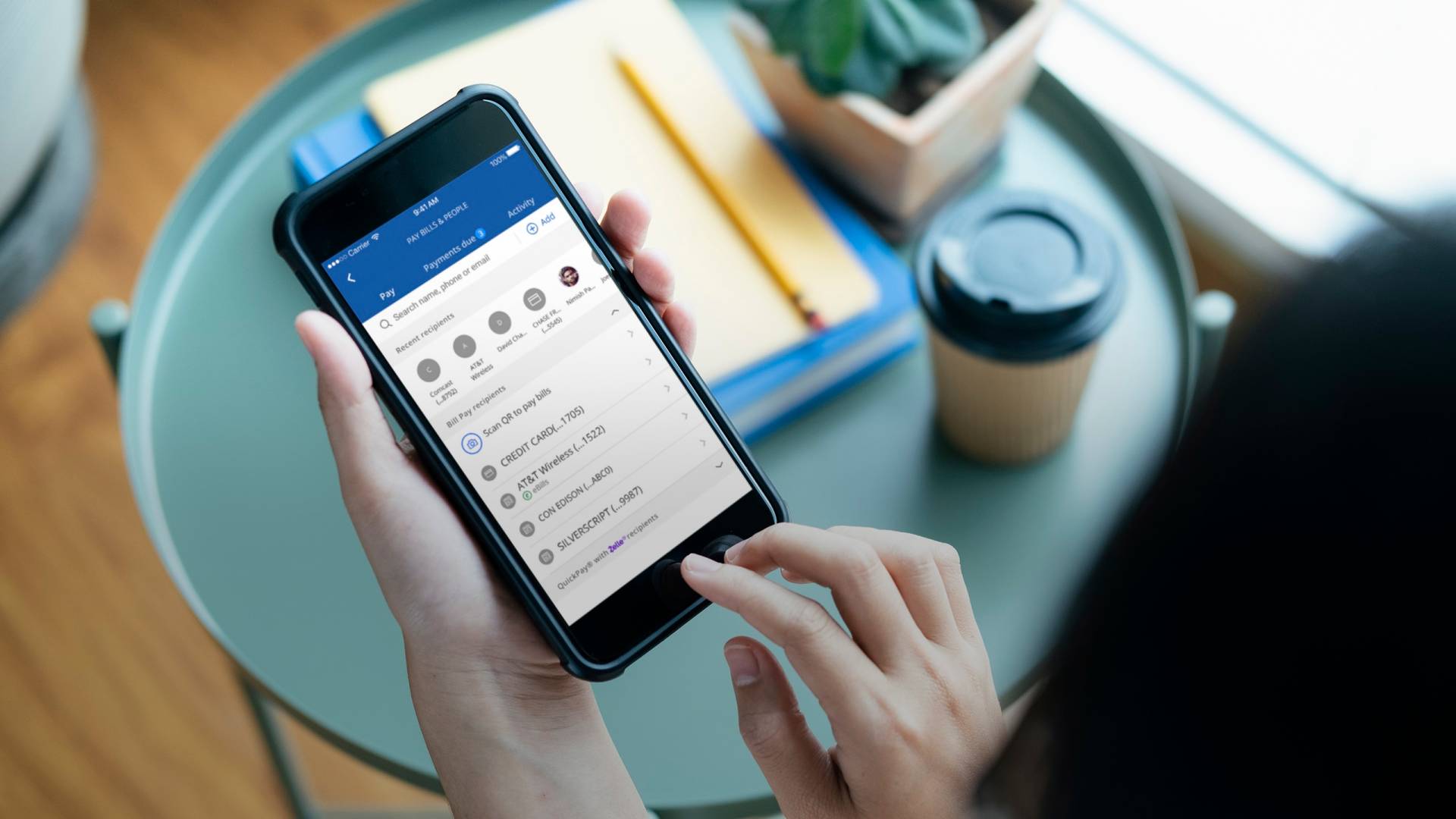

Are you wondering how to use your phone at a Chase ATM? With the advancement of technology, many banking tasks can now be done conveniently from the palm of your hand. Chase Bank, one of the leading financial institutions, has embraced mobile technology to provide its customers with a seamless banking experience. By utilizing your smartphone, you can perform a variety of transactions, such as withdrawing cash, depositing checks, transferring funds, and more, at a Chase ATM. In this article, we will guide you through the process of using your phone at a Chase ATM, ensuring that you can take full advantage of the mobile banking features available to you.

Inside This Article

- Point 1: Accessing your phone at a Chase ATM

- Point 2: Using Mobile Banking Apps at a Chase ATM

- Point 3: Conducting transactions with your phone at a Chase ATM

- Point 4: Ensuring Security When Using Your Phone at a Chase ATM

- Conclusion

- FAQs

Point 1: Accessing your phone at a Chase ATM

Modern technology has revolutionized the way we conduct banking transactions. With the advent of mobile phones, it is now possible to access and manage your bank account right from your fingertips. Chase Bank recognizes the convenience and ease that mobile phones bring to banking, and has incorporated features that allow customers to access their phones at Chase ATMs. Here’s how you can make the most of this convenient feature.

Firstly, ensure that you have a compatible mobile phone with internet access. Generally, Chase Bank supports both iOS and Android devices. In order to access your phone at a Chase ATM, you should have the mobile banking app installed on your device. If you haven’t already done so, head over to the App Store or Google Play Store and download the Chase Mobile app.

Once you have downloaded the app, sign in with your Chase Online Banking username and password. If you don’t have online banking credentials, you can easily register for an account within the app. Follow the prompts and provide the necessary information to set up your account.

Next, make sure that your mobile phone is connected to the internet and has a stable data connection. This is crucial for seamless access to your phone at a Chase ATM. Some ATMs may also require NFC (Near Field Communication) capabilities in order to complete certain transactions with your phone. Check with your specific Chase ATM to ensure compatibility.

When you arrive at a Chase ATM, look for the mobile phone icon on the screen. This indicates that you can use your phone for banking transactions at that particular ATM. Simply select the mobile phone option and follow the on-screen instructions.

It’s important to note that accessing your phone at a Chase ATM may have certain limitations. While basic transactions such as balance inquiries and fund transfers can typically be done with your phone, more complex transactions like cash withdrawals may still require the use of a physical card.

Using your phone at a Chase ATM provides a convenient and efficient way to manage your banking needs. Whether it’s checking your account balance or transferring funds, the mobile phone feature at Chase ATMs offers flexibility and ease. So, take advantage of this innovative technology and enjoy the convenience it brings to your banking experience.

Point 2: Using Mobile Banking Apps at a Chase ATM

Chase offers a user-friendly mobile banking app that allows customers to conveniently manage their finances on the go. With the rise of smartphone usage, the integration of mobile banking apps with Chase ATMs has become seamless, offering a more streamlined banking experience. In this section, we will explore the benefits and functionalities of using mobile banking apps at a Chase ATM.

1. Downloading the app: To get started, download the Chase mobile banking app from your phone’s app store. It is available for both iOS and Android devices. Once installed, log in using your Chase online banking credentials or create a new account if you’re a new customer.

2. Locating the nearest Chase ATM: The app not only allows you to manage your accounts, transfer funds, and pay bills, but it also helps you find the nearest Chase ATM. The app uses your phone’s GPS to provide accurate directions to the closest ATM, making it easier than ever to access your funds.

3. Depositing checks: Gone are the days of waiting in line at the bank to deposit checks. With the Chase mobile app, you can simply take a photo of the front and back of the check and deposit it electronically. This convenient feature saves time and ensures that your funds are available in your account sooner.

4. Withdrawing cash: Using the mobile banking app at a Chase ATM, you can easily withdraw cash without needing your physical debit card. Simply open the app and select the option to withdraw cash. The app will generate a unique code that you can enter at the ATM to complete the transaction securely.

5. Making transfers: Transferring funds between your Chase accounts or to other Chase customers is a breeze with the mobile banking app. You can authorize transfers and schedule recurring transfers right from your phone. This feature comes in handy when you need to move money quickly or manage your finances on the go.

6. Managing notifications: The Chase mobile app allows you to customize your notification preferences, keeping you informed about important account activities. You can receive alerts for account balances, transactions, and payment due dates, ensuring that you stay on top of your finances.

Using the Chase mobile banking app at a Chase ATM provides a convenient and secure way to manage your finances. It eliminates the need for physical cards and allows you to perform various banking tasks right from your phone. Make sure to explore the app’s features and take advantage of the seamless integration with Chase ATMs.

Point 3: Conducting transactions with your phone at a Chase ATM

With the ever-evolving advancements in technology, conducting transactions with your phone at a Chase ATM has become easier and more convenient than ever before. Gone are the days of carrying cash or fishing for your debit card, as you can now simply use your mobile phone to complete various banking tasks. Let’s explore how you can leverage your phone to perform transactions at a Chase ATM.

1. Mobile Wallets: Many smartphones today are equipped with mobile wallet applications such as Apple Pay, Google Pay, or Samsung Pay. These mobile wallet apps allow you to link your debit or credit card to your phone and securely store your payment information. When at a Chase ATM, you can simply hold your phone near the contactless payment symbol and authenticate the transaction using your phone’s biometric features or passcode.

2. QR Code Payments: Chase also offers the option to make payments at their ATMs using QR codes. To utilize this feature, you’ll need to open the Chase mobile banking app on your phone and select the “Scan & Pay” option. Align your phone’s camera with the QR code displayed on the ATM screen, confirm the transaction details, and authorize the payment. It’s a quick and hassle-free way to complete transactions without any physical interaction.

3. Cardless ATM Access: Utilizing Chase’s Cardless ATM Access feature, you can initiate ATM withdrawals or deposits using your phone. Open the Chase mobile app, select the account and the specific transaction you’d like to perform, and generate a unique access code. Once at the ATM, enter the access code, your PIN, and complete the transaction as prompted. This enables you to securely access your funds without requiring your physical debit card.

4. Pre-Staging Transactions: If you’re in a rush and wish to expedite your ATM transaction, you can pre-stage it using the Chase mobile app. This feature allows you to select and customize your desired transaction on your phone before arriving at the ATM. Once at the ATM, simply swipe your card or tap the “Cardless” option and complete the transaction instantly, saving you valuable time.

5. Receipt Digitization: Instead of receiving a paper receipt for your ATM transactions, you can opt for digital receipts. With the Chase mobile app, you have the choice to receive an e-receipt directly on your phone. This eliminates paper waste, reduces clutter, and allows for easy organization of your transaction records within the app.

By leveraging the power of your mobile phone at a Chase ATM, you can save time, enjoy added convenience, and enhance your overall banking experience. Whether it’s using mobile wallets, QR codes, cardless ATM access, pre-staging transactions, or receiving digital receipts, Chase offers a variety of options to ensure seamless and secure transactions using your phone.

Point 4: Ensuring Security When Using Your Phone at a Chase ATM

When using your phone at a Chase ATM, it is crucial to prioritize security to protect your personal and financial information. Here are some key measures you can take to ensure a safe and secure experience:

1. Keep Your Phone Secure: Always keep your phone password-protected and enable biometric authentication where available. This adds an extra layer of security and prevents unauthorized access to your device.

2. Update Your Phone’s Operating System: Regularly update your phone’s operating system and apps to ensure you have the latest security patches. These updates often include crucial security fixes that help protect against potential vulnerabilities.

3. Be Wary of Public Wi-Fi Networks: Avoid connecting to public Wi-Fi networks when using your phone at a Chase ATM. Public Wi-Fi networks can be insecure and make your device vulnerable to hacking attempts. Instead, use your cellular data or a trusted personal hotspot.

4. Be Mindful of Your Surroundings: When using your phone at a Chase ATM, be aware of your surroundings and avoid displaying sensitive information. Shield your phone screen and keypad from prying eyes, especially when entering your PIN or other sensitive data.

5. Install and Use Security Software: Consider installing a reliable anti-malware and security software on your phone. These applications can help protect your device from potential threats, such as malware or phishing attempts.

6. Enable Two-Factor Authentication: Take advantage of two-factor authentication offered by your mobile banking app. This adds an additional layer of security by requiring a second form of verification, such as a unique verification code or biometric authentication, before granting access to your account.

7. Check for Skimming Devices: Before inserting your card or using your phone at a Chase ATM, visually inspect the card slot and the surrounding area for any unusual or suspicious devices. Skimming devices can be installed by criminals to steal your card information, so remain vigilant at all times.

8. Protect Your Passwords and PIN: Never share your banking app passwords or your ATM PIN with anyone. Choose strong and unique passwords for your mobile banking apps, and change them periodically to minimize the risk of unauthorized access.

9. Review Your Account Activity: Regularly monitor your account activity through your mobile banking app to spot any unusual transactions. If you notice any unauthorized activity, contact your bank immediately to report it.

10. Trust Your Instincts: If something feels off or suspicious at a Chase ATM, trust your instincts and abort the transaction. It’s better to prioritize your safety and report any suspected fraudulent activity to the bank.

By following these security measures, you can use your phone at a Chase ATM with confidence, knowing that you are taking the necessary steps to safeguard your information and finances.

Conclusion

Using your phone at a Chase ATM can offer you convenience and a range of banking capabilities. Whether you need to withdraw cash, deposit checks, or check your account balance, the Chase mobile app and related features can make these tasks quick and easy. By following the steps outlined in this article, you can confidently utilize your phone at a Chase ATM and take full advantage of the digital banking options available to you.

Remember, staying informed about the latest updates on Chase’s mobile app and security measures is crucial to ensure a safe and secure banking experience. Always be cautious when entering personal information, and if you face any issues or have concerns, don’t hesitate to reach out to Chase’s customer support for assistance.

So next time you find yourself at a Chase ATM, whip out your phone and tap into the power of mobile banking. It’s time to redefine the way you handle your finances and embrace the convenience and efficiency that comes with using your phone at a Chase ATM!

FAQs

1. Can I use my cellphone at a Chase ATM?

Yes, you can use your cellphone at a Chase ATM. Chase ATMs are equipped with the latest technology to provide convenient banking services for customers, including the ability to use mobile phones for certain transactions.

2. What transactions can I do with my cellphone at a Chase ATM?

You can perform a variety of transactions using your cellphone at a Chase ATM. This includes withdrawing cash, checking your account balance, transferring funds between accounts, and even depositing checks. The mobile banking feature allows you to access your accounts and complete these transactions conveniently and securely.

3. Do I need a specific app to use my cellphone at a Chase ATM?

Yes, in order to use your cellphone at a Chase ATM, you need to have the Chase Mobile app installed on your device. The app is available for both iOS and Android devices, and it provides a seamless and user-friendly interface for accessing your accounts and performing transactions at Chase ATMs.

4. Is it safe to use my cellphone at a Chase ATM?

Chase prioritizes the safety and security of its customers’ transactions. The use of cellphones at Chase ATMs is protected by advanced security measures, including encryption and authentication protocols. Additionally, the Chase Mobile app requires users to enter their unique credentials, such as a username and password or biometric authentication, to ensure secure access to their accounts.

5. What do I do if I encounter any issues while using my cellphone at a Chase ATM?

If you encounter any issues while using your cellphone at a Chase ATM, such as a transaction error or technical difficulties, you can reach out to Chase customer support for assistance. They have dedicated customer service channels, including phone support and online chat, to help resolve any concerns or problems you may have encountered during your transaction.