Apps like Klarna that offer “buy now, pay later” plans have become popular because they make shopping faster and easier. Both traditional retail and e-commerce partners with this type of loan service because it provides their patrons with easier ways to shop. They offer convenient payment plans so shoppers won’t have to worry about making their purchases. With these apps, you can typically order the item that you want and pay for them by installment within a set period. One of the most popular apps that offer this payment scheme is Klarna, but there are many options left.

In this article, we’ll be looking at a couple of apps like Klarna that provide users with “buy now, pay later” plans for their online shopping and e-commerce needs.

Also Read: Top 15 Budget Apps You Need to Use

Inside This Article

What Is Klarna?

Klarna is a handy app that allows you to purchase items online and in-store. The app provides its users with a “buy now, pay later” scheme that allows them to purchase the item that they want with pay-over-time installment options.

In Klarna’s case, they split the cost into four interest-free payments. You pay for them every two weeks. It’s pretty straightforward and all you have to do is to download their app to make your purchases. Ultimately, the app aims to provide its users with hassle-free transactions so that you don’t have to worry about your purchases.

Keep in mind that Klarna imposes a spending limit based on real-time credit decision data to promote good spending practices. That means the approval of your orders will not be guaranteed if they go beyond what the app deems to be ethical spending. If you are exceeding your spending limit and badly need your order, looking for a Klarna alternative is the sensible thing to do.

Download for Android (Play Store)

10 Best Apps Like Klarna to Download Today

While Klarna is one of the best “buy now, pay later” apps in the market today, there are certain apps that you can use as a substitute or alternative. Klarna might not be for everyone that’s why it’s important to explore apps like it to make sure that you have the best app for you. There are a couple of apps like Klarna that can rival its offers and ease of use.

Here are 10 apps like Klarna that you might want to consider using:

Also Read: 10 Apps Like Dave for Getting Cash Advances Easily

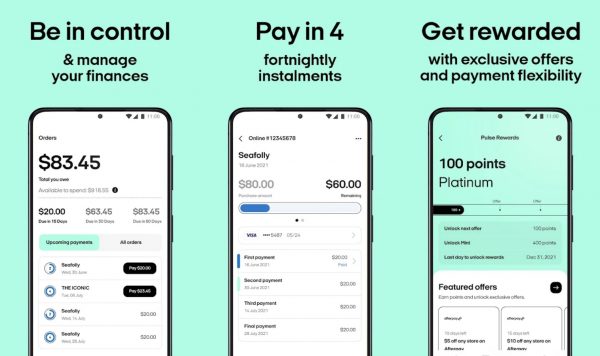

1. Afterpay

- No additional fees, zero interest as long as you pay your dues on time

- Get four interest-free installments due every two weeks

- Check out your items in an instant

Afterpay is one of the more popular apps like Klarna that is very simple to use. Known for its hassle-free transactions, Afterpay provides its users with a way to shop easier. All you have to do is to shop at your preferred online store and choose Afterpay as your payment method upon checkout.

At the start, you’ll be given four interest-free installments that you have to pay every two weeks. For the most part, payments made through Afterpay have zero interest and no additional fees as long as you pay on time. Additionally, you also don’t have to wait for your purchases to be approved, unlike other apps. Afterpay is one of the easiest to use on this list as the process of getting an account and using it is faster and easier.

Download for Android (Play Store)

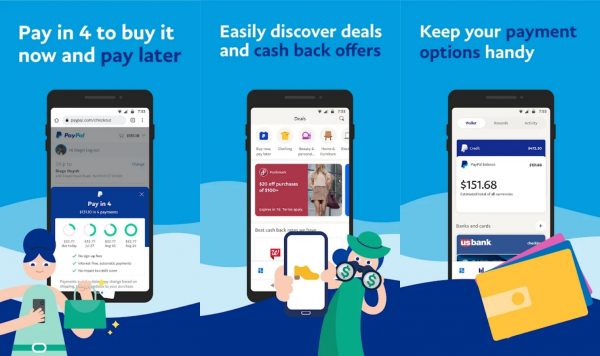

2. PayPal Credit

- 0% interest for 6 months on purchases over $99

- Send money / make a cash advance

Many people are familiar with PayPal. It’s a widely used online payment system that most people know how to use. PayPal Credit is its “buy now, pay later” system that lets you use credits when you purchase through online stores.

Upon registration, you will be given a credit limit attached to your existing PayPal account. From there, you can use your PayPal Credit account to make your online purchases. Do remember to settle your dues on time to avoid additional fees.

Download for Android (Play Store)

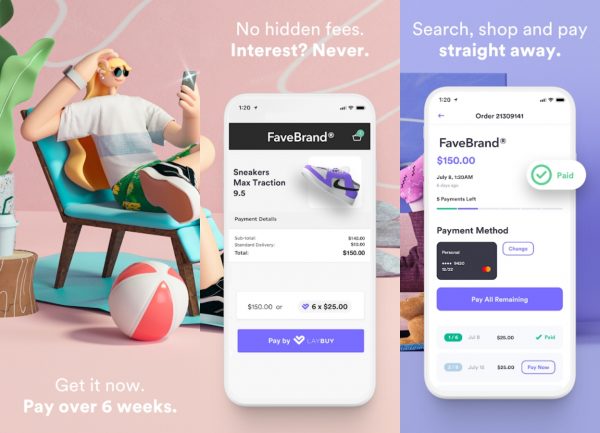

3. Laybuy

- Zero-interest 6-week payment installments

- No signup fees

Laybuy is an app like Klarna that is reliable for those looking to shop and split their payments into installments. You can use the app online and in-store so you don’t have to worry about forgetting your cash or card.

When you use Laybuy, the full price of the item will be divided into 6 installments in five weeks. The first 1/6 of the cost will be charged upon checkout. The downside of this is that you will have to undergo a credit card check during application which might affect your overall credit score.

Download for Android (Play Store)

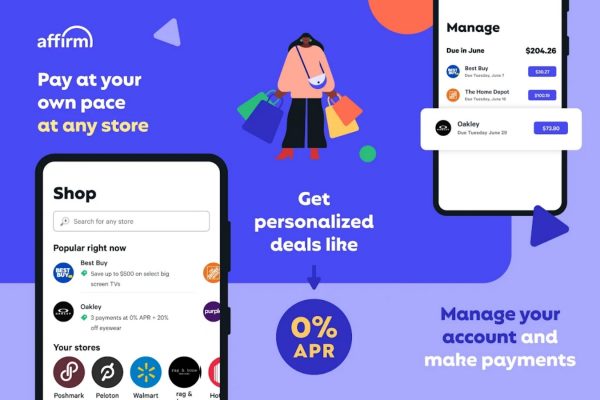

4. Affirm

- No late, service, and prepayment fees

- Longer loan terms

- Bigger loan amounts

- Interest is charged based on the purchase cost

Affirm is one of the most popular apps like Klarna that provides the same service. You can use it in over 6,500 merchants and even use them for short-term loans. The app allows you to make your purchases manageable and give you more flexible payment options.

The app also provides longer prepayment plans with varying interest rates. While the app lacks the “zero-interest” offer that others have, the interest given to you at Affirm will vary depending on where you shop. The interest rates vary from 0% to 30% so it’s best to manage your expectations when using Affirm.

Download for Android (Play Store)

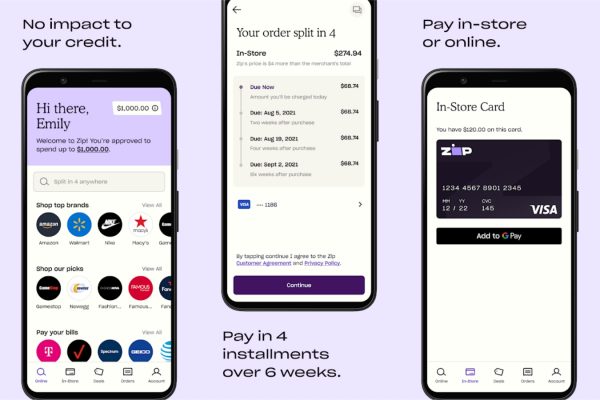

5. Zip (Formerly QuadPay)

- Shorter loan terms

- Interest-free payments

- Doesn’t affect credit scores

With Zip, you can split your purchases into four parts in six weeks. You can also use the app to shop anywhere Visa cards are accepted both in-store and online. However, keep in mind that you will have to go through an approval process before completing a purchase. This will require a 25% initial payment at checkout and the others will be paid over six weeks.

Zip promises no hidden fees and no APR which means that you can shop freely and have transparency when it comes to pricing and making purchases.

Download for Android (Play Store)

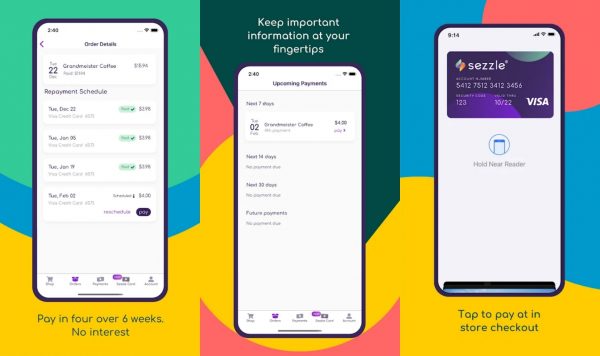

6. Sezzle

- One payment plan (four payments in six weeks)

- No interest

Sezzle is another app like Klarna that aims to make shopping easier for its patrons. It offers simple and interest-free payments. Upon purchase, you will have to pay 25% of the cost and the rest will be spread across four payments in six weeks. The app offers no interest and processing fees as long as you can pay your dues on time.

It is significantly easy to use and you can also use it in-store and online. However, you will have to take note that some banks do not support Sezzle so it’s best to check with your bank so that you can make installment payments accordingly.

Download for Android (Play Store)

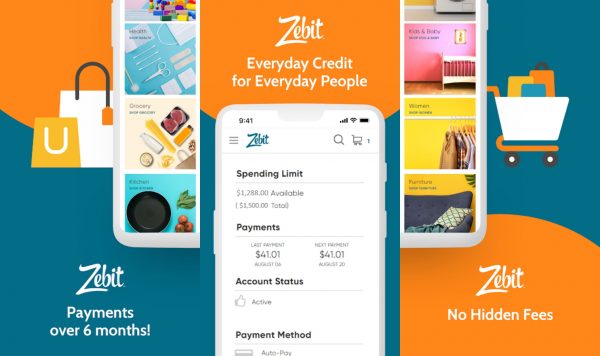

7. Zebit

- Adjustable payment schedule

- Doesn’t impact the credit score

- No hidden charges

- Interest-free credit up to $2,500

Zebit provides a platform for shoppers where they can shop to their heart’s content without having to worry about hidden fees or penalties. Zebit aims to give its customers an inclusive shopping experience and allows them to pay at their convenience.

It offers interest-free credit of up to $2,500 and payments will be split over six months. You don’t have to worry about additional fees and interest as long as you pay your dues on time.

Download for Android (Play Store)

8. FuturePay

- No credit limit

- Easy set-up process

- Flexible payment plans

FuturePay offers a straightforward way to pay for your purchases. It offers functionality, security, and ease of use. FuturePay is a bit different from other apps as it pays for the full cost of an item instead of charging a certain percentage per purchase. After that, the app will charge the customer for the cost in installments.

The app also supports flexible payment schedules so you can pay over multiple months. It’s a great app for when you need to make an emergency purchase but don’t have the cash ready for it yet.

Download for Android (Play Store)

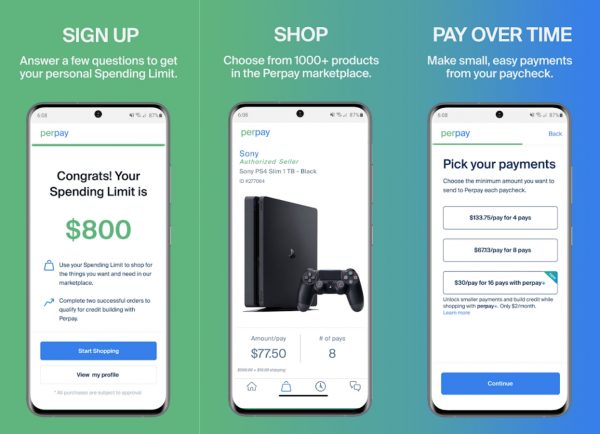

9. Perpay

- Spending limit increases gradually

- Requires a direct payroll deposit

- Easy installment plans

Perpay approached “buy now, pay later” a bit differently. Unlike other apps, Perpay will determine your starting spending limit when you sign up. From there, you can spend your credits on items that they have in their marketplace. Your spending limit will gradually increase as you use the platform.

However, the app does require a direct payroll deposit and your payment will be deducted from your paychecks. You cannot use your credit card for this one so you don’t have to worry about your credit scores.

Download for Android (Play Store)

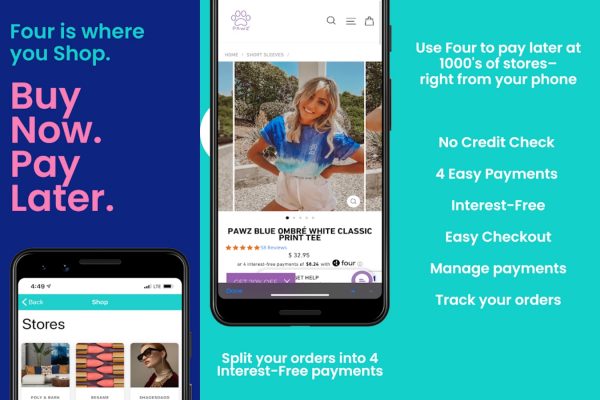

10. Four

- No credit check

- Easy payments and checkout

- Interest-free

Four is a straightforward app that allows you to pay for your purchases with four easy installments. It is one of the apps like Klarna that provides customers with quick and easy checkout. This app also promises no interest rates when it comes to your installments so you don’t have to worry about paying for other fees. It’s a great app to have especially when you’re looking for one that offers short-term payments that won’t affect your credit scores.

Download for Android (Play Store)

Spend Smartly Using Apps Like Klarna

It might take a while for you to find the perfect “buy now, pay later” app for yourself. However, always exercise caution when trying out these apps. We recommend that you try them out one at a time to avoid having too many loans. When dealing with e-commerce and online purchases, always remember to be a smart and responsible buyer to avoid any penalties and additional charges whenever you checkout.