Mobile depositing a check on Cash App is a convenient and efficient way to manage your finances on the go. With the increasing reliance on mobile devices for everyday tasks, the ability to deposit checks using a mobile app has become a valuable feature for many individuals. In this article, we will explore the step-by-step process of mobile depositing a check on Cash App, providing you with a comprehensive guide to make the most of this convenient service. Whether you're new to mobile banking or looking to streamline your financial activities, understanding how to mobile deposit a check on Cash App can simplify your banking experience. Let's delve into the details and discover how easy it is to leverage the power of mobile technology for managing your finances.

Inside This Article

- Setting up Mobile Deposit on Cash App

- Taking a Picture of the Check

- Verifying the Check Information

- Completing the Deposit

- Conclusion

- FAQs

Setting up Mobile Deposit on Cash App

If you're looking to streamline your banking experience, Cash App offers a convenient mobile deposit feature that allows you to deposit checks directly from your smartphone. Setting up mobile deposit on Cash App is a straightforward process that can save you time and hassle. Here's a step-by-step guide to help you get started:

-

Download the Cash App: The first step is to download the Cash App from the App Store (for iOS devices) or the Google Play Store (for Android devices). Once the app is installed, open it and sign in to your account. If you don't have an account yet, you can easily create one by following the on-screen instructions.

-

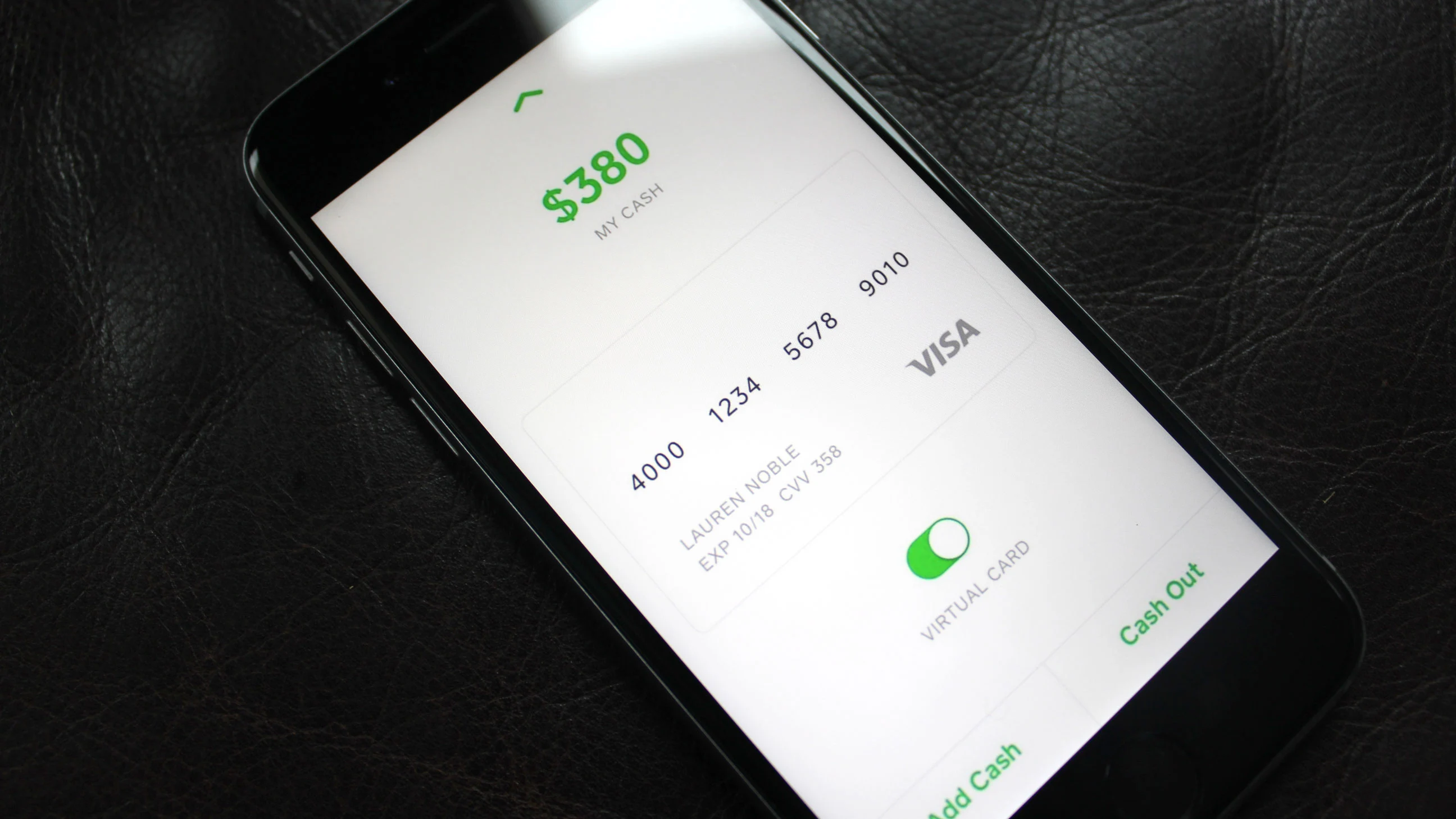

Link Your Bank Account: To use the mobile deposit feature, you'll need to link your bank account to your Cash App. This can be done by navigating to the "Banking" or "My Cash" section of the app and selecting "Add a Bank." Follow the prompts to enter your bank account details and verify ownership.

-

Enable Mobile Deposit: After your bank account is linked, you'll need to enable the mobile deposit feature. This can typically be done by accessing the "Deposit" or "Add Funds" section of the app and following the instructions to enable mobile check deposit.

-

Agree to Terms and Conditions: Before using the mobile deposit feature, you may be required to review and accept the terms and conditions associated with this service. It's important to carefully read through the terms to understand the deposit limits, processing times, and any applicable fees.

-

Verify Your Identity: Cash App may require you to verify your identity before using the mobile deposit feature. This can usually be done by providing personal information and, in some cases, submitting a photo of a valid ID.

-

Set Up Notifications: To stay informed about the status of your mobile deposits, consider enabling notifications within the Cash App. This can help you receive real-time updates on the deposit process and any additional actions required.

By following these steps, you can easily set up mobile deposit on Cash App and gain the convenience of depositing checks from anywhere, at any time. Once the setup is complete, you'll be ready to start using this feature to streamline your banking activities and access funds more efficiently.

Taking a Picture of the Check

When it comes to depositing a check using the Cash App's mobile deposit feature, capturing a clear and accurate image of the check is crucial for a seamless and successful transaction. Here's a detailed walkthrough of the process, along with some essential tips to ensure a smooth check capture experience.

Step-by-Step Guide

-

Select the Deposit Option: After logging into your Cash App account, navigate to the mobile deposit section. This is typically found within the "Banking" or "Deposit" area of the app. Look for the option to "Deposit a Check" or "Add Funds" and tap on it to initiate the process.

-

Position the Check: Find a well-lit area with minimal glare to place the check on a flat surface. Ensure that the entire check is visible within the camera frame. It's important to lay the check on a contrasting background to enhance visibility and clarity.

-

Capture the Images: Cash App usually requires you to capture images of the front and back of the check. When prompted, position your smartphone directly above the check and align it within the on-screen guidelines. Hold your device steady and take the photo. Repeat this process for the back of the check if necessary.

-

Review the Images: After capturing the check images, take a moment to review them for clarity and completeness. Ensure that all corners of the check are visible, and the written information, including the payee, amount, and endorsement, is legible. If the images are satisfactory, proceed to the next step.

-

Retake if Necessary: If the initial images are blurry, poorly aligned, or incomplete, Cash App typically provides an option to retake the photos. Take advantage of this feature to capture clear and well-aligned images that meet the app's requirements.

Essential Tips for Check Capture

-

Stable Positioning: To minimize blurriness, stabilize your smartphone by resting it on a flat surface or using both hands to hold it steady while capturing the check images.

-

Good Lighting: Adequate lighting is essential for clear check images. Avoid harsh shadows and direct light reflections on the check surface, as they can obscure important details.

-

Check Endorsement: Before capturing the back of the check, ensure that it is properly endorsed as per your bank's requirements. This may involve signing the check and adding "For Mobile Deposit Only" beneath the signature.

-

Check for Clarity: Double-check the image clarity before proceeding. Blurry or distorted images may lead to processing delays or rejection of the deposit.

By following these steps and tips, you can effectively capture the check images required for mobile deposit on Cash App. This process is designed to be user-friendly and efficient, allowing you to securely deposit checks from the comfort of your smartphone.

Verifying the Check Information

Once you've successfully captured the images of the front and back of the check using the Cash App's mobile deposit feature, the next crucial step is to verify the check information. This verification process ensures that the details on the check are accurately captured and match the intended transaction. Here's a comprehensive overview of the steps involved in verifying the check information, along with important considerations to ensure a seamless deposit experience.

Reviewing the Check Details

Upon capturing the check images, Cash App typically prompts users to review and verify the information present on the check. This includes crucial details such as the payee's name, the check amount, the date, and any additional endorsements. It's essential to carefully examine each element to confirm its accuracy before proceeding with the deposit. Here's a breakdown of the key aspects to verify:

-

Payee's Name: Double-check the payee's name on the front of the check to ensure that it matches the intended recipient. This is particularly important for personal checks, as discrepancies in the payee's name may lead to processing issues.

-

Check Amount: Verify the written and numerical representations of the check amount to ensure consistency and accuracy. Any discrepancies in the amount may result in deposit delays or rejection.

-

Date: Confirm that the date on the check is current and within the validity period. Post-dated checks may not be eligible for immediate deposit and could require special handling.

-

Endorsements: If the back of the check contains endorsements or additional instructions, review them to ensure compliance with your bank's requirements. Proper endorsements are crucial for the check to be processed smoothly.

Addressing Discrepancies

In the event that you identify discrepancies or errors in the check information during the verification process, it's important to take the necessary steps to rectify the issues before proceeding with the deposit. Here's how you can address common discrepancies:

-

Contact the Issuer: If you notice discrepancies in the payee's name or the check amount, consider reaching out to the issuer of the check to clarify and resolve any discrepancies. This proactive approach can help prevent potential deposit complications.

-

Consult with Your Bank: For checks with unclear endorsements or special instructions, consider consulting with your bank to ensure that the check meets their requirements for mobile deposit. Your bank's guidance can help you navigate any specific endorsement or verification procedures.

-

Retake Images if Necessary: If the check images reveal unclear or incomplete information, Cash App typically provides an option to retake the photos. Take advantage of this feature to capture clear and accurate images that reflect the correct check details.

Ensuring Compliance and Accuracy

Verifying the check information is a critical step in the mobile deposit process, as it helps maintain compliance with banking regulations and ensures the accuracy of the transaction. By carefully reviewing and addressing any discrepancies, you can enhance the efficiency and reliability of the mobile deposit experience. Additionally, staying attentive to the details on each check can contribute to a seamless and secure deposit process, ultimately providing you with greater peace of mind regarding your financial transactions.

Completing the Deposit

After setting up mobile deposit on Cash App, capturing clear images of the check, and verifying the check information, the final step involves completing the deposit. This pivotal stage ensures that the deposited funds are securely processed and made available in your Cash App account. Here's a comprehensive guide to completing the deposit, along with essential insights to facilitate a smooth and efficient transaction.

Submitting the Deposit

Once the check images and information have been verified, Cash App typically prompts users to submit the deposit for processing. This involves confirming the deposit amount, selecting the destination account, and authorizing the transaction. Here's a breakdown of the key elements involved in submitting the deposit:

-

Deposit Amount Confirmation: Review the deposit amount displayed on the app to ensure it matches the intended value of the check. This step is crucial for accuracy and helps prevent discrepancies in the deposited funds.

-

Destination Account Selection: If you have multiple linked accounts or wallets within your Cash App, select the desired destination for the deposit. This ensures that the funds are credited to the correct account for your convenience.

-

Authorization and Submission: After confirming the deposit amount and destination account, authorize the deposit submission. This typically involves reviewing and accepting the terms and conditions associated with the mobile deposit service.

Processing and Notification

Upon submitting the deposit, Cash App initiates the processing phase, where the check images and information are securely transmitted for verification and fund availability confirmation. During this stage, it's important to stay informed about the deposit status and any additional actions required. Here's what to expect during the processing and notification phase:

-

Real-Time Updates: Cash App may provide real-time updates on the deposit status, including confirmation of successful submission, processing timelines, and potential fund availability.

-

Notification Preferences: Ensure that your notification preferences are set up to receive alerts regarding the deposit status. This can help you stay informed about any processing delays, fund availability, or additional verification steps.

-

Reviewing Confirmation: Once the deposit is processed, Cash App typically provides a confirmation notification, indicating the successful crediting of the funds to your account. This serves as a reassurance of the completed deposit and fund availability.

Fund Availability and Usage

After the deposit is successfully processed, the deposited funds become available for use within your Cash App account. This enables you to seamlessly access and utilize the funds for various transactions, payments, or transfers. Here's how you can leverage the deposited funds effectively:

-

Transaction Flexibility: With the deposited funds available in your Cash App account, you can initiate transactions such as peer-to-peer payments, bill payments, or fund transfers to other linked accounts.

-

Budgeting and Management: Utilize the deposited funds to manage your finances, cover expenses, or allocate the funds for specific purposes within your Cash App ecosystem.

-

Fund Transfer Options: If desired, you can transfer the deposited funds to linked bank accounts or external accounts for added flexibility and financial management.

By completing the deposit process on Cash App, you gain the convenience of seamlessly converting physical checks into digital funds, empowering you to manage your finances with greater ease and efficiency.

This comprehensive guide to completing the deposit on Cash App underscores the importance of each step in the mobile deposit process, from submission to fund availability. By following these guidelines and leveraging the features offered by Cash App, you can navigate the deposit process with confidence and enjoy the benefits of streamlined banking and fund accessibility.

In conclusion, mobile check deposit on Cash App offers a convenient and efficient way to handle financial transactions. By leveraging the app's user-friendly interface and secure technology, users can effortlessly deposit checks from anywhere, saving time and effort. The seamless process, coupled with the assurance of encryption and data protection, makes mobile check deposit on Cash App a reliable solution for modern banking needs. As technology continues to advance, embracing mobile deposit services can streamline financial tasks and enhance overall convenience. With Cash App's mobile check deposit feature, users can confidently manage their funds with ease, empowering them to stay on top of their financial responsibilities while on the go.

FAQs

-

Can I deposit a check using the Cash App mobile app?

- Yes, you can deposit a check using the Cash App mobile app. The process is convenient and straightforward, allowing you to deposit checks from anywhere using your smartphone.

-

What types of checks can be deposited through the Cash App?

- The Cash App allows you to deposit various types of checks, including payroll checks, government-issued checks, personal checks, and more. However, it's important to note that there are certain restrictions and guidelines for eligible checks.

-

Are there any fees associated with mobile check deposits on Cash App?

-

How long does it take for a mobile check deposit to be processed on Cash App?

- The processing time for mobile check deposits on Cash App can vary. In general, the funds from a deposited check may become available in your Cash App account within 1-2 business days, but this timeline is subject to change based on various factors.

-

What are the key steps to depositing a check using the Cash App mobile app?

- To deposit a check using the Cash App mobile app, you'll need to follow a few simple steps, including capturing images of the front and back of the check, entering the check amount, and confirming the deposit details. The app will guide you through the process, making it user-friendly and efficient.