Are you wondering how long it takes for a PNC mobile deposit to clear? Well, you’ve come to the right place! With the convenience of mobile banking, many people are opting to deposit checks using their smartphones. However, the speed at which these deposits clear can vary depending on several factors. In this article, we will explore the average processing time for PNC mobile deposits and the factors that can affect clearance times. Whether you’re looking to deposit a paycheck or receive a refund, understanding how long it takes for a PNC mobile deposit to clear will help you manage your finances more effectively. So, let’s dive in and find out everything you need to know!

Inside This Article

- What is PNC Mobile Deposit?

- How Does PNC Mobile Deposit Work?

- Factors That Affect the Time it Takes for PNC Mobile Deposits to Clear

- Tips to Speed up the Clearing Process for PNC Mobile Deposits

- Conclusion

- FAQs

What is PNC Mobile Deposit?

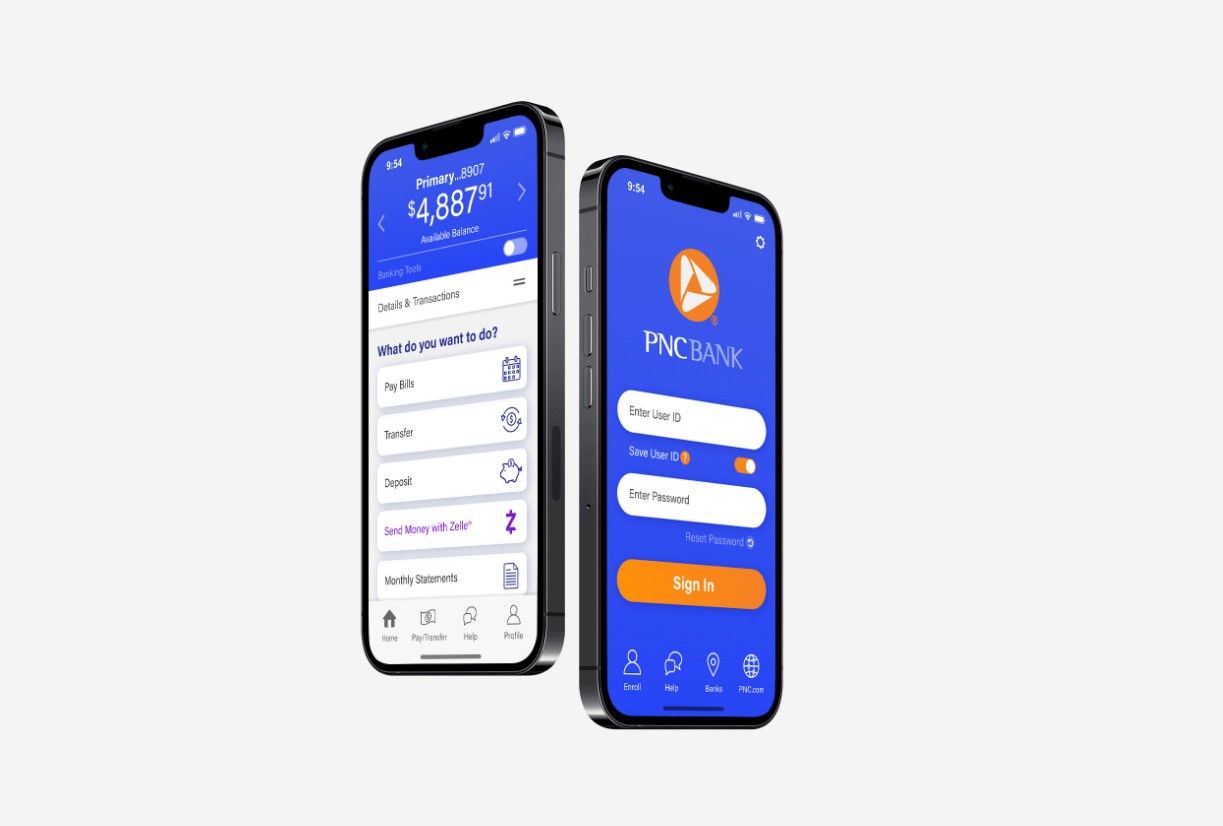

PNC Mobile Deposit is a convenient feature offered by PNC Bank that allows you to deposit checks into your account using your smartphone or tablet. With this service, there’s no need to visit a branch or ATM to make a deposit – you can do it all from the comfort of your own home or on the go.

Using the PNC Mobile Banking app, you simply need to take a photo of the front and back of your check, provide some basic information, and submit the deposit. The funds will then be deposited into your account, making it quick and easy to access your money without the hassle of traditional check deposit methods.

PNC Mobile Deposit provides a secure and efficient way to manage your finances. Whether you’re receiving a paycheck, a rebate, or a personal check, this convenient service allows you to deposit funds anytime, anywhere, without the need for physical check handling or visits to the bank.

How Does PNC Mobile Deposit Work?

If you’re a PNC customer, you have the convenience of depositing checks using the PNC Mobile Deposit feature. This innovative mobile banking feature allows you to deposit checks securely and conveniently from anywhere, at any time, using just your smartphone or tablet.

Using PNC Mobile Deposit is simple. All you need is the PNC Mobile Banking app installed on your mobile device and a PNC checking, savings, or money market account. Once you have these in place, you can follow these easy steps to make a deposit:

- Launch the PNC Mobile Banking app on your mobile device.

- Sign in to your PNC account using your username and password.

- Select “Mobile Deposit” from the main menu.

- Choose the account you wish to deposit the check into.

- Follow the on-screen instructions to take photos of the front and back of the check.

- Verify the check details and enter the amount of the deposit.

- Review the information and confirm the deposit.

Once you have completed these steps, your deposit will be submitted to PNC for processing. The time it takes for the deposit to clear and for the funds to be available in your account can vary depending on several factors, which we will discuss further.

PNC Mobile Deposit is a safe and secure way to deposit checks. The app uses advanced encryption technology to protect your personal and financial information. It also provides you with a confirmation email for each deposit, ensuring that you have a record of the transaction.

With PNC Mobile Deposit, you can save time and avoid the hassle of visiting a physical branch or ATM to deposit checks. The convenience and flexibility of this feature make it a popular choice for PNC customers.

Factors That Affect the Time it Takes for PNC Mobile Deposits to Clear

When it comes to mobile banking, one of the most convenient features is the ability to deposit checks using your smartphone through services like PNC Mobile Deposit. However, you may wonder how long it takes for these deposits to clear and be available in your account. The time it takes for PNC Mobile Deposits to clear can vary based on several factors. Let’s take a closer look at some of the key factors that can affect the clearing time.

1. Check Amount: The amount of the check you are depositing can impact the clearing time. Typically, smaller checks tend to clear more quickly than larger ones. This is because larger amounts may require additional verification and approval before they are cleared.

2. Account History: Your banking history with PNC can also play a role in the clearing time for mobile deposits. If you have a long-standing and stable relationship with the bank, your deposits may clear faster. On the other hand, if you are a new customer or have had past issues with insufficient funds, it may take longer for your deposits to clear.

3. Time of Deposit: The time at which you make the mobile deposit can impact the clearing time. Deposits made during business hours, generally Monday through Friday, tend to clear faster than those made outside of business hours or on weekends. This is because banks typically process transactions during regular business hours.

4. Verification Process: PNC employs a verification process to ensure the authenticity and validity of the checks being deposited. This process involves reviewing the check details, verifying the account it is being deposited into, and checking for any potential issues. Depending on the complexity of the verification process, the clearing time may vary.

5. Holidays and Weekends: If you make a mobile deposit on a holiday or over the weekend, the clearing time may be longer. Banks often have reduced staffing or limited processing capabilities during these times, which can result in delays in clearing mobile deposits.

6. Connectivity and Technology: The speed and reliability of your internet connection or mobile network can also impact the time it takes for your mobile deposit to clear. If you have a weak or unstable connection, it may take longer for the deposit to be processed and marked as cleared.

7. Bank Policies: Finally, it’s important to consider that each bank has its own policies and procedures for clearing mobile deposits. These policies can vary, so it’s always a good idea to check with your specific bank, in this case, PNC, to understand their specific timelines and processes for clearing mobile deposits.

While these factors can influence the time it takes for PNC Mobile Deposits to clear, it’s important to note that in most cases, deposits made through the mobile app are cleared within one to two business days. However, it’s always a good idea to keep these factors in mind to manage your expectations and ensure a smooth banking experience.

Tips to Speed up the Clearing Process for PNC Mobile Deposits

If you’re using PNC Mobile Deposit to deposit checks using your smartphone, you may be wondering how long it takes for the funds to clear. While there are factors that affect the time it takes for PNC Mobile Deposits to clear, there are also some tips you can follow to speed up the clearing process and get access to your funds faster.

1. Ensure Proper Endorsement: When depositing a check through PNC Mobile Deposit, it is crucial to endorse the check properly. This means signing your name on the back of the check exactly as it appears on the payee line. Failing to do so can lead to delays in the clearing process.

2. Capture Clear Images: When taking pictures of the front and back of the check, make sure the images are clear and legible. Ensure that the entire check is in frame, with no parts cut off. Blurry or incomplete images can result in processing delays.

3. Deposit during Business Hours: Depositing a check during PNC’s business hours can help expedite the clearing process. If you deposit a check outside of business hours, it may not be processed until the next business day, leading to additional waiting time.

4. Check Deposit Limits: PNC Mobile Deposit typically has daily and monthly deposit limits. Familiarize yourself with these limits to avoid exceeding them. If you exceed the daily or monthly limit, the excess amount may take longer to clear.

5. Verify Account Information: Double-check that you have entered the correct account information before submitting your deposit. Any errors or discrepancies can cause delays in the clearing process.

6. Stay Connected: Make sure you have a stable and reliable internet connection when using PNC Mobile Deposit. Poor connectivity can result in failed or delayed deposits. It’s a good idea to use Wi-Fi instead of cellular data whenever possible.

7. Monitor Your Account: Keep an eye on your account activity to stay informed about the status of your deposits. PNC Mobile Banking provides real-time updates, allowing you to track the progress of your deposits and know when they have cleared.

By following these tips, you can help speed up the clearing process for PNC Mobile Deposits. However, it’s important to keep in mind that clearing times may vary depending on various factors, including the size and type of the check, as well as the time of day the deposit is made. For any specific concerns or questions, it’s best to contact PNC customer support directly.

Conclusion

In conclusion, PNC Mobile Deposit offers a convenient way for customers to deposit checks using their smartphones. The processing time for mobile deposits can vary depending on various factors such as the time of day the deposit is made, the amount of the deposit, and any potential holds placed on the funds. While PNC aims to make funds available as quickly as possible, it is important to keep in mind that there may be a delay in the processing of mobile deposits.

If you need to access the funds from your mobile deposit quickly, it is recommended to check with PNC for any specific guidelines or restrictions that may apply. Overall, PNC Mobile Deposit provides a user-friendly solution for depositing checks on the go, but it is always wise to plan ahead and allow for potential processing time to ensure that your funds are available when needed.

FAQs

Q: How long does it take for a PNC mobile deposit to clear?

A: The time it takes for a PNC mobile deposit to clear can vary depending on several factors, including the amount of the deposit and the time of day it was made. In general, PNC Bank states that mobile deposits made before 10:00 PM Eastern Time on a business day will typically be available the next business day. However, it’s important to note that there may be additional processing time required for large deposits or deposits made outside of normal banking hours.

Q: Are there any fees associated with PNC mobile deposits?

A: PNC Bank does not charge a fee for using their mobile deposit feature. However, it’s always a good idea to check with your specific account type and review any applicable fees that may be associated with your account.

Q: Is there a limit to how much I can deposit using PNC mobile deposit?

A: The deposit limits for PNC mobile deposits can vary based on individual account type and banking relationship. It’s best to review your specific account terms or contact PNC Bank directly to determine any deposit limits that may apply to you.

Q: Can I deposit checks from any bank using PNC mobile deposit?

A: PNC mobile deposit allows you to deposit checks drawn on U.S. financial institutions. However, it’s important to note that there may be certain restrictions or limitations for checks issued by certain banks or financial institutions. It’s always a good idea to review PNC Bank’s terms and conditions or contact them directly if you have any questions about check deposit eligibility.

Q: What should I do with my paper check after depositing it using PNC mobile deposit?

A: After successfully depositing a check using PNC mobile deposit, it’s recommended to keep the paper check in a secure location for at least 30 days. This is to serve as a backup in case any issues arise with the deposit. Once the deposit has been successfully processed and confirmed, it’s generally safe to destroy the paper check by shredding it to protect your personal and banking information.