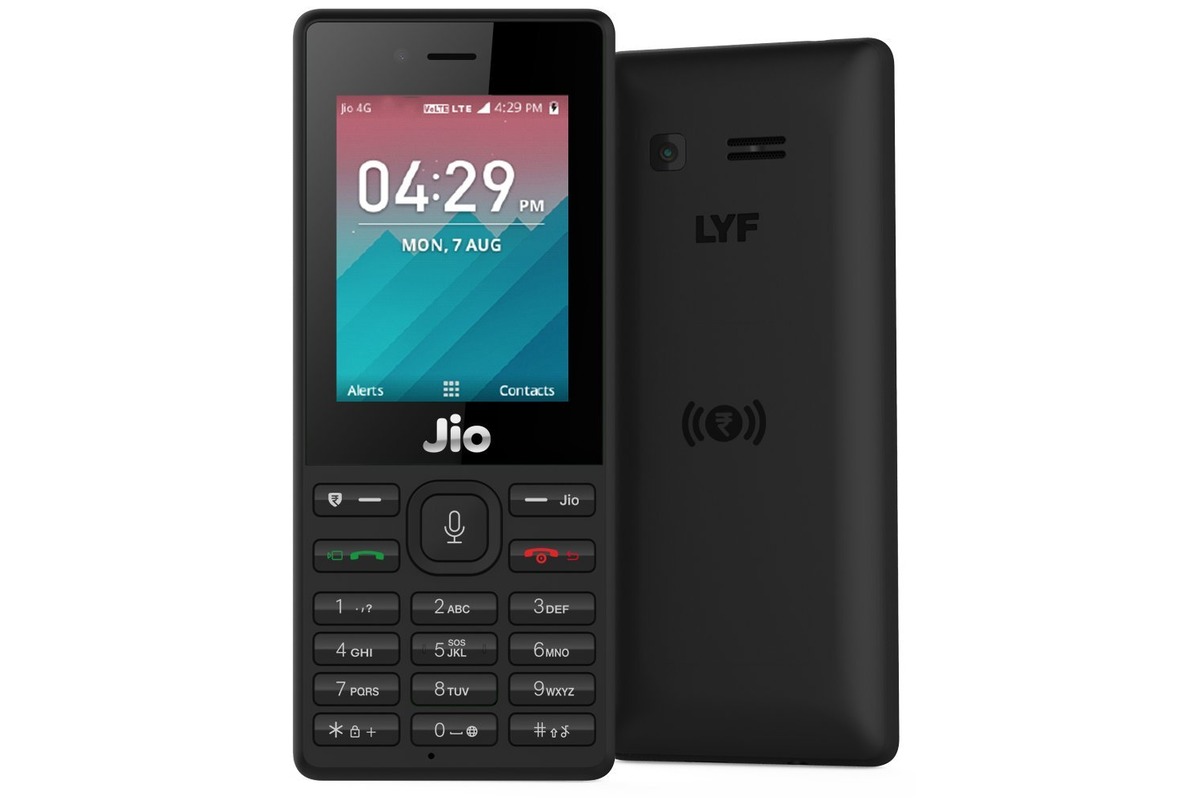

The JioPhone, a popular feature phone in India, may soon be getting UPI (Unified Payments Interface) apps for faster and easier payments. This development comes as a welcome addition for JioPhone users who have been eagerly awaiting the inclusion of UPI apps on their devices. UPI has revolutionized the way people make payments in India, allowing them to seamlessly transfer funds and make purchases with just a few taps on their mobile phones. The integration of UPI apps on the JioPhone will further boost its utility and convenience, making it a go-to choice for those looking for a simple and efficient way to manage their finances. Let’s delve into the potential benefits and implications of this exciting update for JioPhone users.

Inside This Article

JioPhone May Soon Get UPI Apps for Faster Payments

In recent news, there have been rumors circulating that JioPhone, the popular feature phone in India, may soon have the capability to support UPI apps for faster payments. This development could revolutionize the way users handle their financial transactions, bringing convenience and efficiency to the fingertips of millions of JioPhone users.

JioPhone, with its affordable price and unique features, has become a sensation in the Indian market. It is estimated that there are millions of users who rely on this device for their communication and internet needs. However, one area where JioPhone has lacked compared to smartphones is the ability to make fast and secure digital payments.

Enter UPI, or Unified Payments Interface. UPI is an instant payment system developed by the National Payments Corporation of India, allowing users to link multiple bank accounts to a single mobile app. With UPI, users can make seamless, real-time payments directly from their bank accounts, eliminating the need for cash or physical cards.

With the potential integration of UPI apps on the JioPhone platform, users will no longer have to rely on cash or visit ATMs to make payments. They can simply download the UPI app of their choice, link their bank accounts, and start making secure payments with just a few taps on their JioPhone. This will not only save time but also provide users with a hassle-free payment experience.

There are several advantages of having UPI apps on the JioPhone. Firstly, it will empower even those who do not have access to smartphones with the convenience of digital payments. This can have a significant impact on the financial inclusion of individuals who are currently excluded from the digital economy.

Secondly, the integration of UPI apps will enhance the overall user experience of JioPhone. Users will be able to enjoy the benefits of fast and secure payments, making their daily transactions more convenient. Whether it’s paying utility bills, shopping online, or transferring funds, the process will be simplified for JioPhone users.

Furthermore, having UPI apps on the JioPhone will contribute to the government’s vision of a cashless economy. As more people embrace digital payments, the reliance on physical cash will decrease, leading to a more transparent and efficient financial system.

Conclusion

The integration of UPI apps with the JioPhone is a game-changer for users, providing them with a more convenient and faster payment option. With the increasing popularity of digital payments, having UPI apps on the JioPhone will open up a world of possibilities for millions of users. It will not only make financial transactions effortless but also empower people with the ability to manage their finances on the go.

With JioPhone’s wide user base and affordable pricing, the addition of UPI apps will further enhance its value proposition and solidify its position as one of the leading mobile devices in the market. Users can look forward to a seamless and user-friendly experience when it comes to making payments, whether it’s for shopping, bill payments, or money transfers.

Overall, the integration of UPI apps on the JioPhone is a significant development that points towards a more digitally inclusive future. As more users embrace this technology, it will contribute to the growth of the digital economy and drive the adoption of cashless transactions across the country.

FAQs

Q: What is UPI?

UPI stands for Unified Payments Interface. It is a real-time payment system developed by the National Payments Corporation of India, which facilitates easy, instant, and secure transactions between different banks and payment apps.

Q: Can I use UPI apps on JioPhone?

As of now, JioPhone does not support UPI apps. However, there have been reports indicating that JioPhone may soon get UPI app support, allowing users to make faster payments and transactions through their JioPhone devices.

Q: Will the UPI apps work the same way on JioPhone as on smartphones?

While the functionality and features of UPI apps on JioPhone are still to be confirmed, it is expected that the apps will offer similar functionality to their smartphone counterparts. Users should be able to make payments, transfer funds, and perform other UPI-related activities through the supported apps on JioPhone.

Q: How can I install UPI apps on JioPhone?

Once the UPI apps become available for JioPhone, the installation process is likely to be similar to other apps on the device. Users can visit the Jio app store or any other supported app store on their JioPhone, search for the desired UPI app, and download and install it onto their device. Further instructions and onboarding processes will be provided by the respective app developers.

Q: Are there any fees or charges for using UPI apps on JioPhone?

The fees or charges for using UPI apps on JioPhone will depend on the specific app and the terms set by the app developer. Some UPI apps may charge a nominal fee for certain transactions or value-added services. It is advisable to review the terms and conditions of the UPI app and contact the app developer for detailed information on any fees or charges associated with using the app on JioPhone.