Over the years, there have been a number of buy-now-pay-later services (BNPLs) that have risen to popularity, and one of them is Quadpay (now known as Zip). Just imagine being able to buy an item you really need but the seller extends your paying method in four or more equal installments. The flexibility in paying the full price of the item makes this credit service appealing. While it is a service that many use, there are other apps like Quadpay out there.

These apps like Quadpay are what we are featuring in this article. Furthermore, we want to go over the features of these apps and probably help you decide whether they are worth the shot.

Related: 13 Best Buy Now, Pay Later Apps for Easy Shopping

Inside This Article

What Is Quadpay and Its Problems?

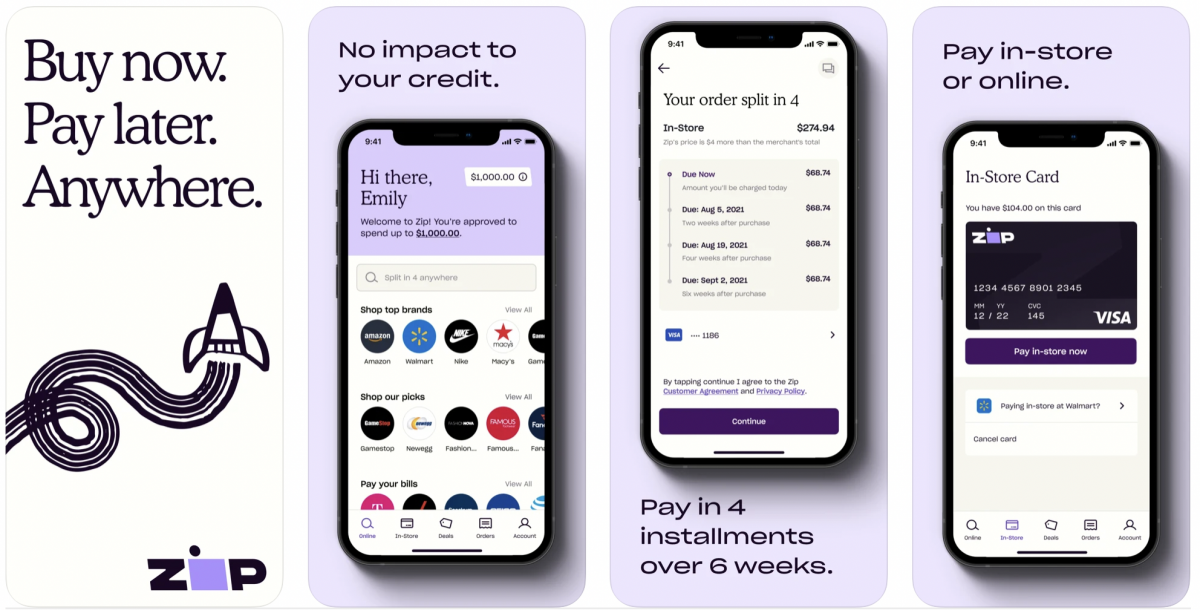

Quadpay, or what is now known as Zip, is a financing scheme that allows a buyer to pay for an item in four installments. In that context, this BNPL service will definitely allow anyone to cover important expenses. This app essentially works in the similar way other BNPLs do.

- Choose the app as your payment method during checkout.

- Enter the full amount of the item, taxes included, and wait for the approval.

- Once approved, Quadpay creates a virtual credit card.

- Complete purchase using the in-app credit card.

In addition, Quadpay offers a buyer the flexibility to pay the item in full over four-installment periods that can be paid within six weeks. Therein lies some issues about this BNPL service.

There are three main issues buyers often encounter when using Quadpay. Because of these issues, users tend to look for alternative apps similar to Quadpay to try shopping with. These are the following:

- Charges for late fees. Quadpay’s TOCs on payment dates are easy to understand. However, it charges buyers who fail to pay on the date specified. Late fees charged depend on which state you are a resident of, and it can range from $5, $7 to $10.

- Charges by payment card. When a buyer fails to pay on a specified date, the payment card a buyer associates with Quadpay may charge for interest, late fees, or overdraft fees.

- Complicated refund scheme. Quadpay’s TOCs on refund, return, or exchange items state the buyer has to deal with the merchant directly. Once the merchant approves the refund or return, only then Quadpay can refund the amount the buyer paid.

Despite these hiccups, Quadpay still maintains a reputation as one of the BNPL options for Americans.

Download Quadpay (Zip) for Android

Download Quadpay (Zip) for iOS

Best Apps Like Quadpay

If you are having issues with Quadpay (Zip) and want an alternative app, here are some of our recommendations for you!

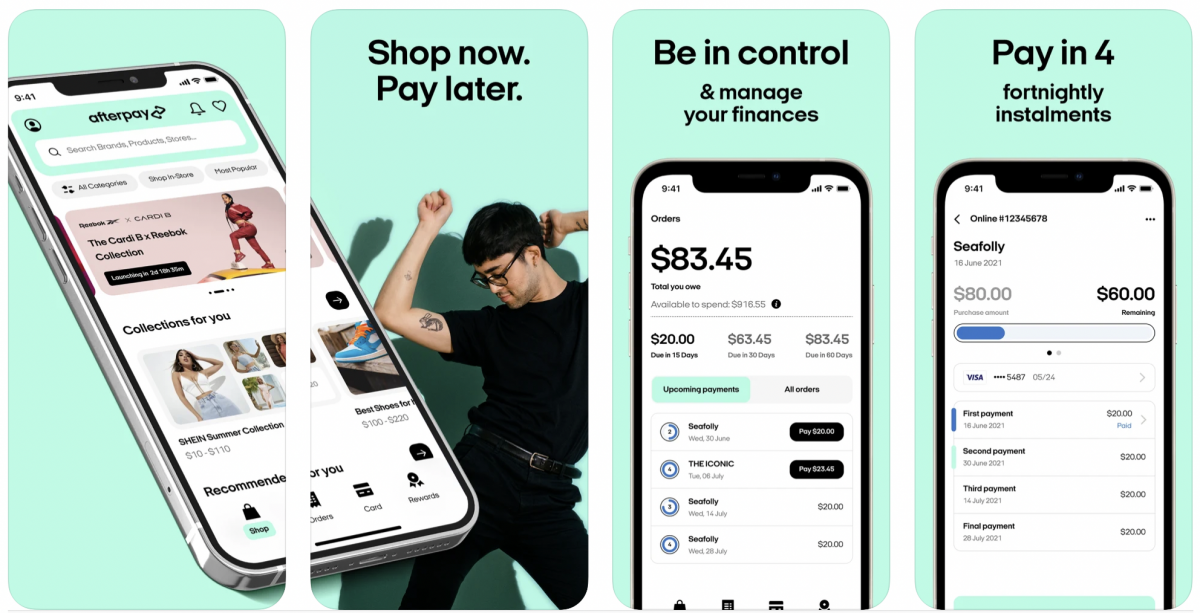

1. Afterpay

This Sydney-based buy-now-pay-later service gives buyers the payment flexibility they need to be able to purchase an item. Afterpay only requires buyers to deposit 25% of the full price for the item purchased. In addition, its appeal is centered on how transparent Afterpay is when it comes to charges. Afterpay is clear in stating it does not dupe buyers by showering them with hidden fees and high rates.

Furthermore, buyers can instantly get a spending limit upon signing up. Afterpay has tens and thousands of trusted merchant partners around the globe that millions of verified customers get to enjoy the service.

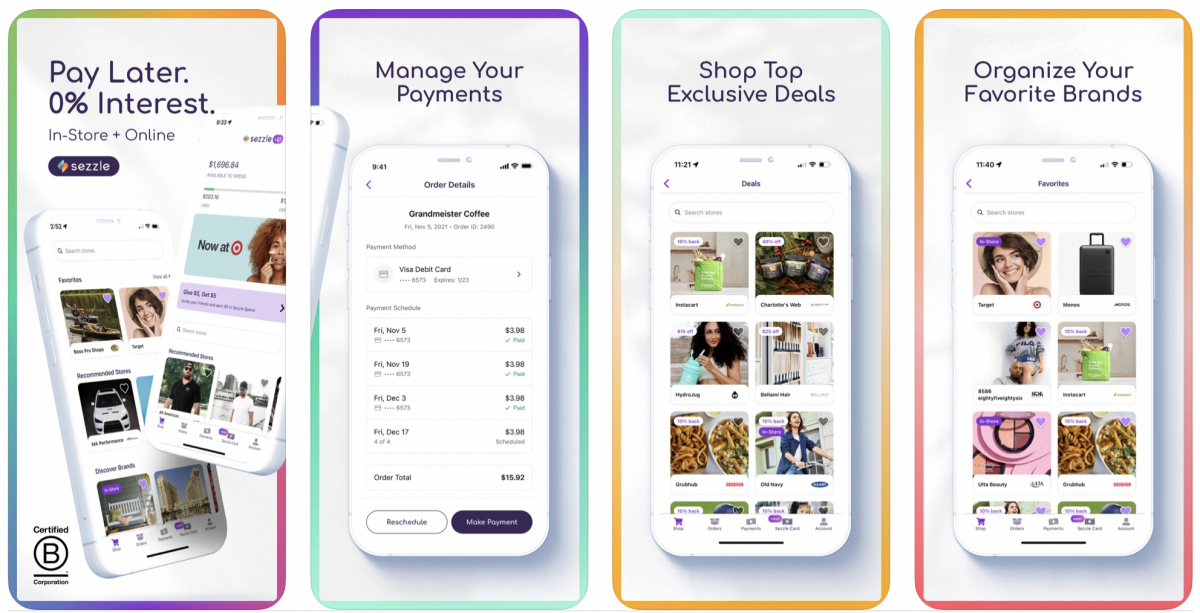

2. Sezzle

Sezzle is a Minneapolis-based buy-now-pay-later service that guarantees buyers (1) flexible payment methods and (2) purchases from 40,000 up-and-coming brands. It has one of the best user interfaces for an app, making purchases easy for buyers.

However, buyers would often be surprised by how the service operates. For one, Sezzle assesses a buyer’s credit score before a spending limit is assigned. Sezzle also cuts the installment period generously, although it does charge interest fees on top of the amount due. Nonetheless, this BNPL service has amassed millions of loyal active members, which is a testament to its reputation as one of the trusted and verified apps like Quadpay.

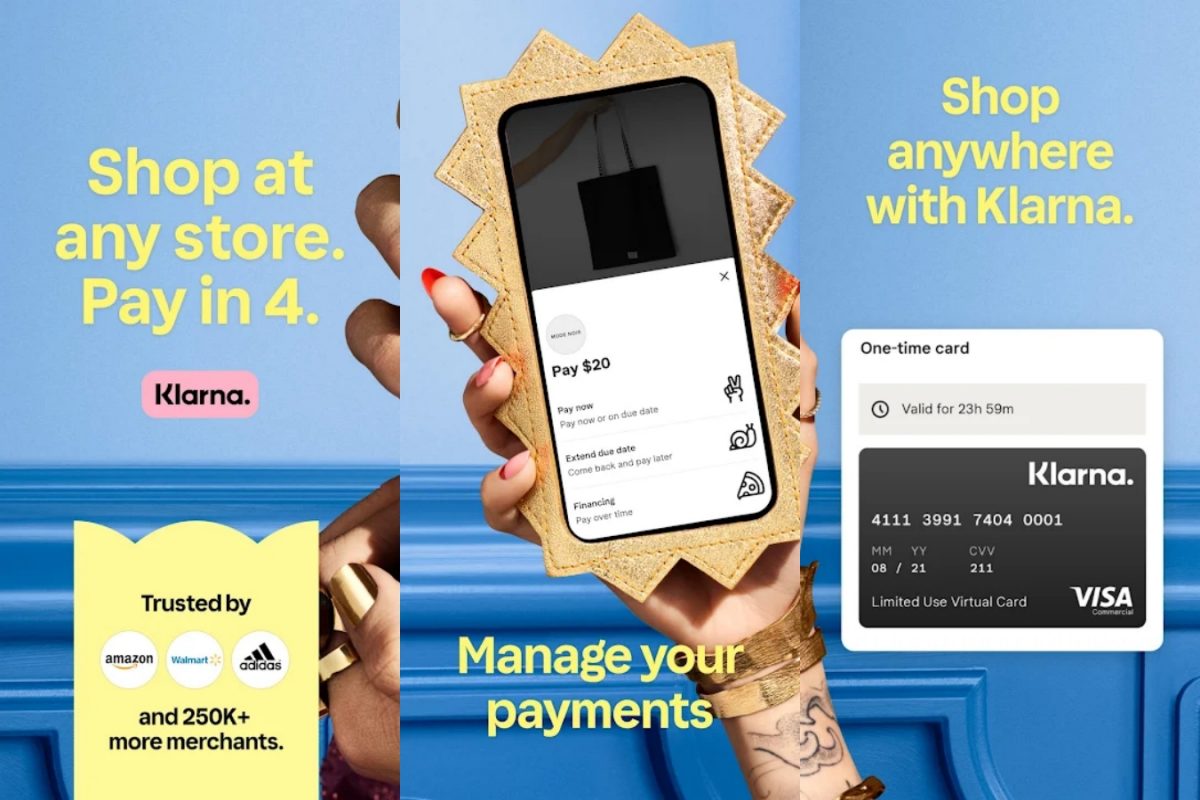

3. Klarna

Klarna is one of the recognizable BNPLs in America as it allows a consumer to buy an item from its partner retailer and split the payment into installment periods. Essentially, Klarna allows buyers to borrow money and use the credit to pay for an item that accepts debit or credit cards as a mode of payment. In addition, Klarna reviews a buyer’s financial and credit backgrounds to approve one the use of its services and for the company to ensure a standard.

Klarna is preferred by many Americans as it does not charge an annual fee like other financial services. This is one of its selling points considering Klarna acts as an alternative to traditional credit cards or traditional loans services.

Our team has conducted a full review of Klarna. You can read our Klarna Review: Why Use It for Shopping? article to know more.

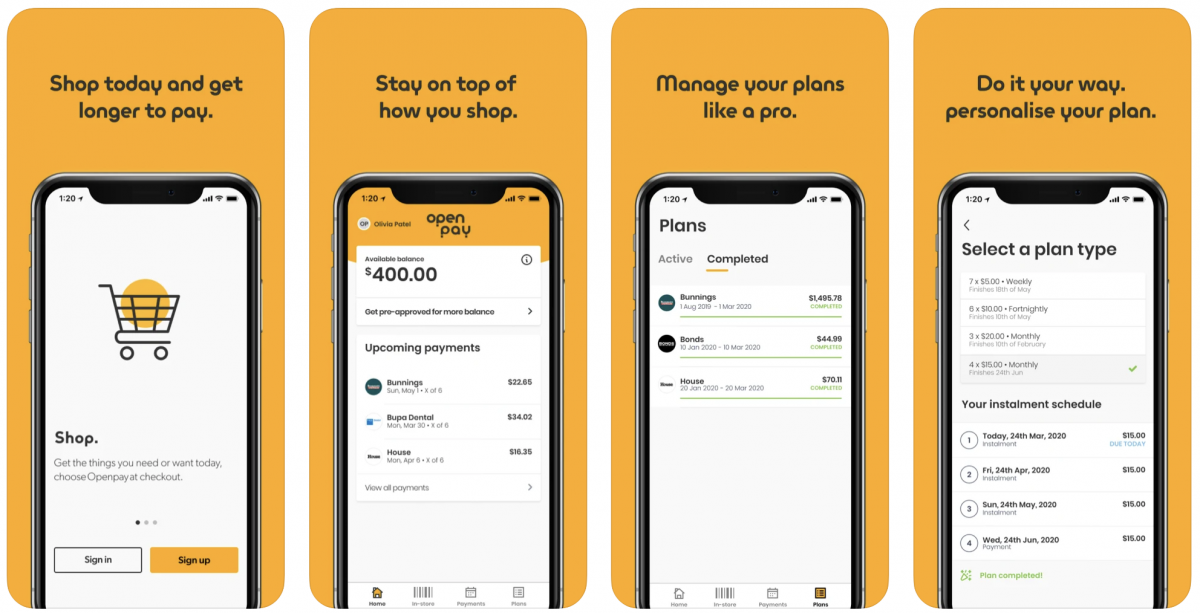

4. OpenPay

Openpay, commonly abbreviated as Opy, offers buyers the chance to purchase an item easily and helps them make that payment. Essentially, this BNPL service promises buyers to pay for a service without bombarding them with hidden charges. This goes to show Opy’s TOCs are transparent to the buyer.

However, Opy isn’t like other BNPLs we have on this list. This is because Opy specializes in services like veterinary, with plans to expand on the following markets:

- Big Ticket Retail

- Education

- Home Improvement

- Optometry

It’s nice to see BNPLs now expanding on other essential services aside from retail.

5. Affirm: Buy Now, Pay Over Time

Affirm maintains a positive reputation as being a verified and trusted BNLP in the industry. It certainly has a good image, considering it is a recognized partner of big, global brands. In addition, it has amassed an extensive client base in the US and around the world.

Affirm has been founded with the goal to offer buyers the ability to control their finances. It also aims to deliver premium and client-oriented services to its members. In order to make this happen, part of this BNPL’s TOCs is that members have to pay an annual fee capped at 30% or lower. In return, the service makes it easier for buyers to shop from the comfort of their homes; it has an app for iOS and Android devices. Plus, it also sends timely email notifications reminding members of their due dates.

How is Affirm asking buyers to pay for their loans, you may ask? Well, Affirm gives its members one year to pay their purchases in full. Making payments ahead of due dates would result in perks such as an increase in spending limits.

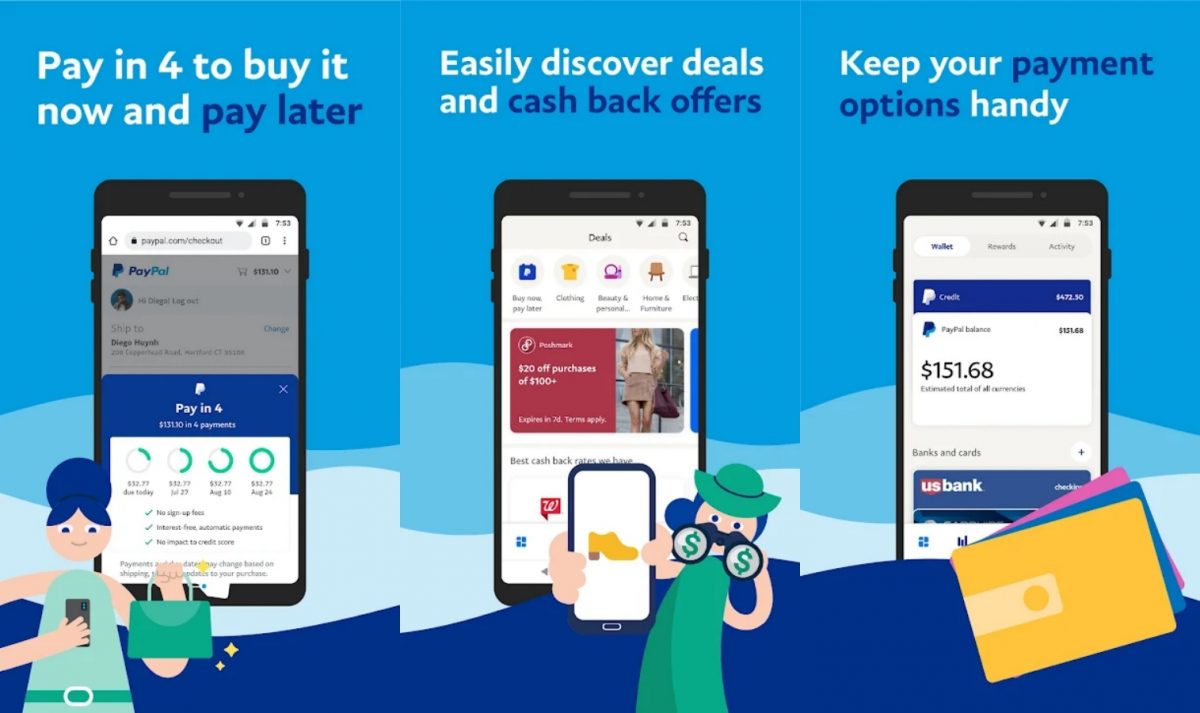

6. PayPal Credit

It is impossible to imagine anyone who uses the internet not knowing about PayPal. It was founded by Elon Musk to serve as an online payment gateway that people enjoy to complete monetary transactions. More recently, this company has launched its own BNPL service called PayPal Credit.

Similar to other BNPLs, PayPal Credit assigns a spending limit for every member which they can use to complete their purchases and pay the amount due over time. In the case of PayPal Credit, the amount due is split into four interest-free payments with no late fees. Furthermore, buyers need to pay a mandatory $0.3 and 2.9% on every transaction.

Nonetheless, applying for PayPal Credit is easy and fast.

7. Zebit

Apply and get approved to enjoy Zebit’s 0% APR while paying for an item purchased over six months. As one of the Zip Pay alternatives, Zebit has partnered with global brands to bring products to buyers and pay for them interest-free. These brands include Samsung, Apple, Sony, Nintendo, etc. Moreover, Zebit is preferred by a good number of Americans because it’s transparent when it comes to the non-collection of late fees, membership fees, and even product repossession.

Zebit caps a member’s spending limit to around $2500. Furthermore, it assesses an applicant’s credit score through its own service called Zebitscore System. The report generated by this system helps inform the company whether to lower or raise a member’s spending limit.

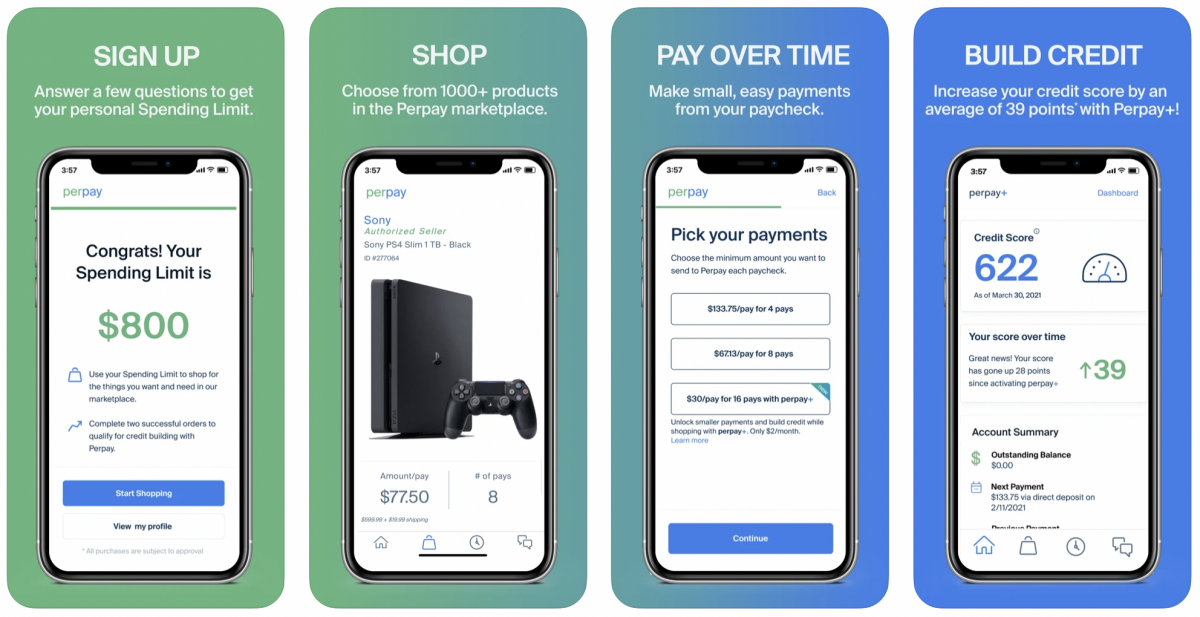

8. Perpay

Aside from being a buy-now-pay-later service, Perpay also helps increase someone’s credit score over time. However, the service does not require an in-depth credit check upon signing up. In addition, signing up and using the app is pretty straightforward, thanks to the user-friendly user interface on both the website and app platforms.

Once Perpay finishes conducting a soft credit check, a member would be assigned a spending limit to use when making purchases. Members can then get access to partner merchants through the PerPay Marketplace in the app.

We mentioned that Perpay helps increase one’s credit score within four months. This is provided a member pays for his amount due responsibly and on time. With this feature, Perpay is an excellent app like Quadpay, or maybe even better.

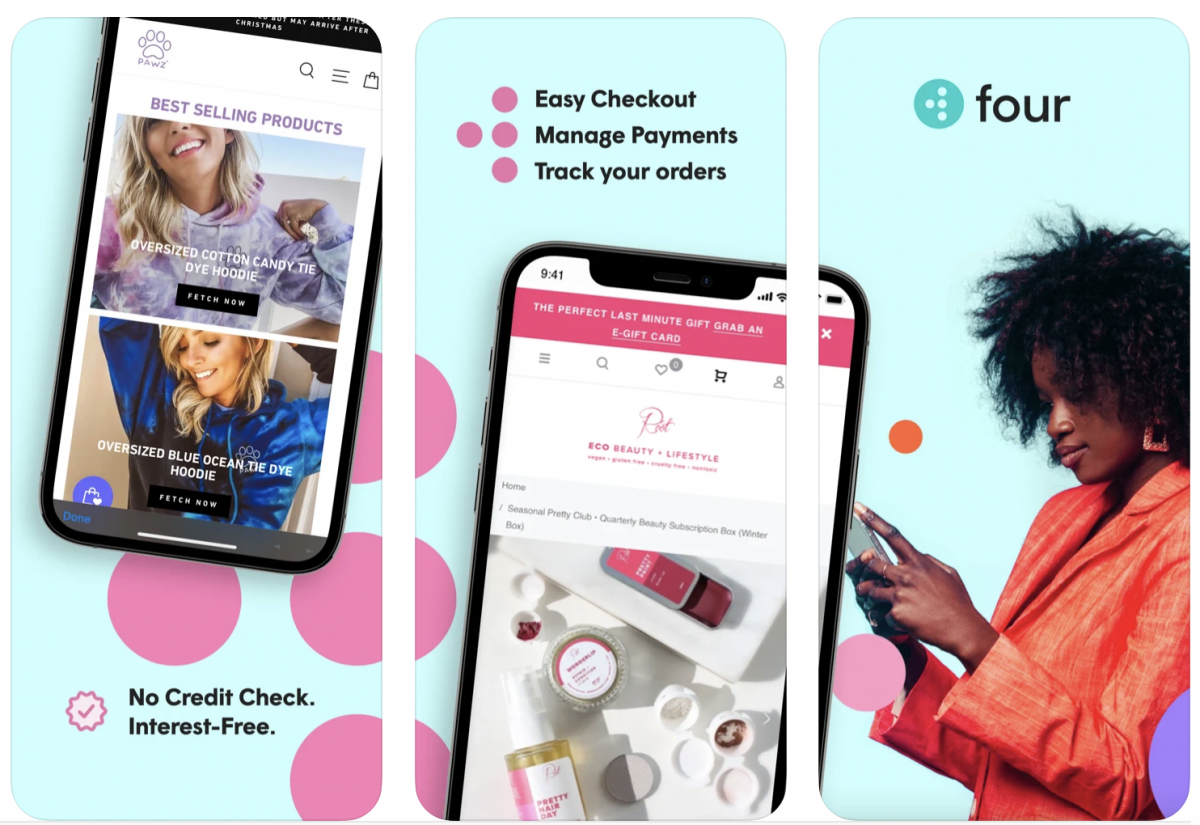

9. Four Pay Later App

Similar to other apps like Quadpay, Four has partnered with trusted global brands to deliver a smooth shopping experience to its members around the world. As a buy-now-pay-later service, it allows members to make purchases and have them pay the amount due in four installment periods right at the comfort of their homes. Plus, these payments are interest-free!

In addition, the Four Pay Later app is quite straightforward and easy to use. It has four designs that members can choose from that fit their degree of convenience.

Download Four Pay Later for Android

Download Four Pay Later for iOS

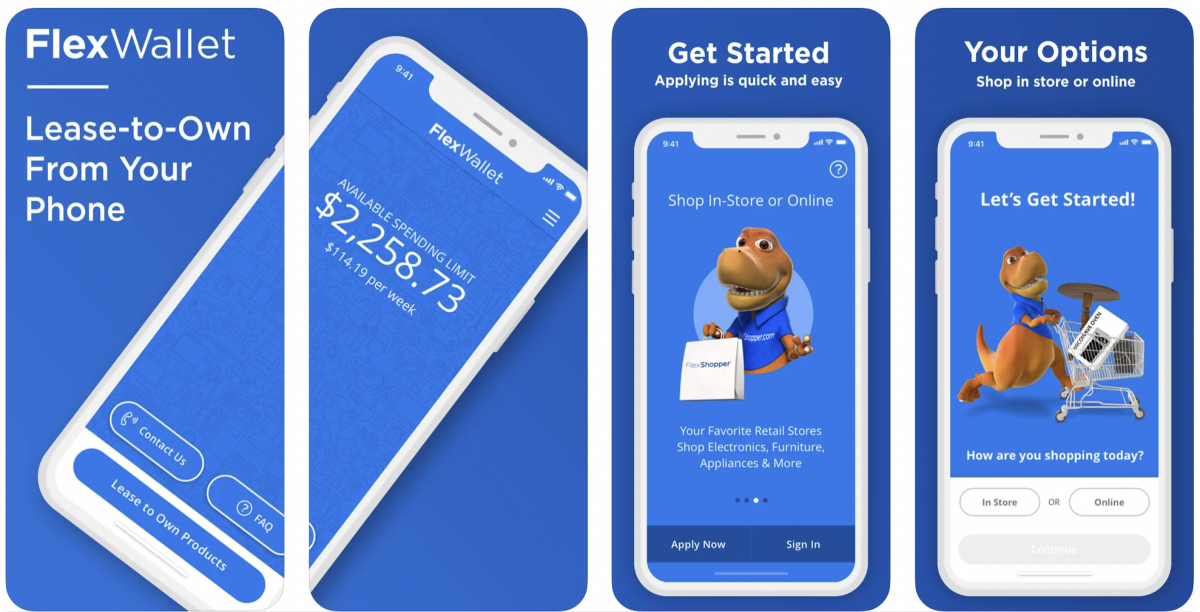

10. FlexWallet

FlexWallet operates slightly differently from the other BNPLs we have on this list. Its main market is those who are more drawn to the lease-to-own types of purchases. In addition, FlexWallet does not use an applicant’s credit score as a determinant for his/her spending limit. Once the application is approved, FlexWallet goes over an applicant’s purchase history and income before it allocates a spending limit equaling or lower than $2500.

Once the application is approved, successful applicants get a virtual credit card which they can use to complete purchase transactions online or in-store locations.

Download FlexWallet for Android

11. FuturePay

FuturePay is an innovative non-credit-based payment solution preferred by many Americans as it delivers options that fit their spending trends. It is also further supported by the ease at which members can access its service both online and on the app platforms. In addition, FuturePay eradicates the inconveniences members often encounter with single purchase installments and credit card loans.

Applying and creating a FuturePay account is easy and does not require the use of a credit card. However, FuturePay charges $1.50 /month for every $50 carried forward in case a member fails to pay the amount due as stated in the billing cycle.

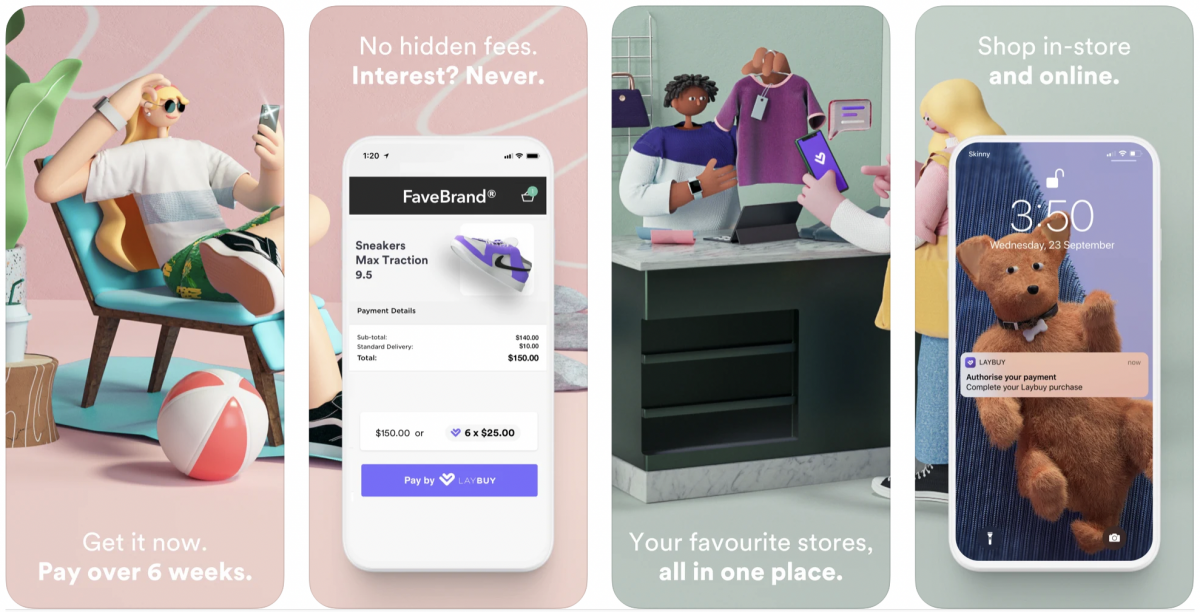

12. LayBuy

LayBuy is another Zip Pay alternative that will allow a member to buy an item and pay the price in six weekly interest-free installments. Moreover, creating an account is easy using its website or smartphone application. Once the account has been created and Laybuy approves the application, a member gets assigned a buying limit. Laybuy does conduct a credit check before it approves any application.

In case a member fails to pay the amount due on the specified billing cycle, Laybuy charges an $8 late charge fee. Nonetheless, a member is given a chance to pay for the item purchased once a week over six weeks period.

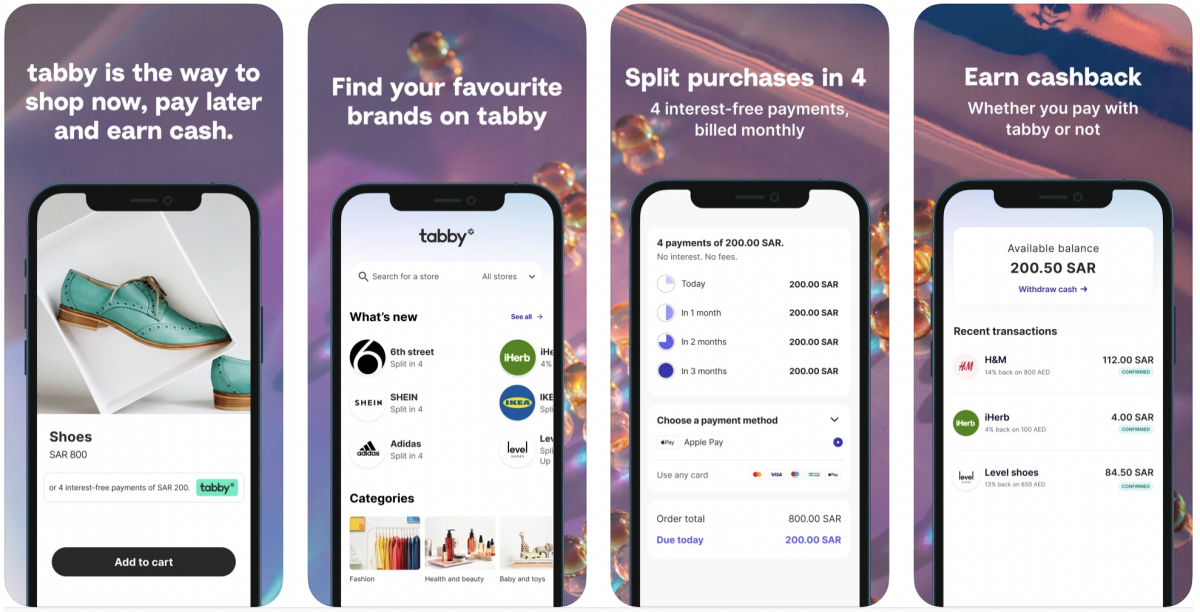

13. Tabby App

Wrapping our list is another decent app like Quadpay is Tabby (stylized as tabby). Tabby is a partner of many American retailers and aims to bring the convenience of shopping to your homes. Getting an account application approved is easy and fast. Once approved, a member simply has to link a credit card before proceeding. Moreover, customers can enjoy shopping for various brands with the Tabby app without incurring additional charges or worries of hidden charges.

Takeaway

That’s our list of the best apps like Quadpay. If you are not ready to spend a huge sum of money upfront, getting these services can offer you a flexible financing scheme to split your payment. Most of them would offer low to zero financing interest, so you won’t feel as if you are getting ripped off. Needless to say, you should be a responsible borrower and settle your amount due on time to avoid charges.