PayPal is a top-notch online payments solution and money transfer app, but that doesn’t mean you’re stuck with it. There are plenty of competing services as good as or better than the online giant. What are those, and which alternative suits your needs the most? Stick around to learn more about the 13 best PayPal alternative services and apps you can switch to.

Inside This Article

What is PayPal and Why Seek an Alternative?

If you’re not familiar with PayPal, we’ll first tell you what it is exactly and why some users are now making the switch. Otherwise, head to our roundup of PayPal alternative services.

PayPal began in 1998 — thanks to tech enthusiasts who sought to change the world of commerce via online payment solutions. Within four years, it became the staple online solution for managing funds. The platform was so popular that eBay purchased it in 2002. In 2019, the service hit a record payment volume of $712 billion. Nowadays, it’s still a dominant payment platform.

As for how it works, PayPal charges fees for transfers, currency conversions, donations, and other transactions. There’s also a transfer limit for the withdrawals and transactions you make. Refer to this table for the features:

| Features | |

| Compatibility | Android, iOS, web browser |

| Payment Methods | Visa, MasterCard, American Express, Discover, Google Pay (US Only) |

| Fees for Withdrawals/Transfers | No fee for transfers to Local Accounts with no currency conversion 1% of the amount for transfers to eligible linked debit cards $10 maximum fee per transaction |

| Transaction Fees | 2.9% of the amount + fixed-rate (based on currency, usually $0.30) for online sales 2.7% + currency fee for in-store US sales 4.4% for non-US online transactions 4.2% for non-US in-store transactions |

| Speed of Withdrawals/Transfers | 1 to 30 minutes Instant Transfer for Visa debit cards only 1 to 3 business days for Standard Transfer |

| Limits on Withdrawals/Transfers | 5,000 CAD (approx. $3,916) per transaction/per day/per week 15,000 CAD (approx. $11,748) per month |

The features, although good, didn’t lead to PayPal monopolizing the online payments industry. That’s because there are several flaws that clients see as deal breakers, prompting them to seek a PayPal alternative. For example, while PayPal has instant money transfers that take only minutes, those are limited to Visa debit cards.

Best PayPal Alternative Services and Apps

Through the years, PayPal competitors have been on the rise. And many of them address PayPal’s flaws or provide unique perks clients can enjoy. Let’s now put the spotlight on those, shall we? Here are the top 13 PayPal alternative services and apps you can try today.

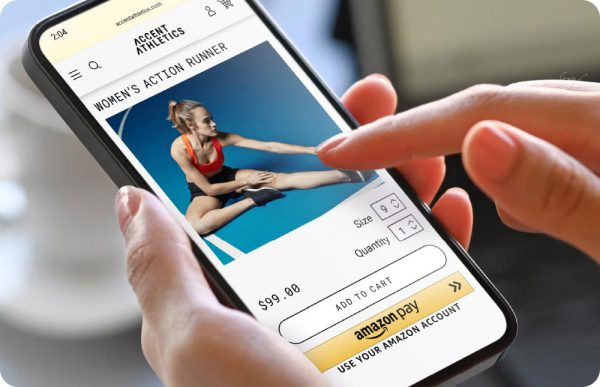

1. Amazon Pay

If you’re searching for a reliable and widely-used PayPal alternative, check out Amazon Pay. It’s among the best solutions for online payments if you frequently use the online shopping giant Amazon.

You’ll only need your phone or laptop, an Amazon account, and to accept the terms and conditions for Amazon Pay. Afterward, you can make all the purchases you want on third-party websites.

What’s great about Amazon Pay is that transaction fees are more or less similar to PayPal. Moreover, it has a familiar interface for Amazon users so there’s less friction and confusion. It also accepts all credit and debit cards so there’s no limitation to payment methods.

However, Amazon Pay does charge a 2.9% or 3.9% (both +$0.30) fee for US and non-US transactions, respectively. Additionally, it’s not useful for transferring money to the bank and is only handy for online shopping.

2. Braintree

Another great PayPal alternative is Braintree, an online payments solution for large businesses and corporations such as Uber, Dropbox, and more. It’s the ideal solution if you’re looking for something that works with other payment solutions for your business. Some of its compatible services include PayPal, Venmo (US), Apple Pay, Google Pay, as well as credit and debit cards.

With Braintree, your business can easily handle online transactions in over 130 currencies and within more than 45 countries. Most transactions will incur only a 2.9% + $0.30 fee each, and you can find custom pricing plans if you ask for a quotation.

Apart from what’s mentioned, Braintree is great for businesses because it employs business-specific features. For example, you can manage recurring payments and customer support with it – something other PayPal alternative solutions can’t do. That said, it’s not as easy to integrate as other services. That’s because you can only integrate it to your store by programming it manually to your website. Nonetheless, Braintree is worth trying.

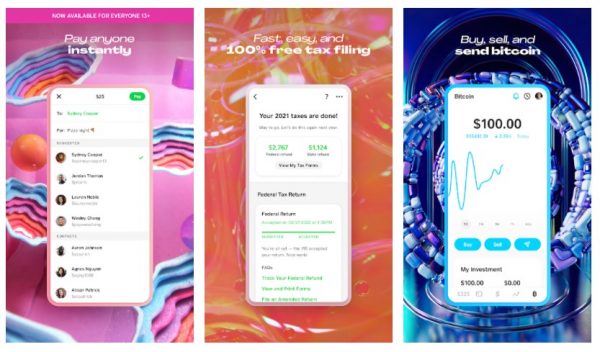

3. Cash App

If you’re looking for apps like PayPal that are more convenient for the average joe, we recommend Cash App. It’s a great PayPal alternative if you need an all-in-one solution for managing your funds. This includes sending money to other individuals, spending money via debit card, depositing to banks, and investing in stocks or cryptocurrencies.

There are numerous benefits to using apps like Cash App, and we’ll mention some of those. Firstly, payments on Cash App are free and instantly made, so there’s not much waiting time. Secondly, the linked debit card doesn’t incur fees and is useful for transacting online. Lastly, there are no fees for money transfers, inactivity, or foreign transactions.

The only fee you’ll face is a 1.5% (or a minimum $0.25) fee if you want Instant Deposits. Otherwise, you can use Cash App’s Standard Deposit feature and get your money within one to three business days. The only downside to Cash App is that it’s only available in the US and UK.

4. Google Pay

With people always online on various Google services, Google Pay becomes a welcome addition to the ecosystem.

Through Google Pay, you may link your debit and credit cards and make transactions as you please. You can transact both online and in physical stores using just your phone. The said PayPal alternative even incorporated peer-to-peer payments recently.

Best of all, the payments come instantly, and the service is mostly free. However, you will be charged 2.9% for credit card transactions.

For more information about Google Pay on mobile, head to our Google Pay app review.

Download Google Pay on Android

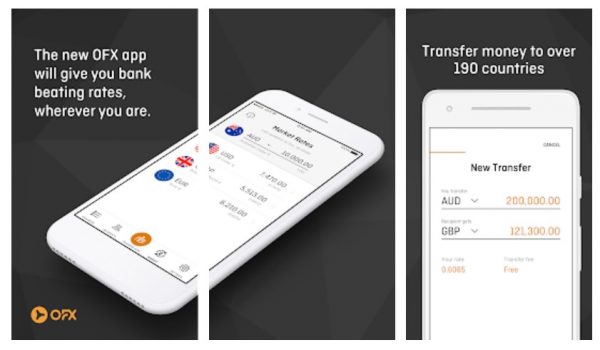

5. OFX

Another great PayPal alternative for businesses is OFX. It’s useful if your business regularly transfers more than $10,000 at a time. That’s because transfers above the said amount are free. However, if you transfer anywhere below that amount, you’ll incur a fee that’s roughly $15. There’s also a minimum amount for transfers in OFX – about $200 per transaction and $1,000 yearly.

On the bright side, OFX doesn’t have a maximum limit so you’ll never get capped. Furthermore, it doesn’t take too long for the money transfer to happen because it gets completed one to two days on average. OFX is also available on mobile so you’re not limited to the computer.

6. Payoneer

The ever-popular Payoneer is also a robust alternative to PayPal. It’s one of PayPal’s main competitors, and it works in over 150 countries.

Using Payoneer, you can avail of two kinds of accounts: free or prepaid. The free account offers withdrawals that go straight to your bank. Withdrawals take one to three working days to reflect in your account. The latter account type gives you a prepaid card (only for individual users) and costs $29.95 monthly. Besides that, know that Payoneer charges $1.50 for local bank transfers.

Businesses can avail of the platform’s Billing Service to request customer payments. However, it will charge 3% on credit cards and 1% on debit card transactions.

All in all, Payoneer is a near-perfect PayPal alternative that’s accessible on the web or mobile.

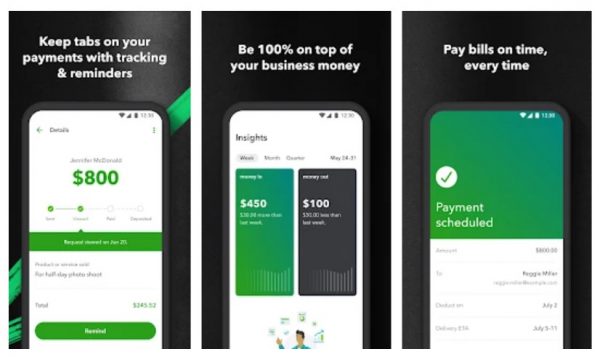

7. Quickbooks Payments

Quickbooks Payments is a great PayPal alternative for integrating online payments with accounting software. That’s because it works best in tandem with Quickbooks, the company’s proprietary accounting software for businesses.

Going back to Quickbooks Payments, it should have all you might want in a PayPal alternative. There are features for recurring billing, generating and sending invoices, taking mobile card payments, bank transfers, and automated payment notifications.

Quickbooks Payments can even link your transactions to timesheets and payroll. It’s also available on mobile so you don’t always need a computer to make transactions. Plus, transfers with Quickbooks Payments are pretty snappy. For example, credit card payments and bank transfers usually reflect on the next day or in two business days. It will take longer, or up to five business days, for the first four weeks if you’re a new user, though. And card payments will incur a 2.9% + $0.25 fee. Meanwhile, bank transfers are free for basic plans.

Overall, Quickbooks Payments is the perfect solution if you own a company that needs an all-in-one solution.

Download Money on QuickBooks App on Android

Download Money on QuickBooks App on iOS

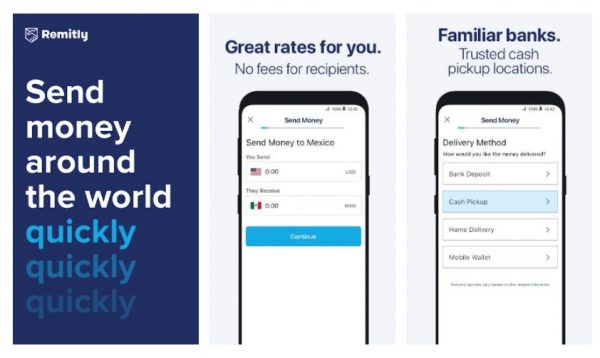

8. Remitly

Remitly is a great PayPal alternative that’s free to download and has a big pool of financial partners. It’s convenient, allowing users to send money directly to their banks. It even supports cash pick-ups, a feature that’s not so common in other alternatives.

Like PayPal, Remitly can link to debit and credit cards with secure data encryption. But what’s different is that its economy transfers are usually free, although those will take three to five business days to complete.

Perhaps the biggest downside with Remitly is the cost of its express transfers. Sure, it starts at $3.99, but it can even go as high as $93.99 for big amounts of money. Nonetheless, it’s a reliable platform overall.

9. Shopify Payments

If you’re running an eCommerce business via Shopify, add to your Paypal alternative solutions Shopify Payments. With it, you can make credit or debit card transactions. It’s even compatible with physical stores through Shopify’s POS system.

Moreover, it works with other online marketplaces such as Facebook shops, Messenger, eBay, Amazon, and more. It’s also available on mobile so it’s convenient for users to transact.

What might make you skip Shopify Payments, though, is its requirement for a basic Shopify account that costs $29 monthly. Its transfer speeds aren’t fast, either. Transfers take approximately five days, plus the number of days until payout. However, its credit card payments charge the same 2.9% + $0.30 fee as PayPal. So, it’s still a superb option, especially if you’re running an online store.

10. Skrill

Skrill is another great PayPal alternative, especially if you’re a merchant who wants to minimize transaction fees. That’s because it only charges 2.5% to 4% per transaction, whereas PayPal charges 4.5%. Skrill is also great for private users because it has no fees for deposits, withdrawals, or even sending and receiving money. However, it does charge you $5 if your account goes dormant for one year.

Apart from that, Skrill is pretty fast. The money sent usually arrives on the same business day. However, some transactions take three to five days under certain conditions.

On another note, Skrill is as versatile as PayPal in terms of compatibility and payment methods. That’s because Skrill can also link to your debit or credit card, bank account, and even functions as an eWallet. Moreover, it’s available on both the web and mobile.

11. Square

Square is a wonderful PayPal alternative if your main focus is mobile POS transactions and online payments. With its POS service, you can accept cards, checks, cash, and gift cards as well. Moreover, it allows you to generate receipts and even issue them to consumers online.

You can also generate invoices, set up recurring billings, and manage your inventory and payroll. Additionally, Square’s POS system doesn’t require an internet connection for swiping cards. Best of all, you can access most of its services conveniently through the mobile app.

However, Square does have fees like any other PayPal alternative. For example, it charges 2.75% per POS transaction and 1.5% per fund transfer to a bank. Nonetheless, it’s faster than most as it normally transfers funds the next business day. Instant transfers are also possible under certain conditions.

Download Square Point of Sale on Android

Download Square Point of Sale on iOS

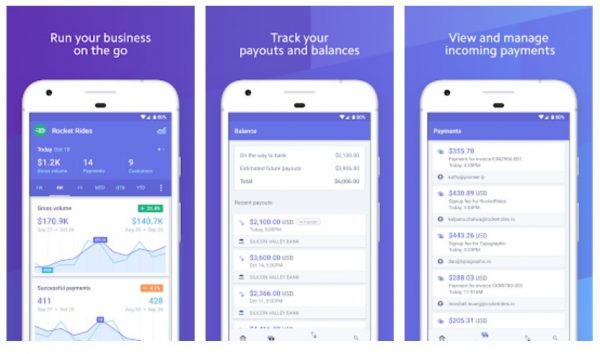

12. Stripe

Running an eCommerce website? One of the best PayPal alternative services to try is undoubtedly Stripe. It’s available in the US and Canada, although you can accept payments from all corners of the globe.

Through the service, you’ll only get charged a 2.9% + $0.30 fee per transaction, much like PayPal. It also accepts connections to debit cards, credit cards, mobile wallets, and more. In addition, it even has a mobile app that makes transacting with businesses convenient.

Unlike PayPal, Stripe’s checkout can be integrated into your website — convenient for both buyers and sellers. Moreover, it deposits funds automatically to your account. Unfortunately, payout speed varies per country. In the US, though, it’s two business days.

Download Stripe Dashboard on Android

Download Stripe Dashboard on iOS

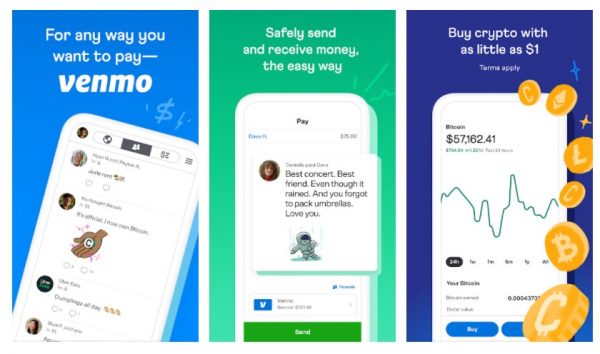

13. Venmo

If peer-to-peer payments are your priority, then Venmo is one of the best PayPal alternative services you can utilize. You may register your debit card or bank account to it to transmit or get money. You can even transfer funds to your bank account – but the balance gets updated in one to three business days. If you opt for a speedy transfer, that will cost you a 1% fee (maximum of $10).

Most transactions you make through Venmo are free. However, it does cost $2.50 if you withdraw from an out-of-network ATM. And if you utilize a linked credit card, expect a 3% fee. Nonetheless, Venmo is a great overall peer-to-peer mobile service if you’re based in the US.

Which PayPal Alternative Did You Pick?

PayPal is a big online payment service, but that doesn’t mean it’s alone. The industry is full of alternative solutions that are equally robust and efficient. Some cost more or less than PayPal, but each is geared toward a specific audience. There will be some that are great for individuals, while others are more suitable for businesses. No matter what your needs are, there will be a PayPal alternative that’s right for you.

If you have picked one already, which one is it? Feel free to share with us your choice and experience using it.