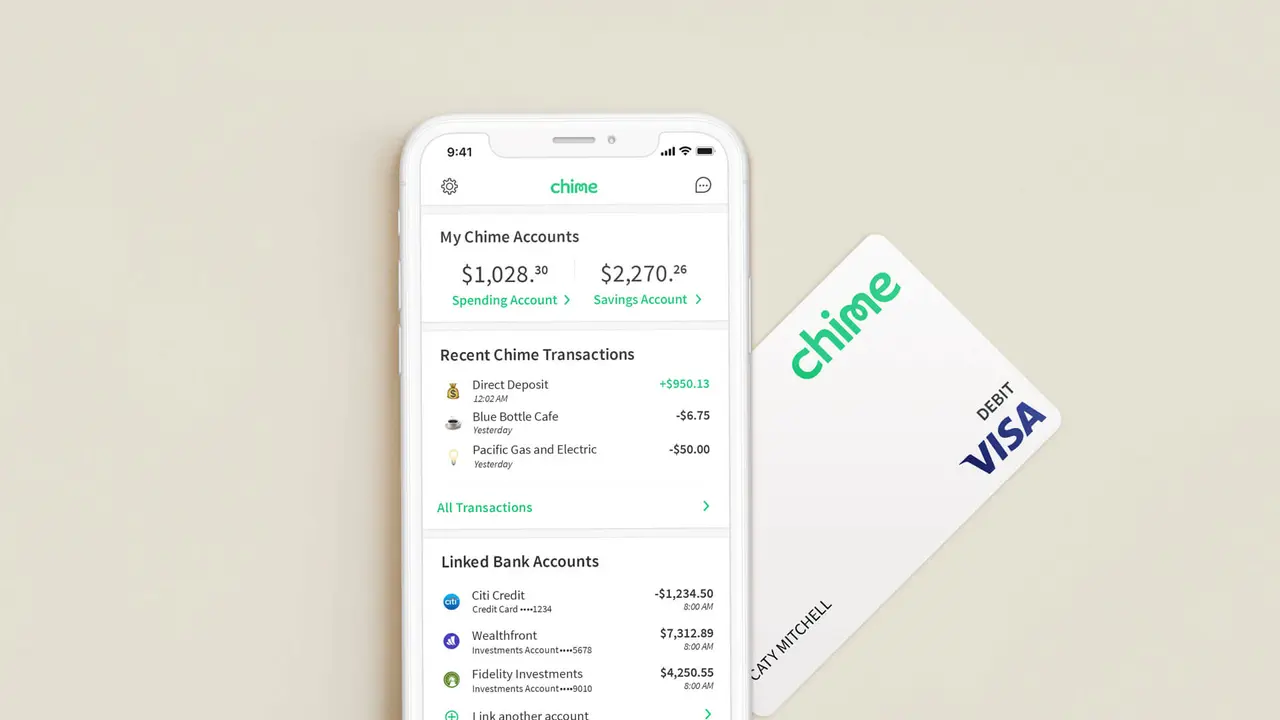

Have you ever wondered how long it takes to deposit a mobile check on Chime? As technology continues to revolutionize the way we handle our finances, mobile banking has become increasingly popular. With Chime, a popular mobile banking app, you can deposit checks simply by taking a photo with your smartphone. This convenient feature eliminates the need to visit a physical bank branch or ATM. But just how long does it take for the funds from a mobile check deposit to be available in your account? In this article, we will explore the deposit processing time on Chime and provide you with all the information you need to know. So, let’s dive in and discover how quickly your mobile check can turn into usable funds in your Chime account.

Inside This Article

How Long Does It Take To Deposit A Mobile Check On Chime

Chime, the popular mobile banking app, offers users the convenience of depositing checks through their smartphones. This feature allows you to skip the hassle of visiting a physical bank branch and wait in line to make a deposit. But how long does it take for a mobile check deposit to be processed on Chime? Well, the answer depends on several factors that we’re going to explore in this article.

When you deposit a mobile check on Chime, the app uses advanced image recognition technology to quickly and accurately process the check. This automated process speeds up the overall deposit time, making it faster than traditional methods.

However, there are a few factors that can influence the time it takes for your mobile check deposit to be credited to your Chime account. Let’s take a closer look at these factors:

- Check Amount: The amount of the check can impact the processing time. Smaller checks may be processed faster compared to larger checks, which may require additional verification steps.

- Check Endorsement: Ensure that you have properly endorsed the back of the check before making a mobile deposit. Missing or incorrect endorsements can cause delays in the deposit processing.

- Check Image Quality: It’s important to capture a clear and legible image of the check while using the Chime app. Poor image quality may result in the need for manual review, causing a delay in deposit processing.

- Deposit Time: The time at which you submit the mobile check deposit also matters. Deposits made during weekdays or business hours are typically processed faster than those made on weekends or outside of business hours.

Despite these factors, the majority of Chime users experience a relatively quick deposit time for their mobile checks. In most cases, deposits are processed within 1-2 business days. You can check the status of your deposit under the “Transactions” section of the Chime app.

If you have any concerns or if your mobile check deposit is taking longer than expected to be processed, it’s always a good idea to reach out to Chime’s customer support for assistance. Their team can provide you with updates on the status of your deposit and address any potential issues.

Conclusion

The ability to deposit a mobile check on Chime provides a convenient and efficient way to access your funds. With the simple steps outlined in this article, you can deposit checks from the comfort of your own home or on the go, without the need to visit a physical bank branch. Chime’s seamless integration with mobile devices ensures a smooth and hassle-free experience, allowing you to deposit funds and have quick access to your money.

While the exact deposit time can vary depending on various factors such as the amount of the check, any holds on your account, and the timing of the deposit, typically, you can expect the funds to be available within a few minutes to two business days. It’s important to keep in mind that during weekends or holidays, there may be slight delays in the processing times.

Overall, Chime offers a user-friendly mobile check deposit feature that makes managing your finances easier and more convenient. By taking advantage of this technology, you can save time and effort, eliminating the need for traditional check deposit methods. So why wait in long lines at a bank when you can deposit checks with just a few taps on your mobile device? Start enjoying the benefits of Chime’s mobile check deposit feature today.

FAQs

1. How long does it take to deposit a mobile check on Chime?

Depositing a mobile check on Chime is quick and easy. Once you’ve taken a clear photo of the front and back of the check using the Chime mobile banking app, the processing time typically ranges from a few minutes to a few hours. However, please note that in some cases, it may take longer for the check to be processed, depending on external factors such as the issuing bank’s verification process. Chime will provide you with real-time updates on the status of your deposit, so you can track its progress.

2. Are there any limits on mobile check deposits with Chime?

Chime imposes certain limits on mobile check deposits for security and regulatory purposes. For most account holders, the daily limit for mobile check deposits is $5,000, while the monthly limit is $10,000. It’s important to note that these limits may vary based on factors like your account history and the length of time you have been a Chime member. If you regularly need to deposit checks exceeding these limits, you may want to explore alternative options such as direct deposit or visiting a physical branch of your bank.

3. Is mobile check deposit on Chime available for all account holders?

Mobile check deposit is generally available for all Chime account holders. However, there might be certain criteria or restrictions that apply. For example, new account holders may have a waiting period before they can start using the mobile check deposit feature. Chime reserves the right to determine eligibility and may require additional verification steps for security purposes.

4. Are there any fees associated with mobile check deposits on Chime?

Chime does not charge any fees for mobile check deposits. This means you can deposit checks using the Chime mobile banking app without incurring any additional costs. However, please note that certain external factors, such as fees imposed by the issuing bank or other financial institutions involved in the check processing, may still apply. It’s always a good idea to check with your bank and review the terms and conditions of the check you’re depositing to ensure you’re aware of any potential fees.

5. What should I do with the physical check after depositing it on Chime?

Once you’ve completed the mobile check deposit process on Chime and received confirmation of a successful deposit, it’s important to securely store the physical check for a certain period of time. Chime recommends keeping the check in a safe place for at least 60 days, in case any issues or questions arise concerning the deposit. After this period, you can cross out the payee and “VOID” the check to prevent it from being used again, or you can shred and dispose of it in a secure manner to prevent identity theft or fraud.