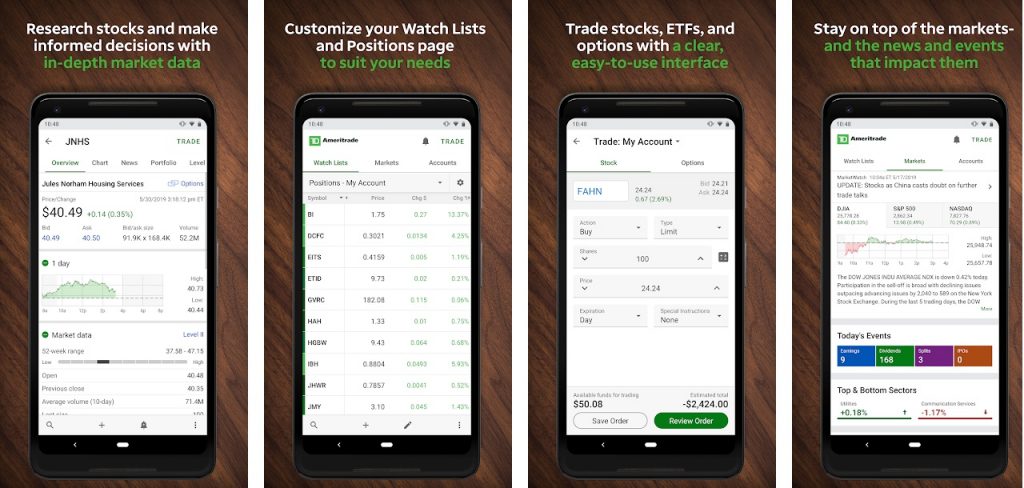

14. TD Ameritrade Mobile

TD Ameritrade Mobile is one of the best investment apps for comprehensive information and research availability.

Apart from being one of the most renowned brokerage firms, TD Ameritrade Mobile excels in providing data. In the app, you’ll find stock market information as well as data on different companies. It even offers investment strategy educational videos.

As an investment app, you can reliably browse your portfolio’s breakdown and check your investments within the app. You can also add notifications for breaking news or when stock prices drop or rise to a designated figure.

If you want additional customization, TD Ameritrade has a separate app called “TD Ameritrade Trading” with its “thinkorswim” platform. More seasoned investors who want to customize their trading will benefit from this app the most.

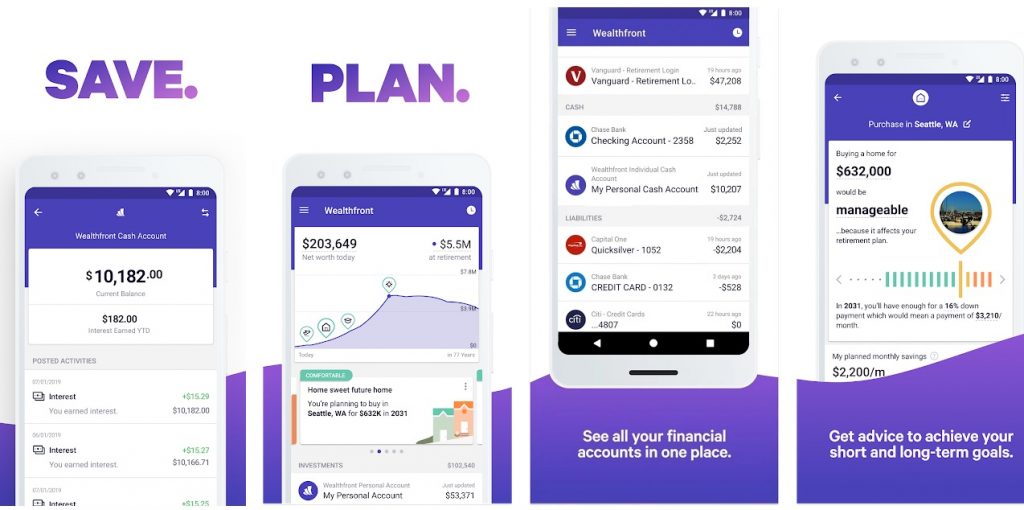

15. Wealthfront

With Wealthfront, a robot-advisor will invest your money in low-cost portfolios. Those can either be ETFs or individual stocks. The portfolios are cataloged from 11 asset classes having ETFs distilled into six to eight per portfolio.

Wealthfront profiles you based on risk-aversion and investment goals. Based on this, the software will select funds and make trades for you. Your portfolio will also automatically rebalance based on the software’s programming. That’s great if you want low-maintenance investments.

You will have fees though — there’s a 0.25% management fee. This fee can only be waived if you refer a friend that funds an account. However, this only lasts for the first $5,000.

The minimum balance to open an account is $500, which seems high in contrast to the other apps. However, it’s a small investment overall.

Conclusion

There are numerous kinds of investment apps out there. From fun, gamified apps to more robust, information-heavy apps, there’s an investment app for every kind of investor. The app you choose will depend on your needs and goals. If you want something low-maintenance, robot-advisors are very handy. However, some might want a more human touch. In that case, human-assisted apps and accounts are the best way to go. Whatever your situation, investment apps are handy for both seasoned and beginner investors alike.

Also need solutions for safe and reliable online financial transactions? See our roundup of the best money transfer apps, too!