Are you tired of sifting through piles of receipts, spreadsheets, and financial statements? Look no further because SilverWiz has the perfect solution for you! With their revolutionary finance app, MoneyWiz, managing your money has never been easier. Whether you’re a budget-conscious individual or a small business owner, MoneyWiz is designed to simplify your financial life.

In this article, we’ll delve into the secrets behind MoneyWiz’s success and why it’s become a breakout star in the world of mobile finance apps. From its intuitive interface to its powerful features, we’ll explore how MoneyWiz stands out from the competition and how it addresses the pain points of traditional finance management methods.

So, get ready to embark on a financial journey that will revolutionize the way you handle your money. Let’s uncover the secrets of MoneyWiz and discover how it can help you take control of your finances!

Inside This Article

- Money Talks: SilverWiz Shares Secrets of its Breakout Finance App, MoneyWiz

- Key Features of MoneyWiz

- User Interface and Design

- Advanced Financial Tracking Tools

- Security and Privacy Measures

- Conclusion

- FAQs

Money Talks: SilverWiz Shares Secrets of its Breakout Finance App, MoneyWiz

In today’s digital age, managing finances has become more important than ever. With a plethora of apps available, finding the right one that offers a seamless user experience and advanced financial tools can be a challenge. That’s where MoneyWiz, the breakout finance app developed by SilverWiz, comes into the picture.

MoneyWiz is a game-changer in the world of personal finance management. Packed with a wide range of features, it streamlines the process of budget tracking, expense management, and investment tracking, making it the go-to choice for individuals looking to take control of their finances.

One of the key selling points of MoneyWiz is its cross-platform compatibility. Whether you’re using an iPhone, Android device, or desktop computer, the app seamlessly syncs your financial data in real-time, ensuring that you always have access to the most up-to-date information, no matter which device you use.

The app also caters to an international audience with its support for multiple currencies. This feature makes it easy for users to manage their finances regardless of their location, whether they’re traveling or dealing with foreign investments.

When it comes to budgeting and expense tracking, MoneyWiz offers robust tools to keep your financial goals on track. With its intuitive user interface and customizable dashboard and reports, you can easily monitor your income and expenses, create budgets, and set financial targets.

Furthermore, MoneyWiz goes beyond basic expense tracking and offers advanced financial tracking tools. You can easily manage and track your investment portfolio, keeping an eye on stock prices and performance. The app also provides bill reminders and scheduled payments, ensuring that you never miss a payment and avoid late fees.

Another standout feature of MoneyWiz is its automatic transaction categorization. The app intelligently categorizes your transactions, saving you time and effort in manually organizing them. It also provides built-in currency exchange rates, making it convenient for users dealing with multiple currencies.

MoneyWiz puts a strong emphasis on security and privacy. All your financial data is encrypted and securely stored in the cloud, minimizing the risk of unauthorized access or data breaches. The app also supports biometric authentication, such as fingerprint or face recognition, and offers two-factor authentication for an added layer of security.

Key Features of MoneyWiz

MoneyWiz, the breakout finance app developed by SilverWiz, offers a range of impressive features that make it a must-have tool for managing personal finances. Let’s take a closer look at some of its key features:

Cross-platform compatibility: One of the major advantages of MoneyWiz is its cross-platform compatibility. Whether you’re using a smartphone, tablet, or computer, you can access and manage your financial data seamlessly across all your devices.

Real-time syncing of financial data: MoneyWiz ensures that your financial information is always up-to-date by providing real-time syncing. Any changes or updates you make on one device will instantly reflect on all your other devices, guaranteeing consistency and accuracy.

Multiple currency support: For individuals who often deal with different currencies, MoneyWiz has got you covered. It supports multiple currencies, enabling you to track your expenses and manage your money in various currencies effortlessly.

Budgeting and expense tracking tools: MoneyWiz is equipped with robust budgeting and expense tracking tools that empower you to take control of your finances. Set up budgets, track your spending, and receive alerts when you’re approaching your budget limits.

With these key features, MoneyWiz provides a comprehensive solution for efficient money management, allowing you to stay on top of your finances and make informed financial decisions.

User Interface and Design

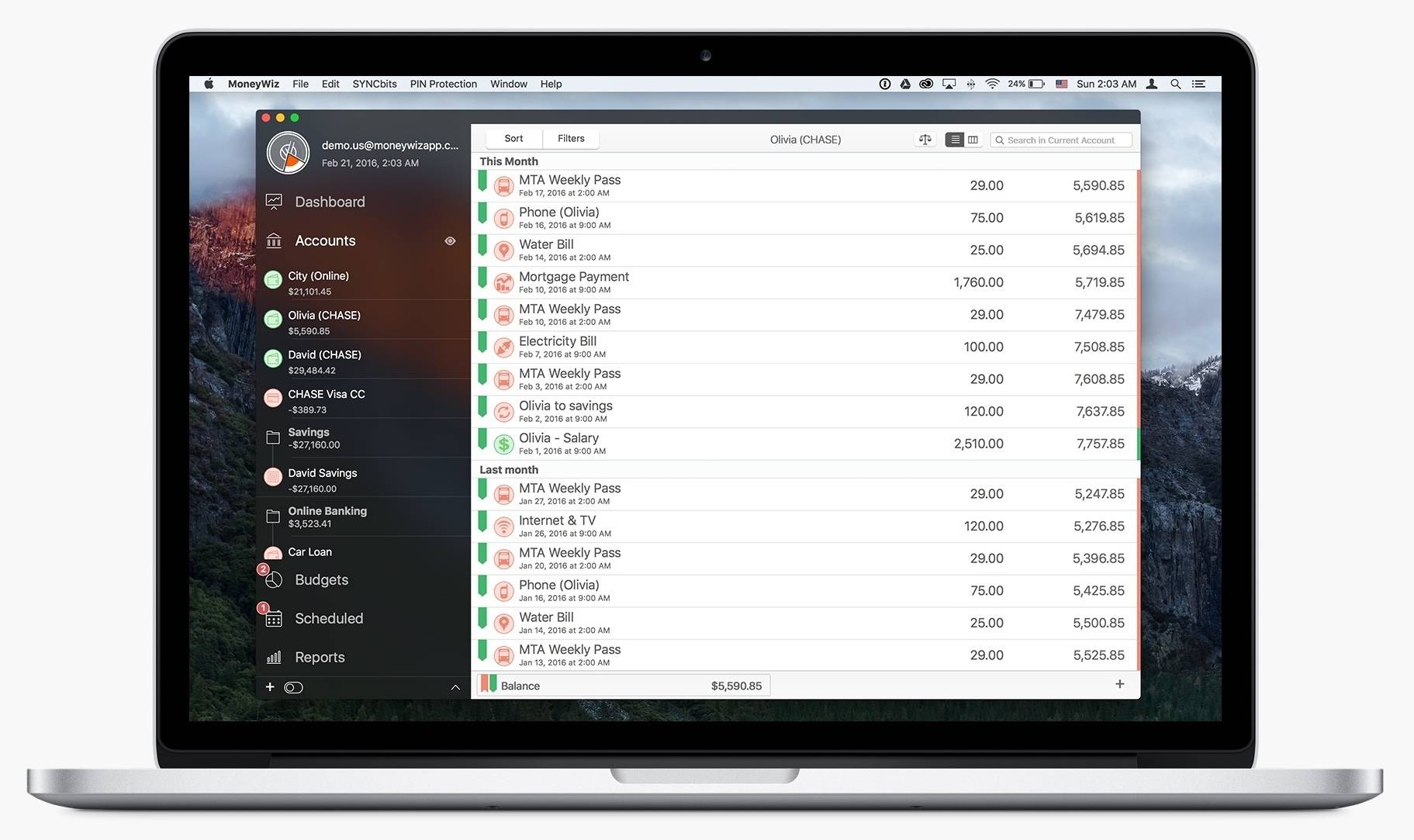

One of the standout features of MoneyWiz is its intuitive and user-friendly interface. Whether you’re a tech-savvy individual or someone who is new to financial management apps, MoneyWiz provides a seamless user experience that is easy to navigate and understand.

The app’s customizable dashboard and reports allow you to tailor the interface to suit your personal preferences and financial goals. You can arrange widgets and elements on the dashboard to prioritize the information that matters most to you, such as account balances, spending summaries, or upcoming bills.

MoneyWiz excels in the clear categorization of transactions, making it easy to track and analyze your expenses. You can categorize transactions by assigning them to specific categories, such as groceries, utilities, or entertainment. This helps you get a clear overview of where your money is going and enables you to make informed decisions regarding your spending habits.

Visual representation is a powerful tool when it comes to understanding your financial situation, and MoneyWiz delivers on this front with its interactive charts and graphs. The app provides various visualization options, such as pie chart, bar graph, or line graph, allowing you to analyze your income and expenses patterns over time. This visual representation of your financial data gives you a comprehensive view of your financial health, making it easier to identify trends and areas where you can make improvements.

Advanced Financial Tracking Tools

When it comes to managing your finances, having advanced tools can make a huge difference in keeping track of your investments, bills, transactions, and currency exchange rates. The MoneyWiz app offers a range of robust features that will help you stay on top of your financial game.

One of the standout features of MoneyWiz is its investment portfolio management. It allows you to easily track and analyze your investments, monitor their performance, and get insights on your portfolio’s growth. With real-time updates and interactive charts, you can make informed decisions about buying, selling, or holding onto your investments.

Bill reminders and scheduled payments are another valuable feature of MoneyWiz. You can set up reminders for upcoming bills and schedule automatic payments, ensuring that you never miss a payment deadline. This not only helps you avoid late fees but also keeps your credit score in good standing.

Another handy feature of MoneyWiz is automatic transaction categorization. The app uses intelligent algorithms to categorize your transactions, saving you time and effort. It accurately classifies your expenses and income into categories such as groceries, transportation, entertainment, and more. This allows you to easily analyze your spending patterns and identify areas for savings.

MoneyWiz also offers built-in currency exchange rates. Whether you’re traveling abroad or dealing with international transactions, having up-to-date exchange rates is essential. With MoneyWiz, you can convert between currencies with ease and ensure that you have accurate information for budgeting and tracking your expenses.

These advanced financial tracking tools provided by MoneyWiz make it an indispensable app for individuals and businesses alike. Whether you’re a busy professional, a frequent traveler, or simply someone who wants to stay on top of their finances, MoneyWiz has got you covered.

Security and Privacy Measures

When it comes to managing our finances, security and privacy are of utmost importance. SilverWiz, the developer behind the breakout finance app MoneyWiz, understands this need and has implemented a range of robust security measures to safeguard user data.

Data encryption and secure cloud storage are at the forefront of MoneyWiz’s security features. Every piece of financial information, including transactions and account details, is encrypted using industry-standard AES-256 encryption. This ensures that even if unauthorized access to the data occurs, it remains indecipherable and protected.

In addition to encryption, MoneyWiz supports secure cloud storage. This means that your financial data is not stored locally on your device but is instead stored in the cloud using state-of-the-art security protocols. This adds an extra layer of protection, as cloud storage providers often employ advanced security features and regular data backups to prevent any loss or breach of information.

Biometric authentication is another notable security measure offered by MoneyWiz. By leveraging the biometric capabilities of your device, such as fingerprint or facial recognition, you can ensure that only you have access to your financial data. This provides an additional level of security, as biometric information is unique to each individual and cannot be easily replicated.

In addition to biometric authentication, MoneyWiz also supports two-factor authentication (2FA). Two-factor authentication requires users to provide two forms of identification to access their accounts, typically a password and a unique verification code sent to their mobile device. This feature adds an extra layer of security by ensuring that even if someone gains access to your password, they still cannot log in without the second verification step.

MoneyWiz also includes privacy settings for sensitive information. Users have the ability to set privacy preferences for specific categories or tags in their financial data. This allows them to keep certain transactions or accounts hidden from view, even within the app itself. With this level of control, users can maintain the confidentiality of sensitive financial information.

With data encryption, secure cloud storage, biometric authentication, two-factor authentication, and privacy settings, MoneyWiz takes security and privacy seriously. These measures provide users with the peace of mind and confidence to entrust their financial information to the app, making it a standout choice in the realm of personal finance management.

Conclusion

MoneyWiz, developed by SilverWiz, is a remarkable finance app that combines functionality with user-friendliness. This powerful tool empowers users to take control of their personal finances, providing seamless integration with various banks and financial institutions.

With its comprehensive set of features, intuitive interface, and customizable options, MoneyWiz stands out among its competitors in the finance app market. Whether you’re tracking your expenses, managing your budget, or planning for the future, MoneyWiz offers the tools and insights you need.

SilverWiz’s commitment to continual improvement is evident in the regular updates and enhancements to MoneyWiz. They listen to user feedback and make innovative changes to ensure the app meets the evolving needs of its growing user base.

Whether you’re a student, a young professional, or a seasoned investor, MoneyWiz is the go-to finance app that will help you make informed decisions and achieve your financial goals. Say goodbye to financial stress and hello to financial empowerment with MoneyWiz.

FAQs

1. What is MoneyWiz?

MoneyWiz is a revolutionary finance app developed by SilverWiz. It is designed to help users manage their finances effectively, track expenses, create budgets, and achieve their financial goals. With its user-friendly interface and powerful features, MoneyWiz has gained popularity as one of the top finance apps available.

2. How does MoneyWiz help with financial management?

MoneyWiz provides a wide range of tools and features to simplify financial management. Users can link their bank accounts, credit cards, and investment portfolios to MoneyWiz, allowing for automatic transaction imports and real-time balance updates. The app also allows users to create budgets, track expenses and income, set financial goals, generate reports, and even schedule bill payments – all in one place.

3. Is MoneyWiz secure?

Yes, MoneyWiz takes user security and privacy seriously. The app uses end-to-end encryption to protect sensitive financial information, ensuring that your data remains safe and secure. Additionally, MoneyWiz does not store your bank login credentials and exclusively uses read-only access to fetch your financial data, providing an extra layer of security.

4. Can MoneyWiz sync across multiple devices?

Absolutely! MoneyWiz offers seamless syncing across multiple devices, including smartphones, tablets, and computers. Whether you’re at home or on the go, you can access your financial data and manage your finances from any device. The automatic syncing feature ensures that any changes made on one device are instantly reflected on all other devices.

5. Can I customize MoneyWiz to suit my financial needs?

Certainly! MoneyWiz is highly customizable to adapt to your unique financial requirements. You can personalize categories, tags, and labels to fit your specific budgeting needs. Additionally, the app allows you to create custom reports and charts to gain insights into your spending patterns and financial habits. MoneyWiz offers flexibility and personalization, making it a powerful tool for financial management.