As the world becomes increasingly digital, the need for convenient and secure payment solutions has never been more crucial. With the widespread adoption of smartphones, mobile payment systems have emerged as a game-changer in the realm of financial transactions. Whether it’s paying for groceries, booking movie tickets, or splitting the bill with friends, mobile payment systems offer a seamless and hassle-free way to make transactions on the go.

In this article, we will explore the ins and outs of building a mobile payment system. From understanding the technologies involved to ensuring security and user-friendliness, we will delve into the key considerations and steps required to create a robust and successful mobile payment platform. So, whether you’re an entrepreneur looking to revolutionize the payment landscape or a curious individual wanting to learn more about mobile payments, let’s dive in and explore the exciting world of mobile payment systems.

Inside This Article

- Overview

- Building Blocks of a Mobile Payment System

- Design Considerations

- Implementation Steps

- Conclusion

- FAQs

Overview

A mobile payment system is a digital platform that allows users to make transactions using their mobile devices. With the rise of smartphones and the increasing popularity of mobile banking and e-commerce, mobile payment systems have become an integral part of our daily lives.

Mobile payment systems provide a convenient and secure way for users to pay for goods and services without the need for cash or physical credit cards. They enable transactions to be completed quickly and effortlessly, making them ideal for both online and in-person purchases.

There are various types of mobile payment systems available today. Some rely on near-field communication (NFC) technology, enabling users to make contactless payments by simply tapping their mobile device on a payment terminal. Others utilize mobile wallet apps, where users can store their payment information and make payments securely through the app.

One of the key advantages of mobile payment systems is their accessibility. With the widespread adoption of smartphones, mobile payment solutions have reached a vast user base, allowing individuals from all walks of life to make transactions conveniently.

Furthermore, mobile payment systems are designed with security in mind. They incorporate multiple layers of encryption and authentication to safeguard users’ sensitive financial information. Additionally, many mobile payment systems offer additional security features, such as fingerprint or face recognition, further ensuring the protection of user data.

In recent years, mobile payment systems have experienced significant growth and are expected to continue to evolve and expand. As technology advances and consumer adoption increases, mobile payments are likely to become even more commonplace and seamlessly integrated into our daily routines.

Building Blocks of a Mobile Payment System

A mobile payment system is a complex infrastructure that enables users to make financial transactions using their mobile devices. It involves several key components, or building blocks, working together to ensure seamless and secure payment processing. These building blocks include:

1. Mobile Wallet: The mobile wallet serves as a virtual container to store a user’s payment credentials, such as credit card information, bank account details, or digital currencies. It allows users to make payments conveniently and securely by securely encrypting and storing their financial data on their mobile devices.

2. Payment Gateway: The payment gateway acts as a bridge between the mobile payment application and the payment network or acquiring bank. It securely routes the payment information from the mobile device to the relevant financial institution for authorization and settlement.

3. Secure Authentication: To ensure the security of mobile payments, strong authentication measures are necessary. This can include biometric authentication such as fingerprints or facial recognition, as well as two-factor authentication using SMS verification codes or token-based systems.

4. Near Field Communication (NFC) Technology: NFC technology allows the wireless transmission of payment information over short distances. It enables mobile devices to communicate with contactless payment terminals, facilitating quick and convenient tap-and-go payments.

5. Mobile Network Operators (MNOs): MNOs play a crucial role in enabling mobile payments by providing the infrastructure and connectivity required for secure transactions. They ensure the availability and reliability of network services, allowing users to access mobile payment systems anywhere, anytime.

6. Point of Sale (POS) Systems: POS systems are the hardware and software solutions used by merchants to accept mobile payments. They include card readers or NFC terminals that can process payments from mobile wallets, ensuring a smooth transaction experience for both the customers and the merchants.

7. Payment Networks: Payment networks, such as Visa, Mastercard, or PayPal, facilitate the transfer of funds between the cardholder’s account and the merchant’s account. They ensure the secure and efficient transmission of payment information, providing the backbone for mobile payment transactions.

8. Security Standards and Protocols: Mobile payment systems must adhere to strict security standards and protocols to protect users’ sensitive financial data. These include encryption, tokenization, and secure coding practices to safeguard against unauthorized access and fraud.

By utilizing these building blocks, a robust and efficient mobile payment system can be created. Each component plays a crucial role in ensuring the smooth, secure, and convenient processing of mobile payments, offering users a seamless transaction experience and peace of mind.

Design Considerations

When designing a mobile payment system, there are several key considerations that must be taken into account to ensure a seamless and secure user experience. Let’s explore some of the most important design considerations for building a mobile payment system.

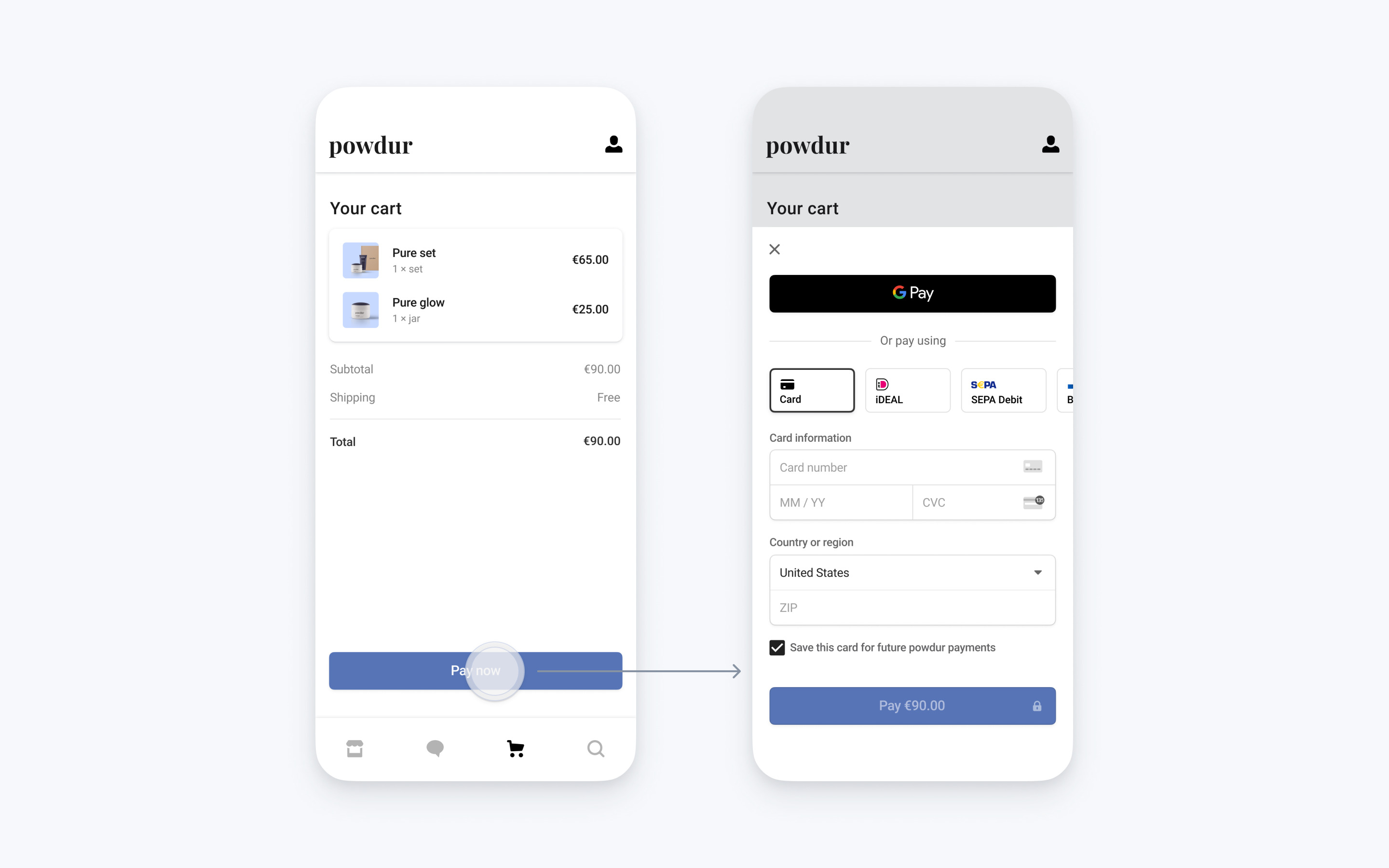

User Interface: The user interface (UI) of the mobile payment system should be intuitive and user-friendly. It should provide a clear and easy-to-understand flow for users to make payments, check transaction history, and manage their accounts. The UI design should be responsive and adaptable to different screen sizes and orientations, ensuring a consistent experience across various mobile devices.

Security: Security is of utmost importance in a mobile payment system. The design should incorporate robust security measures to protect sensitive user data, such as encryption, tokenization, and two-factor authentication. It should also have mechanisms in place to detect and prevent fraud, including real-time transaction monitoring and notification alerts for suspicious activities.

Compatibility: The mobile payment system should be compatible with a wide range of mobile devices and operating systems. It should support both Android and iOS platforms, ensuring that the majority of smartphone users can access and utilize the system. Compatibility with different payment gateways and financial institutions is also crucial to enable seamless integration and transactions.

Speed and Reliability: A mobile payment system must be fast and reliable to provide a smooth user experience. It should have the capability to process transactions quickly, without any significant delays or downtime. The system should also have efficient error handling and recovery mechanisms, ensuring that any technical issues or disruptions are promptly addressed and resolved.

Localization: Considering the global nature of mobile payments, it is essential to design the system to accommodate multiple languages, currencies, and legal requirements. The payment system should support localization features, allowing users to select their preferred language and currency. Additionally, it should comply with relevant regulatory guidelines and standards in different geographical regions.

Integration and Scalability: The design of a mobile payment system should allow for easy integration with third-party services and APIs. It should provide flexibility for merchants to integrate loyalty programs, coupon codes, and other value-added features to enhance the user experience. Furthermore, the system should be scalable to accommodate a growing user base and handle increased transaction volumes without compromising performance.

Usability Testing: Conducting usability testing is essential to ensure that the mobile payment system meets the needs and expectations of its users. Usability testing can help identify any usability issues, navigation complexities, or design flaws and provide valuable insights for further optimization and enhancements.

By considering these design considerations, you can create a mobile payment system that offers a secure, user-friendly, and seamless payment experience for your customers.

Implementation Steps

Implementing a mobile payment system may seem like a daunting task, but with careful planning and execution, it can be a smooth and successful process. Here are the key steps to consider when building a mobile payment system:

-

Define your objectives: Start by clearly defining your objectives for implementing a mobile payment system. Is it to increase convenience for customers, streamline your payment process, or improve security? Understanding your goals will guide your decision-making process throughout the implementation.

-

Choose a reliable payment gateway: The payment gateway is the backbone of your mobile payment system. Choose a reputable and secure provider that offers the features and functionality you need. Consider factors such as transaction fees, supported payment methods, integration options, and customer support.

-

Integrate the payment gateway: Once you have selected a payment gateway, integrate it with your existing systems. This may involve working with your development team or partnering with a payment solution provider. Ensure that the integration is seamless and user-friendly for both customers and your staff.

-

Implement robust security measures: Security should be a top priority when building a mobile payment system. Implement industry-standard encryption protocols, tokenization, multi-factor authentication, and other security measures to protect sensitive customer data. Regularly update your systems to address any vulnerabilities and stay ahead of emerging threats.

-

Create a user-friendly mobile app or website: Your mobile payment system should offer a seamless and intuitive user experience. Design and develop a mobile app or website that is easy to navigate, responsive, and optimized for mobile devices. Include features such as account creation, payment history, and support options to enhance the user experience.

-

Test thoroughly: Before launching your mobile payment system, conduct thorough testing to identify and resolve any bugs or usability issues. Test all payment scenarios, including different payment methods, error handling, and refund processes. Engage real users in the testing process to gather valuable feedback and ensure a smooth customer experience.

-

Implement effective customer support: A robust customer support system is essential for any mobile payment system. Provide multiple channels for customers to reach out for assistance, such as email, live chat, and phone support. Ensure that your support team is well-trained and equipped to handle inquiries and resolve issues promptly and efficiently.

-

Launch and promote your mobile payment system: Once you are confident in the functionality and security of your mobile payment system, it’s time to launch it to the public. Develop a comprehensive marketing strategy to promote your mobile payment system to your target audience. Utilize social media, email marketing, and other channels to create awareness and encourage adoption.

-

Monitor and optimize: After the launch, closely monitor the performance of your mobile payment system. Track key metrics such as transaction volume, conversion rates, and customer feedback. Use this data to identify any areas for improvement and optimize your system for better performance, security, and user experience.

By following these implementation steps, you can build a robust and user-friendly mobile payment system that enhances convenience and security for your customers while streamlining your payment processes.

Conclusion

In conclusion, building a mobile payment system requires careful planning, expertise, and attention to detail. With the increasing popularity and convenience of mobile payments, businesses must adapt to stay competitive in the modern market. By implementing a robust and secure mobile payment system, companies can streamline transactions, enhance customer satisfaction, and improve overall efficiency.

When building a mobile payment system, it is important to consider factors such as user experience, security measures, compatibility with existing systems, and scalability. Collaborating with experienced developers, software providers, and payment processors can help ensure a successful implementation.

As technology continues to advance, mobile payments will become more prevalent, and the demand for innovative and secure systems will grow. By staying informed about the latest trends and best practices in mobile payment system development, businesses can stay ahead of the curve and provide customers with a seamless and convenient payment experience.

Don’t miss out on the opportunity to leverage the power of mobile payments. Start building your mobile payment system today and unlock new possibilities for your business.

FAQs

1. What is a mobile payment system?

A mobile payment system is a technology that enables users to make transactions using their mobile devices, such as smartphones or tablets. It allows for seamless and convenient payments by leveraging various technologies like Near Field Communication (NFC), QR codes, or mobile wallets.

2. How does a mobile payment system work?

When using a mobile payment system, users can link their payment method, such as a credit card or bank account, to their mobile device. When making a payment, the system securely transmits the payment information to the merchant’s point of sale (POS) device or online payment gateway. This process ensures that the transaction is authorized and completed securely and efficiently.

3. What are the benefits of using a mobile payment system?

Using a mobile payment system offers numerous benefits for users. It provides convenience by eliminating the need to carry physical cash or credit cards. Mobile payments are quick and easy, allowing for faster transactions at checkout. Additionally, mobile payment systems often offer rewards programs and discounts, making it a cost-effective choice for users.

4. Is a mobile payment system secure?

Mobile payment systems prioritize security to protect user’s payment information. They use encryption and tokenization to secure the transaction data and protect it from unauthorized access. Many mobile payment systems also require the use of biometric authentication, such as fingerprint or facial recognition, to add an extra layer of security. However, users should also practice basic security measures, like using a strong PIN or password and keeping their mobile devices updated.

5. Which mobile payment systems are widely used?

There are several popular mobile payment systems available today. Some of the widely used ones include Apple Pay, Google Pay, Samsung Pay, and PayPal. These platforms are accepted at a growing number of retailers and online merchants, providing users with widespread accessibility and acceptance.