Welcome to our comprehensive guide on how to transfer money from Apple Pay. In the digital age, mobile payment systems have revolutionized the way we handle financial transactions, and Apple Pay is at the forefront of this innovative technology. Whether you need to send money to a friend, pay for goods and services, or split a bill, Apple Pay provides a convenient and secure platform to make seamless money transfers. In this article, we will walk you through the step-by-step process of transferring money using Apple Pay, including setting up the app, adding payment methods, and initiating transfers. So, if you’re ready to make your life easier by harnessing the power of mobile payments, let’s get started!

Inside This Article

- Apple Pay: An Overview

- Adding and Setting Up Apple Pay – Linking bank accounts and cards to Apple Pay – Verifying cards for use with Apple Pay – Setting up security features

- Transferring Money with Apple Pay

- Apple Pay Transaction Fees and Limits

- Troubleshooting and FAQs – Common issues with Apple Pay transfers and their solutions – Frequently asked questions about transferring money with Apple Pay

- Conclusion

- FAQs

Apple Pay: An Overview

Apple Pay is a digital payment service offered by Apple, which allows users to make secure transactions using their iPhones, iPads, or Apple Watches. It provides a convenient and efficient way to make payments without the need for physical cards or cash.

So how does Apple Pay work? When making a payment, Apple Pay uses Near Field Communication (NFC) technology to communicate with a compatible payment terminal. The user simply needs to hold their device near the terminal, authenticate the payment using Face ID, Touch ID, or a passcode, and the transaction is completed.

There are several benefits to using Apple Pay. Firstly, it offers enhanced security. Instead of sharing card details with a merchant, Apple Pay generates a unique Device Account Number for each transaction, keeping your financial information secure. Additionally, the biometric authentication methods provide an extra layer of security, making it difficult for unauthorized users to access your device and make payments.

Another advantage of Apple Pay is its widespread acceptance. It is accepted at millions of locations worldwide, including major retailers, restaurants, and online stores. This makes it easy and convenient to use in various situations, whether you’re shopping in-store or making an online purchase.

Apple Pay also simplifies the checkout process. With just a few taps, you can complete your purchase, eliminating the need to manually enter card details or fill out lengthy forms. This saves both time and effort, making the overall payment experience smoother and more efficient.

Overall, Apple Pay offers a secure, convenient, and streamlined way to make payments using your Apple devices. With its ease of use and enhanced security features, it has become a popular choice for many users to handle their transactions effortlessly.

Adding and Setting Up Apple Pay – Linking bank accounts and cards to Apple Pay – Verifying cards for use with Apple Pay – Setting up security features

Adding and setting up Apple Pay on your device is a simple process that allows you to conveniently make secure transactions. Here are the steps to link your bank accounts and cards to Apple Pay, verify them, and set up important security features:

1. Linking bank accounts and cards to Apple Pay: To start using Apple Pay, you need to add your bank accounts and credit or debit cards to your Apple Wallet. Open the Wallet app on your iPhone or iPad, and tap on the “+” icon to add a new card. You can either use the camera to scan your card details or enter them manually.

2. Verifying cards for use with Apple Pay: After adding your cards, you may need to verify them with your bank or card issuer. This typically involves receiving a verification code via SMS, email, or a phone call. Follow the prompts to complete the verification process. Once verified, your cards are ready to be used with Apple Pay.

3. Setting up security features: Apple Pay offers several security features to ensure the safety of your transactions. One such feature is Touch ID or Face ID, which allows you to authenticate payments with your fingerprint or facial recognition. To set up Touch ID or Face ID, go to the Settings app on your device and navigate to Face ID & Passcode or Touch ID & Passcode. Enable the option to use your biometric data for Apple Pay transactions.

In addition, you can also set up a passcode to secure your device and prevent unauthorized access to Apple Pay. Go to Settings, then navigate to Touch ID & Passcode or Face ID & Passcode, and select “Add a passcode.” Choose a strong and memorable passcode that you will use to unlock your device and authorize transactions with Apple Pay.

It is worth noting that the exact steps and options for adding and setting up Apple Pay may vary slightly depending on your device model, iOS version, and region. However, the general process remains the same.

By linking your bank accounts and cards to Apple Pay, verifying them, and setting up security features, you can ensure a seamless and secure payment experience with your Apple devices.

Transferring Money with Apple Pay

Apple Pay not only allows you to make convenient and secure payments at various merchants, but it also enables you to transfer money to your contacts or even to your bank accounts or debit cards. Let’s explore the different ways you can transfer money with Apple Pay.

Sending Money to Contacts within Apple Pay

One of the easiest ways to transfer money is by sending it directly to your contacts within the Apple Pay app. Simply follow these steps:

- Open the Apple Pay app on your iPhone or iPad.

- Select the contact you want to send money to.

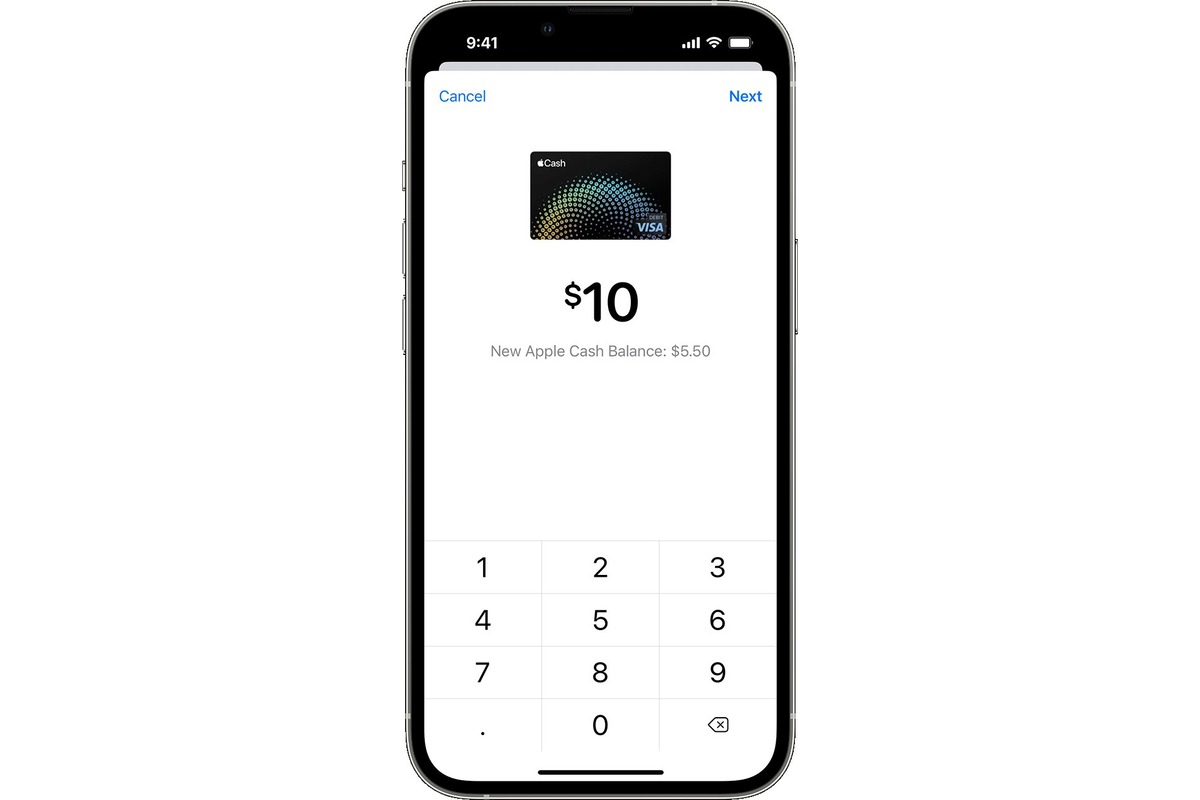

- Enter the amount you wish to transfer.

- Review the payment details and confirm the transaction.

Once the transaction is complete, the recipient will receive the money in their Apple Pay account and can use it for purchases or transfer it to their bank account.

Transferring Money to Bank Accounts or Debit Cards

If you need to transfer money to a bank account or debit card instead of a contact within Apple Pay, you can do so by following these steps:

- Open the Apple Pay app on your device.

- Tap on the “Wallet & Apple Pay” option.

- Select the bank account or debit card you want to transfer money to.

- Enter the amount you wish to transfer.

- Confirm the transaction and enter any required security details.

Apple Pay will typically process the transfer within a few business days, and the money will be available in the designated bank account or debit card.

Requesting Money from Contacts

If you’re in need of funds from a contact, Apple Pay allows you to send a request for money. Follow these steps to request money from your contacts:

- Open the Apple Pay app on your device.

- Select the contact you wish to request money from.

- Tap on the “Request” option.

- Enter the amount you want to request and add a brief note if necessary.

- Send the request, and the recipient will receive a notification to fulfill it.

Your contact can then choose to accept or decline the request. If accepted, the money will be transferred to your Apple Pay account, and you can use it as you wish.

With Apple Pay, transferring money has never been easier. Whether you need to send money to a friend, transfer funds to your bank, or request money from a contact, Apple Pay provides a secure and user-friendly platform for all your financial transactions.

Apple Pay Transaction Fees and Limits

When it comes to transferring money using Apple Pay, it’s important to be aware of the transaction fees and limits associated with the service. Understanding these fees and limits can help you plan your transfers more effectively and avoid any unexpected charges.

Firstly, let’s talk about transaction fees. Apple Pay typically does not charge any fees for transferring money between users. This means that you can send money to your contacts or receive money from them without incurring any additional costs. This makes Apple Pay a convenient and cost-effective option for peer-to-peer transactions.

However, it’s worth noting that there may be certain exceptions and additional charges depending on your financial institution or the type of transaction. Some banks or card issuers may impose fees for transferring money from Apple Pay to your linked bank account or debit card. It’s recommended to check with your bank or card issuer for any specific fees that may apply.

In addition to transaction fees, there are also limits on the amount of money you can transfer using Apple Pay. These limits vary depending on your bank and the type of transfer you are making. For most users, the daily transfer limit for Apple Pay is typically set at $10,000. This means that you can transfer up to $10,000 in a single day using Apple Pay.

However, it’s important to note that some banks may have lower limits, so it’s always a good idea to check with your bank to determine your specific transfer limit. If you need to transfer an amount that exceeds the daily limit, you may need to consider alternative methods or break the transfer into smaller amounts over multiple days.

Furthermore, there are additional restrictions and limits on international transfers made through Apple Pay. These limits can vary depending on the country and the specific financial institution involved. It’s recommended to consult with your bank or financial institution to understand the applicable restrictions and limits for international transfers using Apple Pay.

Lastly, it’s crucial to keep in mind that the transaction fees, limits, and additional charges associated with Apple Pay are subject to change. Banks and financial institutions may update their policies and fees over time, so it’s always a good idea to stay updated by checking with your bank or referring to the Apple Pay website for the most recent information.

By understanding the transaction fees and limits associated with Apple Pay, you can make informed decisions when transferring money using the service. Whether you’re sending money to a friend or paying for goods and services, knowing the fees and limits in advance can help you manage your finances more effectively and avoid any surprises.

Troubleshooting and FAQs – Common issues with Apple Pay transfers and their solutions – Frequently asked questions about transferring money with Apple Pay

As with any financial transaction, there may be occasional hiccups when using Apple Pay to transfer money. Here are some common issues that users may encounter and the solutions to resolve them:

1. Payment Declined: One common issue is when a payment is declined when attempting to transfer money with Apple Pay. This can happen due to insufficient funds, incorrect card information, or restrictions set by your bank. To resolve this issue, ensure that you have enough funds available and verify that the card information is entered correctly. You may also need to contact your bank to lift any restrictions on your account.

2. Communication Error: Sometimes, a communication error may occur when trying to send money using Apple Pay. This could be due to a weak internet connection or a temporary issue with the Apple Pay service. Check your internet connection, try again later, or contact Apple Support for assistance if the problem persists.

3. Incorrect Payment Amount: Another common issue is when the payment amount entered is incorrect. Double-check the entered amount before confirming the transfer to ensure accuracy. If an incorrect payment has already been sent, contact the recipient and ask for a refund or discuss how to rectify the situation.

4. Issues with Contacts: Sometimes, you may encounter issues when trying to transfer money to your contacts through Apple Pay. Ensure that the contact information is correct and up-to-date in your phone’s contact list. If the issue persists, try deleting and re-adding the contact or contact Apple Support for further assistance.

5. Security Concerns: If you have concerns about the security of your Apple Pay transactions, make sure that you have enabled the necessary security features such as Face ID, Touch ID, or a passcode. Additionally, regularly update your device’s operating system and keep an eye out for any suspicious activity in your transaction history. If you suspect fraud or unauthorized transactions, contact your bank immediately.

Now, let’s address some frequently asked questions about transferring money with Apple Pay:

Q: Is there a fee to transfer money with Apple Pay?

A: In most cases, there are no fees associated with transferring money using Apple Pay. However, some banks or financial institutions may have their own policies and fees, so it is always a good idea to check with your bank for any applicable charges.

Q: Can I transfer money internationally with Apple Pay?

A: Currently, Apple Pay is primarily available for domestic transactions within the country where your Apple Pay account is registered. International transfers are not widely supported, but it’s always a good idea to check with your bank or Apple for the most up-to-date information.

Q: How long does it take for money to be transferred with Apple Pay?

A: In most cases, money transferred with Apple Pay is processed and available almost immediately. However, some banks or financial institutions may take longer to process the transaction, so the timing may vary.

Q: Can I cancel or reverse a payment made through Apple Pay?

A: Once a payment is sent through Apple Pay, it cannot be canceled or reversed directly through the Apple Pay app. You will need to contact the recipient and request a refund or come to an agreement on how to resolve the situation.

Q: Is Apple Pay secure for transferring money?

A: Apple Pay utilizes various security features such as device authentication (Face ID, Touch ID, or passcode), tokenization, and encryption to ensure the security of your transactions. However, it is always important to maintain good online security practices and be cautious when sharing sensitive information.

By addressing common issues and answering frequently asked questions, we hope to have provided you with insights and solutions to help you have a smooth experience when transferring money with Apple Pay.

In conclusion, transferring money from Apple Pay is a convenient and secure way to send and receive funds. With just a few simple steps, users can easily link their bank accounts or cards to Apple Pay and start sending money to friends and family without the hassle of cash or checks.

Apple Pay provides an intuitive and seamless experience, allowing users to make payments and transfers directly from their mobile devices. The added security features, such as Touch ID and Face ID, ensure that your transactions are protected. Plus, the ability to sync Apple Pay across multiple devices makes it even more convenient.

Whether you need to split a bill, pay a friend back, or send money to a loved one, Apple Pay offers a fast and reliable solution. So, if you haven’t tried it yet, give it a go and discover the convenience of transferring money with Apple Pay.

FAQs

1. Can I transfer money from Apple Pay to a bank account?

Unfortunately, Apple Pay does not have a direct feature to transfer money from your Apple Pay account to a bank account. However, you can use services like Apple Cash or third-party apps to send money to friends and family, which they can then transfer to their bank accounts.

2. Can I transfer money between Apple Pay and other digital wallets?

No, Apple Pay does not support direct transfers between different digital wallets. Apple Pay is designed to primarily facilitate payments in stores and online through your Apple devices.

3. How long does it take to transfer money from Apple Pay to another person?

The time it takes to transfer money from Apple Pay to another person depends on the method you choose. If you are using Apple Cash, the transfer is usually immediate. However, if you are using a third-party app, the transfer time may vary depending on their processing times.

4. Are there any fees associated with transferring money through Apple Pay?

Apple Pay itself does not charge any fees for transferring money. However, third-party apps or services may have their own fees for facilitating the transfer. It is always best to check and compare the fees associated with different apps or services before initiating a transfer.

5. Is it safe to transfer money through Apple Pay?

Yes, transferring money through Apple Pay is generally considered safe. Apple Pay uses various security features, including encryption, tokenization, and biometric authentication, to protect your financial information during transactions. However, it’s important to ensure that you are using legitimate and trusted apps or services when making transfers through Apple Pay.