Are you looking for a convenient way to deposit a check into your Chase bank account? Well, you’re in luck! Chase offers a user-friendly mobile deposit feature that allows you to deposit checks without having to visit a branch. But before you can take advantage of this convenient service, you may be wondering how to properly endorse your check. In this article, we will guide you through the process of endorsing a check to Chase Mobile Deposit. Whether you’re a tech-savvy individual or new to the world of mobile banking, we’ve got you covered with step-by-step instructions and tips to ensure a successful mobile deposit experience. So, let’s dive in and explore how you can easily endorse your check and deposit it using Chase’s mobile app.

Inside This Article

- Title: How To Endorse A Check To Chase Mobile Deposit

- What is Chase Mobile Deposit?

- Understanding the Importance of Endorsing a Check

- Step-by-Step Guide to Endorsing a Check for Chase Mobile Deposit

- Tips and Best Practices for a Smooth Endorsement Process

- Conclusion

- FAQs

Title: How To Endorse A Check To Chase Mobile Deposit

If you’re a Chase customer and want to save a trip to the bank, you’ll be glad to know that Chase offers a convenient feature called “Mobile Deposit.” With Mobile Deposit, you can deposit checks directly into your Chase checking or savings account using the camera on your smartphone. However, before you can make a mobile deposit, you need to know how to properly endorse the check. In this article, we’ll guide you through the process of endorsing a check for Chase Mobile Deposit.

Understanding the endorsement process is crucial to ensure the check gets processed correctly. When you endorse a check, you’re essentially giving permission for the bank to deposit the funds into your account. In the case of Chase Mobile Deposit, it’s crucial to follow the endorsement guidelines to avoid any delays or complications.

Here are the steps to endorse a check for Chase Mobile Deposit:

- Flip the check over and locate the backside.

- Write “For Mobile Deposit Only” above the endorsement line. This statement indicates that the check should only be deposited via mobile.

- Sign your name exactly as it appears on the front of the check.

Once you’ve completed these steps, your check is now properly endorsed for Chase Mobile Deposit. It’s essential to remember that you should not fold, staple, or damage the check in any way that may affect the visibility of the necessary information.

Tips for a successful mobile deposit:

- Ensure the check is properly endorsed and the image is clear and legible.

- Find a well-lit area with a stable surface to capture the check image.

- Make sure your smartphone camera lens is clean to avoid blurry images.

- Double-check the entered amount to avoid errors.

- Keep the original check in a secure location for a few weeks before safely disposing of it.

By following these tips, you can maximize your chances of a successful mobile deposit and avoid any issues or delays.

If you encounter any problems while depositing a check using Chase Mobile Deposit, here are some common issues and troubleshooting steps:

- Image is blurry: Make sure the check is well-positioned and your smartphone camera lens is clean. Retake the photo in a well-lit area for better image quality.

- Check is not being accepted: Verify that the check is properly endorsed and that nothing is obstructing any crucial information, such as the account number or MICR line.

- Amount entered is incorrect: Double-check the amount entered and ensure it matches the amount written on the check. If there is a discrepancy, correct it and attempt the deposit again.

Remember, endorsing a check correctly is essential for a smooth mobile deposit process. By following the steps outlined in this article and keeping these tips in mind, you’ll be well-prepared to make a successful mobile deposit using Chase Mobile Deposit. So go ahead and streamline your banking experience with the convenience of depositing checks from the comfort of your own smartphone!

What is Chase Mobile Deposit?

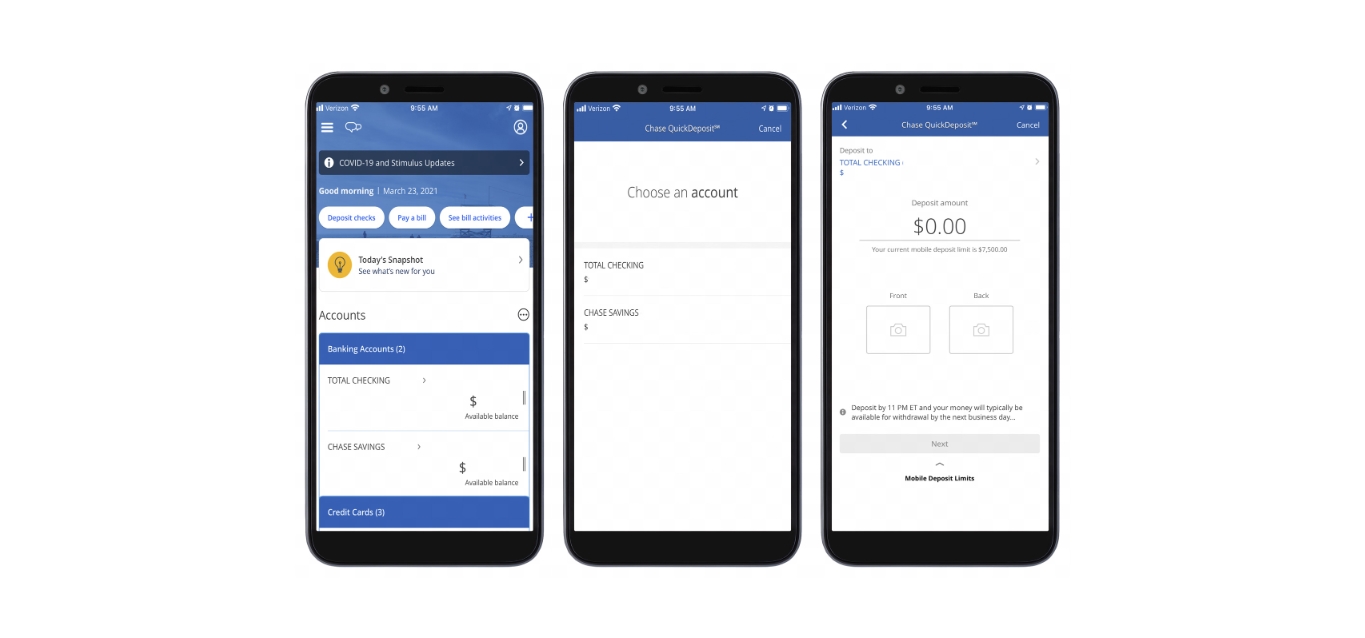

Chase Mobile Deposit is a convenient feature offered by Chase Bank that allows users to deposit checks using their mobile phone. With this feature, you no longer need to visit a physical branch or ATM to deposit a check. Instead, you can simply take a photo of the front and back of the check, and the funds will be deposited into your Chase account.

Understanding the Importance of Endorsing a Check

Endorsing a check is a crucial step in the mobile deposit process. It is a way of confirming that you are the intended recipient of the funds and that you authorize Chase Bank to process the deposit. By endorsing the check, you also minimize the risk of any potential fraud or unauthorized use of the funds.

Step-by-Step Guide to Endorsing a Check for Chase Mobile Deposit

Here is a step-by-step guide to help you correctly endorse a check for Chase Mobile Deposit:

- Sign the back of the check: In the designated endorsement area on the back of the check, sign your name exactly as it appears on the front of the check. Use a pen with dark ink to ensure clarity.

- Write “For Mobile Deposit Only” below your signature: This additional endorsement helps to specify that the check is being deposited through the mobile deposit feature.

- Ensure check is properly filled out: Before endorsing, make sure all the necessary fields on the front of the check, such as the date, payee information, and amount, are correctly filled out.

- Verify the check amount: Confirm that the amount written on the front of the check matches the actual amount you wish to deposit.

- Capture clear images of the check: Open the Chase Mobile app on your phone and select the Mobile Deposit option. Follow the prompts to take photos of the front and back of the check, making sure that the images are clear and all corners of the check are captured.

- Submit the deposit: Review the deposit details and confirm the transaction. The funds will typically be available in your account within a few business days.

Tips and Best Practices for a Smooth Endorsement Process

To ensure a smooth endorsement process for Chase Mobile Deposit, consider the following tips and best practices:

- Use a well-lit area: When capturing images of the check, find a well-lit area that eliminates shadows and ensures clarity.

- Avoid folded or damaged checks: Make sure the check is in good condition without any folds, tears, or damages that could hinder the scanning process.

- Double-check the information: Before submitting the deposit, review all the details, including the check amount, to avoid any errors.

- Keep the check for a designated period: After depositing the check through the mobile app, retain the physical check for a specified period, usually 30 to 60 days, as a precautionary measure.

- Contact Chase for assistance: If you encounter any issues during the endorsement or mobile deposit process, don’t hesitate to reach out to Chase Bank’s customer support for assistance. They will be able to guide you through the troubleshooting steps.

By following these guidelines and using the Chase Mobile Deposit feature responsibly, you can enjoy the convenience and efficiency of depositing checks from the comfort of your own home or on the go.

Conclusion

In conclusion, endorsing a check to Chase mobile deposit is a convenient and efficient way to deposit funds into your account. By following the step-by-step process outlined in this article, you can ensure that your check is properly endorsed and submitted through the mobile app. The Chase mobile deposit feature eliminates the need to physically visit a branch or ATM, saving you time and effort.

Remember to always double-check the accuracy of the information entered into the app, including the amount and account number. Additionally, make sure the check is properly endorsed and written “for mobile deposit only”. This will help to minimize any potential errors or issues with the deposit.

With the simplicity and convenience of mobile banking, Chase makes it easier than ever to manage your finances on the go. By taking advantage of the mobile deposit feature, you can deposit checks quickly, safely, and securely from the comfort of your own home or anywhere you have a reliable internet connection.

So why wait? Start utilizing the Chase mobile deposit feature today and experience the convenience of depositing checks with just a few taps on your smartphone or tablet.

FAQs

1. What is mobile deposit?

2. Does Chase Bank offer mobile deposit?

3. How do I endorse a check for mobile deposit?

4. Is it safe to endorse a check for mobile deposit?

5. Are there any limitations to mobile deposit?