Are you tired of fumbling for your wallet every time you need to make a purchase? If so, you’re not alone. As a tech-savvy individual, I’ve discovered a game-changing solution that has revolutionized the way I handle transactions: Apple Pay. This innovative mobile payment platform has won me over for several compelling reasons, and I can’t wait to share my insights with you. From its seamless integration with my iPhone to its robust security features, Apple Pay has transformed the way I shop, dine, and travel. Join me as I delve into the top 5 reasons why I’m a staunch advocate of Apple Pay and why you should consider embracing this cutting-edge payment method.

Inside This Article

**

Security

**

When it comes to mobile payment systems, security is a top concern for users. Apple Pay addresses this concern by incorporating several layers of security measures that protect users’ financial information. One of the key security features of Apple Pay is its use of tokenization, which replaces sensitive card data with a unique token. This means that your actual card details are never shared with merchants, reducing the risk of unauthorized access to your financial information.

Furthermore, Apple Pay utilizes Touch ID or Face ID authentication, adding an extra layer of security to the payment process. This biometric authentication ensures that only authorized users can make payments using their devices, minimizing the risk of fraudulent transactions. In the event that your device is lost or stolen, you can remotely suspend Apple Pay using the “Find My” app, preventing unauthorized access to your payment information.

Moreover, Apple Pay transactions are encrypted, making it extremely difficult for cybercriminals to intercept and decipher the payment data. This end-to-end encryption provides peace of mind to users, knowing that their financial details are well-protected during transactions. With these robust security measures in place, Apple Pay offers a secure and trustworthy platform for making mobile payments.

Convenience

One of the most compelling reasons I’m sold on Apple Pay is the unmatched convenience it offers. Gone are the days of fumbling through my wallet for the right card or struggling to find loose change. With Apple Pay, all I need is my iPhone or Apple Watch, and I’m ready to make a purchase. Whether I’m grabbing a quick coffee on my way to work or shopping for groceries, the ability to pay with a simple tap or glance makes the entire process seamless and efficient.

Furthermore, the integration of Apple Pay in various apps and websites has revolutionized online shopping. Gone are the days of tediously entering my payment and shipping information for every online purchase. With Apple Pay, I can complete transactions with just a touch or glance, eliminating the hassle of manual data entry and streamlining the checkout process. This level of convenience has undoubtedly transformed the way I shop and pay for goods and services, saving me valuable time and effort.

Wide Acceptance

One of the most compelling reasons why I’m sold on Apple Pay is its widespread acceptance. It’s no secret that Apple Pay is supported by a vast network of merchants, including major retailers, small businesses, and even public transportation systems. This means that wherever I go, I can confidently rely on Apple Pay to make secure and convenient transactions.

Furthermore, the global expansion of Apple Pay has made it a go-to payment method in numerous countries around the world. Whether I’m traveling internationally or simply exploring my local community, I can count on Apple Pay to streamline my transactions without the hassle of carrying physical cards or cash.

The seamless integration of Apple Pay into various industries, from retail to hospitality, demonstrates its adaptability and appeal to a diverse range of consumers. With such widespread acceptance, I have peace of mind knowing that I can use Apple Pay almost anywhere, making it an indispensable tool in my daily life.

Integration with Apple Ecosystem

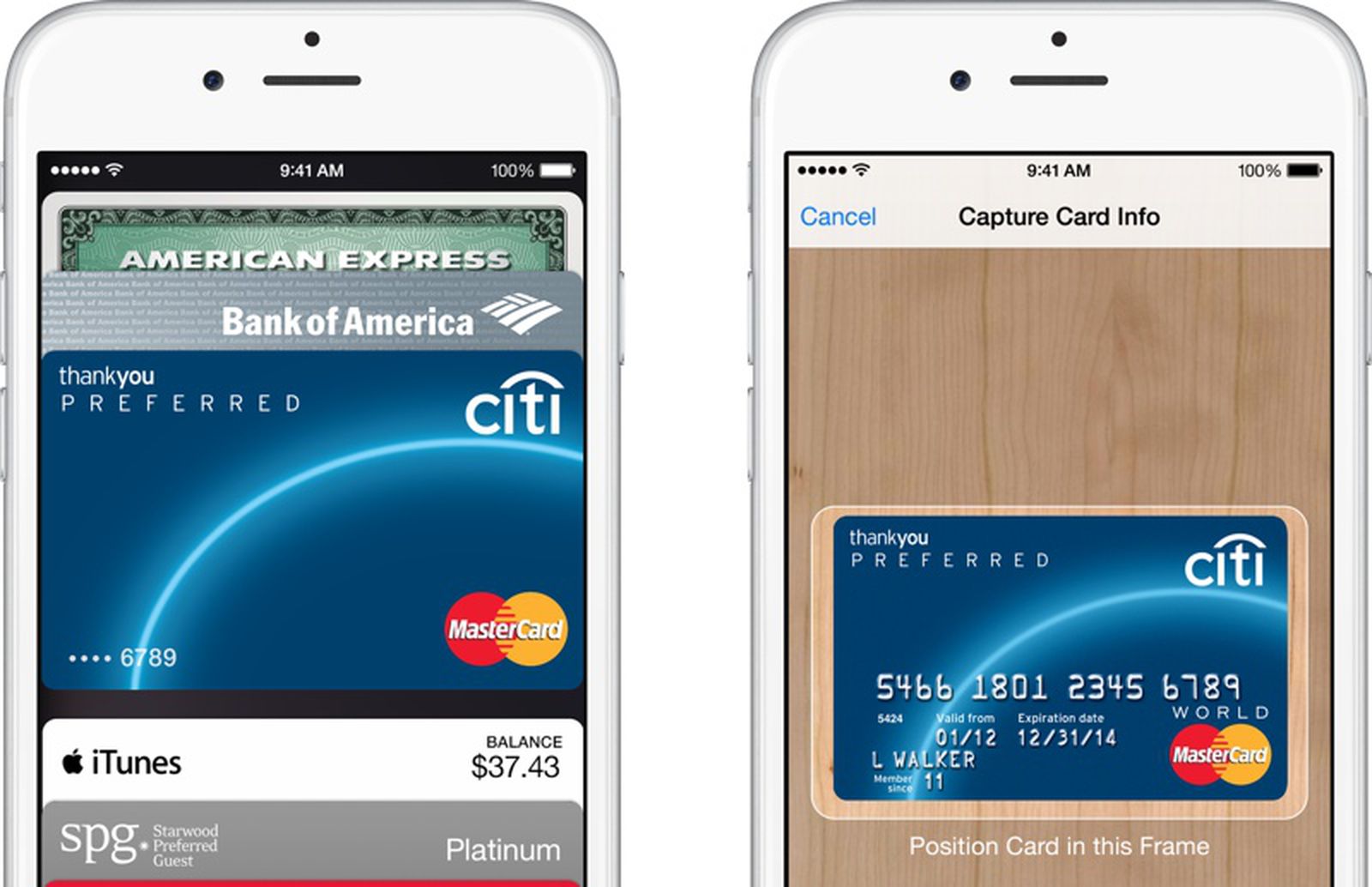

One of the most compelling reasons to embrace Apple Pay is its seamless integration with the broader Apple ecosystem. The convenience of using Apple Pay across various Apple devices, including the iPhone, iPad, Apple Watch, and Mac, creates a unified and effortless payment experience. Whether you’re making a purchase online, at a physical store, or within an app, the ability to utilize Apple Pay across multiple devices exemplifies the interconnected nature of the Apple ecosystem.

Furthermore, the integration extends beyond payments, enabling users to store boarding passes, event tickets, and loyalty cards within the Wallet app. This consolidation of essential items not only declutters physical wallets but also streamlines the overall user experience. The synchronization of information across different Apple devices fosters a sense of cohesion and efficiency, aligning with Apple’s commitment to simplifying everyday tasks through intuitive technology.

Moreover, the integration with Apple’s native apps, such as Messages and Siri, enhances the versatility of Apple Pay. The ability to send money to friends and family directly through iMessage or ask Siri to initiate a payment underscores the interconnectedness of Apple’s services. This seamless interoperability amplifies the utility of Apple Pay, positioning it as an integral component of the broader Apple ecosystem.

Conclusion

After exploring the incredible benefits of Apple Pay, it’s clear that this mobile payment solution offers unparalleled convenience, security, and versatility. With its seamless integration across a myriad of devices, robust security features, and widespread acceptance, Apple Pay has undoubtedly revolutionized the way we handle transactions. Whether it’s the ease of use, the added layer of security, or the ability to streamline everyday transactions, Apple Pay has undoubtedly won me over. As technology continues to advance, the adoption of mobile payment solutions like Apple Pay is poised to reshape the future of commerce, making transactions more efficient and secure than ever before.

FAQs

-

What is Apple Pay, and how does it work?

Apple Pay is a mobile payment and digital wallet service designed by Apple Inc. It allows users to make payments in person, in iOS apps, and on the web. The service utilizes near field communication (NFC) technology for contactless payments and is compatible with various Apple devices, including the iPhone, iPad, Apple Watch, and Mac. -

Is Apple Pay secure?

Yes, Apple Pay is renowned for its robust security features. It leverages tokenization, which replaces sensitive card data with a unique digital token, ensuring that actual card details are never shared during transactions. Additionally, the service requires biometric authentication, such as Touch ID or Face ID, for authorization, adding an extra layer of security. -

Can I use Apple Pay at any store?

Apple Pay is widely accepted at numerous retail locations, including grocery stores, restaurants, gas stations, and more. Many major chains and small businesses have embraced the convenience of Apple Pay, making it increasingly accessible for users to make purchases using their Apple devices. -

How do I set up Apple Pay on my device?

To set up Apple Pay, open the Wallet app on your iPhone and tap the "+" symbol to add a new card. You can then follow the prompts to add your credit or debit card details. For added convenience, some banks and financial institutions also offer the option to add cards directly through their respective mobile banking apps. -

What are the benefits of using Apple Pay?

Using Apple Pay offers several advantages, including enhanced security, expedited checkouts, and the ability to store multiple cards in one digital wallet. Moreover, Apple Pay promotes contactless transactions, which are particularly valuable in today's environment, as they minimize physical contact and contribute to a seamless and efficient payment experience.