Your phone bill for the month has arrived unexpectedly earlier than usual, but payday is not until the next two weeks. Things like this can be a headache, especially if you are living paycheck to paycheck. Thankfully, there are now financial apps that will help you get by without trapping you into the pit of debt. Dave, a cash advance app, has been helping people get the money they’ve already earned prior to payday while avoiding bank overdraft fees. It’s not just Dave now, though. Apps like Dave have started to emerge, giving you more and potentially better alternatives.

Also read: 12 Best Budgeting Apps to Help You Plan Your Finances

Inside This Article

What Is Dave and Its Problems

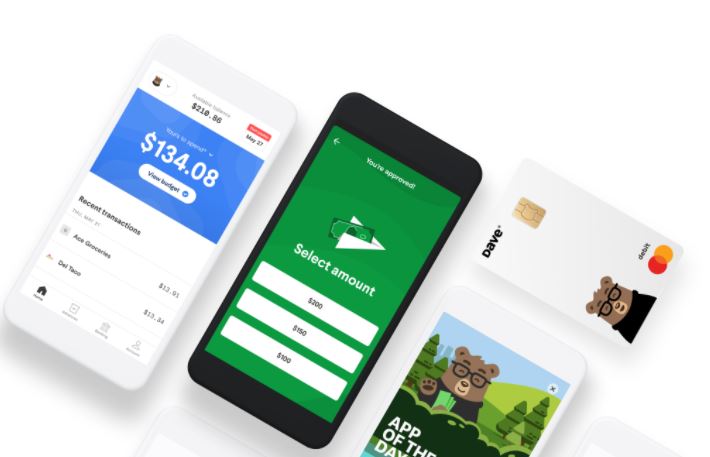

Dave has grown exponentially since it became public in 2016. Since 2020, Dave has garnered over seven million subscribers. Essentially, Dave is a personal financial app that offers you an advance paycheck of up to $250. It is appealing to many subscribers, considering it only charges a $1 monthly subscription fee instead of interest rates. Users can also get quick access to cash within eight hours for an express fee of between $1.99 and $5.99. That is in contrast to the standard Dave ETA of one to three days.

However, Dave has been plagued with issues recently. Among them is a big data breach issue, which affected 7.5 million users in July 2020. The notice of data breach published on their website states that personal details — ranging from the names of customers, email, and phone numbers down to encrypted social security numbers — were breached. Dave further stated that no financial information had been stolen during the breach, and no bank or credit card information had been impacted.

The breach has been investigated, but the bad news will forever be printed in black ink across Dave’s reputation. It also goes to show that while security breaches on financial support services agencies are rare, the chances are never zero.

Below are the pros and cons of getting an advance paycheck from Dave:

PROS

- 1. Dave is good for a small emergency expense.

- 2. Dave is a good financial lifesaver only if your paycheck can cover the cost.

- 3. Dave offers a low monthly subscription charge.

- 4. Dave issues a personal debit card to subscribers.

CONS

- 1. Requires access to subscriber’s personal bank account details.

- 2. Encourages people to spend money they don’t have.

Download Dave from Google Play Store

Download Dave from the App Store

12 Best Cash Advance Apps Like Dave

So, now you want to explore your options. Dave is the best app for an advance paycheck app there is but there are apps like Dave offering the same services with different policies. Below are our top 10 picks for best apps like Dave (including cash advance apps only).

1. Earnin

Earnin is perfect for people with predictable incomes because they would be able to connect their bank accounts with the app. It offers $100 cash out per day or up to $500 cash out per pay period. Essentially, the app behaves like Dave — it allows you to borrow money depending on the number of hours you already work. However, this app does not charge subscribers a subscription fee. It does have a tipping system that allows you to tip Earnin between $1 to $15. This system has been put in place as an alternative for borrowers not to incur interest rates and credit checks.

You can also get instant access to borrowed cash by using their Lightning Speed program, which will deposit the amount you borrowed within the day into your bank account. What’s the catch? There is no catch. While most banks charge express fees for transfer transactions, cashing out with Earnin is free of charge. Earnin then auto-debits the borrowed amount from your bank account come payday.

Download from Google Play Store

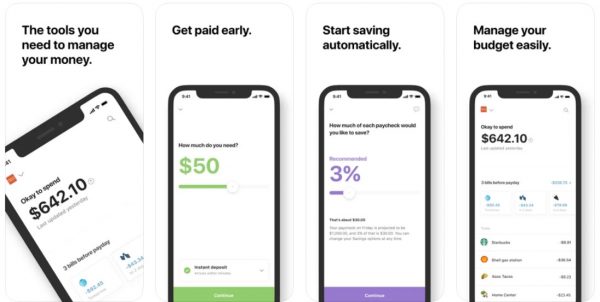

2. Even

Here’s one of the decent apps like Dave that offers not only early grants for unpaid wages but also a range of financial planning tools. First, employers need to have an open account with Even for employees or users to be able to take advantage of its Instapay app feature and get early access to pay. Users can borrow up to 50% of their unpaid wages for a given pay period. This concept is based on the idea that workers earn credits for every hour they work. Hence, it makes them entitled to every penny that goes into those hours.

Moreover, users do not accrue taxes or interest rates when cashing out from Even. However, a monthly subscription fee is charged per user. Users then can get their cash-out money on one business day or get an Instapay from Walmart MoneyCenter.

Download from Google Play Store

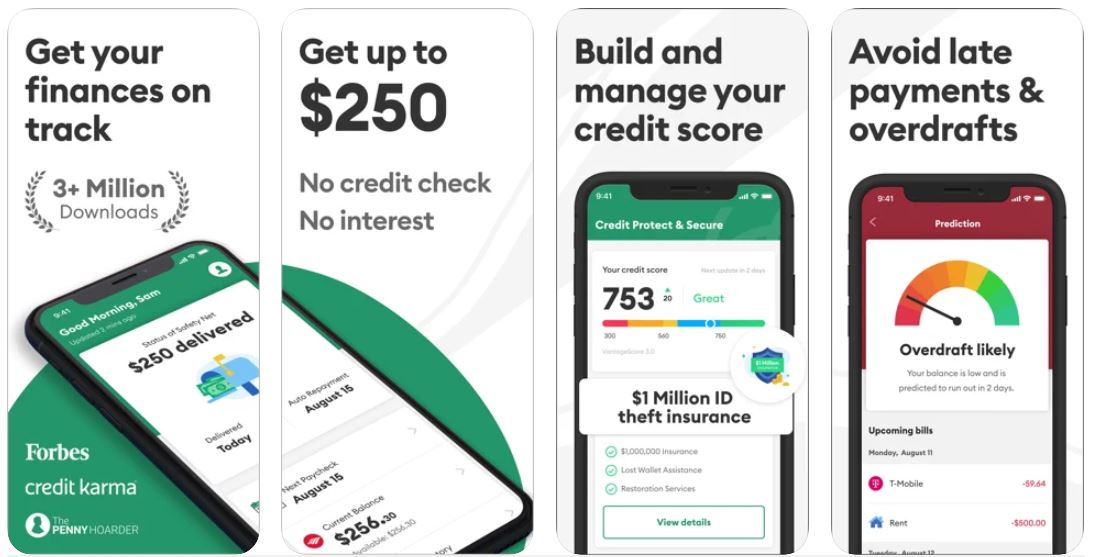

3. Brigit

Brigit is a cash advance app that provides a decent cash-out amount of $9.99 up to $250 a month. What makes this app like Dave stand out is its credit check, which means it analyzes your account and makes predictions about your spending habit. This is strategic because it goes to show that the service wants to offer you a financial bailout while at the same time ensuring you do not incur overdrafts.

However, getting a cash-out from Brigit is easier said than done. Unlike Dave, Brigit screens its potential subscribers strictly; you have to match a list of criteria before getting in. For example, a subscriber needs to make at least $1,500 per month to qualify to use the service. On top of this, Brigit sets a subscriber back by up to $120 a year — Dave offers $12 a year. This makes Brigit an expensive cash advance app compared to Dave.

Download from Google Play Store

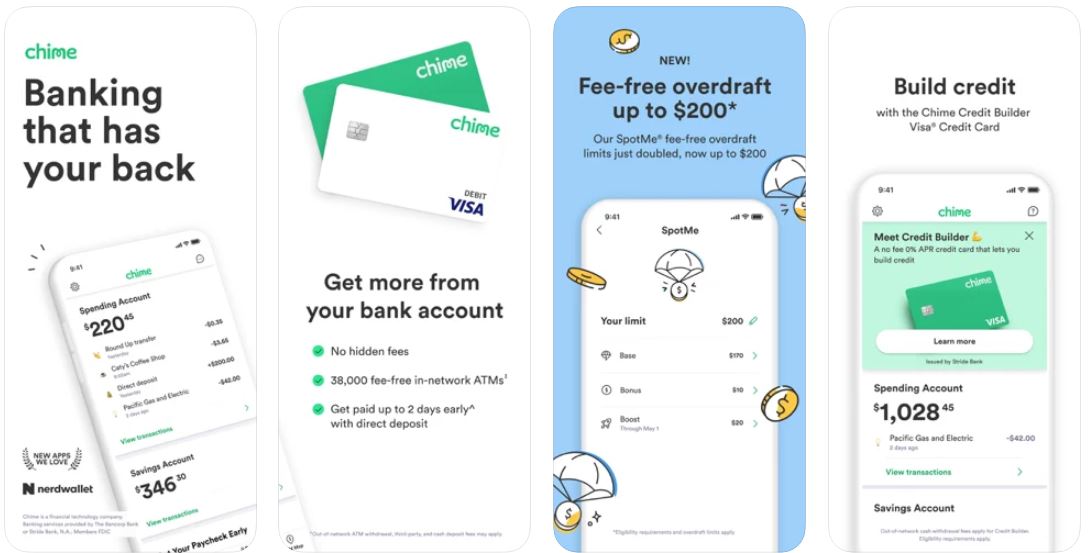

4. Chime

Chime has gained popularity as an app like Dave despite the fact that it’s still nine years young in the fintech and banking business. It has more than 10 million users. And there have been rumors that its competitions are gearing towards imitating what Chime is doing or adding their twists to what Chime is doing to gain success.

Chime is a good starting point if you want to build your credit score and save money. These two factors are appealing especially among those who just turned 18 and want to open up a bank account. If we don’t know any better, building good credit is essential in America.

You can cash out up to $200 a day, free from an overdraft fee. But Chime is more than just an advance paycheck finance app. If you open an account with Chime, you automatically get spending and personal savings accounts. And when you have a balance on your savings account, Chime will automatically put interest on it at 0.5% APY.

Download from Google Play Store

5. FloatMe

FloatMe is a financial app that targets millennials and helps them avoid cash caps and improve their finances. In an interview with FloatMe founder Josh Sanchez, he stated the company used to give advances of up to $200 but later on found out an average American accrues overdrafts by going over $24 on a spend. After this, the company strategized and started winding down its advances to just up to $50, factoring in its major target demographic.

FloatMe is a new payday advance app. Anyone who wishes to subscribe will also have to pay a monthly membership fee of just $1.99. What’s more, FloatMe offers a 30-day trial to potential subscribers to try the services. Users can opt to continue with the subscription or cancel anytime before the trial period expires.

Download from Google Play Store

6. Payactiv

Payactiv markets itself as one of the best payday advance apps like Dave. The app services any employed subscribers. Payactiv gives them access to cash out for the number of hours they have already worked. The beauty about using Payactiv is subscribers won’t deal with any interest because they are not asking for a loan in the first place. If employers support the use of Payactiv, subscribers can have access to financial assistance right away.

Moreover, Payctiv does not impose on customers hidden charges such as monthly fees, inactive fees, and recurring fees. It’s fast and easy. You can request for advance paycheck based on how much you’ve already earned in a pay period. The money gets transferred to your bank account and auto-debited when your next paycheck comes.

7. MoneyLion

Anyone in dire need of access to money can count on MoneyLion’s paycheck advance program. Subscribers can cash out up to $250 a day from MoneyLion. However, similar to Brigit, MoneyLion applies strict guidelines in screening potential subscribers and even the policy in applying for a paycheck advance. Users are required to open a checking account at MoneyLion to get pay advances.

Those eligible for advance paycheck need not worry about incurring interest rates as well. Plus, cash-outs are ensured to hit your personal bank account within the same business day. However, MoneyLion is not accessible in some states in the US, mainly Montana, Iowa, Indiana, Vermont, Nevada, and Nebraska.

Download from Google Play Store

8. Branch

Branch is a fee-free mobile banking and debit card that grants users access to money when needed. Users can cash out up to $500 pay advance in increments of $150 per day. Of course, that depends on the number of hours a user has already rendered and earned. While Branch and Dave are almost alike when it comes to user experience, Branch does not charge users a monthly membership fee.

Perhaps the catch in using Branch is this: your employer needs to have an open account with Branch before you, the employee, can borrow cash out of your payment in advance. Otherwise, it’s a no-go until your employer opens an account with Branch. Without that, you will not be eligible for this program.

Download from Google Play Store

9. DailyPay

DailyPay is another app like Dave that grants early access to unpaid worker wages even before payday. Users can choose where to receive the borrowed cash — choose any debit card, bank account, prepaid card, or pay card. Users are entitled to borrow up to 100% of their unpaid wages. That is because DailyPay operates on the idea that every day, workers earn credits for the hours worked. Hence, they are entitled to every penny that goes into that credit. What’s more, users can make money transfers up to five times and up to $1,000 per day.

Download from Google Play Store

10. Ingo Money

Capping our list is Ingo Money, one of the apps like Dave that provides financial services including, but not limited to getting cash paychecks, personal checks, and business checks.

We’re all about checks with Ingo Money. So, how does it work? Users’ checks are subject to funding approval from $5 up to $5,000. However, you need to be aware that Ingo Money imposes a standard fee of 2% for payroll and government checks with a pre-printed signature and 5% for all other accepted checks. Once the check is approved for encashment, you can get your money within minutes for a little extra fee. Otherwise, the money will be transferred to your preferred card within a business day.

Download from Google Play Store

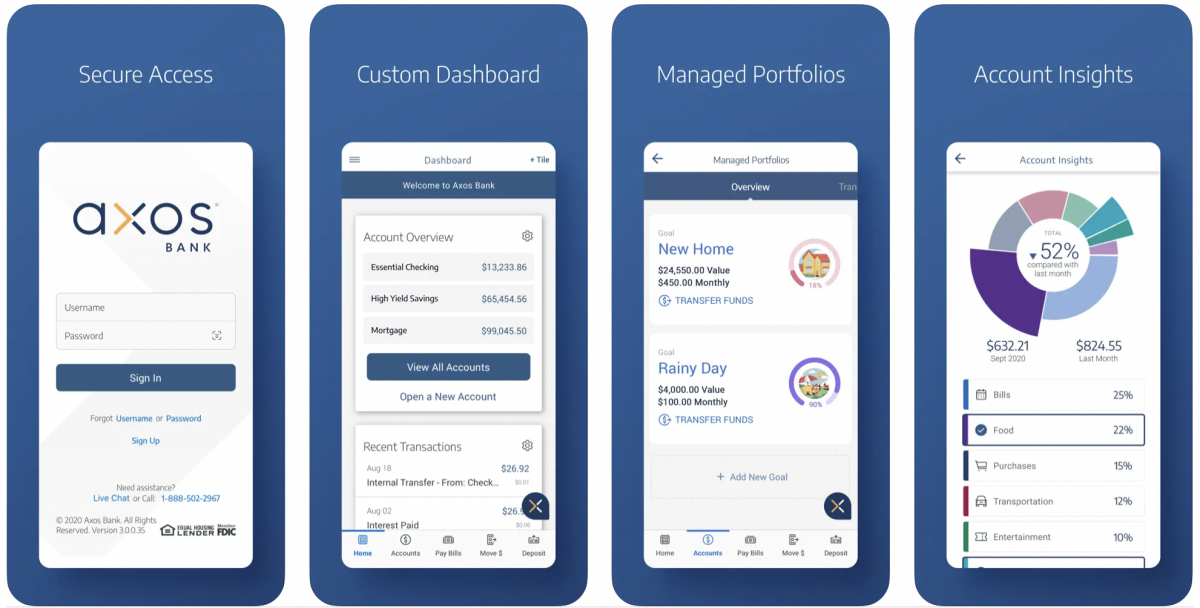

11. Axos Bank

Axos Bank functions like Dave in terms of giving borrowers access to an early paycheck. However, it requires you to have a savings account with Axos to gain access to Axos’ Direct Deposit Express feature. This feature, much like the other apps like Dave we have here, gives you access to borrow money equal to how much you have already earned. Borrowers who wish to take advantage of this simply have to set up a direct deposit account.

Unlike Dave, Axos does not charge borrowers monthly service fee, does not charge overdraft fees, and do not require a minimum maintaining balance in your account. On top of that, Axos offers other perks like cashback checking, finance management service, check deposit, and others.

12. Empower

Empower provides convenience and ease to access advance paychecks amounting to up to $250 sans late fees or interest rate charges. Thanks to Empower’s Early Paycheck Deposit feature, anyone could get access to a paycheck at least two days early. The money is injected into your Empower Account with a $3 flat fee. Additionally, the Empower Card is accessible to 37,000 ATMs across America. However, Empower requires its customers to regularly deposit any amount into their checking accounts to keep their accounts active.

Cash Advance vs. Loan Apps

The concept of app-based cash advance services is fairly new and is advocated by fintech startup companies. However, many consumers believe cash advance services and payday loans have more things in common than differences. In essence, cash advances and loan apps grant anyone access to money. And this is quite appealing for the economically vulnerable demographics. One difference between cash advances and loan apps is the charging of interest rates. Payday lenders are notorious in terms of putting an interest rate on borrowed money. Meanwhile, cash advance services encourage users to tip their early access to unpaid wages.

Both services are helpful if they can’t be helped. However, whether you are getting cash or payroll advances, or payday loans, the truth remains: if you borrow at the expense of your next paycheck, you are putting a hole in your next paycheck. Needless to say, you should only borrow the amount you can earn. That way, the strain is not as heavy as it should be.

Tips for Using Cash Advance Apps Like Dave

When finances are concerned, it is important to go over the pros and cons before planting your feet firm about making a move about it. App-based cash advance services are no different. These apps like Dave offer a short-term financial floatation alternative to anyone who needs access to cash. Many advance paycheck services are strict and are looking into the hours a user has already worked to determine how much a user can cash out — other services offer a pre-determined cap.

Another thing to keep in mind is that the money borrowed is money due. While it claims you are borrowing money you will earn, the keyword there is that that’s money you have yet to earn. And you are requesting early access to it through a third-party provider who will then ask you to pay the money you cash out in advance. With that in mind, it pays to check just how much you really need and whether interest rates apply when requesting an advance paycheck.