Title: Why Can't I Mobile Deposit My Check

In today's fast-paced world, mobile banking has become an integral part of managing personal finances. The convenience of depositing checks using a mobile device has revolutionized traditional banking practices. However, encountering issues with mobile check deposits can be frustrating and perplexing for users. From technical glitches to specific limitations, various factors can hinder the seamless process of mobile check deposits.

This article aims to unravel the common reasons behind the question, "Why can't I mobile deposit my check?" By delving into the intricacies of mobile banking technology, account policies, and check characteristics, we will shed light on the potential barriers that users may encounter. Understanding these factors can empower individuals to navigate through challenges and make informed decisions when utilizing mobile deposit services.

So, let's embark on a journey to uncover the mysteries behind mobile check deposits and equip ourselves with the knowledge to overcome obstacles in this digital financial landscape.

Inside This Article

- Understanding Mobile Deposit

- Common Reasons for Mobile Deposit Rejection

- Tips for Successful Mobile Deposit

- Conclusion

- FAQs

Understanding Mobile Deposit

Mobile deposit, also known as remote deposit capture, is a convenient and time-saving feature offered by many banks and financial institutions. It allows account holders to deposit checks into their accounts using a smartphone or tablet, eliminating the need to visit a physical bank branch. This innovative technology has transformed the way individuals and businesses handle their banking transactions, providing a seamless and efficient alternative to traditional deposit methods.

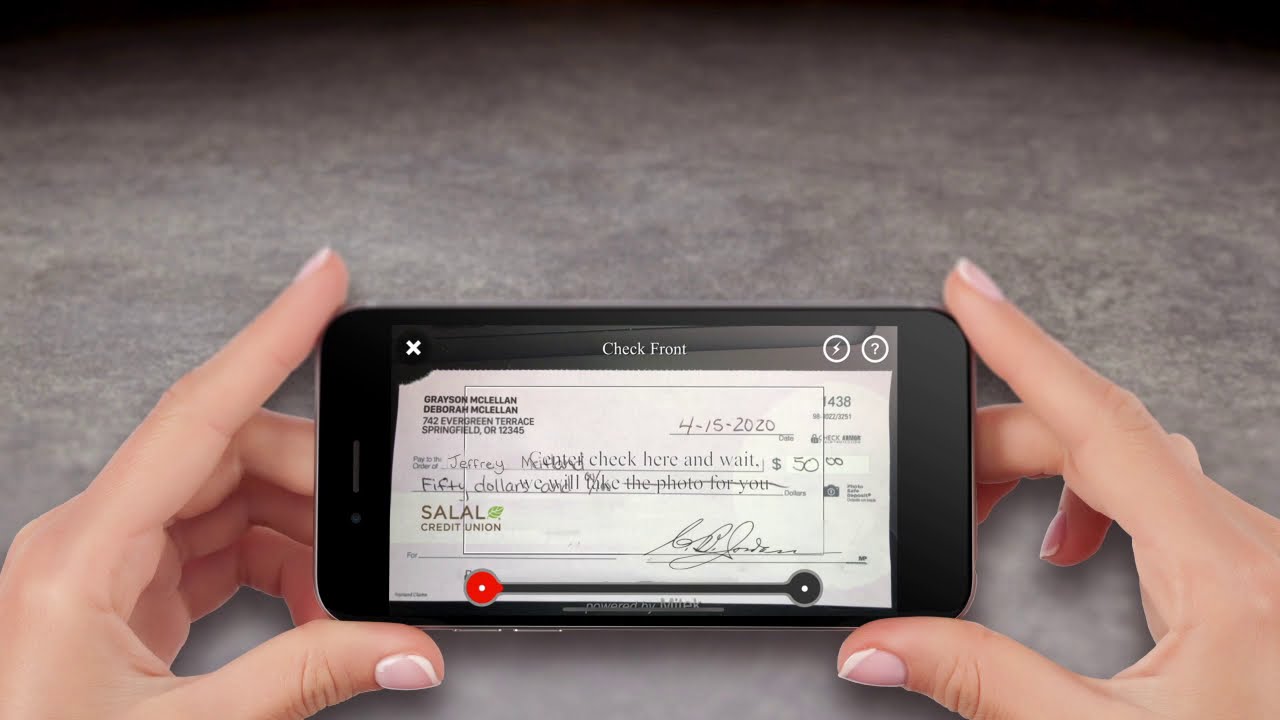

When utilizing mobile deposit, users are typically required to download their bank's mobile app and follow the specific instructions for depositing a check. The process involves capturing images of the front and back of the check using the device's camera, inputting the deposit amount, and selecting the account for the deposit. Once the images are submitted, the bank's system processes the deposit, and the funds are typically made available in the account within a specified timeframe, often within one to two business days.

Mobile deposit leverages advanced image recognition and security technologies to ensure the accuracy and integrity of the deposited checks. These systems are designed to detect and prevent fraudulent activities, such as duplicate deposits or altered checks, safeguarding both the bank and its customers against potential risks.

Furthermore, mobile deposit offers unparalleled convenience, enabling users to deposit checks anytime and anywhere, without being constrained by traditional banking hours or geographical limitations. This flexibility is particularly beneficial for individuals with busy schedules, remote workers, and businesses that receive a high volume of checks.

It's important to note that while mobile deposit provides numerous advantages, there are certain limitations and guidelines that users must adhere to. For instance, there are often restrictions on the types of checks that can be deposited via mobile, such as money orders, foreign checks, or third-party checks. Additionally, there are usually daily and monthly deposit limits imposed by banks to mitigate potential risks associated with mobile deposit transactions.

Understanding the intricacies of mobile deposit empowers users to make informed decisions and maximize the benefits of this convenient banking feature. By familiarizing themselves with the specific requirements and best practices outlined by their financial institution, individuals can confidently and securely leverage mobile deposit to streamline their banking experience and expedite the processing of check deposits.

Common Reasons for Mobile Deposit Rejection

Mobile deposit offers unparalleled convenience, but there are instances where a deposit may be rejected by the bank. Understanding the common reasons for mobile deposit rejection is crucial for users to avoid potential frustrations and delays in accessing their funds.

-

Image Quality: One of the primary reasons for mobile deposit rejection is poor image quality. When capturing images of the front and back of the check, it's essential to ensure that the entire check is visible, with no blurriness or distortion. Any smudges, shadows, or irregularities in the images can lead to rejection, as the bank's system may struggle to accurately process the check.

-

Missing Endorsement: For security and verification purposes, checks deposited via mobile often require proper endorsement. Failure to sign the back of the check with the account holder's signature, along with the phrase "For Mobile Deposit Only," can result in rejection. It's crucial to follow the specific endorsement instructions provided by the bank to prevent this issue.

-

Duplicate Deposit: Attempting to deposit the same check through both mobile and traditional means can lead to rejection. Banks have sophisticated systems in place to detect duplicate deposits, and such actions are flagged to prevent potential fraud or double funding of the same check.

-

Amount Exceeds Limit: Many banks impose daily and monthly deposit limits for mobile deposit transactions. If the deposit amount exceeds these limits, the transaction may be rejected. It's important for users to be aware of their bank's deposit limits and consider alternative deposit methods for larger amounts.

-

Check Eligibility: Certain types of checks may not be eligible for mobile deposit, such as money orders, third-party checks, or checks with restrictive endorsements. Attempting to deposit such checks via mobile can lead to rejection. Users should familiarize themselves with their bank's guidelines regarding acceptable check types for mobile deposit.

-

Account Holds or Restrictions: In some cases, account-specific holds or restrictions may lead to mobile deposit rejection. This could be due to outstanding account issues, previous deposit concerns, or other factors that prompt the bank to reject the deposit. Users should contact their bank to address any account-related issues that may be causing rejections.

Understanding these common reasons for mobile deposit rejection empowers users to take proactive measures to ensure successful and efficient check deposits. By adhering to best practices, maintaining clear communication with the bank, and being mindful of the specific requirements for mobile deposit, individuals can minimize the likelihood of experiencing deposit rejections and enjoy the full benefits of this convenient banking feature.

Tips for Successful Mobile Deposit

Ensuring a seamless and successful mobile deposit experience requires attention to detail and adherence to best practices. By following these essential tips, users can optimize their mobile deposit process and minimize the risk of rejection or delays.

-

Prepare the Check: Before initiating the mobile deposit, ensure that the check is in optimal condition. Straighten any folds or creases, remove any staples or clips, and ensure that the writing is clear and legible. This preparation minimizes the risk of image quality issues during the capture process.

-

Choose the Right Environment: Select a well-lit environment with minimal glare and distractions when capturing images of the check. Adequate lighting and a plain, contrasting background can significantly enhance the clarity and quality of the check images, reducing the likelihood of rejection due to poor image quality.

-

Follow Endorsement Guidelines: Properly endorse the back of the check with your signature and include the phrase "For Mobile Deposit Only" as per the bank's specific instructions. Adhering to the endorsement guidelines is crucial for security and verification, reducing the risk of rejection due to missing endorsement.

-

Verify Deposit Limits: Familiarize yourself with the daily and monthly deposit limits set by your bank for mobile deposit transactions. If the check amount exceeds these limits, consider alternative deposit methods or contact the bank for guidance to avoid rejection due to exceeding deposit limits.

-

Double-Check Account Information: Ensure that you select the correct account for the deposit and input the accurate deposit amount. Verifying the account information and deposit details minimizes the risk of errors that could lead to rejection or processing delays.

-

Retain the Original Check: After a successful mobile deposit, retain the original check for a reasonable period, typically at least 15 days. This serves as a precautionary measure in case any issues arise with the deposit and may be requested by the bank for verification purposes.

-

Monitor Deposit Status: Keep track of the deposit status through the bank's mobile app or online banking platform. If there are any concerns or if the deposit is not processed within the expected timeframe, promptly reach out to the bank for assistance and clarification.

-

Stay Informed: Regularly review the bank's mobile deposit terms and guidelines to stay informed about any updates or changes that may impact the deposit process. Being aware of the latest requirements and recommendations can help ensure a smooth and successful mobile deposit experience.

By incorporating these tips into their mobile deposit routine, users can enhance the efficiency and reliability of their check deposits, mitigating the risk of rejection and enjoying the full benefits of this convenient banking feature.

In conclusion, mobile deposit offers a convenient and efficient way to deposit checks, providing flexibility and saving time for users. However, various factors such as check eligibility, endorsement requirements, and technical issues can impact the ability to use this feature. Understanding the reasons behind mobile deposit limitations can help users navigate potential challenges and make informed decisions. By staying informed about the specific requirements and limitations of mobile deposit, individuals can maximize the benefits of this convenient banking feature while effectively managing their financial transactions.

FAQs

-

Why can't I mobile deposit my check?

- There are several reasons why you may be unable to deposit your check using a mobile app. It could be due to a poor image of the check, unsupported check types, or issues with your account or the mobile deposit feature itself.

-

What should I do if my mobile deposit is declined?

- If your mobile deposit is declined, double-check the image quality of the check, ensure that the check is eligible for mobile deposit, and verify that you've endorsed the check properly. If the issue persists, reach out to your bank's customer support for assistance.

-

Are there limitations on the amount I can deposit via mobile?

- Yes, many banks impose limits on the amount you can deposit through mobile banking. These limits vary by institution and account type. It's advisable to check with your bank to understand the specific mobile deposit limits that apply to your account.

-

Can I deposit any type of check using mobile deposit?

- Not all checks are eligible for mobile deposit. For instance, some banks may not accept third-party checks, foreign checks, or checks exceeding a certain amount. Additionally, checks that are damaged, altered, or not properly endorsed may not be accepted via mobile deposit.

-

How long does it take for a mobile deposit to clear?

- The time it takes for a mobile deposit to clear can vary depending on the bank's policies. In general, funds from a mobile deposit may be made available within one to two business days, but this timeline can differ based on the specific bank and the nature of the deposited check.