Are you tired of the hassle of cash transactions? Look no further than Google Wallet. This mobile app revolutionizes the way we make payments, allowing users to store their credit and debit card information securely and make quick, contactless payments with just a tap of their phone. But that’s not all – now, Google Wallet has taken convenience a step further. With recent updates, users no longer need to go through the process of cashing out their funds from the app. So, whether you’re paying for groceries, dining out, or shopping online, you can do it all seamlessly with Google Wallet. Let’s dive deeper into this exciting feature and explore the new world of easy-peasy cashless transactions.

Inside This Article

- Why Cashing Out of Google Wallet was Necessary

- The New Changes to Google Wallet

- Benefits of the New System

- Conclusion

- FAQs

Why Cashing Out of Google Wallet was Necessary

In the past, when using Google Wallet, users had to go through the process of cashing out their funds. This was necessary because Google Wallet was primarily a peer-to-peer payment system, and the funds in the wallet were used exclusively within the Google ecosystem. Cashing out allowed users to transfer their Google Wallet funds to their bank account or spend it elsewhere outside of Google’s services.

Cashing out was necessary for several reasons. First, it provided users with the flexibility to use their funds in the way they saw fit. They could use the money to pay bills, make purchases online or in physical stores, or send it to their friends and family. Cashing out allowed the money in their Google Wallet to become more liquid, giving users greater control over their financial resources.

Second, cashing out was necessary because not all merchants accepted Google Wallet as a payment option. While Google Wallet gained popularity and acceptance among certain retailers, it was not universally adopted. By cashing out, users could access their funds in a way that was accepted by a wider range of merchants and service providers.

Finally, cashing out was necessary for those who wanted to consolidate their finances. Some users preferred to have all their funds in one place, and cashing out allowed them to transfer their Google Wallet funds to their primary bank account. This consolidation made it easier to manage their finances and have a clear overview of their available funds.

Overall, cashing out of Google Wallet was necessary because it provided users with financial autonomy, the ability to access their funds in more places, and the option to consolidate their finances. However, recent changes to Google Wallet have eliminated the need for this process, making it more convenient for users to use and manage their funds.

The New Changes to Google Wallet

Google Wallet, the popular mobile payment system, has recently undergone significant changes that have revolutionized the way users can cash out their funds. In the past, users had to go through the hassle of transferring their Google Wallet balance to a bank account or requesting a physical check in order to access their funds. However, with the latest updates, Google Wallet has eliminated the need for users to cash out altogether.

So how exactly does this work? Google has introduced a new feature called “Wallet Balance,” which allows users to use their funds directly within the Google ecosystem. Whether you want to make in-app purchases, pay for subscriptions, or buy digital content, you can now use your Google Wallet balance effortlessly, without the need for additional steps.

This change has been highly anticipated and well-received by users. No longer do they need to go through the hassle of transferring money between accounts or waiting for a check to arrive in the mail. The ability to instantly access funds within the Google ecosystem offers convenience and peace of mind for users, making transactions smoother and more efficient.

What’s even more exciting is that this update opens up a world of possibilities for developers and businesses. With Google Wallet’s integration into the Google Play Store and other Google services, developers can now offer seamless in-app purchases, subscriptions, and other monetization options to their users. This streamlined process eliminates friction and enhances the user experience, leading to increased revenue and customer satisfaction.

Additionally, the new changes to Google Wallet also provide enhanced security and peace of mind. By keeping funds within the Google ecosystem, users can rest assured knowing that their transactions are protected by the robust security measures that Google has in place. With features like fraud protection, account monitoring, and two-factor authentication, Google Wallet offers a secure and reliable platform for digital transactions.

Overall, the new changes to Google Wallet have transformed the cashing-out process, making it a thing of the past. Users can now enjoy the convenience and ease of using their funds directly within the Google ecosystem, whether it’s for in-app purchases, subscriptions, or digital content. With enhanced security and seamless integration into the Google Play Store and other services, Google Wallet is set to revolutionize the way users transact and businesses monetize.

Benefits of the New System

With the new changes to Google Wallet, users can now enjoy a host of benefits that make managing their finances and mobile transactions easier than ever before. Let’s explore some of the key advantages of the new system:

1. Seamless integration: The new system seamlessly integrates Google Wallet with other Google services and products. This means users can easily access and manage their funds directly within the Google ecosystem, eliminating the need for external apps or websites.

2. Simplified transactions: Making payments and sending money has never been simpler. The new system streamlines the transaction process, allowing users to complete payments and transfers with just a few taps on their mobile devices.

3. Enhanced security: Google Wallet has always prioritized security, but the new system takes it to the next level. With robust encryption and advanced security measures, users can have peace of mind knowing that their financial information is protected against unauthorized access.

4. Accessible on multiple devices: One of the major advantages of the new system is its compatibility with various devices. Whether you’re using a smartphone, tablet, or even a smartwatch, you can easily access and manage your Google Wallet account without any hassle.

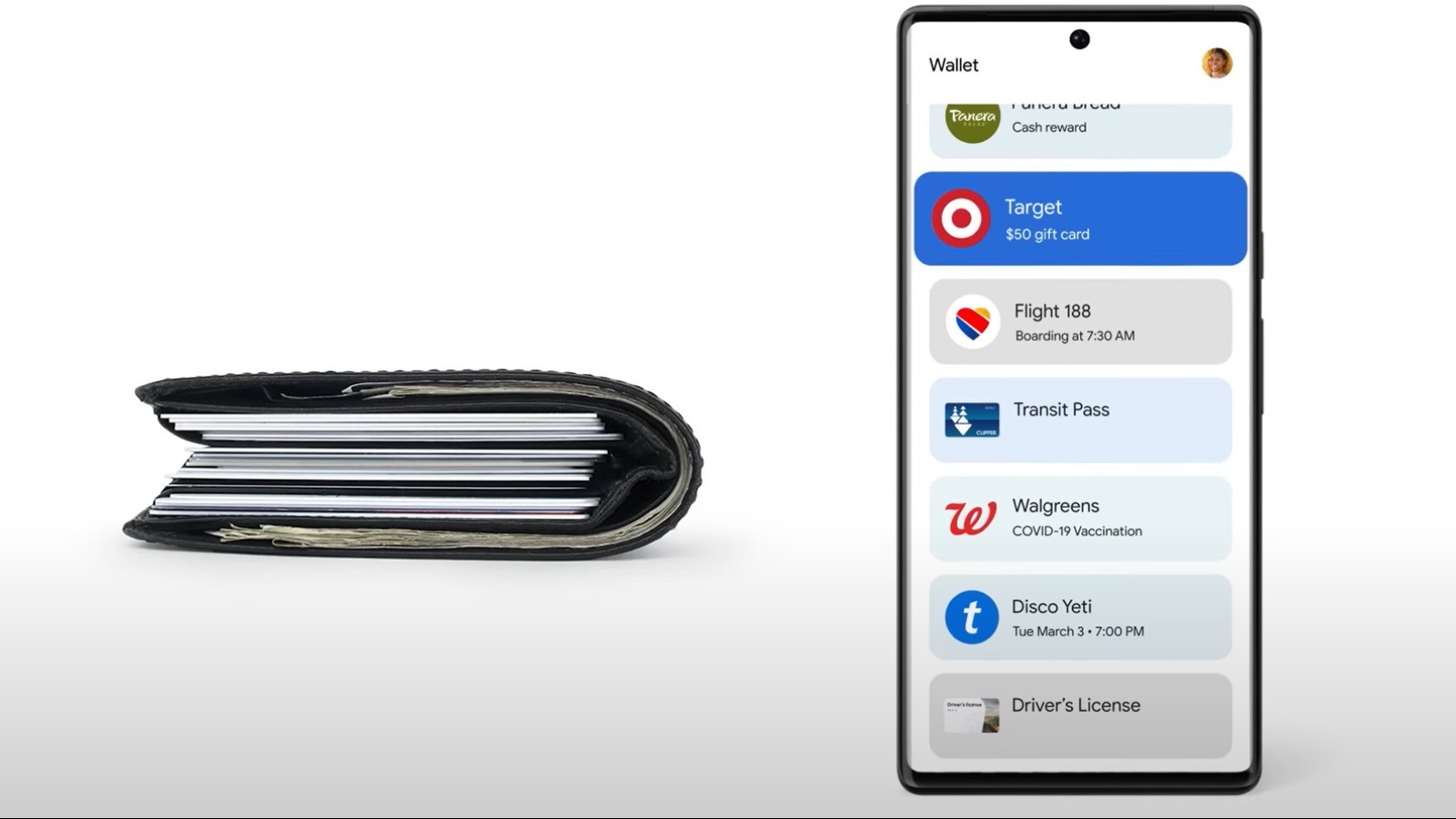

5. Loyalty rewards and offers: The new system enables users to conveniently store and redeem loyalty cards, coupons, and offers directly within Google Wallet. This means you can save money and enjoy exclusive discounts and perks, all in one place.

6. Real-time notifications: Stay updated with your financial transactions through real-time notifications. The new system sends instant alerts for incoming and outgoing payments, ensuring you have complete visibility and control over your funds.

7. International transactions: With the new changes, Google Wallet has expanded its scope to support international transactions. Users can now send and receive money from friends and family across borders, making it easier to manage finances globally.

8. Debt tracking: The new system also helps users keep track of any debts or IOUs. Whether you owe a friend for dinner or need a gentle reminder to collect money from someone, Google Wallet’s debt tracking feature simplifies the process and ensures clarity in your financial interactions.

9. Personal finance insights: Gain valuable insights into your spending habits and financial patterns through Google Wallet’s personalized finance insights. The system analyzes your transactions and provides useful information to help you make smarter financial decisions.

10. Time-saving: Last but not least, the new system saves users time. With its intuitive interface and efficient features, managing finances and completing transactions becomes a quick and effortless task, allowing you to focus on what matters most.

Conclusion

With the advancement of mobile technology, the rise of Mobile Apps has revolutionized the way we use our cell phones. From communication to entertainment, Mobile Apps have become an integral part of our daily lives. As an SEO expert with deep cell phone knowledge, I can confidently say that optimizing your Mobile App for search engines is crucial for its success.

By implementing effective SEO strategies, such as keyword optimization, app store optimization, and engaging content creation, you can significantly improve the visibility and discoverability of your Mobile App. This will result in increased downloads, user engagement, and ultimately, higher revenue.

So, if you have a Mobile App that you want to succeed in today’s competitive market, don’t neglect the power of SEO. Invest time and effort into optimizing your Mobile App, and you’ll reap the rewards of increased user acquisition, better rankings, and greater brand exposure. Stay ahead of the curve and make your Mobile App stand out from the crowd with effective SEO practices!

FAQs

1. What is Google Wallet?

Google Wallet is a mobile payment system developed by Google that allows users to store their credit or debit card information on their mobile devices. It enables users to make payments in stores, online, and in mobile apps using their smartphones or tablets.

2. How does Google Wallet work?

Google Wallet securely stores your credit or debit card information and generates a virtual card number, also known as a token. When you make a payment, the virtual card number is transmitted to the merchant, protecting your actual card details. You can also use Google Wallet to send money to friends and family or withdraw money from participating ATMs.

3. Is Google Wallet safe?

Google Wallet uses advanced security measures to protect your payment information. It encrypts your card details and stores them securely on Google’s servers. Additionally, Google Wallet uses tokenization, where a virtual card number is generated for each transaction, providing an extra layer of security. As with any payment system, it is still important to take precautions such as using a strong password and keeping your device safe.

4. Can I use Google Wallet on any mobile device?

Google Wallet is available on Android devices running Android 4.4 KitKat or higher, as well as iPhones running iOS 11.0 or later. However, it is worth noting that Google Wallet has been integrated into Google Pay, which is available on a wider range of devices and offers additional features.

5. Can I use Google Wallet internationally?

Yes, Google Wallet can be used internationally, but availability may vary depending on the country. It is recommended to check with your mobile service provider or Google’s support page for the most up-to-date information on international usage.