Mobile check deposit has revolutionized the way we handle banking transactions, offering unparalleled convenience and flexibility. However, there are times when you may need to cancel a mobile check deposit for various reasons. Understanding the process of canceling a mobile check deposit is crucial for managing your finances effectively. In this comprehensive guide, we will delve into the steps and considerations involved in canceling a mobile check deposit. Whether it's due to an error in the deposit amount, a misplaced check, or any other unforeseen circumstance, knowing how to navigate the cancellation process can save you time and alleviate potential stress. Let's explore the essential insights and practical tips to successfully cancel a mobile check deposit, empowering you to confidently manage your banking activities with ease.

Inside This Article

- Step 1: Accessing Your Mobile Banking App

- Step 2: Navigating to the Mobile Check Deposit Feature

- Step 3: Cancelling the Mobile Check Deposit

- Conclusion

- FAQs

Step 1: Accessing Your Mobile Banking App

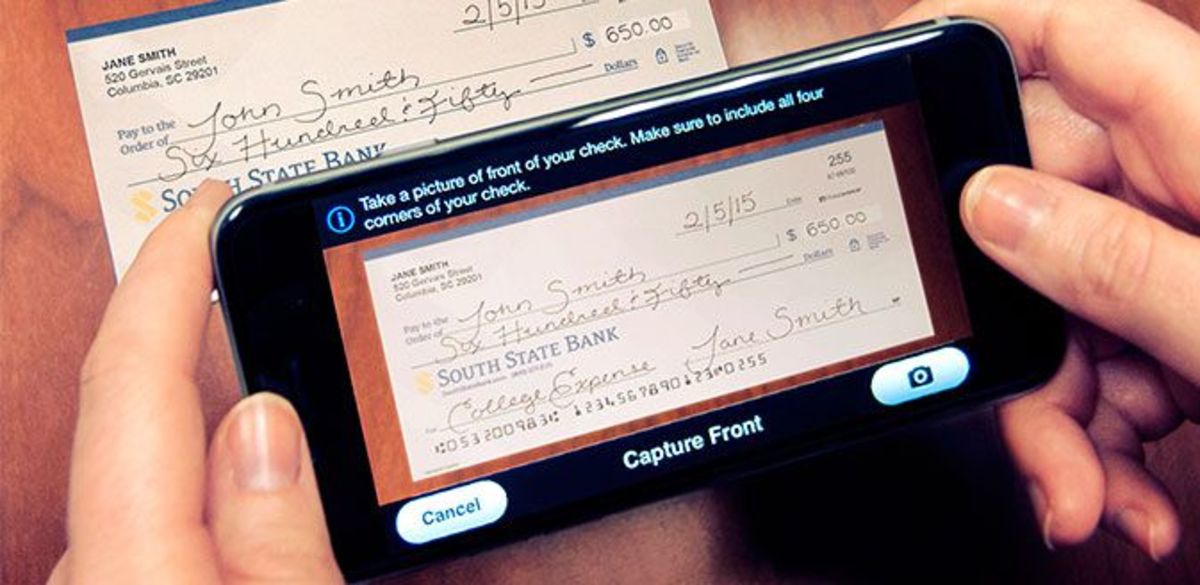

Accessing your mobile banking app is the initial step in the process of canceling a mobile check deposit. In today's fast-paced world, mobile banking has become an integral part of managing personal finances. Whether you're at home, at work, or on the go, the convenience of mobile banking allows you to handle various financial tasks with ease.

To begin, ensure that your mobile device is connected to a stable internet connection. Once connected, locate the icon of your mobile banking app on your device's home screen or in the app drawer. Upon tapping the app icon, the mobile banking app will launch, presenting you with a secure gateway to your financial accounts.

Upon opening the app, you may be prompted to enter your login credentials, such as your username and password, to access your account. This crucial security measure ensures that only authorized individuals can view and manage the sensitive financial information within the app.

After successfully logging in, you will be greeted by the app's home screen, which typically displays an overview of your account balances, recent transactions, and other pertinent financial information. From here, you can navigate to the specific section of the app where the mobile check deposit feature is located.

It's important to note that the layout and navigation of mobile banking apps may vary among different financial institutions. Some apps may feature a prominent "Deposit" or "Check Deposit" option on the home screen, while others may require you to access a menu or navigate to a specific section within the app to initiate the cancellation process for a mobile check deposit.

In the event that you encounter any difficulties accessing your mobile banking app or locating the mobile check deposit feature, don't hesitate to reach out to your financial institution's customer support for assistance. They can provide guidance tailored to their specific app and ensure that you can seamlessly navigate to the necessary section to cancel the mobile check deposit.

By successfully accessing your mobile banking app, you've taken the crucial first step toward canceling a mobile check deposit. With the app at your fingertips, you're empowered to manage your finances efficiently and address any pending transactions, including the cancellation of a mobile check deposit.

Step 2: Navigating to the Mobile Check Deposit Feature

Once you have successfully accessed your mobile banking app, the next step is to navigate to the mobile check deposit feature. This feature allows you to manage the deposit of checks directly from your mobile device, providing a convenient and efficient way to handle your financial transactions.

Upon entering the mobile banking app, you may find the mobile check deposit feature prominently displayed on the home screen or within a designated section of the app. Look for options such as "Deposit," "Check Deposit," or a similar label that indicates the functionality for processing check deposits via the app.

If the mobile check deposit feature is not immediately visible, you can explore the app's menu or navigation bar to locate it. Some banking apps organize features into categories, so you may find the mobile check deposit option under a section related to deposits, transactions, or mobile services.

Once you have identified the mobile check deposit feature, select it to access the corresponding section of the app. Here, you will typically find options to view pending check deposits, review deposit details, and manage the status of individual deposits, including the ability to cancel a pending deposit.

When navigating to the mobile check deposit feature, it's essential to familiarize yourself with the layout and functionality of this section within the app. Take a moment to review any available instructions or guidance provided by the app to ensure that you understand the steps involved in canceling a mobile check deposit.

In the event that you encounter any challenges while navigating to the mobile check deposit feature, consider utilizing the app's search function or referring to the app's help or support resources for specific guidance on locating this feature. Additionally, reaching out to your financial institution's customer support can provide valuable assistance in navigating to the mobile check deposit feature and initiating the cancellation process.

By successfully navigating to the mobile check deposit feature within your mobile banking app, you are one step closer to managing your pending check deposits effectively. This seamless navigation empowers you to take control of your financial transactions and address any necessary adjustments, including the cancellation of a mobile check deposit.

Step 3: Cancelling the Mobile Check Deposit

Cancelling a mobile check deposit is a straightforward process that can be conveniently initiated through your mobile banking app. Whether you've encountered an error in the deposit amount, need to make adjustments to the deposited check, or simply wish to cancel the transaction for any reason, the app provides a user-friendly interface for managing your pending deposits.

Upon accessing the mobile check deposit feature within your banking app, you will typically find a list of pending deposits awaiting processing. To cancel a specific mobile check deposit, navigate to the deposit in question and locate the option to manage or cancel the transaction. This may involve tapping on the deposit details or selecting a dedicated "Cancel" button, depending on the app's interface.

When initiating the cancellation process, the app may prompt you to confirm your decision to cancel the mobile check deposit. This serves as a safeguard against accidental cancellations and ensures that you have the opportunity to review and confirm the action before proceeding. Once you have confirmed the cancellation, the app will process the request and update the status of the deposit accordingly.

It's important to note that the ability to cancel a mobile check deposit may be subject to certain time constraints. Some banking apps impose a cutoff time for cancelling pending deposits, typically aligning with the end of the business day or a specific processing deadline. Therefore, it's advisable to initiate the cancellation promptly if you identify the need to do so, ensuring that the request falls within the designated timeframe for cancellations.

In the event that you encounter any challenges or are unable to locate the option to cancel a mobile check deposit within the app, don't hesitate to explore the app's help resources or reach out to customer support for guidance. The app's support resources may provide specific instructions for cancelling deposits, while customer support can offer personalized assistance to address your unique situation.

By effectively navigating the cancellation process for a mobile check deposit, you can promptly address any discrepancies or adjustments related to your deposited checks. This seamless management of pending deposits through the mobile banking app empowers you to maintain control over your financial transactions and ensures that your deposit records accurately reflect your intended actions.

This section provides a comprehensive guide to cancelling a mobile check deposit, enabling you to navigate the process with confidence and efficiency. With the cancellation successfully initiated, you can proceed with peace of mind, knowing that your pending deposit has been managed according to your preferences and requirements.

In conclusion, canceling a mobile check deposit is a straightforward process that can be completed with a few simple steps. By following the specific guidelines provided by your bank or financial institution, you can effectively cancel a mobile check deposit and address any related concerns. It's essential to adhere to the designated time frames and procedures outlined by your bank to ensure a smooth cancellation process. Additionally, maintaining open communication with your bank's customer support team can be beneficial in resolving any issues or inquiries that may arise during the cancellation process. Overall, understanding the cancellation process for mobile check deposits empowers individuals to manage their financial transactions efficiently and confidently.

FAQs

-

Can I cancel a mobile check deposit after it has been submitted?

Once a mobile check deposit has been submitted, it may not be possible to cancel it. However, some banks may offer a limited window for cancellation or provide assistance in case of errors. It's advisable to contact your bank's customer support immediately if you need to cancel a mobile check deposit.

-

What should I do if I make a mistake while depositing a check using my mobile device?

If you make an error while depositing a check via mobile, such as entering the wrong amount or endorsing the check incorrectly, promptly reach out to your bank's customer service. They can guide you on the necessary steps to rectify the mistake and ensure the successful processing of the deposit.

-

Is there a time limit for canceling a mobile check deposit?

The time limit for canceling a mobile check deposit varies among financial institutions. Some banks may allow a brief window for cancellation after submission, while others may not offer this option. It's crucial to refer to your bank's specific policies or contact their customer support for accurate information.

-

What are the potential consequences of attempting to cancel a mobile check deposit?

Attempting to cancel a mobile check deposit after submission may lead to complications, such as the check being processed despite the cancellation request. Additionally, it could result in delays or fees, depending on the bank's policies. It's essential to understand the potential repercussions before initiating a cancellation.

-

Can I cancel a mobile check deposit if the funds have not yet been credited to my account?

If the funds from a mobile check deposit have not been credited to your account, there may still be a chance to cancel the deposit. Contact your bank as soon as possible to explore the available options and prevent any processing of the deposit.