It is truly heartbreaking when your phone suddenly breaks down. Even with the utmost care you give to your dearest phone, falls and sudden water splashes can get your phone into a mere paperweight. But there is a way of how to replace your damaged phone without touching your life savings or emergency funds. Cell phone insurance is there to save your day. This kind of insurance can help you replace your broken phone regardless of the circumstances.

Today, we shall discuss how does cell phone insurance work and should you get one for your phone.

How Does a Cell Phone Insurance Work?

These days, everything can be insured, our phones included. You have the option to avail of cell phone insurance once you buy a brand new phone or get one up to four weeks after your purchase. Otherwise, you will need to depend on your phone’s warranty if you decided not to buy an insurance policy. A cell phone insurance can either be paid upfront or paid monthly depending on the policy. Once you have paid all the fees and read and signed your contract, your phone is assured of protection.

Claiming your phone insurance works just like your usual insurance. You need to report the incidence of loss, theft, or damage to your insurance company before getting your claim. For damaged phones, you may need to send your phones to the insurance company to verify the damages. They will also assess if the phone can still be fixed or not. Some insurance policies offer phone replacement when the phone is deemed unrepairable, lost, or stolen. The replacement can either be the same phone model as your damaged phone or another model with an equivalent price.

You’ll usually get a refurbished unit as a replacement for your phone. With this in mind, expect the replacement to be in a less mint condition. Do not worry though, for these refurbished phones can still run perfectly.

Why Do You Need a Cell Phone Insurance?

There are many reasons why you should get phone insurance. When everything goes to red, here are some of the compelling reasons why subscribing to phone insurance is a smart idea:

Reduced Repair Prices

Troubleshooting a phone immersed in water can be troublesome for most of us. You can rest your phone in a rice bin for days, or let the experts repair your phone immediately. This can cost you hundreds of dollars, but not with a phone insurance plan. You’ll only get to pay some deductibles, which does not cost much when you need to repair your phone. That shouts convenience for you.

Reduced Risks of Third-Party Repairs

When your phone gets a cracked screen, you may send it to a third-party repair shop. They tend to offer repairs for your phone for a lower price. Sadly, third-party repairers tend to install cheap components on your phone, thus adding to the risk of your phone being repaired again. Getting an insurance policy for your phone can help you steer away from third-party repairs. Insurance companies will lead you to repair centers authorized by manufacturers. This will give you peace of mind, knowing that your phone is in safe hands.

Easy Phone Replacement

If your phone is beyond repair, some insurance policies grant a replacement for your phone. The replacement can either be the same model as your damaged phone or, for a little extra, a higher-specced phone. This policy may also apply for lost or stolen phones. Now, you wouldn’t need to worry about spending huge sums of money just to buy a new phone.

Cell Phone Insurance Providers

There are many phone insurance providers out there that can give protection to your phones. It ranges from the phone’s manufacturer, wireless carrier, to independent insurance companies. To give you an idea what is the best insurance policy for you, here are some of the best offers from the best insurance providers:

AppleCare+

Nothing beats the care for Apple products like AppleCare+. They offer protection for your iPhones and iPads for an additional cost. AppleCare+ extends the warranty provided by AppleCare by another year. This covers two incidents of theft or loss, hardware damages, and two accidental damages that have happened within 12 months. You’ll also get priority on their chat support. Repairs and replacement are all subject to fees. Don’t worry for the cost is still reasonable enough. Deductibles can range from $29 to $149 depending on the incident.

Subscribing to an AppleCare+ plan may be too expensive for some. Even with the monthly payment scheme, this can be a burden for your wallet. If you’re looking for an alternative, don’t worry; other insurance providers give the same protection as the AppleCare+ but for a more affordable price.

Samsung Care Plus

Samsung also has an extensive insurance plan for their products. The Samsung Care Plus is an extended service insurance for Samsung products. It covers drops, water splashes, and any other damages on your Samsung phone. The damaged parts are replaced by Samsung with legitimate Samsung parts. This will give you peace of mind knowing that your phone is being repaired with high-quality parts. And if your phone gets lost, Samsung can replace your phone with the same model. Samsung guarantees you the best service with their Samsung Care Plus.

Visit Samsung Care Plus Website

SquareTrade

If you find the plans for Apple or Samsung to be somewhat over-the-top or you own other phone brands, SquareTrade is one of the best third-party phone insurance companies out there. It covers hardware damages on your phone like water spills, accidental drops, and other electronic failures. The great news is SquareTrade charges its fees annually. Coverage fees will depend on the device, but the usual rate is $8.99 per month.

You have to make your mind quick, though. SquareTrade only grants phone insurance for phones that are purchased within 30 days. Better grab their offer while your phone is still “hot.” SquareTrade also doesn’t offer protection for intentional damage, theft, or loss. Take a better grip on your phone if you want your phone to be covered by their insurance.

Geek Squad

You may have known Geek Squad as Best Buy’s team of technical experts, and this is the same Geek Squad that protects your phones. At $8.99, you’ll get protection against screen cracks, speaker damages, and other device malfunctions. Not only is your phone protected, but your accessories such as your earbuds and smartwatches are insured too. Add $2 to your monthly plan and you’ll get additional protection against loss and theft. This is considerably cheap compared to the competition.

There is one condition that you need to adhere to. You can only avail yourself of Geek Squad Protection Plan when you purchase your phones on Best Buy. So, better purchase from them if you want to avail their services.

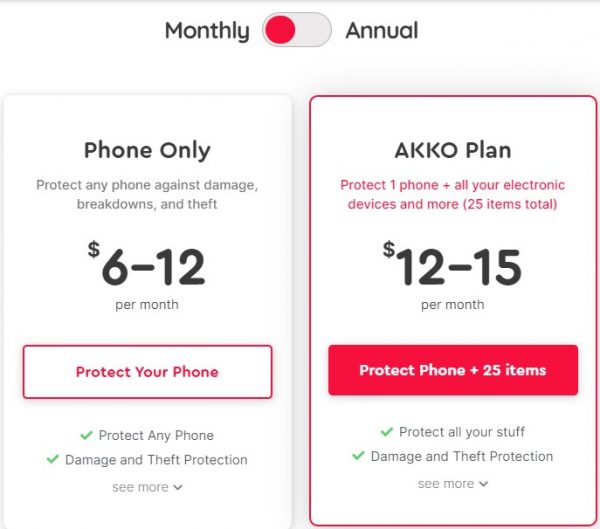

Akko

Akko is new but offers the same great insurance services as other veterans out there. For as low as $6 per month, you can protect your phone from theft, loss, and damages. Deductibles are also justifiably priced, only ranging from $29 to 99.

There is also a more extensive protection plan that extends to other gadgets and appliances. For $12 to $15, you can protect not just your phones, but also your cameras, gaming consoles, headphones, even your bicycles, and skateboards. Now that’s a great deal for protecting your personal stuff.

Upsie

Another start-up insurance company is Upsie. Their prices for a two-year insurance plan are hugely discounted compared to its competitors. For example, insuring a Samsung Galaxy Note 20 would only cost $129.99 for two years. That saves you an estimate of more than $100 for a two-year plan. This makes it a more drooling deal for an insurance plan. What makes it more enticing is they can give protection for your phone 120 days after its purchase. Finally, you can get protection for your device even if it’s a little bit late.

As much as their plans are affordable, they do not provide insurance against stolen or lost phones. That is a real bummer especially if you want an insurance plan on your phone for cheaps. And as already mentioned above, Upsie is still a freshman in the market. If you want a more trusted insurance provider, look somewhere else. But give them a shot for their affordable services, which are compelling enough to get an insurance plan from them.

Insurance Plans From Phone Carriers

If you have subscribed to a plan from your carrier, they will usually offer additional protection for your phone. This is in a form of cell phone insurance. Here are the insurance offers of the major carriers:

AT&T

AT&T offers a variety of insurance plans for their phones. If you want extensive coverage for your phone, AT&T offers $15 per month of protection on one device. You can get up to three claims per year, $29 repair for a cracked screen, and free device tune-ups. Aside from these, you’ll also get unlimited storage for your photos and videos on their cloud services.

There is also a group plan that has the same benefits as their plan for individual devices. Only this time, AT&T is offering it for a group of four devices. This will cost you around $40. It is the best plan for those who have children who own some gadgets.

There is another AT&T insurance plan that is more affordable for its subscribers. Their most basic insurance plan costs only around $8.99. This plan covers intentional and accidental damages, loss, and theft. When you accidentally cracked your screen, a $49 deductible will be charged for its repair. This is enough if you just want to protect your phone from AT&T.

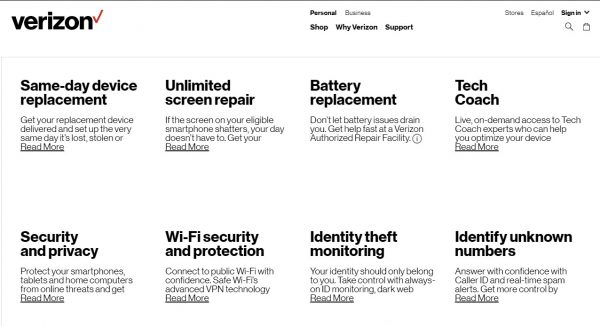

Verizon

Verizon offers their insurance plan aptly called “Verizon Protect” for their mobile phones. Their plans start from $17 per month for individual devices or $50 per month for three to ten devices. These plans may look expensive, but you’ll get more than what you pay for. Aside from the usual repairs for cracked screens and other mechanical failures, you’ll also get battery replacements on your phone. Say goodbye to busted batteries now. What makes Verizon’s services more distinct is their virtually unlimited claims for their insurance services. So, whenever you crack your screen, just bring it to Verizon, pay $29, and wait for the screen to be repaired.

Verizon does not only protect your physical device but also your Internet activities. Wi-Fi protection, identity theft monitoring, caller ID identification, and internet protection are just some of the additional services they offer. This is one jampacked insurance plan from a wireless carrier.

T-Mobile

T-Mobile offers two cell phone insurance services under its hood. Their basic “Device Protection” offers the most basic protection for your device. Screen repairs, mechanical failures, and phone replacement are just some of the services they offer under “Device Protection.” There is a more extensive protection plan called “Protection <360>” that extends its services not just on your physical device but also your identity over the web. You’ll get unlimited screen protector replacements, priority tech services by Assurant, identity theft protection, and AppleCare services.

Is Phone Insurance Worth Getting?

The primary reason why consumers get phone insurance is because of accidents such as sudden drops and water damages. These incidents can severely damage the sensitive parts within a smartphone. The screen, display, and glass protection of the phone are just some of the parts that need utmost care. Even the hardest cases and toughest screen protectors wouldn’t protect your phone from damages. This fact holds true especially for those who have a rowdy child or people who are “passionate to be fit.”

If you are one of those people who are into premium phones but tend to be on the clumsy side, getting phone insurance is worthy in itself. This is also applicable for those who have children. In case you lost your phone or suddenly broke it, replacing it is a breeze when you avail a cell phone insurance plan. But if you take care of your phone meticulously, you do not need to avail of such. Your phone’s warranty is more than enough to guarantee protection for your phone.

Pros and Cons of Getting a Cell Phone Insurance

Getting a phone insurance plan may be a bit confusing. If you are still not that convinced if you should get insurance for your mobile device, here are some of the pros and cons of getting one:

Pros

Here are some of the reasons why a phone insurance plan is beneficial for you:

1. Insurance Plan Means Less Money to Spend

Why spend huge on a sudden buy when you got phone insurance? Whether your phone has been damaged by manufacturer’s fault or human error, phone insurance helps you lessen the stress of buying a new phone. It can either be in a form of free repairs or phone replacement. No need to shell out hundreds of dollars just to buy a new phone.

2. No Further Obligations When Cancelled

If ever you buy a new phone, canceling your previous phone’s insurance won’t give you additional bearing on your end. Your insurance provider won’t charge you once you get a new phone. They can even offer you discounted prices on their insurance plans.

3. Extended Protection for Your Phone

Most of the phone manufacturers give a one-year limited warranty on their phones. Once this warranty expires, you will be definitely charged by your manufacturer when you encounter major problems with your phone. With a phone insurance subscription, your expenses will be cut when repairing or replacing your phone. The insurance will catch the impending expenses you may encounter when you diagnose the problems on your phone.

4. Protection Against Theft or Loss

When you lose your phone due to robbery or you just misplaced it, some insurance policies can protect your money against unexpected spending. They can help you replace your stolen or lost phone. You’ll only need to spend on the deductibles to replace your phone.

Cons

Now, here are some of the disadvantages of phone insurance. These can help you decide if you should get one or not:

1. Can Be Unutilized

If you give your phone the most delicate care, you might end up not using your phone’s insurance. It can be a waste of money at your end for paying premium protection on your phone. That extra money can be allotted for buying a new phone or a flight ticket to your next vacation.

2. Some Situations Not in the Scope of the Insurance

Some insurance policies don’t cater to some unusual situations. For example, some phone manufacturers do not replace your phone once it is stolen or lost. Damages due to carelessness may also not be covered by your phone insurance. This is inconvenient especially when you are earning up for something. Read the insurance policy very carefully before subscribing to it.

3. Tedious Claiming Process

Claiming phone insurance may take some time. Tons of documents may be needed by insurance companies if you ever want to claim your insurance. For example, if your phone is lost due to theft, you may need to acquire a police report. You will also need to notify your insurance company regarding the incident. This can take a considerable amount of time and effort just to claim your phone insurance. You might as well just get a new phone if you want to save time.

4. Huge Deductibles for Phone Replacement

Its advantage can also be its drawback. When the phone is beyond repair, stolen, or lost, it would be a huge relief when you replace it under an insurance policy. But be ready to shell out a huge deductible when replacing your phone. The deductible usually cost you around $30 and higher. It can even be identically priced as the price of your damaged or lost phone. That can be a huge cut on your emergency expenses. Better buy a second-hand phone as your replacement if you find the deductible cost to be steep. You can also sell your damaged phone on ecoATM to get some moolah from your broken phone. This can help you save for your next phone or maybe buy some groceries.

Phone Insurance vs Warranty: Which Is Better?

A warranty is a must for every newly-purchased phone. This serves as a protection for the consumer if ever there is a factory defect on the phone. But what makes a phone warranty different from phone insurance? Does a warranty guarantee the same protection as insurance?

What Is the Difference Anyway?

A warranty is a guarantee from manufacturers that protects its consumers from factory defects. If you purchase a brand new phone with dead pixels or software glitches, this qualifies as a factory defect. Manufacturers will grant free repairs to your phone if these things happen. They usually grant this privilege for one year to ensure they deliver high-quality tech products. But once you have done some tweaks to the software of your phone, the warranty will automatically be voided by the manufacturer.

Unintentional damages like a cracked screen due to accidental falls may be denied by warranty claim too. This can be inconvenient for most of us especially with hardware issues. Free repairs usually do not include the price for hardware replacement. You’d end up still paying a considerable amount just to replace the parts of your phone. We want to avoid unnecessary expenses, for sure.

Meanwhile, phone insurance protects your phone from anything, from software glitches to hardware damages. Some policies can even protect you from external causes such as loss or theft. This can make you feel secure knowing that your phone is safe from any harm. But this will come at a cost. If you want to avail of phone insurance, you need to subscribe to the insurance provider of your choice. This can cost you from tens of dollars per month to hundred dollars for a straight payment. With this amount of money, you can continually protect your phone or earn it up for another new phone.

Which Is Better?

This will depend on your situation and lifestyle. If you are on the clumsy side, you might want to add extra protection for your phone by getting an insurance plan for your phone. If you treat your phone with the most delicate care, you may not need to subscribe to an insurance plan. But then again, things like theft and pickpocketing are unpredictable and beyond one’s control.

This can also depend on your financial status. If you can afford to buy the latest phones, you may want to just stick with your phone’s warranty. Otherwise, it would be wise to get an insurance plan for your phone.

Final Word

Adding protection to your phone is not limited to hard phone cases or glass screen protectors. These accessories are not enough to protect your phone. A cell phone insurance gives you peace of mind that your phone is secured not just on physical damages, but also from misplacement and theft.

This doesn’t mean you have the license to break and misplace your phone, though. An insurance policy only adds a layer of protection and assurance for your phone. Even without an insurance policy, you can still give the delicate care your phone needs. Just handle your phone with care. Weigh your options and situations first before availing of an insurance policy, or you might end up not using the insurance at all.