When it comes to cash advance apps, Earnin is a popular choice. But that does not automatically mean you have to go with it. There are alternatives that do the job well and boast unique benefits. What are those and should you use them? Here, we showcase the best apps like Earnin that you can find right now.

Inside This Article

What Earnin Is and Why Search for Other Apps Like It

Apps like Earnin have become all the rage, especially for those living from paycheck to paycheck. They’re a lifesaver for the average American and a way to get financial breathing room. But before we get to those, what is Earnin, and why are some of its users opting for alternatives?

Earnin is an app that gives you a cash advance on your paycheck. Think of it as a payday loan but without the interest or deductions. Moreover, Earnin functions as a financial management tool that notifies you when your balance is low. It’s easy to use and works in a pinch for folks in immediate need of cash.

While there are many benefits to Earnin, it also has several drawbacks. For one, the eligibility is limited because you need a direct deposit checking account set up by your company first. Furthermore, Earnin requires a consistent payroll period – whether it’s monthly, biweekly, or any other frequency. Thus, people with erratic paydays won’t get any benefit from the app. They include contractual workers, commission-based workers, or those who use money-making apps.

In addition, Earnin requires you to use online timesheets or work at the same place every day. And it accepts you only if you earn a net income of $4 per hour (after deductions). Moreover, Earnin doesn’t account for unemployment, disability payments, or supplemental security income in its calculations.

Lastly, Earnin has a lot of limitations. For example, if you’re a new user, you can only take out $100 during a cycle. While this amount can increase, it’s capped at $500 per user. Hence, it’s not the ideal solution for folks who need larger loans on their paychecks. For that, you’ll have to use apps like Dave and other alternatives.

Apps Like Earnin That Are Worth Trying

1. Brigit

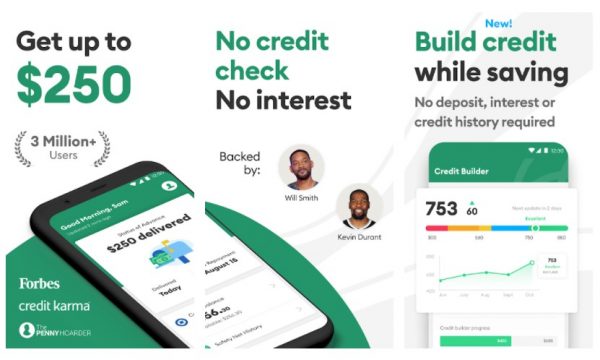

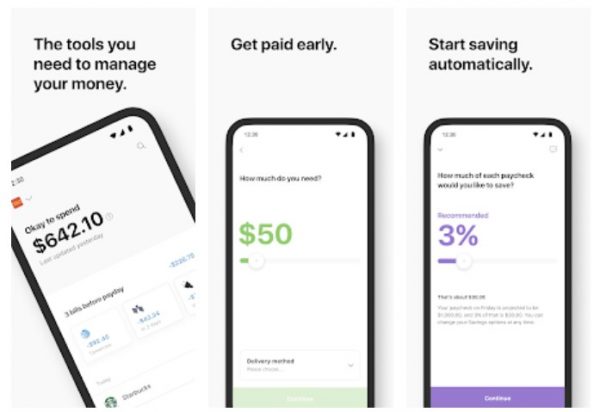

Apps like Earnin usually have a maximum withdrawal amount that most people consider small. In Earnin’s case, the amount is $100 – not enough for emergency car repairs or medical expenses. Thus, there are alternative apps like Earnin that increase the limit. One such app is Brigit.

Through Brigit, you can borrow up to $250 a month. Like Earnin, it has no monthly fees and functions pretty well as a cash advance app. It even has advanced features like overdraft protection, instant transfers, financial analytics, and more. However, you’ll have to pay a $9.99 monthly subscription fee if you want access to those. The free version, while convenient, is limited in functionality.

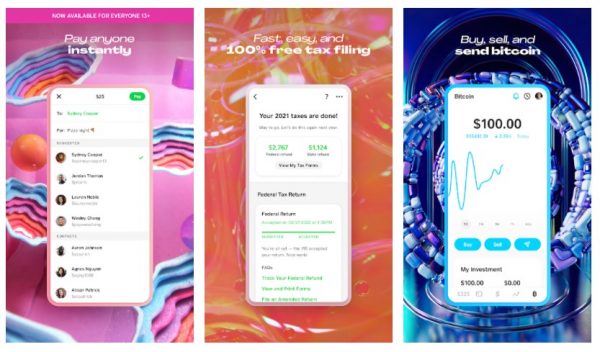

2. Cash App

Cash App is one of the best apps like Earnin for folks who want something more than just advanced payments. Once installed, the app will let you send or receive money from other users or even donate to causes. It also provides convenient investment opportunities and even offers Cash App debit cards to its users.

Note that Cash App’s cash advance feature lets you only get your paycheck up to two days early, though. As a result, it isn’t ideal to use when you’re in a financial pinch. What’s more, the app charges a fee of up to 3% on some activities. Nonetheless, if you want alternative apps like Earnin that are more versatile, Cash App is a good choice.

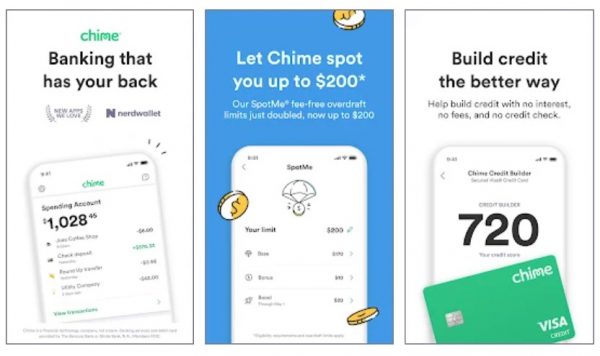

3. Chime

Chime works more like a bank than anything else. Nonetheless, it’s one of the most convenient apps like Earnin out there. How does it work? With Chime, you can get an advance up to two days ahead of your payday.

Now, we understand that’s not the ideal time frame and isn’t as helpful for financial emergencies. However, there are numerous benefits to Chime that can overshadow that flaw. For example, the spending account and Visa Debit Card newly registered users get. With those, you immediately have the right tools to spend money at your disposal without qualms. You can even withdraw money from your Chime account anytime through an ATM.

In addition, Chime doesn’t charge any transaction fees or subscriptions and it doesn’t even ask for tips. Instead, Chime earns through interchange fees that you incur whenever you use the debit card.

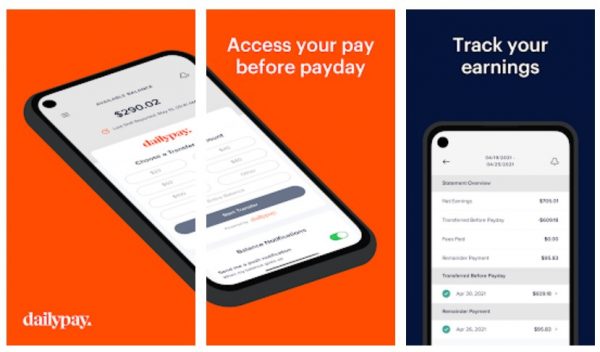

4. DailyPay

If you want to withdraw your balance earlier in the payroll cycle, the right apps like Earnin are hard to come by. Thankfully, alternatives such as DailyPay do exist. How does it work?

Simply put, the DailyPay app integrates with your company’s payroll system. This allows the app to calculate how much you’ve already earned as you work. You can then choose to withdraw your balance anytime as long as you’ve already earned it. Of course, this does come with a $1.99 transaction fee, but that’s fairly affordable if you don’t withdraw often.

The only downside with DailyPay is that it has to work with your company already. Thus, if the app isn’t linked to your company’s payroll system, there’s no way you can use it.

5. Dave

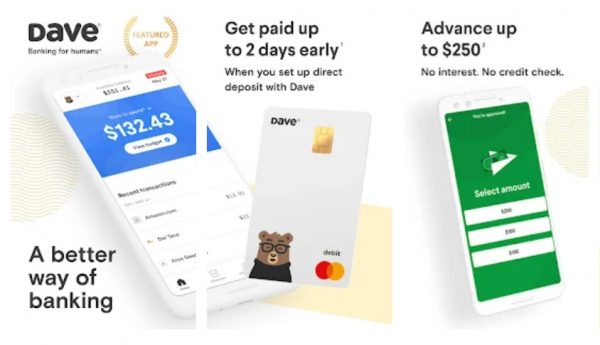

If you’re looking for another app similar to Earnin, then we highly recommend Dave. Like when you’re using Earnin, you can get a maximum advance of $100 up to two days before payday and without fees. The only thing Dave will cost you is a $1 monthly subscription.

Now, that may seem like a disadvantage considering Earnin charges you nothing but tips. Nonetheless, what makes Dave a great alternative is how it helps you earn credit. This is because Dave has partnerships with LevelCredit, allowing you to report your rent payments to credit bureaus. In turn, this will help bolster your credit rating and improve your overall score.

6. Even

If you want to get unlimited instant advances on your paycheck, Even is the better choice over other apps like Earnin. Why? Even doesn’t restrict its users on when, how often, or how much they withdraw. As long as you’ve already earned it, Even will let you withdraw it.

Of course, there are strings attached to the app, and they come in two forms. The first is the monthly subscription it charges users, and the second is company integration. Let’s talk about the former first.

Even charges an $8 fee, which you have to pay monthly. While this may seem steep, the app actually charges a fairly low price if you withdraw pretty often. Moreover, these payments come instantly. To top it off, Even throws in additional features for budgeting and accumulating savings.

The second catch is that Even has to integrate with your company. Hence, your employer has to have already partnered with the app for you to use it. If not, you’ll have to look for other solutions.

7. Fast Cash Advance

Many apps like Earnin don’t always provide quick approvals for loans and advances. That’s the main reason why people like to look for alternatives. If speed is your main priority, check out Fast Cash Advance.

Through Fast Cash Advance, you can apply for payday loans and get quick approvals. Its approval system is so quick that it can even take only minutes to complete. The app even notifies you about the status of your request.

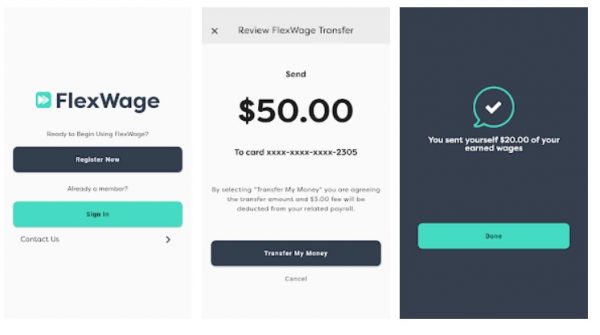

8. FlexWage

Like other apps like Earnin, FlexWage is best used when it’s integrated into your employer’s system. Once set, you can get an advance on your salary before payday. Unlike Earnin, though, there will be fees attached to the service, but those will depend on your employer.

Apart from advances, FlexWage has other features that you might find compelling. For one, it has something called Flex Pay which is the feature that lets you access immediate one-time earnings. The said income can be from anywhere, like tips, bonuses, or commissions if you’re a freelancer.

In addition, FlexWage has a Pay Card feature that essentially acts as a prepaid debit card. You can use it in tandem with FlexWage compensations, and once you have money, you can use it anytime.

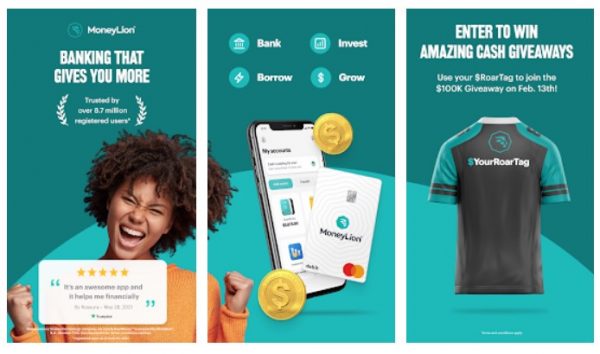

9. MoneyLion

If you’re looking for apps like Earnin that work with Chime, then we recommend MoneyLion. However, the key difference between Earnin and MoneyLion is that the latter provides loans, not advances.

Through the app, you can get a loan of up to $1,000 starting from the first year. The best part is you can get a loan no matter what your credit score is. Moreover, it even boosts your credit score if you pay within the deadline.

Overall, MoneyLion is a great option if your credit score isn’t good. However, it does have a catch — the steep $19.99 monthly membership. It also has a high APR (about 5.99% to 29.99%, inclusive of your monthly fee). Nonetheless, it’s a good deal if you need to spend on something big.

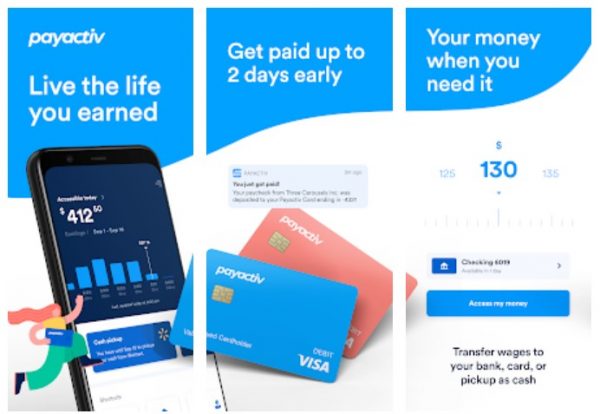

10. PayActiv

PayActiv is among the handiest apps like Earnin that let you withdraw your paycheck in advance. But what makes it better than Earnin is that it increases your withdrawal limit to $500. Moreover, it charges no interest or fees unless you gain money with PayActiv.

With it, you can also opt to get a prepaid card for accessing your funds. That card is good for online and offline transactions, and it even lets you withdraw cash through ATMs. Unfortunately, there is a downside to PayActiv, and that’s company integration. This means it works like other apps like Earnin that need to explicitly partner with your employer. So, if your company doesn’t integrate with the app, you’re better off getting something else.

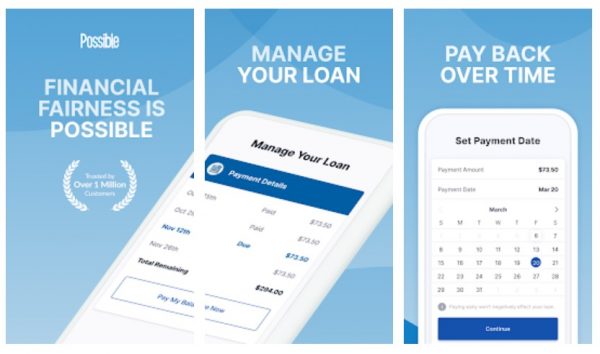

11. Possible Finance

If you like the idea of borrowing money online but aren’t keen on MoneyLion’s terms, you can use Possible Finance. Unlike most lending apps, Possible Finance provides shorter terms of up to eight weeks. Of course, this means the money you can borrow is a lot smaller as well – about $500 maximum.

However, it’s still a good alternative, especially if you don’t have that much to withdraw as an advance. What’s more, Possible Finance can even improve your credit score if you make repayments quickly. Although the APR is quite high – around 150% to 200% – it’s still lower than payday loans.

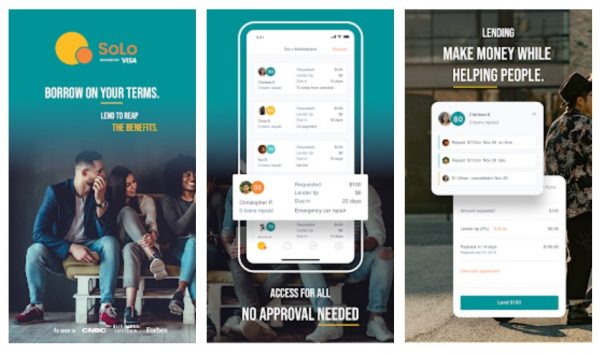

12. SoLo Funds

Apps like Earnin that loan you money tend to only go one way. So, if you want to not only borrow money but also lend it, go for SoLo Funds. Via the app, you can borrow or lend money as you please to manage earnings. Its loans cap is $1,000 and usually has terms of 14 to 30 days. That’s pretty short but also convenient if you need decent cash quickly.

What also makes SoLo Funds great is that it charges you no fees. All you need to do is get the app, and you can start borrowing or lending money. Of course, finding a good deal means you have to do a little digging. Nonetheless, it’s a pretty convenient platform if all you need are connections.

13. Vola

One of the most notable apps like Earnin and Dave is Vola. With it, you only need to pay $5 monthly to get a $300 advance. Sure, that’s not ideal, considering other apps like Earnin charge less and give more. However, you can change these restrictions if you get higher Vola Scores as you use the app. If you can get a high score, you can obtain a higher advance limit and lower your subscription fee.

14. Zirtue

A lot of peer-to-peer lending apps like Earnin seem to get their funds from pools of money lent by strangers. While this format may be convenient, sometimes it’s a little uncomfortable especially if you don’t like trusting strangers. This is precisely why Zirtue exists and why it’s included in this list.

What is Zirtue? Simply put, it’s a lending app that, instead of connecting you to random lenders, connects you to people you know. Zirtue allows you to lend or borrow money from friends or family and keeps track of the cash flow. Thus, there’s more structure and assurance you’ll get paid.

Conclusion

There are many cash advance and lending apps like Earnin on the market you can use. But remember, availability doesn’t mean good reliability.

Despite the benefits, some apps might not be worth it even if you’re struggling with your cash flow. And several apps charge high interest rates or ask for a monthly fee. So, aside from picking the best apps, be wise when it comes to money management and earn or pay back what you owe. Otherwise, you’ll be in deep trouble even with access to apps like Earnin.