Almost everything, including the movement of cash, has gone digital. We now have the capability to transfer money to other people using our phones via payment or money transfer apps like Cash App. But if you’re not happy about its service or want to explore more options, you’ll be glad to know that there are many Cash App alternatives out there.

Figuring out which payment or money transfer platform to use is a bit daunting, though. So, we’ll walk you through a list of 15 services or apps like Cash App that are worth checking out.

Inside This Article

- What Cash App Is and Why You Might Need an Alternative

- Top Apps and Services Like Cash App

- Are Money Transfer and Payment Apps Like Cash App Safe?

- How Do You Use Money Transfer or Payment Apps Like Cash App?

What Cash App Is and Why You Might Need an Alternative

Cash App is a popular money transfer or payment app known for its low transaction fees. With it, you can instantly transfer cash to another person who also has the Cash App installed on their phone. Depending on the amount you send, there might not be a transfer fee at all.

Cash App is quite popular in the US, especially for cash transfers that only require a small amount. The app also supports various cards, such as Visa and MasterCard. On top of that, Cash App has an investing feature for avid investors and beginners alike.

It sounds perfect up to this point. But Cash App has downsides long-time users know, which might make you push through with looking for other apps like Cash App. Here are some of those:

1. Cash App has a $1,000 monthly limit for sending and receiving money if you’re not yet a member.

2. Users under 18 years old find it difficult to be verified on the app.

3. The app doesn’t support bill splitting; therefore, fewer opportunities to save cash.

4. Cash App is a debit card-only app.

5. Social experience is limited in-app.

Top Apps and Services Like Cash App

Cash App might not be for everyone, as you already know. Different people have different needs. So, if you find that Cash App isn’t the way to go for you, we’ve got a list of Cash App alternatives you can try. Browse these services and apps that are similar to Cash App and see if they’re suitable for your needs.

1. Apple Pay

Apple Pay isn’t an app but an Apple proprietary service for payments. Nonetheless, it’s still in any conversation pitting the best apps like Cash App against each other. So, we’ll be including it here among your options, too.

If you’re an iPhone or Mac user, there’s no need to download Apple Pay. It’s already integrated into your gadget; you only have to activate it. All you need to enable Apple Pay is your existing Apple account. With the said Cash App alternative, you can send money and messages to someone. Best of all, you don’t have to run the risk of bringing physical money when you have it.

Apple Pay allows you to transfer up to $10,000 per attempt. In a week, you can send and receive up to $20,000. For credit cards, the transfer fee is usually around 3%. The transfer process can be completed in up to three days, depending on the amount. But if you’re in a hurry, you can send money immediately using an instant transfer.

Apple Pay isn’t perfect, though. Hackers target it, which is typical in every payment app or service. The good thing is that Apple has put many security measures in place, though verifying yourself can take a long time due to that.

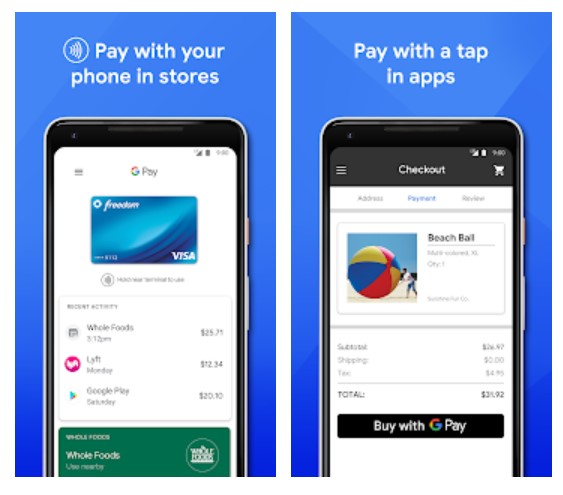

2. Google Pay

Google also has its solution for money transfers and payments — Google Pay. It’s an app that supports debit and credit cards and is easy to set up and use. Unlike Apple Pay, this app is available on all major devices that run on Android and iOS.

Google Pay transfer fees are usually about 1.5% of the amount you transfer for debit cards. In terms of limits, the maximum amount in a single transaction is $2,000. Meanwhile, the daily maximum is $2,500.

Many users applaud Google Pay for its transfer speed because it can usually transfer within three days. However, that’s not to say the experience is always smooth-sailing. For example, transactions might sometimes be unaccepted. Additionally, there are concerns regarding how much information gets disclosed. Regardless, it’s a great app.

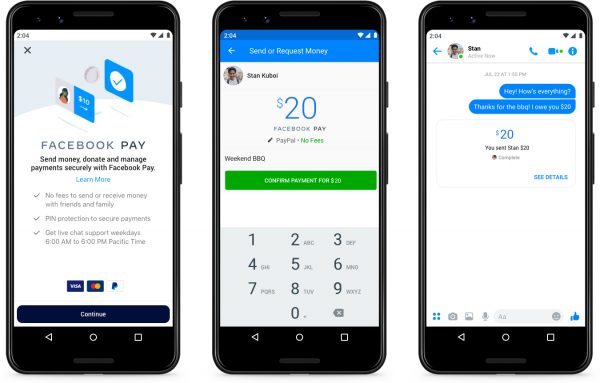

3. Meta Pay

Meta Pay, also known as Facebook Pay, isn’t an app per se. But its convenience due to being integrated into Meta-owned mainstream apps such as Facebook, Instagram, and Messenger makes it qualified into our list.

Meta Pay lets you pay multiple people at once and invest in cryptocurrency, unlike other apps like Cash App. The transaction limit is relatively high; it’s $9,999 for a single transfer.

Additionally, you’ll prefer Meta Pay even more because of its customer support that can occasionally respond within minutes. Also, it has a rewards program that gives benefits to loyal users.

To use Meta Pay, though, you’ll also need to be over 18 for verification. In addition, you must be situated within the app’s supported countries.

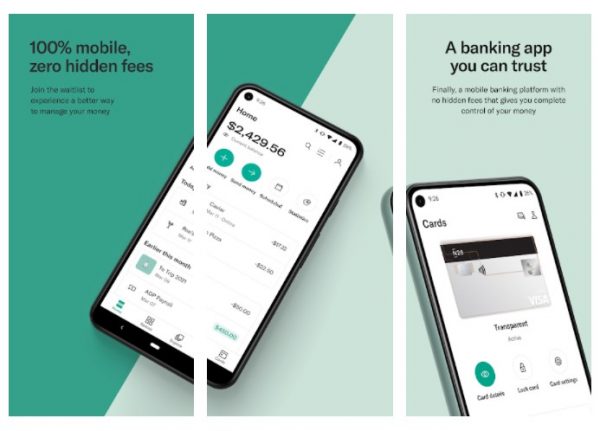

4. N26

Another widely-used payment app in the US is N26. It’s considered one of the most flexible of its kind since it’s more of a digital banking app. You can use it to receive big payments, and transfer cash to people in the US for free, unless you’re sending money to a bank.

People use N26 to receive their salaries since it comes with a physical card as well. The limit is also fairly lenient, allowing you to send $30,000 a month or $5,000 a day. You can also withdraw up to $1,500 a day from an ATM using a physical card.

While N26 has great features, it does have some major flaws. For instance, the transfer fees are quite high for a payment app. Moreover, you can only use a debit card with it. Despite this, N26 is still considered one of the best money apps like Cash App.

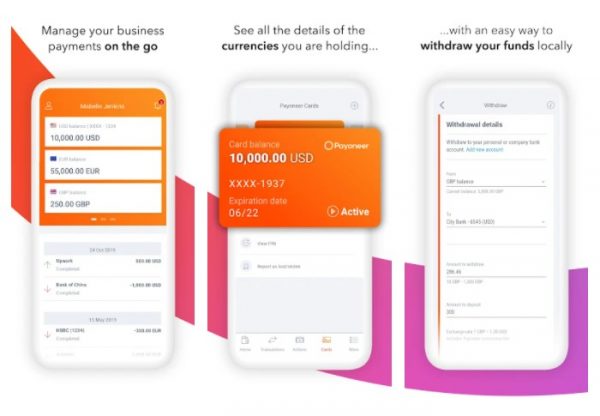

5. Payoneer

Also among the mainstream global payment platforms to try is Payoneer. Unlike other apps like Cash App, Payoneer is mainly for businesses, often used for paying out wages. It’s popular with international companies.

A worldwide consensus states that Payoneer is trustworthy, so you don’t have to worry about it being unsafe. Plus, the service can even give you a debit card. However, some people have mentioned that its customer support can be unresponsive. Many have also complained about the transaction fees.

The transfer limit for Payoneer is $2,500 a day. And within 30 ATM transactions, you can withdraw up to $5,000.

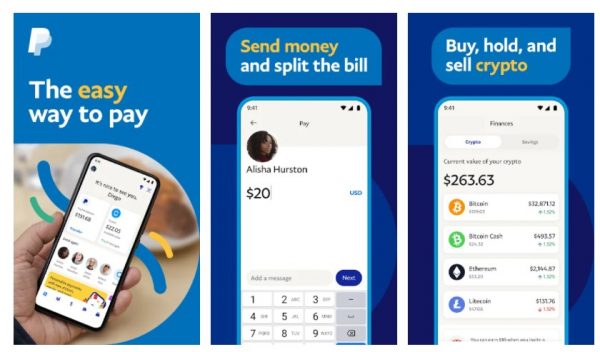

6. PayPal

PayPal needs no introduction. It’s the trendsetter that made payment apps popular. But in case you’re among the uninitiated, it’s one of the leading money apps like Cash App and has worldwide recognition for being a platform that keeps you safe against fraudulent activities.

If you’re verified on PayPal, you can transfer up to $4,000 at one time. There are also little to no fees for transactions made to relatives and friends. But for businesses, there’s a different story. Also, bank transfers are slower (sometimes needs many days to complete) using the app.

Despite the few drawbacks, PayPal is worth it because of the said reputation.

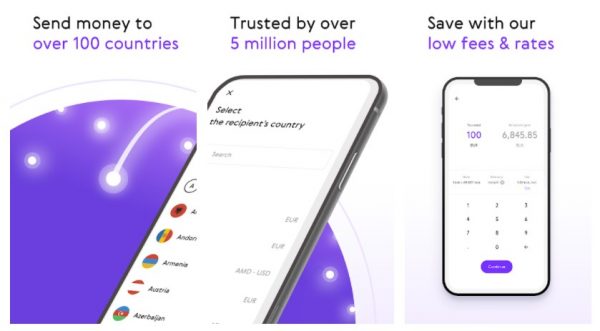

7. Paysend

If you want apps like Cash App that have a fixed transfer fee, then Paysend might be for you. Transfer fees are a flat $2 on the app no matter the amount you send. There are also various methods for you to pay, be your preference card payment or direct payment from your bank account. Paysend is also available in more than a hundred countries.

While the transfer fee may be flat, you’re going to need to be patient for your transfer to kick in. The transaction speed is inconsistent, and it can take from three days to a week for your money to be sent to the intended recipient. And if you’re unverified, you can only send and receive $1,000 every six months.

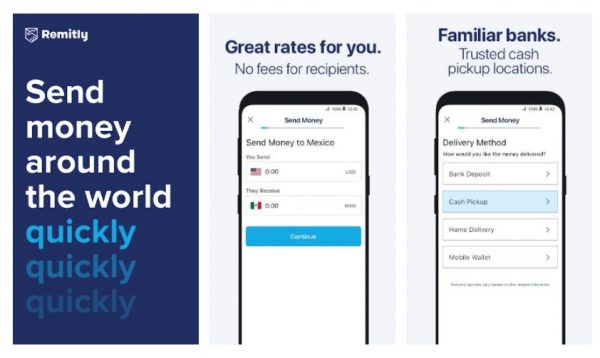

8. Remitly

Unlike most entries in this list of apps like Cash App, Remitly lets you deliver and receive physical cash. Given that, it’s both a payment app and a cash delivery app.

What’s great about Remitly is that it offers low rates and is said to have good customer service. The transfer limits on the app range from $3,000 to $10,000 depending on your verification level. The transaction fee and speed also vary from region to region. Cash deliveries abroad are slow using the platform, though. Still, Remitly is worth a try if you’re a bit patient about that.

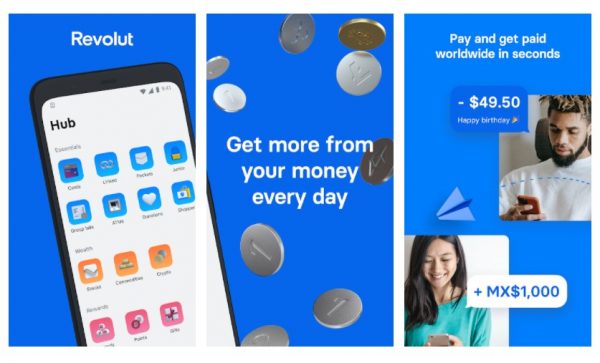

9. Revolut

Revolut is more of a finance and budgeting app that just so happens to double as a payment app like Cash App. It features a budget planner and lets you purchase cryptocurrency. And if you’re a parent, you can also set up a junior account for your kids.

People use Revolut primarily because it doesn’t have a transfer limit. Also, the transfer time is pretty quick. While there’s no transfer limit, there are still costs for the actual transfer. That gets higher the more you send. Transfer fees can also be based on where you live.

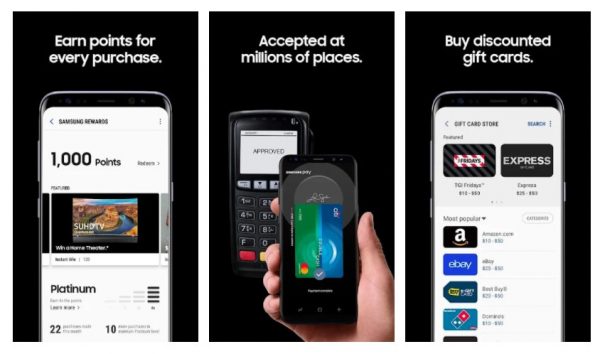

10. Samsung Pay

Big companies like Apple, Google, and Meta created payment services or apps like Cash App. There’s no surprise Samsung noticed that and made its own – Samsung Pay. The app has conditions and offers different from its counterparts, of course.

For starters, Samsung Pay allows you to pay upfront at point-of-sale places. Samsung Pay also keeps its customer base by offering unique and exciting rewards for loyal customers. And naturally, it’s also only useable on Samsung phones.

Unlike other popular payment apps that double as money transfer platforms, you can’t send money to friends and family using Samsung Pay. You can only utilize it for certain payments. Nonetheless, if you’re a fan of loyalty programs and are a Samsung device user, make the most of the app now.

11. Skrill

Another app that made payment apps popular is Skrill. It functions as an online wallet, letting you manage separate personal and business accounts and get your Skrill card exclusively for use in the US.

The transfer fees are relatively low at 1% for bank transfers and are determined via the type of transaction. You can also send any amount from $1,000 to $5,000 if you’re verified. But it does take a while to get verified, and customer service is limited when it comes to this. Also, Skrill’s transfer speed is around two to five days for bank transfers, which is slower than some of its competitors.

If the pros stand out more than the cons for you, then choose this app now.

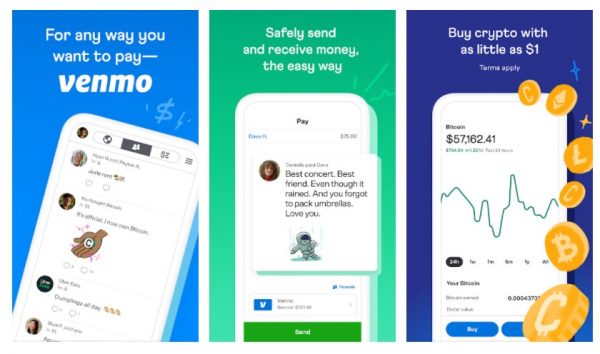

12. Venmo

Started by PayPal in 2009, Venmo is one of the most popular apps like Cash App in the US. Venmo changes things up by allowing you to send emojis to your friends. You can also receive big amounts of cash, including salaries.

Venmo limits you to $300 per week if you’re not verified, though. If you’re verified, the cap goes up to $5,000. And if you avail of a Venmo MasterCard, it becomes $7,000. The transfer fees are also reliant on how much cash you are about to send. Venmo gives you options for instant transfers, too.

A disadvantage of using Venmo is that it has no room for international transactions. Also, there are user complaints about poor customer service.

Also read: Cash App vs. Venmo: Which is the Better Mobile Payment App?

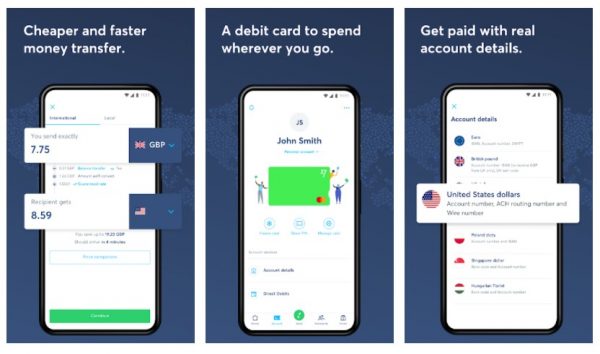

13. Wise

Looking for more apps like Cash App? Check out Wise. It’s among the most used payment apps internationally because it gives free debit and credit cards, and has excellent customer service. Plus, there are small or no conversion fees when you do international transactions.

Apart from what’s mentioned, Wise is a great choice for major businesses and individuals because of its high transfer limits. You can send up to $1 million in the US and $1.6 million internationally. Wise only allows you to pay using bank transfers, though.

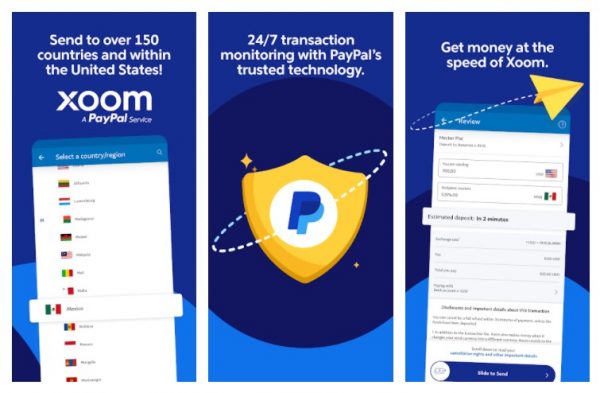

14. Xoom

When it comes to flexibility, among the best payment apps available is Xoom. PayPal created Xoom with many different types of transactions in mind. You can do cash deliveries as well as send money to the bank using it. It’s also available in over 160 countries, making it excellent for international transfers.

Despite this, people criticize Xoom for its low transfer limit and inconsistent transfer fees depending on the country. However, transfers with Xoom are almost always instantly sent. Xoom is one of the best apps like Cash App with the fastest transfer speeds.

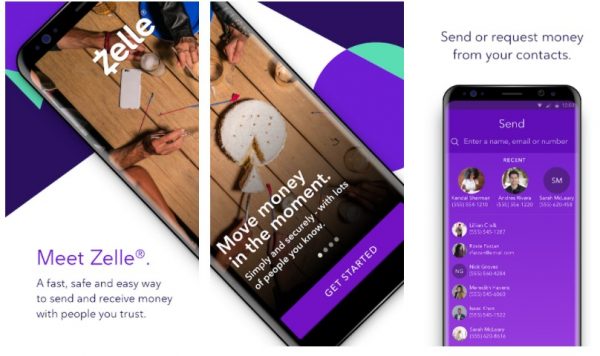

15. Zelle

Unique for having no receiving limit, Zelle is a great choice for anyone who wants apps like Cash App. It’s compatible with most apps already, and if the banking app you use supports it, you don’t need to download a separate app. Most banking apps in the US are compatible with Zelle, too.

However, Zelle doesn’t support credit cards; it is debit-only. It also has low security, not having any protection services for fraud. Moreover, the app only accepts US bank accounts. Despite its flaws, Zelle is still one of the most widely used apps due to its integration into banking apps.

Are Money Transfer and Payment Apps Like Cash App Safe?

Now that you have a list of the top picks, you might still be hesitant in actually trying the options because you want to be more than 100 percent sure that they are safe. If you indeed are, know that using apps like Cash App is fairly safe since most of those will prevent unauthorized transactions. The best money transfer and payment apps even have multiple (and strict) measures in place.

In fact, the majority of money transfer and payment apps have ways to get your money back in the event of an unauthorized transaction. Some of those let you retrieve your hard-earned cash even if the issue is your fault, say you’ve sent money to the wrong person. A few even support dispute resolutions.

A gentle reminder, though — even if the apps are trustworthy, that does not mean they aren’t impenetrable. Your money might still be stolen through new fraudulent schemes that the makers of the apps haven’t prepared for. Thus, feel free to try the app you think will meet your needs but do not lower your guard down while using them. Find ways to protect yourself on top of what the apps offer. For example, familiarize yourself with phishing schemes and do not provide your data or push through with the transaction if you already sense a few red flags.

How Do You Use Money Transfer or Payment Apps Like Cash App?

If safety isn’t your concern, maybe you’re a bit worried about how you’ll use the apps since you’re new to them. In that case, we’re going to give you a quick backgrounder.

If you didn’t know yet, money transfer or payment apps usually require you to link your debit card to start using them. That is because the money from your debit card is what fuels the app. When permission is granted, the amount you put in the app will be the source of the funds to be transferred.

Why can’t you just use cards for your transactions, you ask? Well, money transfer and payment apps are more convenient when buying things online and sending money to friends. Plus, it’s easier and quicker to log in to those payment apps than to input the digits of your card for the traditional methods. Best of all, you don’t have to risk your cash being stolen physically if you have an app.

Experience Smooth Transactions Through the Best Apps

There are more services and apps like Cash App out there, but with this list, you already know the ones with the best reputation. Thus, we really hope you find the one that you can rely on. Experience smooth money transfers and payments now with the app or service of your choice!