Gmail, one of the leading email service providers, has made online financial transactions even easier with its latest feature. Users can now send money as an attachment directly through their Gmail accounts. This groundbreaking addition to the popular email platform allows individuals to quickly and securely transfer funds to friends, family, or business associates. With just a few simple clicks, Gmail users can now skip the hassle of logging into separate payment systems and directly send money along with their email messages. This revolutionary feature brings convenience, efficiency, and security to the forefront, making financial transactions a seamless part of everyday email communication. Whether splitting a bill, reimbursing a colleague, or donating to a charity, Gmail users can now complete transactions within the familiar and trusted environment of their email inbox.

Inside This Article

- Gmail Now Lets You Send Money as an Attachment

- How to Send Money through Gmail

- Supported Payment Methods

- Security and Privacy Considerations

- Conclusion

- FAQs

Gmail Now Lets You Send Money as an Attachment

Are you tired of switching between different apps or platforms to send money to your friends, family, or colleagues? Well, Gmail has come to the rescue! In a recent update, Gmail now allows you to send money directly as an attachment, making financial transactions more seamless than ever before.

With this new feature, you can easily send money to anyone right from your Gmail account. Whether you want to pay your share of the dinner bill, contribute to a group gift, or reimburse a friend for borrowing money, Gmail’s money attachment feature has got you covered.

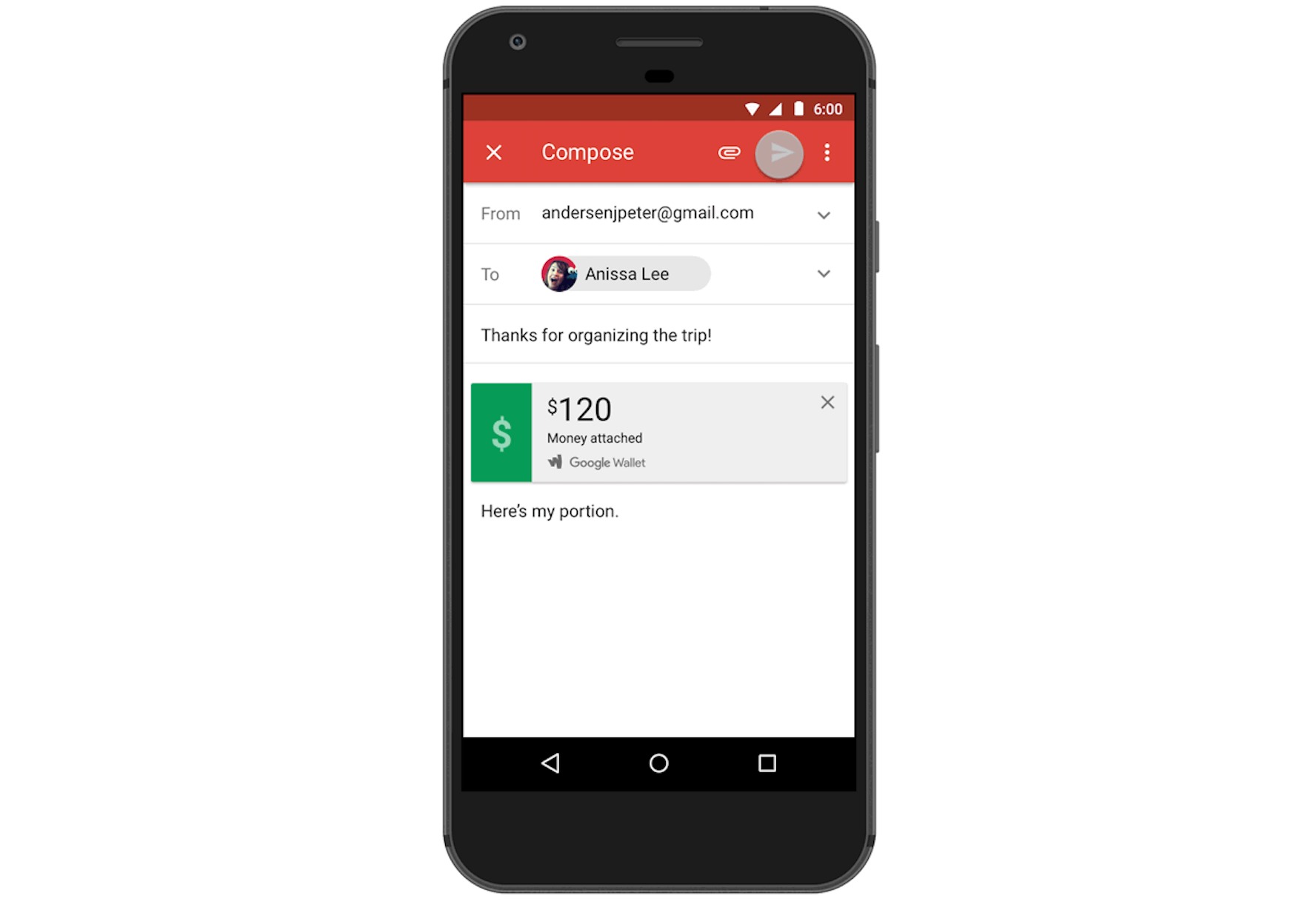

So, how does it work? It’s simple! When composing an email, you can now find the option to attach money right alongside the other attachment options. Just click on the dollar sign icon, enter the amount you want to send, and you’re good to go!

Once you’ve chosen the amount, you can select the payment method you prefer. Whether it’s using your Google Wallet balance or linked debit or credit cards, Gmail supports a variety of payment options to suit your needs.

Concerned about security? Gmail has taken measures to ensure the safety of your financial transactions. All money transfers through Gmail are encrypted and backed by Google’s robust security system, keeping your sensitive information secure.

Furthermore, Gmail doesn’t charge any fees for sending money. It’s a hassle-free way to transfer funds at no additional cost. However, it’s worth noting that there may be fees associated with receiving money, depending on the recipient’s financial institution or payment method.

So, what are you waiting for? Start taking advantage of this convenient feature by updating your Gmail app or accessing your Gmail account online. Say goodbye to the hassle of using multiple apps or payment platforms – Gmail has simplified the process by allowing you to send money as an attachment, making it easier than ever to settle financial transactions with your contacts.

Whether it’s splitting bills, repaying debts, or sharing funds for a shared expense, Gmail’s new money attachment feature is a game-changer for mobile users. Say goodbye to the days of going back and forth between apps and hello to seamless payments through your favorite email platform.

How to Send Money through Gmail

Gmail, the popular email service from Google, has recently introduced a game-changing feature that allows users to send money directly through their email. With this new functionality, sending money to family, friends, or business partners has become quicker and more convenient than ever before. Whether you need to split the bill at a restaurant or pay for a service, Gmail has got you covered with its seamless payment system.

To send money through Gmail, follow these simple steps:

- Sign in to your Gmail account or open the Gmail app on your mobile device.

- Click on the “Compose” button to start composing a new email.

- Enter the recipient’s email address in the “To” field.

- In the subject line, type a relevant message indicating that you are sending money.

- Now, click on the dollar sign icon ($) at the bottom of the email composition window.

- Enter the amount of money you want to send.

- Select a payment method from the available options (more on this in the next section).

- Include a short message explaining the purpose of the payment, if necessary.

- Review the details of the payment and click on the “Send” button.

And that’s it! Your money will be sent as an attachment along with the email. The recipient will receive a notification and can claim the funds directly from their Gmail account.

It’s important to note that both the sender and the recipient must have a Gmail account to use this feature. If the recipient doesn’t have a Gmail account, they can easily create one for free to access the funds.

Gmail’s money sending feature not only simplifies the payment process but also eliminates the need for third-party payment platforms, reducing the risk of scams or fraudulent transactions. You can now securely send money without having to switch between different apps or platforms.

So why not take advantage of this convenient feature and make your life a little easier? Next time you need to send money, just jump into your Gmail account and complete the transaction in a few simple clicks.

Supported Payment Methods

Gmail’s new feature that allows you to send money as an attachment offers a range of supported payment methods to ensure convenience and flexibility for users.

Currently, Gmail supports popular payment platforms such as Google Pay, PayPal, Venmo, and Square Cash. These platforms not only provide secure transactions but also offer additional features like buyer protection and instant transfers.

With Google Pay, you can send money directly from your bank account or credit/debit card. It is a widely accepted and well-integrated service, making it a convenient option for many users. Plus, if the recipient also uses Google Pay, they can easily receive the money and transfer it to their bank account or make future payments with just a few taps.

PayPal, a trusted and renowned payment platform, is also supported by Gmail. Through PayPal, you can connect your bank accounts, credit cards, or PayPal balance to send money quickly and securely. Additionally, it offers buyer and seller protection, ensuring a safe transaction for both parties involved.

Venmo, a popular peer-to-peer payment service, is another supported method within Gmail. This app allows you to send and receive money seamlessly, with the option to connect your bank account or debit card. Venmo also offers social features, allowing you to share payments and split bills among friends or groups.

Square Cash, known as Cash App, is a simple and user-friendly payment platform supported by Gmail. By linking your bank account or debit card, you can send and receive money effortlessly. Square Cash also offers a Cash Card, which functions like a traditional debit card, allowing you to spend the money received through the app at any retailer that accepts Visa.

It is important to note that the availability of these payment methods may vary depending on your location. Some payment platforms may have certain restrictions or limitations based on the country or region. Therefore, it is advisable to check with the individual payment service provider for specific details regarding their availability and functionality within Gmail.

By supporting a variety of payment methods, Gmail aims to simplify the process of sending money as an attachment, making it accessible to a wide range of users. Whether you prefer Google Pay, PayPal, Venmo, or Square Cash, you can now conveniently transfer funds right from your Gmail account.

Security and Privacy Considerations

When it comes to sending money through Gmail, it’s important to consider the security and privacy aspects. Google has implemented certain measures to ensure the safety of your transactions, but it’s also crucial for users to take their own precautions.

First and foremost, Gmail uses advanced encryption protocols to protect the information transmitted between users. This encryption ensures that your financial data is secure and only accessible to the intended recipient.

Additionally, Gmail utilizes multi-factor authentication to add an extra layer of security to your account. This means that even if someone were to gain access to your login credentials, they would still need a second verification method, such as a unique code sent to your phone, to access your account and initiate a money transfer.

It’s worth noting that while Google takes steps to safeguard your information, it’s important to be cautious and exercise good online security practices. Avoid clicking on suspicious links or opening attachments from unknown sources. Be mindful of phishing attempts, where malicious actors may try to trick you into revealing personal or financial information.

Moreover, it’s advisable to keep your Gmail account and associated payment methods up to date. Regularly review your account settings and ensure that you have strong, unique passwords for both your Gmail account and any linked financial accounts.

Google also offers a feature called “Suspicious Activity” alerts, which notify you if there is any suspicious or unusual activity detected in your account. If you receive such an alert, take prompt action to review the activity and report any unauthorized access.

Lastly, it’s essential to be mindful of the recipient’s privacy when sending money through Gmail. Double-check the recipient’s email address before initiating the transfer to ensure that the funds are being sent to the intended person.

Conclusion

Gmail’s new feature, allowing users to send money as an attachment, is a game-changer in the realm of email communication and online payments. With just a few simple steps, users can easily send money directly through their Gmail account, making it incredibly convenient and hassle-free. Whether it’s splitting the bill with friends, reimbursing a colleague, or paying for goods and services, this feature offers a seamless and efficient way to handle financial transactions. It eliminates the need for separate payment platforms or apps, streamlining the process for users worldwide. Gmail’s commitment to innovation continues to make it a frontrunner in the email market, constantly enhancing the user experience and providing integrated functionalities to meet the diverse needs of its users.

FAQs

1. Can I really send money as an attachment through Gmail?

Yes, Gmail now allows you to send money as an attachment. This feature allows you to conveniently and securely send money to your contacts directly from your Gmail account.

2. How does sending money as an attachment work?

Sending money as an attachment on Gmail is a simple process. You can link your Google Pay account with your Gmail account, and then when composing an email, click on the attachment icon. From the available options, select the “Send Money” feature, enter the amount you wish to send, and choose the recipient. Once the email is sent, the recipient will be notified and can easily claim the funds.

3. Is it safe to send money as an attachment on Gmail?

Yes, sending money as an attachment on Gmail is secure. Google Pay employs industry-standard encryption and security measures to protect your financial information. Additionally, the recipient must also have a Google Pay account to claim the funds, adding an extra layer of security.

4. Are there any fees associated with sending money as an attachment on Gmail?

There are no fees for sending money as an attachment within the United States. However, there might be fees associated with international transactions or if you’re sending money using a credit card. It’s best to review Google Pay’s terms and conditions for detailed information on fees.

5. Can I send money as an attachment to anyone, even if they don’t have a Gmail account?

To receive the money sent as an attachment on Gmail, the recipient must have a Google Pay account. However, they do not necessarily need to have a Gmail account. If the recipient doesn’t have a Google Pay account, they will receive an email with instructions on how to create one and claim the funds.