Are you interested in gaining a deeper understanding of the financial markets? If so, you may have come across the term “Level 2 data.” Level 2 data provides valuable information about the supply and demand for a particular stock or other financial instrument. It goes beyond the basic price and volume data provided by Level 1 quotes. By delving into Level 2 data, you can get a glimpse of the real-time order book, showing the buy and sell orders at various price levels. This information can help you identify potential trends and make more informed trading decisions. In this article, we will guide you through the process of reading Level 2 data, explaining its significance and providing practical tips to interpret and utilize this information effectively.

Inside This Article

- Understanding Level 2 Data

- Benefits of Reading Level 2 Data

- Analyzing Level 2 Data

- Techniques for Reading Level 2 Data

- Conclusion

- FAQs

Understanding Level 2 Data

Level 2 data is a key component in the world of stock trading. It provides a deeper insight into the supply and demand dynamics of a particular stock. Unlike Level 1 data, which only shows basic information such as the current bid and ask prices, Level 2 data reveals the full order book, displaying detailed market depth.

When viewing Level 2 data, traders can see the various price levels at which buyers and sellers are willing to transact. This transparency allows traders to gauge the overall sentiment of the market and make more informed trading decisions. It also enables them to identify potential support and resistance levels, as well as detect significant buy and sell orders.

Level 2 data provides a wealth of information that allows traders to understand the liquidity and volatility of a stock. By observing the order flow, traders can see the number of buy and sell orders being placed at different price levels. This information helps traders determine whether a stock is experiencing strong buying or selling pressure, which can influence their trading strategies.

Furthermore, Level 2 data offers insights into market makers and the role they play in the trading ecosystem. Market makers are financial firms that help facilitate trading by providing liquidity to the market. By analyzing Level 2 data, traders can detect the presence and activity of market makers, which can be advantageous in predicting potential price movements.

With Level 2 data, traders can also identify patterns and trends in the order book. By monitoring price changes and fluctuations in the bid and ask sizes, traders can spot patterns such as accumulation or distribution. These patterns may indicate potential buying or selling opportunities.

Understanding Level 2 data is crucial for active traders who want to stay ahead in the market. By leveraging this detailed information, traders can gain a competitive edge and make more informed trading decisions.

Benefits of Reading Level 2 Data

Reading Level 2 data provides traders and investors with valuable insights and advantages in the fast-paced world of financial markets. Here are some of the key benefits associated with analyzing Level 2 data:

1. Enhanced Market Depth: Level 2 data offers a deeper understanding of the supply and demand dynamics within a specific market. By providing visibility into the order book, it allows traders to see the number of buyers and sellers at various price levels. This information helps identify potential support and resistance levels, allowing for more precise entry and exit points.

2. Real-Time Trade Analysis: Level 2 data provides traders with immediate access to current market activity. It allows them to monitor the actual trades being executed and the corresponding price levels. This real-time trade analysis helps traders gauge market sentiment, identify trends, and make informed decisions based on actual trading activity.

3. Early Detection of Price Movements: Level 2 data enables traders to spot early signs of price movements that may not be evident from standard price charts. By observing the depth of the order book and tracking changes in the bid-ask spread, traders can identify buying or selling pressure building up and anticipate potential price shifts before they occur.

4. Accurate Order Execution: By analyzing Level 2 data, traders can optimize their order execution strategies. They can identify the ideal price levels to place their orders, ensuring efficient order fulfillment and reducing the risk of slippage. This allows traders to maximize their profitability and minimize trading costs.

5. Improved Risk Management: Reading Level 2 data helps traders assess the liquidity and volatility of a market. This information is crucial for effective risk management. Traders can gauge the depth of a market and determine whether there is sufficient liquidity to support their trading strategy. They can also identify sudden surges in trading activity, indicating increased volatility and the need for caution.

Overall, the benefits of reading Level 2 data are significant for both short-term traders seeking quick profits and long-term investors looking to make informed decisions. By understanding market depth, real-time trade analysis, early detection of price movements, accurate order execution, and improved risk management, traders and investors can gain a competitive edge in the financial markets.

Analyzing Level 2 Data

Level 2 data provides an in-depth view of the current market action by displaying the order book beyond the top bid and ask prices. Analyzing this data can provide valuable insights into market sentiment and potential price movements. Here are some key techniques for effectively analyzing Level 2 data:

1. Depth of Market: The depth of market refers to the number of buy and sell orders at different price levels. By analyzing the depth of market, traders can identify areas of support and resistance and determine the overall liquidity of a particular security.

2. Order Flow Analysis: Order flow analysis involves tracking the flow of buy and sell orders in real-time. By analyzing the order flow, traders can identify significant buying or selling pressure and gauge the strength of market participants. This information can help traders make more informed trading decisions.

3. Time and Sales: Time and sales, also known as the tape, displays the recent trades executed in the market, including the price, volume, and timestamp. By analyzing the time and sales data alongside Level 2 data, traders can identify patterns and trends, such as significant buying or selling activity, and use this information to make strategic trading decisions.

4. Bid and Ask Sizes: The bid size represents the number of shares or contracts being offered by buyers at a specific price level, while the ask size represents the number of shares or contracts being offered by sellers. Analyzing changes in bid and ask sizes can provide insights into the supply and demand dynamics of a security.

5. Price Action: Analyzing Level 2 data in conjunction with price action can offer valuable insights. Traders can observe how bid and ask prices change in response to market orders and how the order book reacts to price movements. This information can help identify potential entry and exit points and gauge market sentiment.

6. Level 2 Patterns: Traders often look for specific patterns in Level 2 data that may indicate potential trading opportunities. Examples of level 2 patterns include large bid or ask orders, stacked bid or ask levels, or significant changes in bid and ask sizes. Recognizing these patterns can help traders identify potential areas of support or resistance, and anticipate price movements.

By utilizing these techniques and analyzing Level 2 data effectively, traders can gain a deeper understanding of the market dynamics and make more informed trading decisions. However, it is important to remember that Level 2 data should be used in conjunction with other analysis tools and strategies to form a comprehensive trading strategy.

Techniques for Reading Level 2 Data

Reading Level 2 data can be a valuable tool for traders and investors looking to gain deeper insights into market activity. However, interpreting and analyzing this data effectively requires the use of specific techniques. In this section, we will explore some techniques that can help you make the most of Level 2 data.

1. Understanding Bid and Ask Prices: Level 2 data provides real-time information on bid and ask prices, which are crucial for understanding market sentiment. Pay attention to the bid prices, which represent the highest price buyers are willing to pay, and the ask prices, which indicate the lowest price sellers are willing to accept.

2. Monitoring Market Depth: Level 2 data also includes information on market depth, which refers to the number of open buy and sell orders at different price levels. By monitoring market depth, you can assess overall market interest and identify support and resistance levels.

3. Identifying Order Flow: Level 2 data can provide insights into order flow, revealing whether buying or selling pressure is increasing or decreasing. Look for large orders or clusters of orders on either the bid or ask side, as it can indicate significant market movements.

4. Spotting Market Manipulation: Level 2 data can help identify potential market manipulation, such as spoofing or layering. These practices involve placing large orders to create the illusion of market activity. Pay attention to sudden changes in bid and ask sizes, and look for patterns that might suggest manipulation.

5. Watching Time and Sales: Time and sales data can provide additional insights when combined with Level 2 data. By comparing the executed trades with the Level 2 data, you can gauge the effectiveness of the bids and asks, and spot potential liquidity imbalances.

6. Utilizing Level 2 Indicators: There are various indicators available that are specifically designed to interpret Level 2 data. These indicators can help you identify market trends, measure buying and selling pressure, and determine optimal entry and exit points.

7. Practice and Observe: Reading Level 2 data is a skill that improves with practice and observation. Spend time familiarizing yourself with the data and regularly monitor its fluctuations. Over time, you’ll develop a deeper understanding of how Level 2 data can guide your trading decisions.

By employing these techniques, you can enhance your ability to interpret and utilize Level 2 data effectively. Remember to combine Level 2 data with other technical and fundamental analysis tools for a comprehensive understanding of the market.

Conclusion

In conclusion, learning how to read Level 2 data can greatly enhance your trading abilities in the stock market. By being able to view real-time order book information, you gain insights into the supply and demand dynamics, allowing you to make more informed trading decisions. Level 2 data provides a deeper understanding of market liquidity, price movements, and the presence of large buyers or sellers.

While it may take some time and practice to fully master interpreting Level 2 data, it is a valuable skill that can give you a competitive edge in the market. By analyzing bid and ask sizes, market depth, and order flow, you can identify potential entry and exit points for your trades. Additionally, understanding how to spot hidden liquidity can help you navigate volatile or fast-moving markets with more confidence.

So, whether you are a seasoned trader looking to gain a new perspective on the market or a beginner just starting your trading journey, taking the time to learn how to read Level 2 data is definitely worth the investment. It can empower you to make more informed trading decisions and improve your overall trading performance.

FAQs

Q: What is Level 2 data?

Level 2 data refers to detailed market information that provides insights beyond the basic bid and ask prices. It includes a breakdown of buy and sell orders at different price levels, giving traders a more comprehensive view of market liquidity.

Q: Why is Level 2 data important?

Level 2 data is important for traders who want to better understand market depth and liquidity. It allows them to see the specific orders being placed, which can help identify trends, predict price movements, and make informed trading decisions.

Q: Where can I access Level 2 data?

Level 2 data is typically available through specialized trading platforms or financial data providers. These platforms offer real-time or delayed market data feeds that include Level 2 information for stocks, options, and other securities.

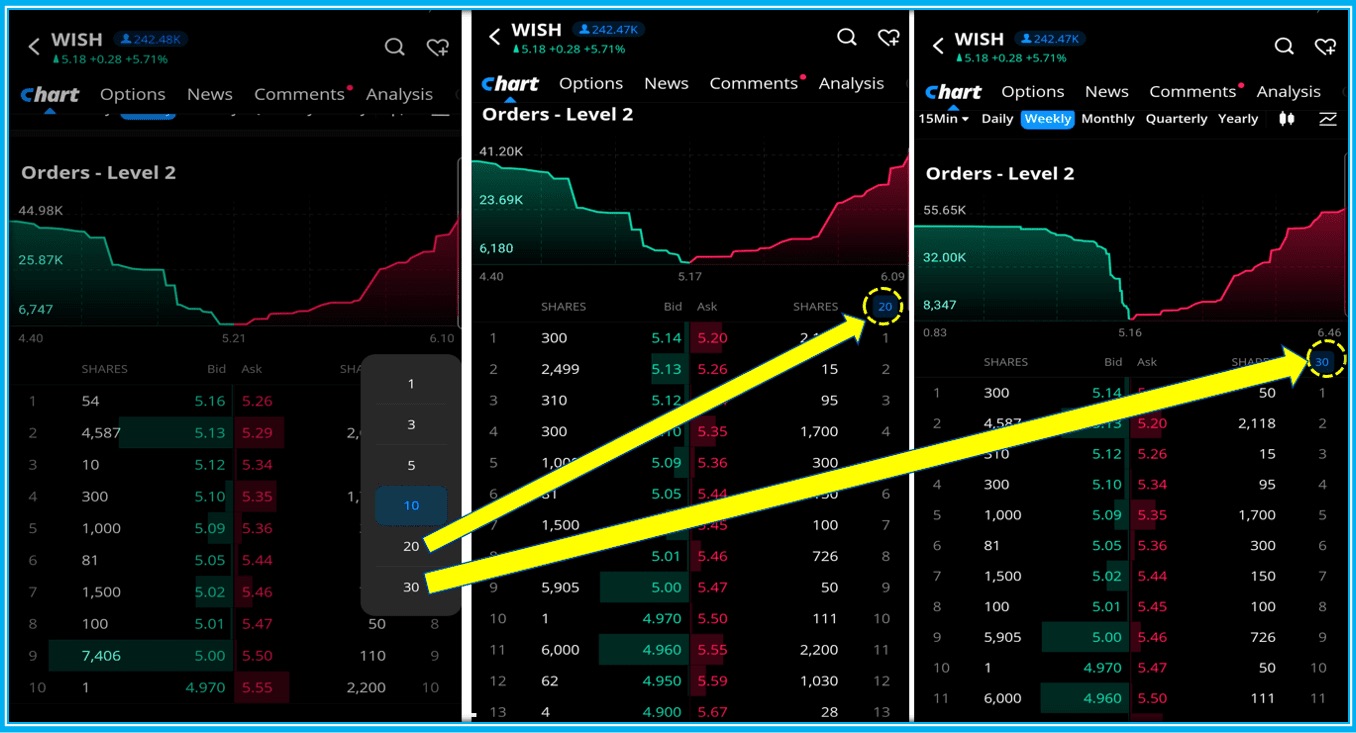

Q: How can I read Level 2 data?

Reading Level 2 data requires familiarity with the format and terminology used. The data is presented in a table-like format, with columns displaying price levels, the size of orders at each level, and the market participants behind those orders. Traders use this data to assess supply and demand dynamics in the market.

Q: What are some key tips for reading Level 2 data?

Here are a few tips for effectively reading Level 2 data:

- Pay attention to the bid-ask spread: A narrow spread indicates high liquidity and generally means there is a healthy market for the security.

- Look for large orders: Large block orders can indicate institutional interest and may influence the direction of the security’s price.

- Monitor order size changes: Watch for significant increases or decreases in order sizes, as these can signal buying or selling pressure.

- Observe the time and sales data: Level 2 data is often accompanied by real-time or delayed trade data, which can provide additional insights into market activity.

- Practice and gain experience: Reading Level 2 data requires practice and familiarity with the market you are trading. Learn from experienced traders and analyze historical data to enhance your skills.